(not comprehensive list of) relevant accounts:

@terra_money (main)

@mirror_protocol (stocks/investing)

@anchor_protocol (savings & lending)

Official Terra team accts:

@d0h0k1 @3william5chen @terraform_cap

Helpful Terra community educators:

@TerraBitesPod @Panterra0x

@terra_money (main)

@mirror_protocol (stocks/investing)

@anchor_protocol (savings & lending)

Official Terra team accts:

@d0h0k1 @3william5chen @terraform_cap

Helpful Terra community educators:

@TerraBitesPod @Panterra0x

@BuzlinkO

blockchain-based social referrals

@HarpoonProtocol

friendly UI for liquidating Anchor loans

Fiat on-ramps:

@alice_finance @Saturn_Money @kashdefi @orion_money

Insurance:

Ozone $O3

@mars_protocol

Money market

@nebula_protocol

ETFs

@loop_finance

AMM DEX

@spar_protocol

Asset mgt/investing strategies

@PayWithTerra

API for merchants to accept $UST payment

@terrakadopay

Spend your $UST IRL

@local_terra

Decentralized P2P exchange

@pylon_protocol

Launchpad/NFTs

@SubsidiumDGTL @angelprotocol

Philanthropy

AMM DEX

@spar_protocol

Asset mgt/investing strategies

@PayWithTerra

API for merchants to accept $UST payment

@terrakadopay

Spend your $UST IRL

@local_terra

Decentralized P2P exchange

@pylon_protocol

Launchpad/NFTs

@SubsidiumDGTL @angelprotocol

Philanthropy

@Mirror_Wallet

(Mobile app for @mirror_protocol)

@Mirror_Market_

(Data/Analytics of @mirror_protocol)

$MIR $LUNA $UST

(Mobile app for @mirror_protocol)

@Mirror_Market_

(Data/Analytics of @mirror_protocol)

$MIR $LUNA $UST

CHAI payments app in South Korea using @terra_money $KRT

- provides merchants with faster settlement time (they get paid in seconds rather than days)

- provides customers with discounts on everyday purchases (by cutting out the 2-3% credit card fee & working with local partners)

- provides merchants with faster settlement time (they get paid in seconds rather than days)

- provides customers with discounts on everyday purchases (by cutting out the 2-3% credit card fee & working with local partners)

Follow @Lu_It_Haeng to see posts about the Chai app & card

@Lu_It_Haeng 팔로우 해주세요 (차이앱, 차이카드)

$KRT $LUNA

@Lu_It_Haeng 팔로우 해주세요 (차이앱, 차이카드)

$KRT $LUNA

@TERRA_MONEY LINKS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://terra.money"> https://terra.money

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://terra.money"> https://terra.money

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://docs.terra.money/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://docs.terra.money/

https://docs.terra.money/">... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://medium.com/terra-money

https://medium.com/terra-mon... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://github.com/terra-project ">https://github.com/terra-pro...

Governance

https://agora.terra.money/

Terra">https://agora.terra.money/">... Station

https://station.terra.money/

PDF">https://station.terra.money/">... GUIDE

https://terra.money/static/Terra_Station_Guide_Eng.pdf

Block">https://terra.money/static/Te... explorer

https://finder.terra.money/ ">https://finder.terra.money/">...

$LUNA

Governance

https://agora.terra.money/

Terra">https://agora.terra.money/">... Station

https://station.terra.money/

PDF">https://station.terra.money/">... GUIDE

https://terra.money/static/Terra_Station_Guide_Eng.pdf

Block">https://terra.money/static/Te... explorer

https://finder.terra.money/ ">https://finder.terra.money/">...

$LUNA

@ANCHOR_PROTOCOL LINKS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://anchorprotocol.com/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://anchorprotocol.com/

https://anchorprotocol.com/">... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://docs.anchorprotocol.com/

https://docs.anchorprotocol.com/">... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://github.com/Anchor-Protocol

Dashboard

https://github.com/Anchor-Pr... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://anchorprotocol.com/dashboard

Web">https://anchorprotocol.com/dashboard... app

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://app.anchorprotocol.com/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://app.anchorprotocol.com/

Forum

https://app.anchorprotocol.com/">... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://forum.anchorprotocol.com/

Whitepaper">https://forum.anchorprotocol.com/">... PDF

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://anchorprotocol.com/docs/anchor-v1.1.pdf

