Part 3: A look at the #Iraqi Dinar (IQD) vs the #Turkish Lira (TRY) & #Iranian Rial (IRR). Effects on #Iraq’s competitiveness

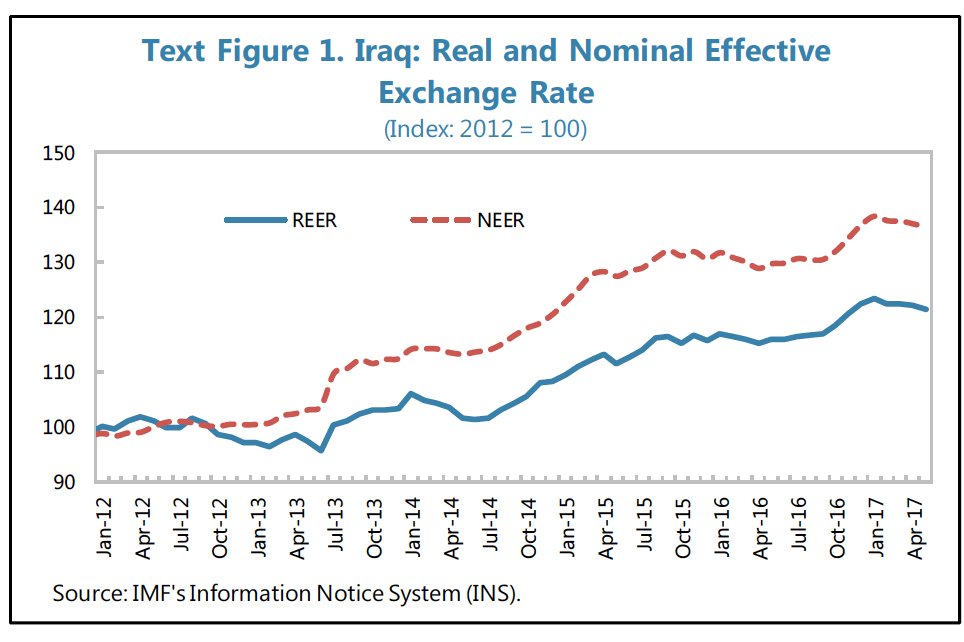

Between 2012 & Dec 2020 the Real Effective Exchange Rate (REER - see end for explanation) of the IQD increased roughly by 30%, ...

1/6 https://twitter.com/AMTabaqchali/status/1380013027718758414">https://twitter.com/AMTabaqch...

Between 2012 & Dec 2020 the Real Effective Exchange Rate (REER - see end for explanation) of the IQD increased roughly by 30%, ...

1/6 https://twitter.com/AMTabaqchali/status/1380013027718758414">https://twitter.com/AMTabaqch...

... mostly due the the devaluations of the currencies of #Iraq’s major trading partners, TRY & IRR-see Pt 1 & 2

This means imports to Iraq, esp. agricultural & food related, basic industries from #Iran & #Turkey have become 30% more competitive than Iraq’s own production.

2/6

This means imports to Iraq, esp. agricultural & food related, basic industries from #Iran & #Turkey have become 30% more competitive than Iraq’s own production.

2/6

This partly explains the loss of market share of Iraqi products in #Iraq to those from #Iran & #Turkey, & the weakness of its private sector … other significant reasons are structural faultiness in the #Iraqi economy as discussed in the White Paper

https://gds.gov.iq/ar/wp-content/uploads/2020/10/Iraq-white-paper-in-arabic-october-2020.pdf

3/6">https://gds.gov.iq/ar/wp-con...

https://gds.gov.iq/ar/wp-content/uploads/2020/10/Iraq-white-paper-in-arabic-october-2020.pdf

3/6">https://gds.gov.iq/ar/wp-con...

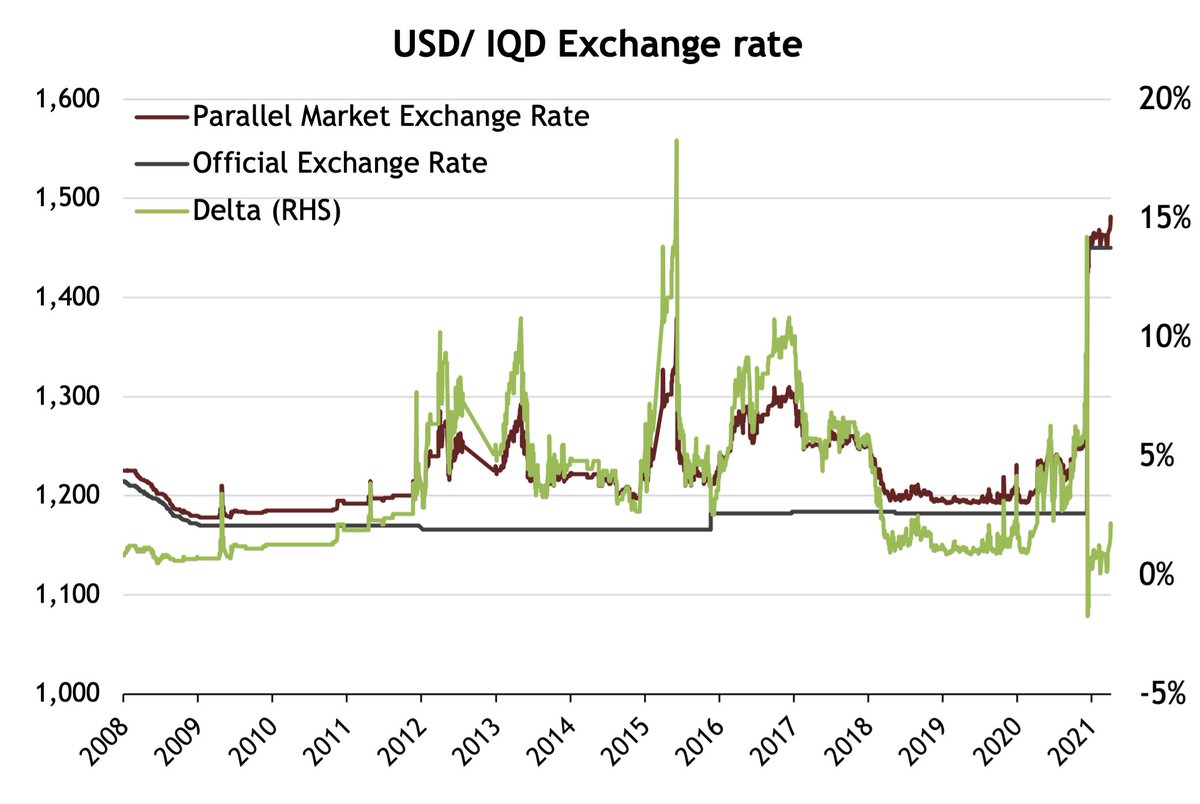

The 23% devaluation of the IQD vs the USD in Dec 2020 reverses almost all of this loss of competitiveness. But fixing other structural faultiness is much harder requiring real reforms of #Iraq’s economy along the lines of those in the White Paper

4/6

4/6

The IQD’s REER basically compares the IQD value against the weighted average of the currencies of its major trading partners, & is adjusted for inflation.

Source for charts in thread (1-6): IMF #Iraq country reports, CBI, https://www.xe.com/currencycharts/

5/6">https://www.xe.com/currencyc...

Source for charts in thread (1-6): IMF #Iraq country reports, CBI, https://www.xe.com/currencycharts/

5/6">https://www.xe.com/currencyc...

Read on Twitter

Read on Twitter