1/6 Since last Sunday, the #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> price went from >$60k to <$50k in a dip that scared some (newer) market participants

https://abs.twimg.com/hashflags... draggable="false" alt=""> price went from >$60k to <$50k in a dip that scared some (newer) market participants

Who were selling here, and are they done selling? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">

A small https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> using @whale_map data to zoom in on the price action of this last week

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> using @whale_map data to zoom in on the price action of this last week

Who were selling here, and are they done selling?

A small

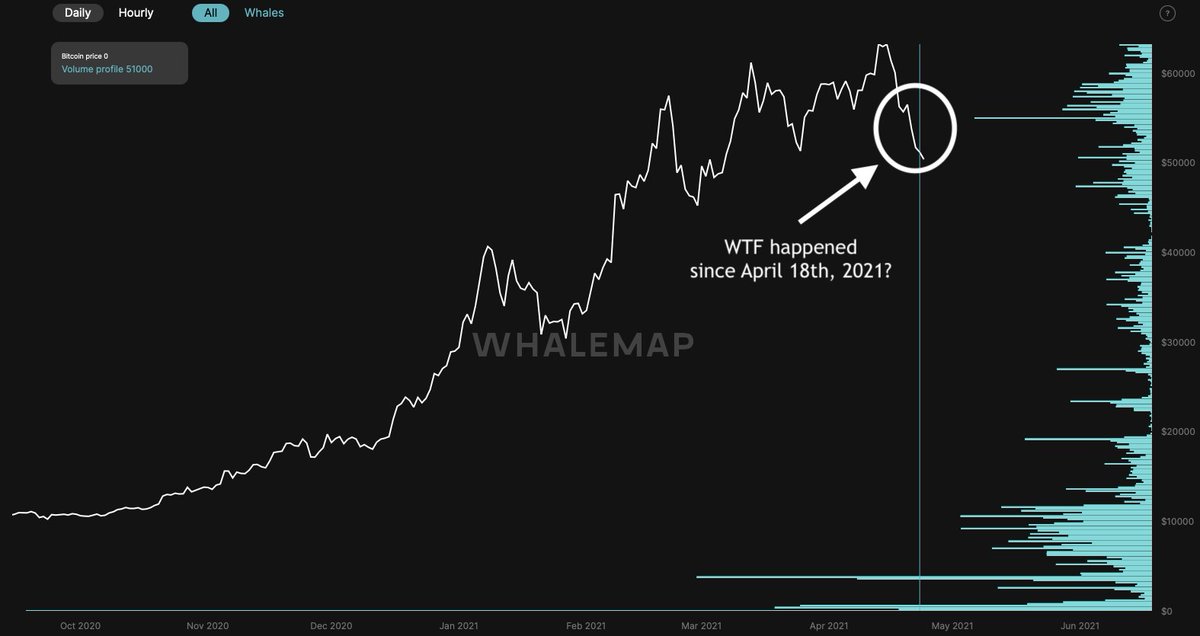

2/6 The market turnaround started last Sunday (April 18th), when price broke through $60k with increased volume

As can be seen in this https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> outflows chart, a lot of #bitcoin

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> outflows chart, a lot of #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> moved that day that was bought by whales on August 3rd, 2020 for ~$11.2k

https://abs.twimg.com/hashflags... draggable="false" alt=""> moved that day that was bought by whales on August 3rd, 2020 for ~$11.2k

