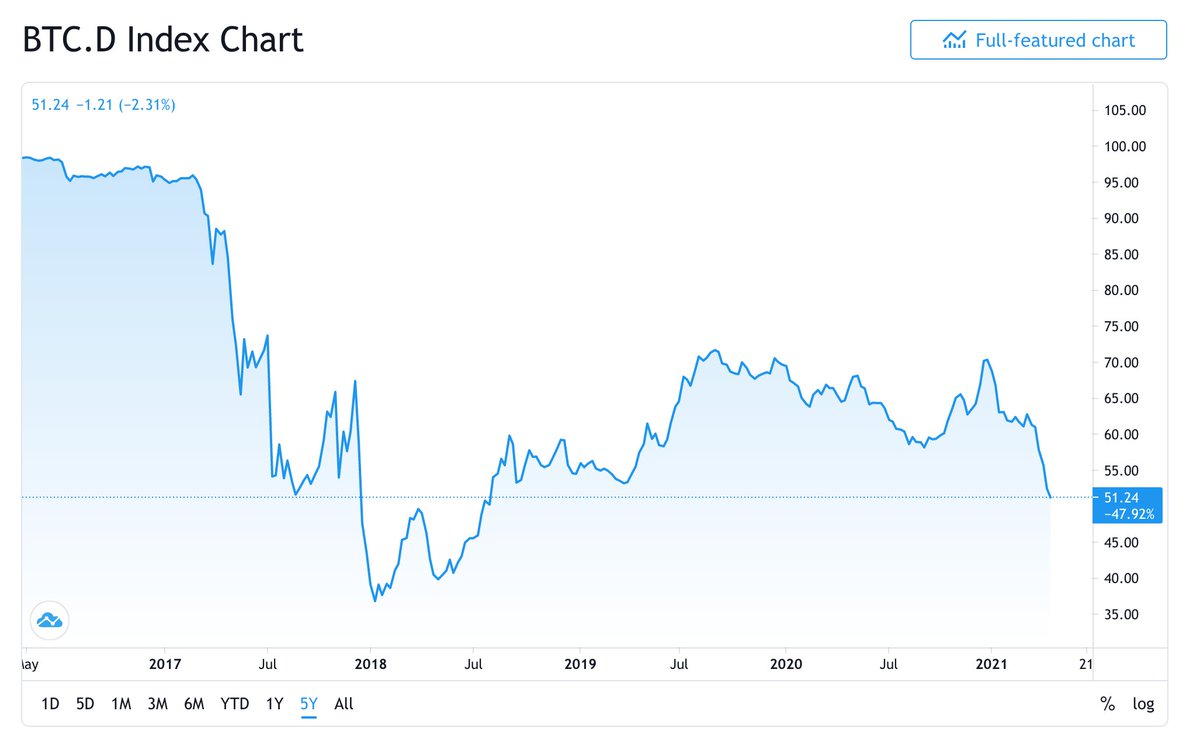

1/ on thursday, bitcoin dominance fell below 50% for the first time in nearly 3 years

