If there was a small-cap equivalent of Air Liquide on the Euronext market, this company would come really close. A 65+bagger (incl. dividends) since its IPO, it is a value creation machine that has rewarded its shareholders handsomely over 30+ years. This is Thermador $THEP. 1/n

While (most?) French were thinking about changing the world, Guy Vincent and four other founders were thinking, more pragmatically, about changing plumbing when they created Thermador in 1968 in a small city near Lyon. 2/n

The original business focused on importing and distributing central heating equipment. Over the next 18 years, the founders will organically build 4 more companies: Thely (property), Jetly (pumps), Sferaco (valves) and Dipra (plumbing accessories for DIY stores). 3/n

In 1986, the existing businesses are combined under the umbrella of the holdco Thermador Groupe. The group is listed in 1987 on the Paris stock exchange at €2.99 a share. It’s the beginning of a great story. 4/n

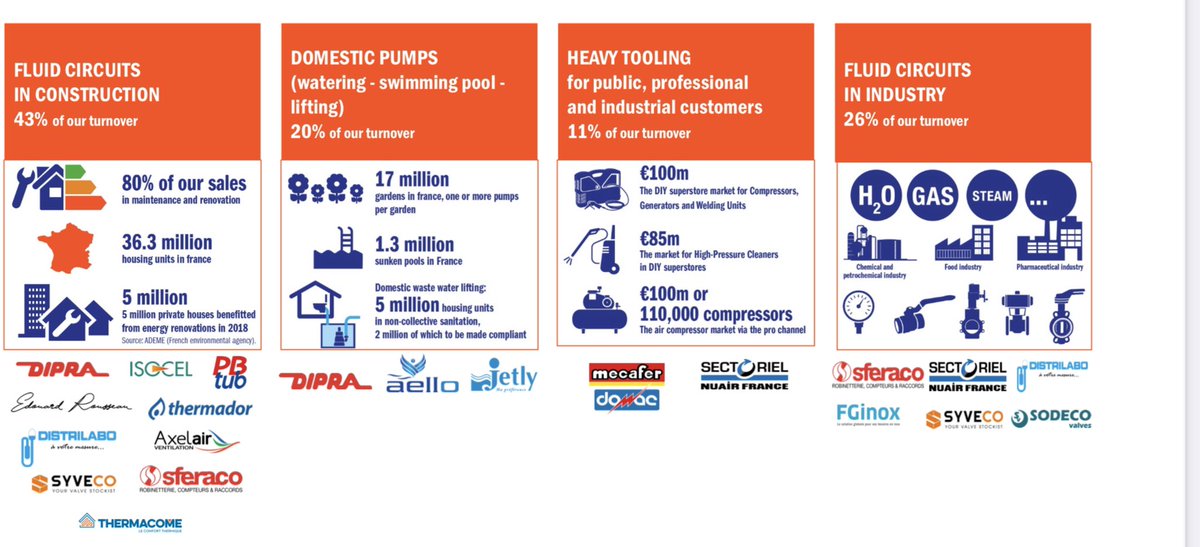

Since its IPO, Thermador has added organically or through acquisitions, a series of businesses that cover the full spectrum of fluid management needs in construction and industrial applications for wholesalers, DIY, e-commerce retailers... 5/n

Thermador Groupe is now a distribution business with 609 suppliers. Its moat is its ability to source a wide range of products always available for a quick delivery. Long-standing relationships with clients/suppliers and logistics have been key to deliver on this. 6/n

A talented and decentralized management, motivated employees, a focus on growth, cost-control and execution combined to savvy capital allocation decisions and long term focus have been instrumental in tripling revenues and doubling net income over the past 10 years. 7/n