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://anchorprotocol.com/docs/anchor-v1.1.pdf

https://anchorprotocol.com/docs/anch... href="https://twitter.com/search?q=%24ANC&src=ctag">$ANC $LUNA

Dashboard

Web">https://anchorprotocol.com/dashboard... app

Forum

Whitepaper">https://forum.anchorprotocol.com/">... PDF

@MIRROR_PROTOCOL LINKS

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://mirror.finance/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://mirror.finance/

https://mirror.finance/">... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://docs.mirror.finance/

https://docs.mirror.finance/">... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://github.com/Mirror-Protocol

https://github.com/Mirror-Pr... class="Emoji" style="height:16px;" src=" https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://mirror-protocol.medium.com/

Web">https://mirror-protocol.medium.com/">... app

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://terra.mirror.finance/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://terra.mirror.finance/

Governance">https://terra.mirror.finance/">... forum

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://forum.mirror.finance/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://forum.mirror.finance/

Whitepaper">https://forum.mirror.finance/">... PDF

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://mirror.finance/MirrorWP.pdf

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://mirror.finance/MirrorWP.pdf

https://mirror.finance/MirrorWP.... href="https://twitter.com/search?q=%24MIR&src=ctag">$MIR $LUNA

Web">https://mirror-protocol.medium.com/">... app

Governance">https://terra.mirror.finance/">... forum

Whitepaper">https://forum.mirror.finance/">... PDF

How @terra_money& #39;s stability mechanism works

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎞️" title="Filmstreifen" aria-label="Emoji: Filmstreifen"> https://youtu.be/KqpGMoYZMhY

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎞️" title="Filmstreifen" aria-label="Emoji: Filmstreifen"> https://youtu.be/KqpGMoYZMhY

https://youtu.be/KqpGMoYZM... href="https://twitter.com/search?q=%24LUNA&src=ctag">$LUNA + Terra stablecoins like $UST & $KRT

