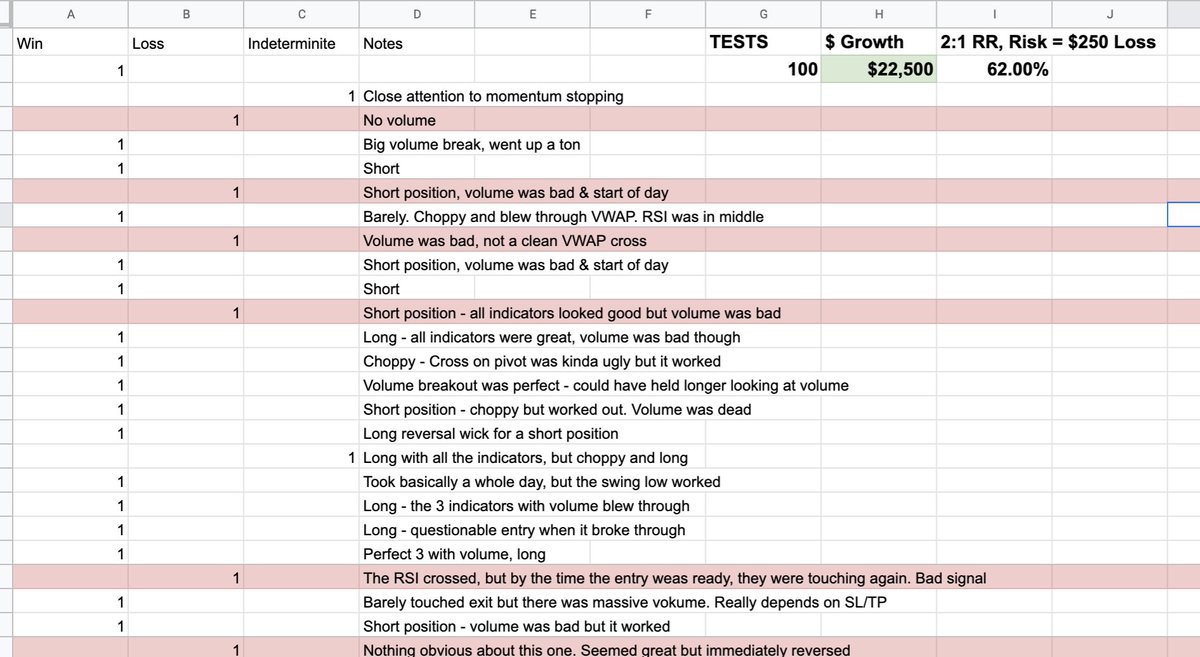

Ran a backtest of @EmperorBTC& #39;s VWAP/RSI day trading strategy

- 4 assets, 25 tests each

- 2:1 RR, with a $250 risk per trade, SL at swing low/high

- 62% win rate, resulting in $22,500 in growth

Remained agnostic to my "gut", and traded purely on the 3 trigger conditions

- 4 assets, 25 tests each

- 2:1 RR, with a $250 risk per trade, SL at swing low/high

- 62% win rate, resulting in $22,500 in growth

Remained agnostic to my "gut", and traded purely on the 3 trigger conditions

a nice takeaway to reduce probably 10% of losses:

- most of the losing trades came from the VWAP flip being on the first 1-3 candles of the day, and reverting to a mean of price. As I said, I remained agnostic to that and tested anyways

Very nice strat @EmperorBTC !

- most of the losing trades came from the VWAP flip being on the first 1-3 candles of the day, and reverting to a mean of price. As I said, I remained agnostic to that and tested anyways

Very nice strat @EmperorBTC !

An example of this:

You can see the VWAP & Pivot crossed on the first candle of the day. Faked out immediately and went down to the stop (granted... back up shortly after)

There& #39;s not enough data on the day yet to get actionable insights from the VWAP location - just ignore

You can see the VWAP & Pivot crossed on the first candle of the day. Faked out immediately and went down to the stop (granted... back up shortly after)

There& #39;s not enough data on the day yet to get actionable insights from the VWAP location - just ignore

Read on Twitter

Read on Twitter