Looks like (>400%) profit taking

As can be seen in this

Looks like (>400%) profit taking

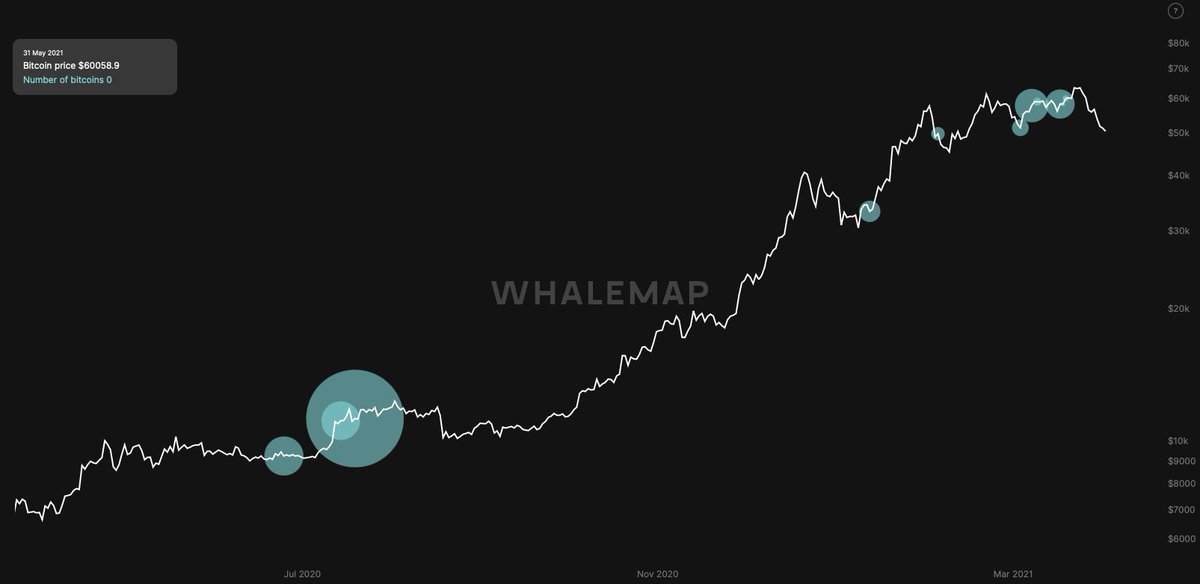

3/6 On Thursday (April 22nd), price also broke down the ~$1 trillion market cap price

On that day, a lot of https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">-owned #bitcoin

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">-owned #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> that were bought on December 22nd, 2020, for ~$23.8k moved

https://abs.twimg.com/hashflags... draggable="false" alt=""> that were bought on December 22nd, 2020, for ~$23.8k moved

Looks again like (>100%) profit taking - this time by a slightly newer market participant

On that day, a lot of

Looks again like (>100%) profit taking - this time by a slightly newer market participant

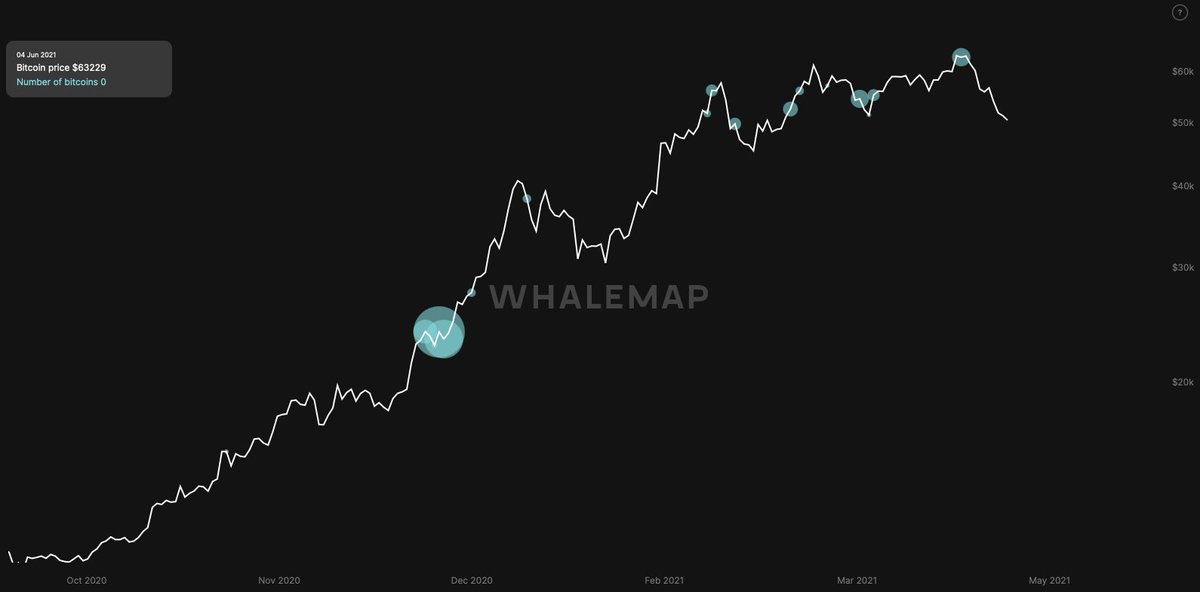

4/6 Yesterday (April 23rd), the #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> price also broke through $50k in what felt like a mini-capitulation event

https://abs.twimg.com/hashflags... draggable="false" alt=""> price also broke through $50k in what felt like a mini-capitulation event

Zooming in on https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> movements again, this time there was a lot less action - only some by <1m old whales that bought around $60k and apparently accepted a ~20% loss

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> movements again, this time there was a lot less action - only some by <1m old whales that bought around $60k and apparently accepted a ~20% loss

