0/ $BTCUSD market condition thread.

TL;DR: Bullish, expecting bottom at $48k (70%), $44k-$45k (25%) and $38k-$39k (5%).

$btc $xbt https://twitter.com/gas_fring_/status/1386186084686594054">https://twitter.com/gas_fring...

TL;DR: Bullish, expecting bottom at $48k (70%), $44k-$45k (25%) and $38k-$39k (5%).

$btc $xbt https://twitter.com/gas_fring_/status/1386186084686594054">https://twitter.com/gas_fring...

1/ First up, we are on a TD9 buy on the daily. $btcusd has already dipped 27% from ATH, so it makes sense to bounce on a TD9.

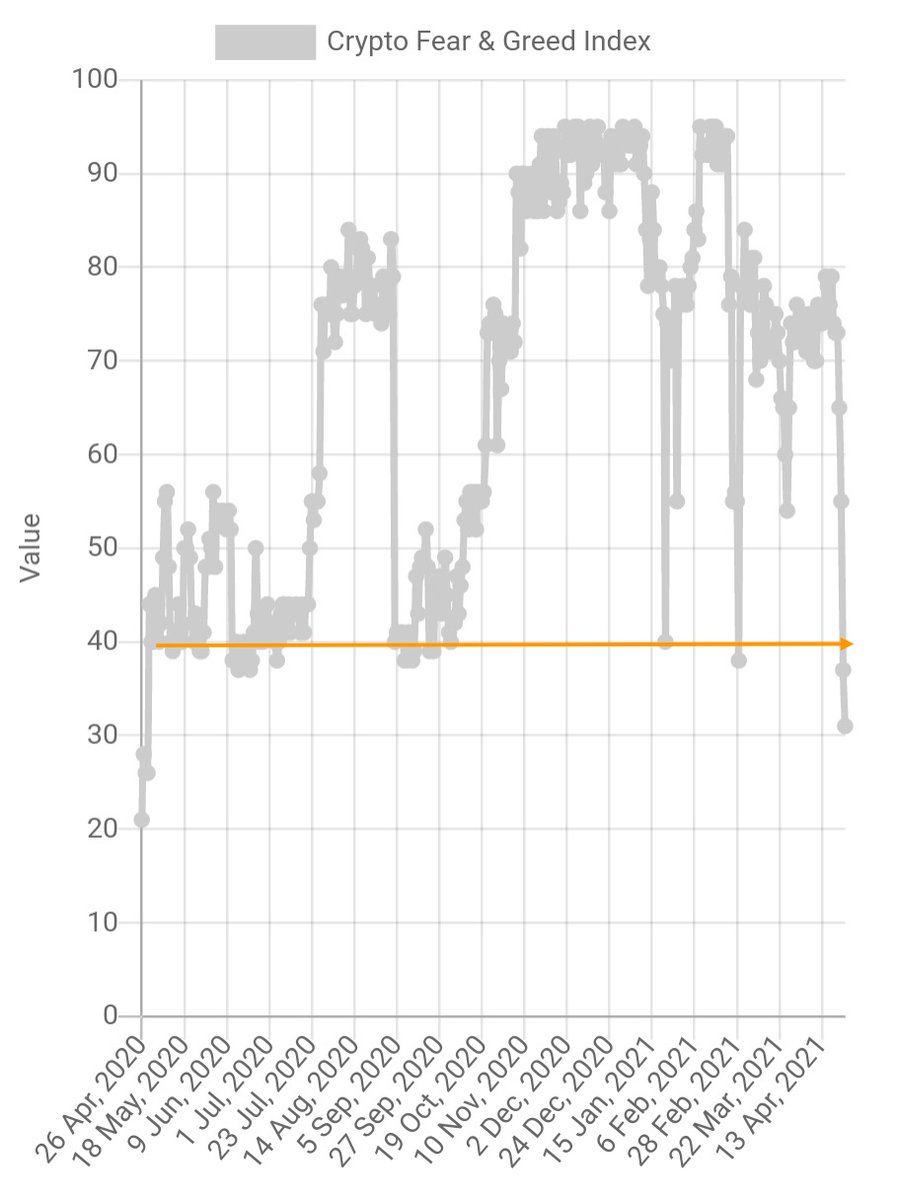

2/ Fear and Greed index has dropped sharply this week and is now below 40, which has marked bull market local bottoms.

$btc $xbt

$btc $xbt

3/ RSI on the daily has lowered itself to levels not since since March 2020 (barring September 2020). Both such occurences were followed by strong upward moves by $btcusd.

The price for RSI 30 bottom is $48.7k.

The price for RSI 30 bottom is $48.7k.

4a/ The ARB near-far ratio (NFARB) is now below 0.9 level.

The ARB itself is below 20%. (h/t: @truenomic)

$btcusd

The ARB itself is below 20%. (h/t: @truenomic)

$btcusd

4b/ I have back-tested FTX ARB data from 2019. Barring the covid March drop, NFARB has bottomed around current levels.

The Adjusted Far ARB seems to test the bottom of an up-trend line.

I plan to test this concept with Bitmex futures data since it has more history.

$btcusd

The Adjusted Far ARB seems to test the bottom of an up-trend line.

I plan to test this concept with Bitmex futures data since it has more history.

$btcusd

5/ This fractal by @therationalroot is bullish for $btc.

I will keep updating this for my own reference. https://twitter.com/therationalroot/status/1385342632755335173?s=19">https://twitter.com/theration...

I will keep updating this for my own reference. https://twitter.com/therationalroot/status/1385342632755335173?s=19">https://twitter.com/theration...