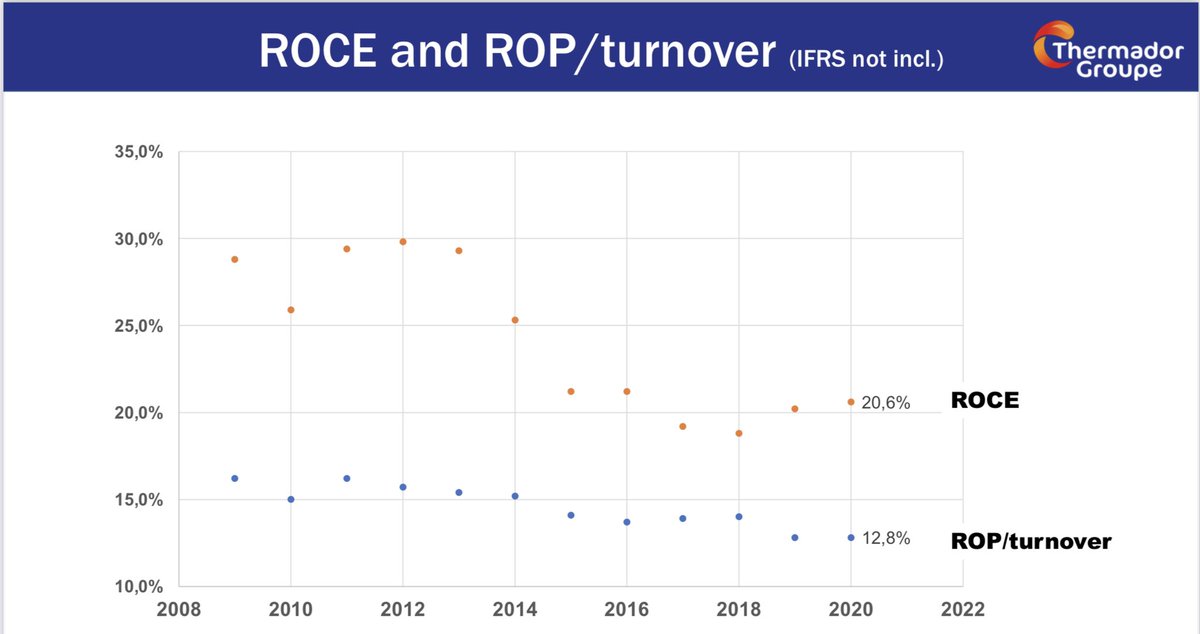

Thermador enjoys very strong financial structure, FCF generation and returns with a net cash position and a ROCE of 20%. It is well positioned to continue to grow although its CEO committed to focus on the integration of recently-acquired businesses and efficiencies in 2021. 8/n

One of its key strengths is a strong alignment of interests between the owners/management and the minority shareholders, with employees/CEOs (current and former) and the founders/their families owning ca. 30% of the company’s shares. 9/n

Thermador could be considered a “small-cap Air Liquide” as they both have a sizable base of individual investors that they stay close to through regular information / meetings and a “club”. Thermador also excels at investors relations with a very approachable top management. 10/n

Thermador has historically been praised by shareholders for its dividend yield (above 3% over the last 5 years on average as it pays out roughly half of its net income). But the share price increase has been no less spectacular, reflecting its consistent value creation. 11/n

More recently, Thermador has weathered the COVID crisis extremely well, growing its revenues 7% and its net income ca. 12% as it benefitted from a renewed interest in DIY as well as favorable housing renovation and stay-at-home trends. 12/n

Is that to say that Thermador is the perfect company? Of course not (although it’s close). First, it can still grow internationally where it generates “only” 18% of its revenues. It’s much higher than 20 years ago but could improve further. 13/n

Second, its ROCE and margins have been suffering from competitive pressures over the past 10 years. They are still at very high levels but the company is aware it has to seek more efficiencies and integrate some acquisitions / functions even further. 14/n

Third, there are clearly inflationary pressures on some raw materials that will make supplies pricier this year. That said, Thermador is confident it can pass those price increases to its clients. 15/n

Fourth, valuation. At a 23 LTM PE, it’s not cheap. But that buys you a ROCE of 20%. Over the long run, that might provide for a double-digit return factoring in a 6% EPS growth (in line with the last 15-year trend). I’m holding but not buying at the current price though. 16/n

That said, there is some “hidden” value / assets in Thermador. The company owns valuable warehousing properties whose real value is not fully reflected on its balance sheet. Although I will not try to put a price on 99,000 sqm of inventory storage, it must be worth a lot... 17/n

To summarize, Thermador is a really well-run listed small cap. With a €800m market cap, it’s been on the radar screen/portfolio of many savvy institutionals for a while. If you were lucky enough to buy at 40-60€ or lower, it might be a good idea to hold for the long run. I do.

Read on Twitter

Read on Twitter