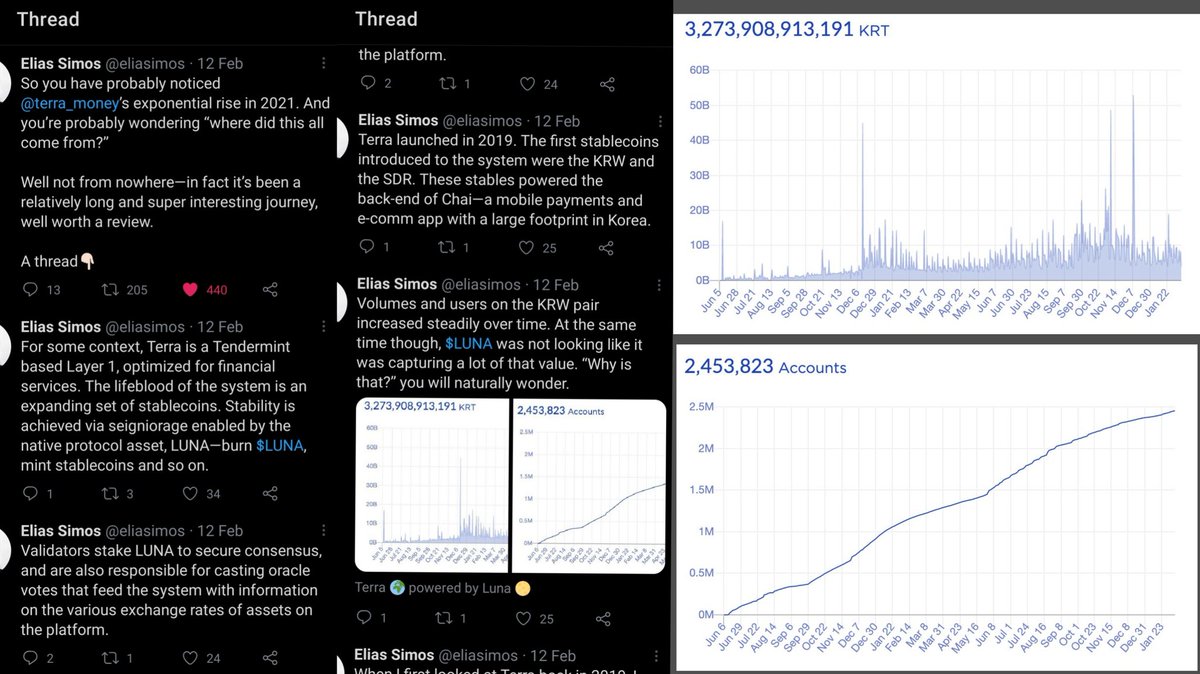

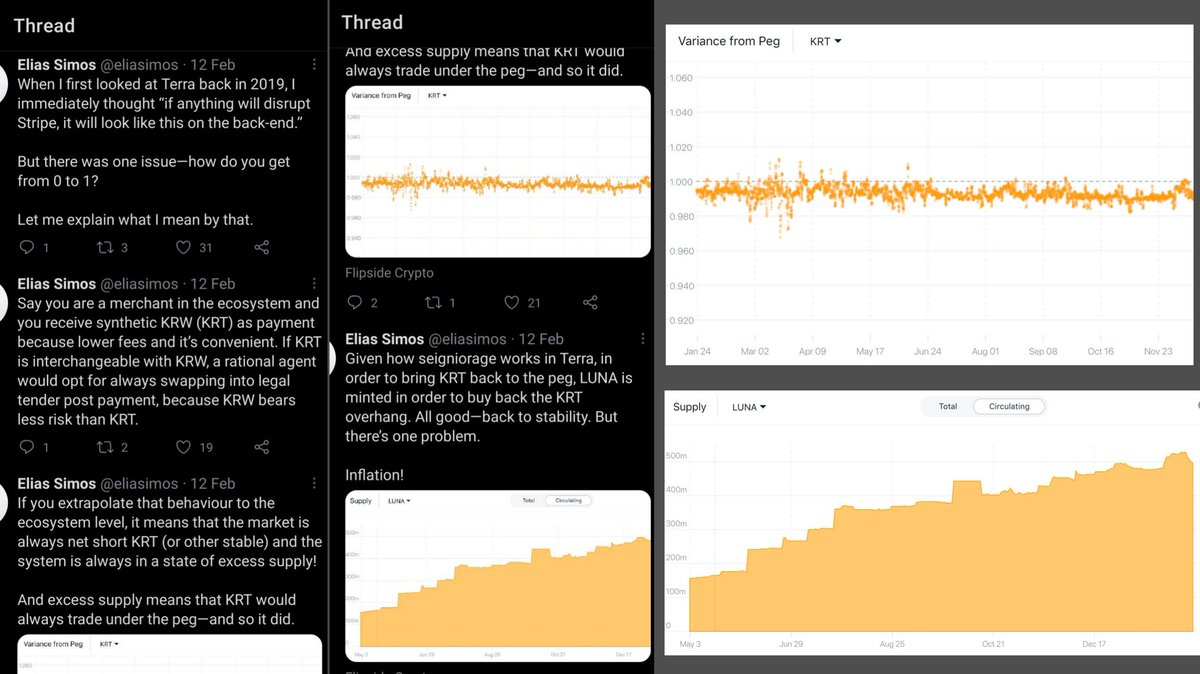

@FLIPSIDECRYPTO ANALYTICS DASHBOARD

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm"> https://terra.flipsidecrypto.com/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📊" title="Balkendiagramm" aria-label="Emoji: Balkendiagramm"> https://terra.flipsidecrypto.com/

Includes">https://terra.flipsidecrypto.com/">... $LUNA $UST $KRT $SDT data such as

- fees generated

- staking rewards

- swap volumes & spreads

- variance from stable peg

- validators

Includes">https://terra.flipsidecrypto.com/">... $LUNA $UST $KRT $SDT data such as

- fees generated

- staking rewards

- swap volumes & spreads

- variance from stable peg

- validators

@SMARTSTAKE AIRDROP TIMER DASHBOARD

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏰" title="Wecker" aria-label="Emoji: Wecker"> https://terra.smartstake.io/timer

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏰" title="Wecker" aria-label="Emoji: Wecker"> https://terra.smartstake.io/timer

Weekly">https://terra.smartstake.io/timer&quo... $MIR & $ANC airdrop countdown timers for $LUNA stakers in Terra Station

Weekly">https://terra.smartstake.io/timer&quo... $MIR & $ANC airdrop countdown timers for $LUNA stakers in Terra Station