Zooming in on

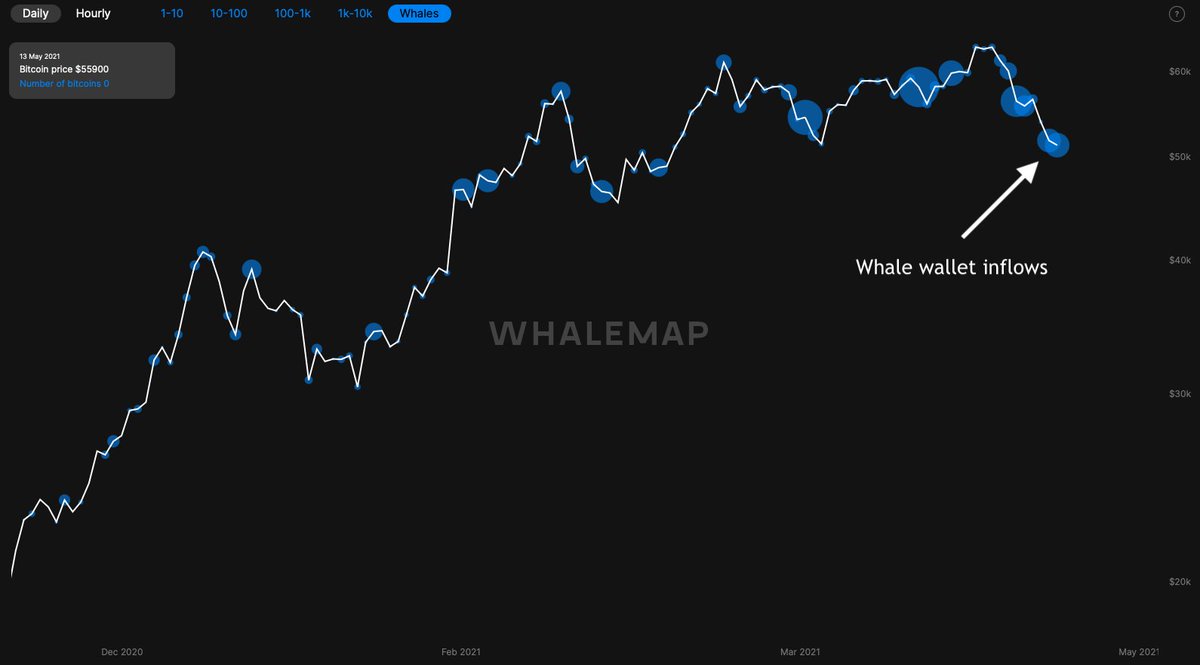

5/6 This dip started with older  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">s taking profit, creating a cascading effect of profit taking all the way to capitulation by newbie

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">s taking profit, creating a cascading effect of profit taking all the way to capitulation by newbie  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">s

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">s

The good news; the Spent Output Profit Ratio (SOPR) has completely reset, which means that profit taking is now neutral (which is bullish)

The good news; the Spent Output Profit Ratio (SOPR) has completely reset, which means that profit taking is now neutral (which is bullish)

6/6 Furthermore, to close this  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> off, the price action over the past week has created new clusters of large

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> off, the price action over the past week has created new clusters of large  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> addresses with a fresh new realized price and profit status that may be the

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> addresses with a fresh new realized price and profit status that may be the  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> HODL& #39;ers of the next leg up - and/or beyond

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> HODL& #39;ers of the next leg up - and/or beyond

Read on Twitter

Read on Twitter price went from >$60k to <$50k in a dip that scared some (newer) market participantsWho were selling here, and are they done selling? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">A small https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> using @whale_map data to zoom in on the price action of this last week" title="1/6 Since last Sunday, the #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price went from >$60k to <$50k in a dip that scared some (newer) market participantsWho were selling here, and are they done selling? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">A small https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> using @whale_map data to zoom in on the price action of this last week" class="img-responsive" style="max-width:100%;"/>

price went from >$60k to <$50k in a dip that scared some (newer) market participantsWho were selling here, and are they done selling? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">A small https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> using @whale_map data to zoom in on the price action of this last week" title="1/6 Since last Sunday, the #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price went from >$60k to <$50k in a dip that scared some (newer) market participantsWho were selling here, and are they done selling? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">A small https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> using @whale_map data to zoom in on the price action of this last week" class="img-responsive" style="max-width:100%;"/>

outflows chart, a lot of #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> moved that day that was bought by whales on August 3rd, 2020 for ~$11.2kLooks like (>400%) profit taking" title="2/6 The market turnaround started last Sunday (April 18th), when price broke through $60k with increased volumeAs can be seen in this https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> outflows chart, a lot of #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> moved that day that was bought by whales on August 3rd, 2020 for ~$11.2kLooks like (>400%) profit taking" class="img-responsive" style="max-width:100%;"/>

outflows chart, a lot of #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> moved that day that was bought by whales on August 3rd, 2020 for ~$11.2kLooks like (>400%) profit taking" title="2/6 The market turnaround started last Sunday (April 18th), when price broke through $60k with increased volumeAs can be seen in this https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> outflows chart, a lot of #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> moved that day that was bought by whales on August 3rd, 2020 for ~$11.2kLooks like (>400%) profit taking" class="img-responsive" style="max-width:100%;"/>