6/ Now moving on to on-chain metrics.

First up, #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> reserve stable coin flows made an ATH yesterday.

https://abs.twimg.com/hashflags... draggable="false" alt=""> reserve stable coin flows made an ATH yesterday.

First up, #bitcoin

7/ Aggregate funding for $btc accross all major exchanges turned negative for the first time since end of January 2021.

8/ Adjusted SOPR has reset to below 1. This after the STH-SOPR reset happened earlier this week.

$btc

$btc

9/ Miners expecting higher prices in the coming months. Chances of miners dumping in the near future lower, hence. https://twitter.com/WClementeIII/status/1385324153989959680?s=19">https://twitter.com/WClemente...

10/ URPD support for $btc at $47k. https://twitter.com/WClementeIII/status/1385322998060789763?s=19">https://twitter.com/WClemente...

11/ 30 day MVRV has fallen to oversold levels. https://twitter.com/satoshilatino/status/1385593193513820164?s=19">https://twitter.com/satoshila...

12/ @intotheblock IOMAP shows us that more money had entered price higher than CP.

On the flipside of this argument $45.3k seems to be support below which price can cascade downwards. But then again, $45.3k happens to be RSI 30 price.

On the flipside of this argument $45.3k seems to be support below which price can cascade downwards. But then again, $45.3k happens to be RSI 30 price.

13/ Historical IOPMAP data since start of 2020 shows us that the percentage of #btc  https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses out of money is at levels comparable to last September& #39;s (~20%) and lower than during the three dips this calender year.

https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses out of money is at levels comparable to last September& #39;s (~20%) and lower than during the three dips this calender year.

$btcusd $btc $xbt

$btcusd $btc $xbt

14/ No. of $btc addresses in losses also around September 2020 levels (~20%).

15/ The 7 day change in the no. of #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses (30 DMA smoothened) with zero balances has bottomed out. Historically, this has marked local bottoms as can be seen in the chart here.

https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses (30 DMA smoothened) with zero balances has bottomed out. Historically, this has marked local bottoms as can be seen in the chart here.

16/ Back to TA, $btcusd should find support at 100 DMA, especially given that it& #39;s already on a TD9.

17/ What about bullish arguments should 100 DMA not hold?

IMO, $44k to $45k should be the bottom then. Here& #39;s why.

Weekly BB mid line at $43.9k. I expect it to rise to $44.2k next week. Big candidate for a $btcusd bounce.

IMO, $44k to $45k should be the bottom then. Here& #39;s why.

Weekly BB mid line at $43.9k. I expect it to rise to $44.2k next week. Big candidate for a $btcusd bounce.

18/ The weekly RSI 53.5 has been a strong $btc bull/bear market separator. Tomorrow, it& #39;s going to $45.2k, which is a strong IOMAP support mentioned earlier.

19/ This wyckoff range analysis by @Crypt0mer has a bottom target of $44k-$45k. I, however, do not expect this to be distribution, but more of a re-accumulation, as elucidated by the contents of this thread. https://twitter.com/Crypt0mer/status/1385529336065892353?s=19">https://twitter.com/Crypt0mer...

20a/ Finally, the S2F price has been been on the rise and is expected to start plateauing out at $78k from second week of May. Historically, the 0.67 multiple of the S2F price (blue) has been a level of significance. It is already at $45.2k.

20b/ The S2F price will also rise to about $90k over the next three years. I& #39;m not sold on this model statistically, but its 0.5x multiple (green) has so far predicted the bottoms at $3k (December 2018) and $3.8k (March 2020). This line will be around $39k in two weeks and...

20c/ $45k thereafter. Another, reason for local bottom being near.

End of thread.

End of thread.

Read on Twitter

Read on Twitter

reserve stable coin flows made an ATH yesterday." title="6/ Now moving on to on-chain metrics. First up, #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> reserve stable coin flows made an ATH yesterday." class="img-responsive" style="max-width:100%;"/>

reserve stable coin flows made an ATH yesterday." title="6/ Now moving on to on-chain metrics. First up, #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> reserve stable coin flows made an ATH yesterday." class="img-responsive" style="max-width:100%;"/>

addresses out of money is at levels comparable to last September& #39;s (~20%) and lower than during the three dips this calender year. $btcusd $btc $xbt" title="13/ Historical IOPMAP data since start of 2020 shows us that the percentage of #btc https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses out of money is at levels comparable to last September& #39;s (~20%) and lower than during the three dips this calender year. $btcusd $btc $xbt" class="img-responsive" style="max-width:100%;"/>

addresses out of money is at levels comparable to last September& #39;s (~20%) and lower than during the three dips this calender year. $btcusd $btc $xbt" title="13/ Historical IOPMAP data since start of 2020 shows us that the percentage of #btc https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses out of money is at levels comparable to last September& #39;s (~20%) and lower than during the three dips this calender year. $btcusd $btc $xbt" class="img-responsive" style="max-width:100%;"/>

addresses (30 DMA smoothened) with zero balances has bottomed out. Historically, this has marked local bottoms as can be seen in the chart here." title="15/ The 7 day change in the no. of #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses (30 DMA smoothened) with zero balances has bottomed out. Historically, this has marked local bottoms as can be seen in the chart here." class="img-responsive" style="max-width:100%;"/>

addresses (30 DMA smoothened) with zero balances has bottomed out. Historically, this has marked local bottoms as can be seen in the chart here." title="15/ The 7 day change in the no. of #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses (30 DMA smoothened) with zero balances has bottomed out. Historically, this has marked local bottoms as can be seen in the chart here." class="img-responsive" style="max-width:100%;"/>