the last time this happened was January 2018, and that cycle last about 6 months

seeing a lot of folks chasing returns by moving further out on the risk spectrum

94 coins w/ mcap > $1B

the last time this happened was January 2018, and that cycle last about 6 months

seeing a lot of folks chasing returns by moving further out on the risk spectrum

94 coins w/ mcap > $1B

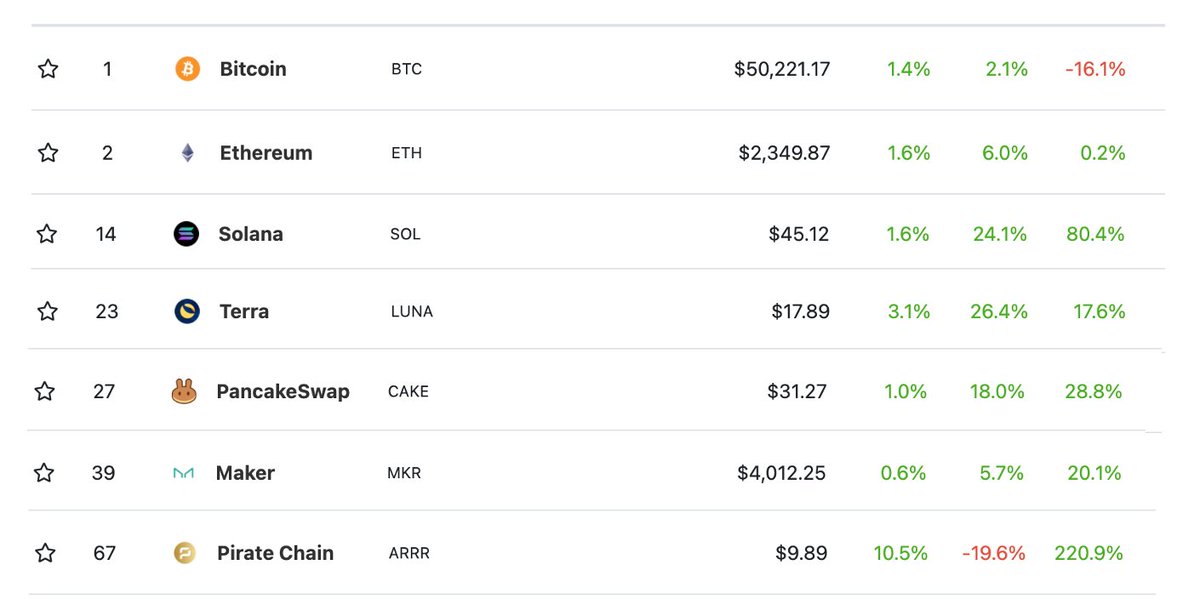

2/ while bitcoin has seen a 25% sell off since last thursday, a larger rotation is under way

some coins didn& #39;t sell off, but rallied, and HARD.

most of these trade only on crypto to crypto platforms, so its crypto rotation, not cash inflows driving these to new highs

some coins didn& #39;t sell off, but rallied, and HARD.

most of these trade only on crypto to crypto platforms, so its crypto rotation, not cash inflows driving these to new highs

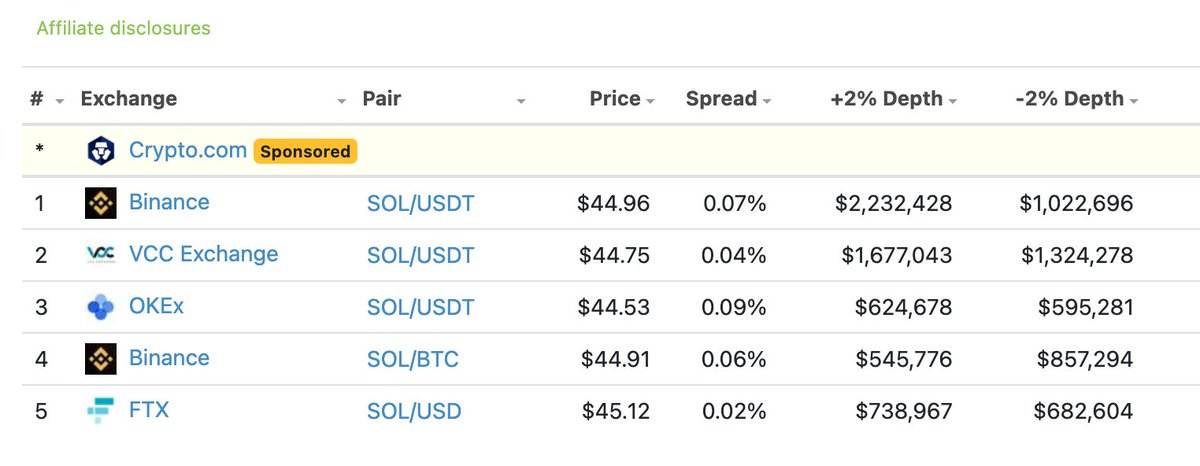

3/ shallow order book depth means small volumes can drive outsized price momentum. this works on the way up... and down. see $SOL market depth for example.

price narratives become a self-fulfilling prophecy, especially in times like these. in reality, the story is more nuanced.

price narratives become a self-fulfilling prophecy, especially in times like these. in reality, the story is more nuanced.

