1/Back to the threads! Today we will look at Hyman Minsky& #39;s ideas on financial economics, business cycles and more!

He& #39;s the guy known for the concept of a "Minsky moment"!

Let& #39;s dig in!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

He& #39;s the guy known for the concept of a "Minsky moment"!

Let& #39;s dig in!

2/Who was Hyman Minsky anyway? And why should we care about him?

Minsky was a financial economist who has done some spectacular work on credit cycles, lending, etc. He was a professor of economics at Washington University in St. Louis.

Minsky was a financial economist who has done some spectacular work on credit cycles, lending, etc. He was a professor of economics at Washington University in St. Louis.

3/Hyman Minsky& #39;s most famous concept was that of his Financial Instability Hypothesis.

Several people have considered this to be the secret behind financial crashes.

Several people have considered this to be the secret behind financial crashes.

4/The Financial Instability Hypothesis has three "types" of borrowers:

1. The Hedge

2. The Speculative

3. The Ponzi

The last one (clearly) is named after Charles Ponzi, the famous fraudster after whom the term "Ponzi scheme" was named.

1. The Hedge

2. The Speculative

3. The Ponzi

The last one (clearly) is named after Charles Ponzi, the famous fraudster after whom the term "Ponzi scheme" was named.

5/The hedge borrower is able to pay back debt using current cash flow from investments. This is the strongest borrower, and is of low risk to the economy.

The debt repayments are pretty much easy to make and thus have no real risk to the economy.

The debt repayments are pretty much easy to make and thus have no real risk to the economy.

6/The speculative borrower can make interest payments / "service the debt" through cash flow from investments, but needs to roll over or borrow more to pay off the principal.

This is the second least risky (or the second most risky!) kind of borrowing.

This is the second least risky (or the second most risky!) kind of borrowing.

7/The third kind of borrower, and the most risky form is the "Ponzi" borrower.

The Ponzi borrower can only be kept afloat through rising asset prices- and cannot make interest / principal payments through cash flow from investments.

The Ponzi borrower can only be kept afloat through rising asset prices- and cannot make interest / principal payments through cash flow from investments.

8/The Ponzi borrower can only refinance his / her debt through appreciating asset values.

Only appreciating asset values keeps the Ponzi borrower afloat.

Only appreciating asset values keeps the Ponzi borrower afloat.

9/Usually what happens is expectations of borrowers tends to go beyond reasonable. If Ponzi finance is very commonly used, it can cause the system to blow up.

When the asset bubble pops, most speculative borrowers are unable to make payments on loans.

When the asset bubble pops, most speculative borrowers are unable to make payments on loans.

10/This is because even if the speculative borrowers can pay off interest payments, they are unable to roll over the principal (aka refinance their loans).

This sets of domino effect and the hedge borrowers are screwed over too.

This sets of domino effect and the hedge borrowers are screwed over too.

11/The hedge borrowers (remember these are the safe guys) are unable to find people to borrow from even if their investments are 100% sound!

In the financialized economy, credit is what drives it- credit boosts spending, investment, etc.

In the financialized economy, credit is what drives it- credit boosts spending, investment, etc.

12/As a general (obvious) principle- the more general the Ponzi borrowers, the riskier the financial system.

Minsky makes an even more nuanced distinction here. He argues that if hedge borrowers are the norm, then the economy is overall & #39;equilibrium seeking / self containing& #39;.

Minsky makes an even more nuanced distinction here. He argues that if hedge borrowers are the norm, then the economy is overall & #39;equilibrium seeking / self containing& #39;.

13/However if the norm is speculative / Ponzi financing, the economy is more likely to be a "deviation -amplifying" system!

As I understand these are deviations from equilibrium that are amplified.

As I understand these are deviations from equilibrium that are amplified.

14/We will take a look at the housing bubble of the mid 2000s as an example of Minsky& #39;s Financial Instability Hypothesis (FIH).

Initially most borrowing was "hedge", meaning the borrowers were able to comfortable pay off loans.