-owned #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> that were bought on December 22nd, 2020, for ~$23.8k movedLooks again like (>100%) profit taking - this time by a slightly newer market participant" title="3/6 On Thursday (April 22nd), price also broke down the ~$1 trillion market cap priceOn that day, a lot of https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">-owned #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> that were bought on December 22nd, 2020, for ~$23.8k movedLooks again like (>100%) profit taking - this time by a slightly newer market participant" class="img-responsive" style="max-width:100%;"/>

-owned #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> that were bought on December 22nd, 2020, for ~$23.8k movedLooks again like (>100%) profit taking - this time by a slightly newer market participant" title="3/6 On Thursday (April 22nd), price also broke down the ~$1 trillion market cap priceOn that day, a lot of https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">-owned #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> that were bought on December 22nd, 2020, for ~$23.8k movedLooks again like (>100%) profit taking - this time by a slightly newer market participant" class="img-responsive" style="max-width:100%;"/>

price also broke through $50k in what felt like a mini-capitulation eventZooming in on https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> movements again, this time there was a lot less action - only some by <1m old whales that bought around $60k and apparently accepted a ~20% loss" title="4/6 Yesterday (April 23rd), the #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price also broke through $50k in what felt like a mini-capitulation eventZooming in on https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> movements again, this time there was a lot less action - only some by <1m old whales that bought around $60k and apparently accepted a ~20% loss" class="img-responsive" style="max-width:100%;"/>

price also broke through $50k in what felt like a mini-capitulation eventZooming in on https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> movements again, this time there was a lot less action - only some by <1m old whales that bought around $60k and apparently accepted a ~20% loss" title="4/6 Yesterday (April 23rd), the #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> price also broke through $50k in what felt like a mini-capitulation eventZooming in on https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> movements again, this time there was a lot less action - only some by <1m old whales that bought around $60k and apparently accepted a ~20% loss" class="img-responsive" style="max-width:100%;"/>

s taking profit, creating a cascading effect of profit taking all the way to capitulation by newbie https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">sThe good news; the Spent Output Profit Ratio (SOPR) has completely reset, which means that profit taking is now neutral (which is bullish)" title="5/6 This dip started with older https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">s taking profit, creating a cascading effect of profit taking all the way to capitulation by newbie https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">sThe good news; the Spent Output Profit Ratio (SOPR) has completely reset, which means that profit taking is now neutral (which is bullish)" class="img-responsive" style="max-width:100%;"/>

s taking profit, creating a cascading effect of profit taking all the way to capitulation by newbie https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">sThe good news; the Spent Output Profit Ratio (SOPR) has completely reset, which means that profit taking is now neutral (which is bullish)" title="5/6 This dip started with older https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">s taking profit, creating a cascading effect of profit taking all the way to capitulation by newbie https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal">sThe good news; the Spent Output Profit Ratio (SOPR) has completely reset, which means that profit taking is now neutral (which is bullish)" class="img-responsive" style="max-width:100%;"/>

off, the price action over the past week has created new clusters of large https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> addresses with a fresh new realized price and profit status that may be the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> HODL& #39;ers of the next leg up - and/or beyond" title="6/6 Furthermore, to close this https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> off, the price action over the past week has created new clusters of large https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> addresses with a fresh new realized price and profit status that may be the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> HODL& #39;ers of the next leg up - and/or beyond" class="img-responsive" style="max-width:100%;"/>

off, the price action over the past week has created new clusters of large https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> addresses with a fresh new realized price and profit status that may be the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> HODL& #39;ers of the next leg up - and/or beyond" title="6/6 Furthermore, to close this https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> off, the price action over the past week has created new clusters of large https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> addresses with a fresh new realized price and profit status that may be the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐳" title="Wasserspeiender Wal" aria-label="Emoji: Wasserspeiender Wal"> HODL& #39;ers of the next leg up - and/or beyond" class="img-responsive" style="max-width:100%;"/>