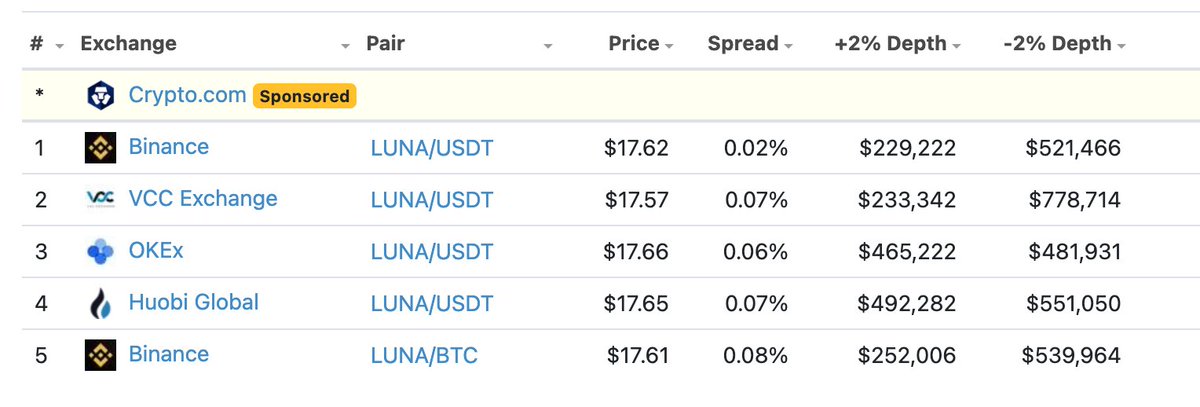

4/ look at the contrast between $LUNA and $BTC for example

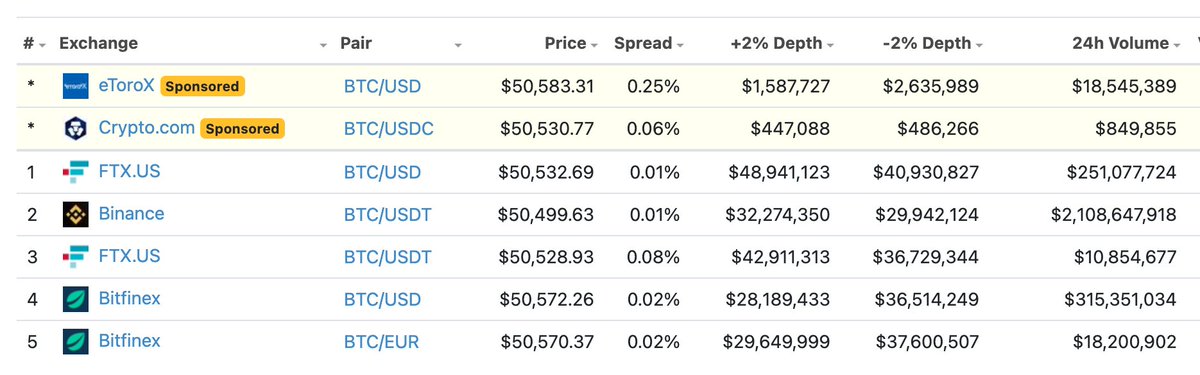

not a judgment, simply an observation. trade pairs and market depth matter, esp in a low liquidity trade.

(sidebar: can anyone @coingecko explain why FTX is ranked 1 for bitcoin despite low volume? it& #39;s very sus...)

not a judgment, simply an observation. trade pairs and market depth matter, esp in a low liquidity trade.

(sidebar: can anyone @coingecko explain why FTX is ranked 1 for bitcoin despite low volume? it& #39;s very sus...)

5/ need more coffee, but, the story around BTC dominance and the rise of alts is def one to follow

history doesn& #39;t repeat, but it rhymes. i& #39;m curious to see how this cycle will unfold and what will be different.

make sure u look at more than just price when making decisions!

history doesn& #39;t repeat, but it rhymes. i& #39;m curious to see how this cycle will unfold and what will be different.

make sure u look at more than just price when making decisions!

6/ and also now i have to research wtf piratechain is, arrrrr, f*in& #39; crypto

Read on Twitter

Read on Twitter