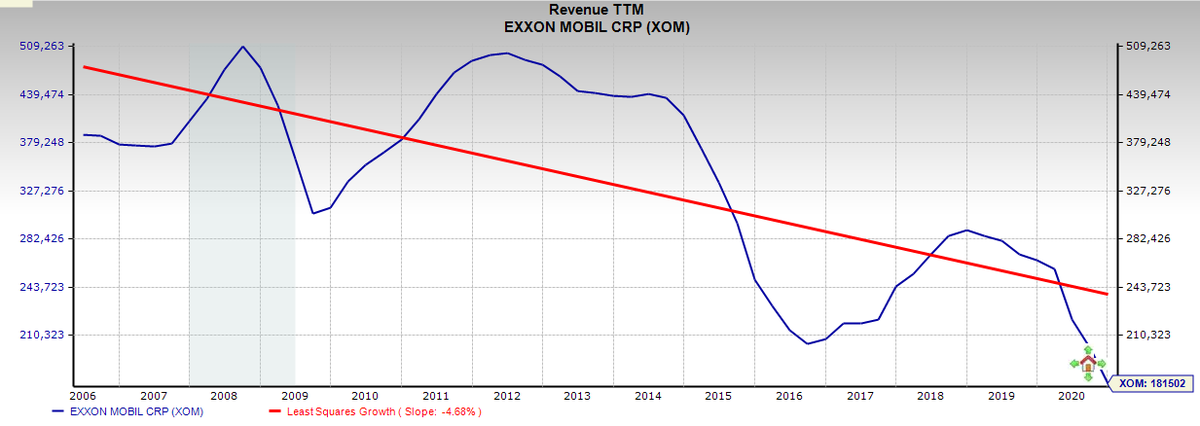

We are going to witness an implosion over at $XOM Mobil that dwarfs what we see in the auto industry over the next 5 years. This is one of the worst-run companies with the worst balance sheets I& #39;ve ever come across.

I hate shorting in general, but this one strongly tempts me.

I hate shorting in general, but this one strongly tempts me.

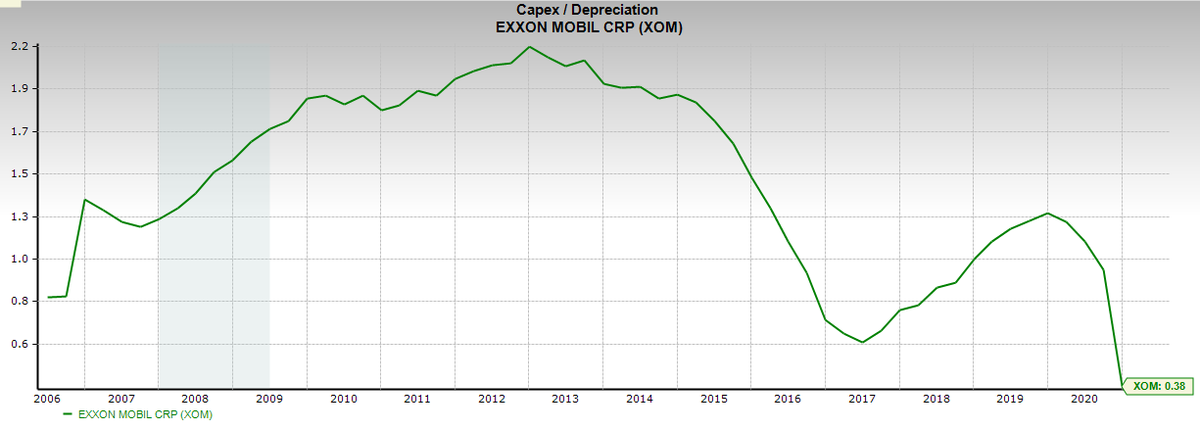

...this in spite slashing their reinvestment rate (capex-depreciation/depletion) to below 1.0 to "conserve" cash:

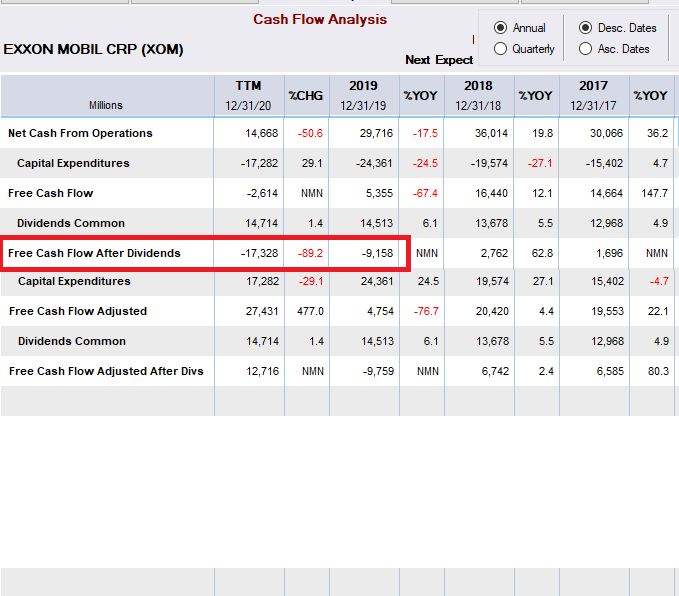

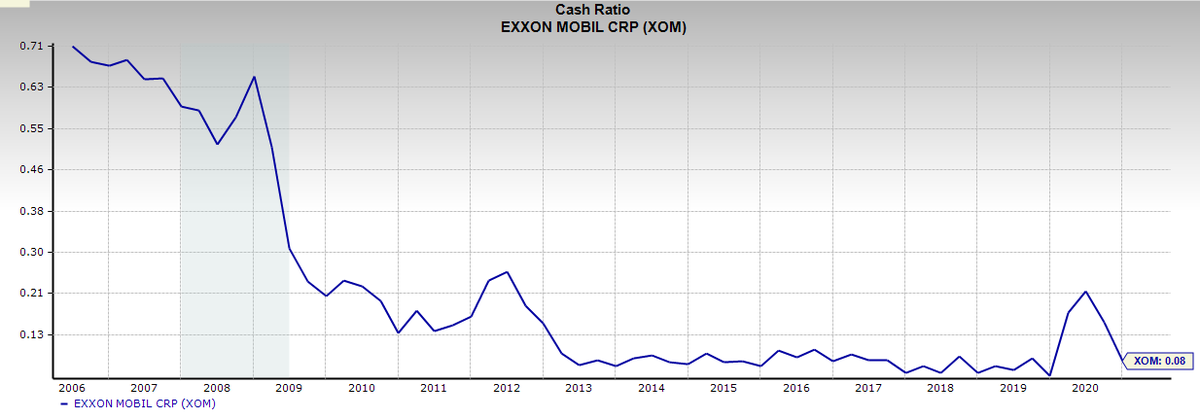

with $4 billion in cash on hand, while staring at $67 BILLION in total debt, including $20 billion in debt coming due in the next 12 months:

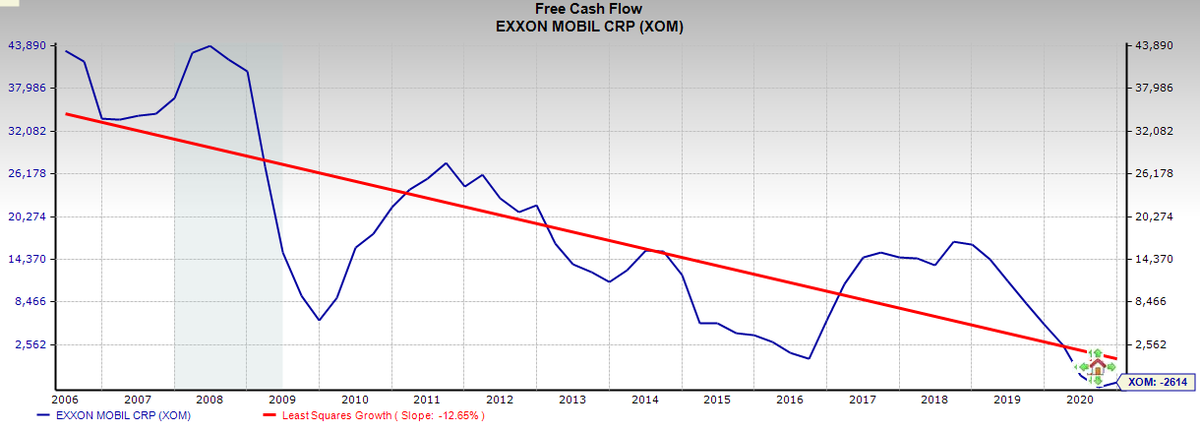

With cash and liquidity being rapidly depleted because of an irrational and frankly reckless commitment to paying a dividend which they cannot afford:

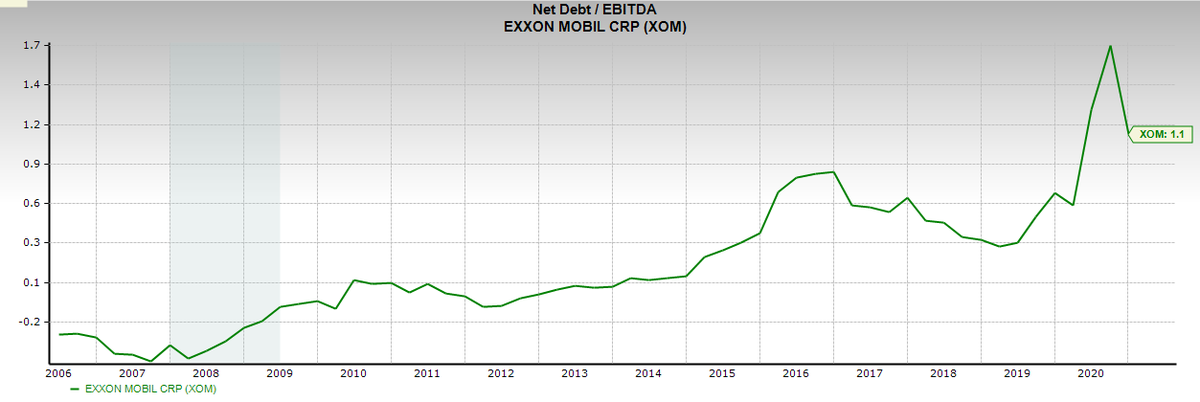

...and surging debt levels relative to EBITDA to all-time highs.

Note: their Net Debt / EBITDA isn& #39;t terrible at 1.1X, but EBITDA is meaningless if your unlevered free cash flow is negative, which is the case for Exxon.

Note: their Net Debt / EBITDA isn& #39;t terrible at 1.1X, but EBITDA is meaningless if your unlevered free cash flow is negative, which is the case for Exxon.

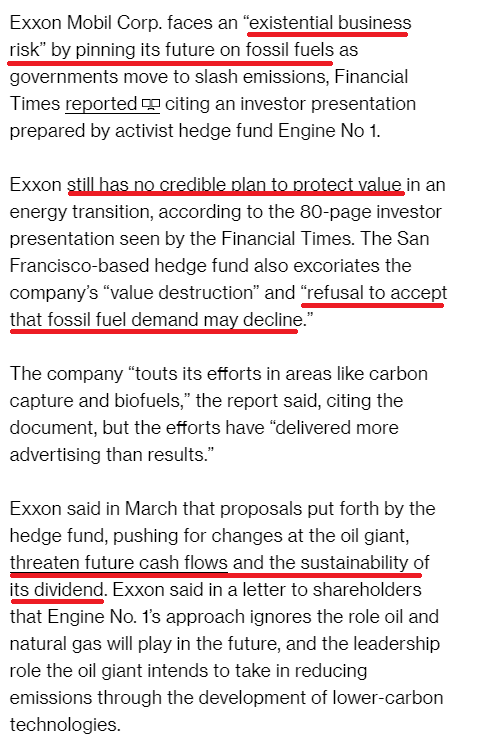

Worst of all, this is a company that& #39;s in denial of any transition to renewable energy-powered electric cars even occurring, having zero initiatives to prepare for such an outcome and care more about paying its dividend (which btw it can& #39;t afford without borrowing money):

I hate shorting in general, but this is greatly tempting me to do it. This is a hot mess of a company with an abysmal balance sheet and utter dinosaurs running the company with old-school MBA-thinking.

It& #39;s hard to change old, established ways of thinking and doing things.

It& #39;s hard to change old, established ways of thinking and doing things.

Read on Twitter

Read on Twitter