Initially most borrowing was "hedge", meaning the borrowers were able to comfortable pay off loans.

15/As things went on, the banks financed exceedingly risky mortgages with higher levels of leverage. And people would own homes on the belief that the prices would continue rising ever higher.

This was the speculative / Ponzi type financing.

This was the speculative / Ponzi type financing.

16/When that became the norm, the market as a whole became very unstable.

We saw the converse on the way down- when the bubble burst, we saw lending standards go up, a mass deleveraging, etc.

We saw the converse on the way down- when the bubble burst, we saw lending standards go up, a mass deleveraging, etc.

17/"Capitalist economies exhibit inflations and debt deflations which seem to have the potential to spin out of control. In such processes, the economic system& #39;s reactions to a movement of the economy amplify the movement – inflation feeds upon inflation."

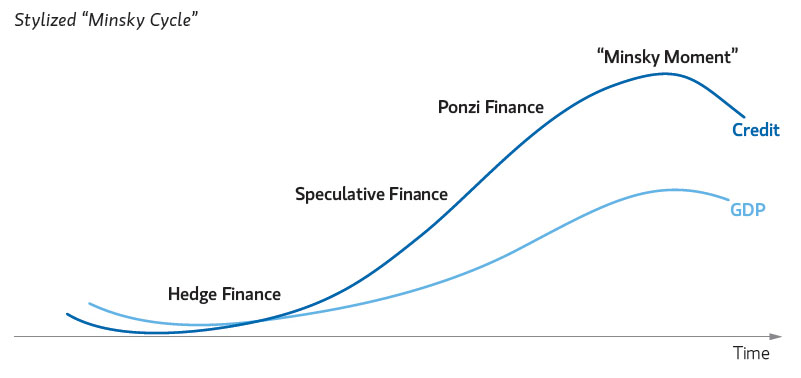

18/Here is a good chart to illustrate how the concept of a "Minsky moment" fits in with the 3 types of borrowing we just saw:

19/Simply put, Minsky argues that "Stability is destabilizing"; which is at odds with most macro economists who argue that the economy is always stable / always shifting towards equilibrium.

20/Another very interesting Minsky idea is his concept of how lending works. Most people believe that you need bank reserves in order to make loans.

Not Minsky! Minsky argued that banks would make loans as they felt fit and then borrowed reserves to make up the difference!

Not Minsky! Minsky argued that banks would make loans as they felt fit and then borrowed reserves to make up the difference!

21/ @wbmosler has made this point in his book "Soft Currency Economics". Banks lend as they please and as they wish.

They aren& #39;t constrained by anyone or anything. They will simply borrow reserves to meet regulation in the next accounting period.

They aren& #39;t constrained by anyone or anything. They will simply borrow reserves to meet regulation in the next accounting period.

22/How can we use Minsky& #39;s ideas to become better investors?

Minsky teaches us that when it looks to good to invest is usually the time of the highest risk. When everything seems good, and money is easy to make, that is when it& #39;s high risk.

Minsky teaches us that when it looks to good to invest is usually the time of the highest risk. When everything seems good, and money is easy to make, that is when it& #39;s high risk.

23/Similarly Minsky agrees with the Baron Rothschild that the best time to invest is when "there& #39;s blood on the streets" as the Baron put it.

Euphoria and panic can both last longer than we might expect.

Euphoria and panic can both last longer than we might expect.

24/But the Minsky ideas of:

1. How credit works

2. How that influences cycles

3. Understanding where in the cycle we might be

Is a very useful mental models to keep in mind as investors as well as entrepreneurs.

1. How credit works

2. How that influences cycles

3. Understanding where in the cycle we might be

Is a very useful mental models to keep in mind as investors as well as entrepreneurs.

25/If you got to the end, thank you so much for reading! Means a lot that you led all the way to the end!

If you enjoyed it, please do share it and consider dropping a follow!

If you enjoyed it, please do share it and consider dropping a follow!

Read on Twitter

Read on Twitter