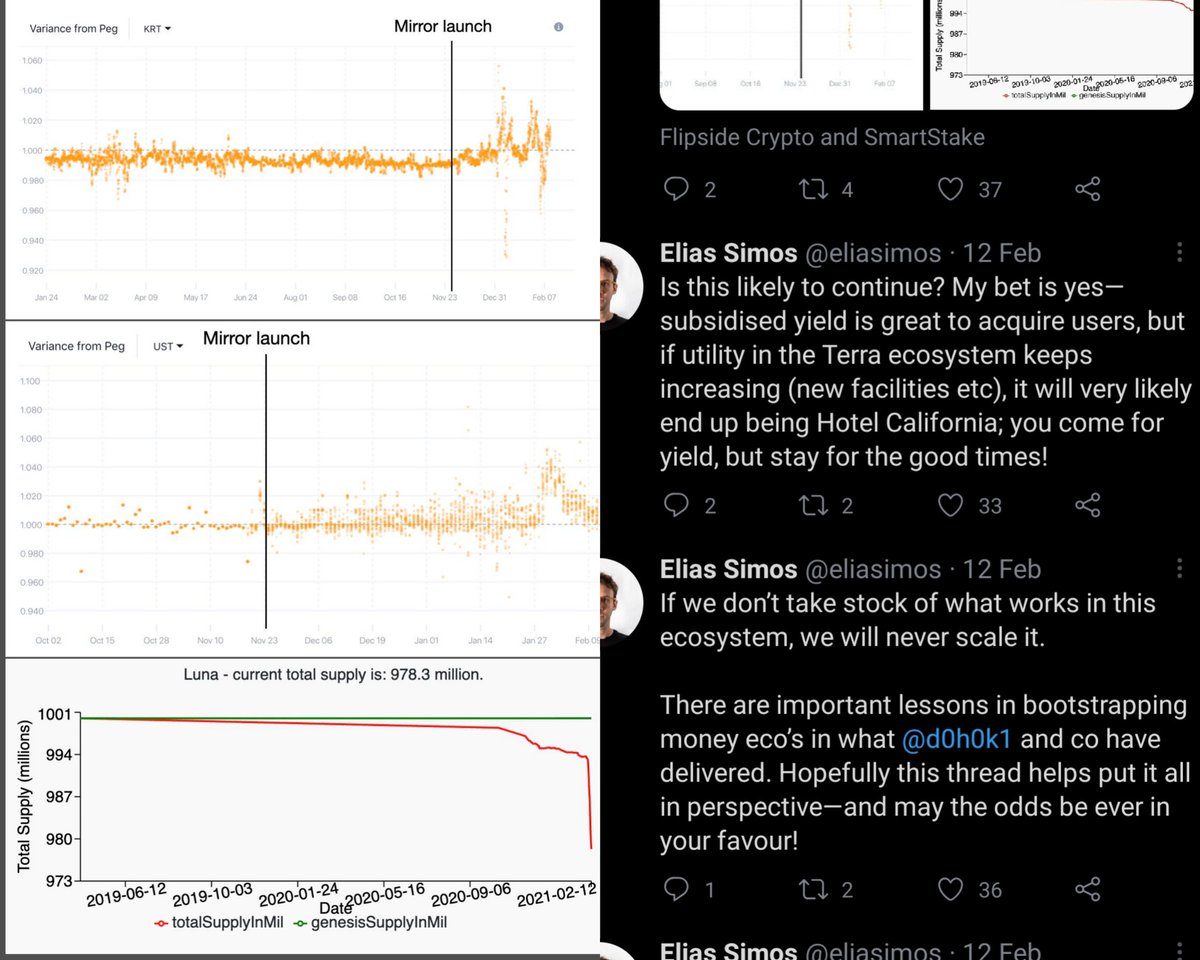

Thread - February 2021

@mirror_protocol @anchor_protocol are catalysts that incentivize demand for Terra stablecoins like $UST (beyond what Chai does for $KRT demand)

+ @flipsidecrypto @SmartStake charts (see above)

$LUNA $MIR $ANC $KRT $UST

https://twitter.com/eliasimos/status/1360239712972242946?s=19">https://twitter.com/eliasimos...

@mirror_protocol @anchor_protocol are catalysts that incentivize demand for Terra stablecoins like $UST (beyond what Chai does for $KRT demand)

+ @flipsidecrypto @SmartStake charts (see above)

$LUNA $MIR $ANC $KRT $UST

https://twitter.com/eliasimos/status/1360239712972242946?s=19">https://twitter.com/eliasimos...

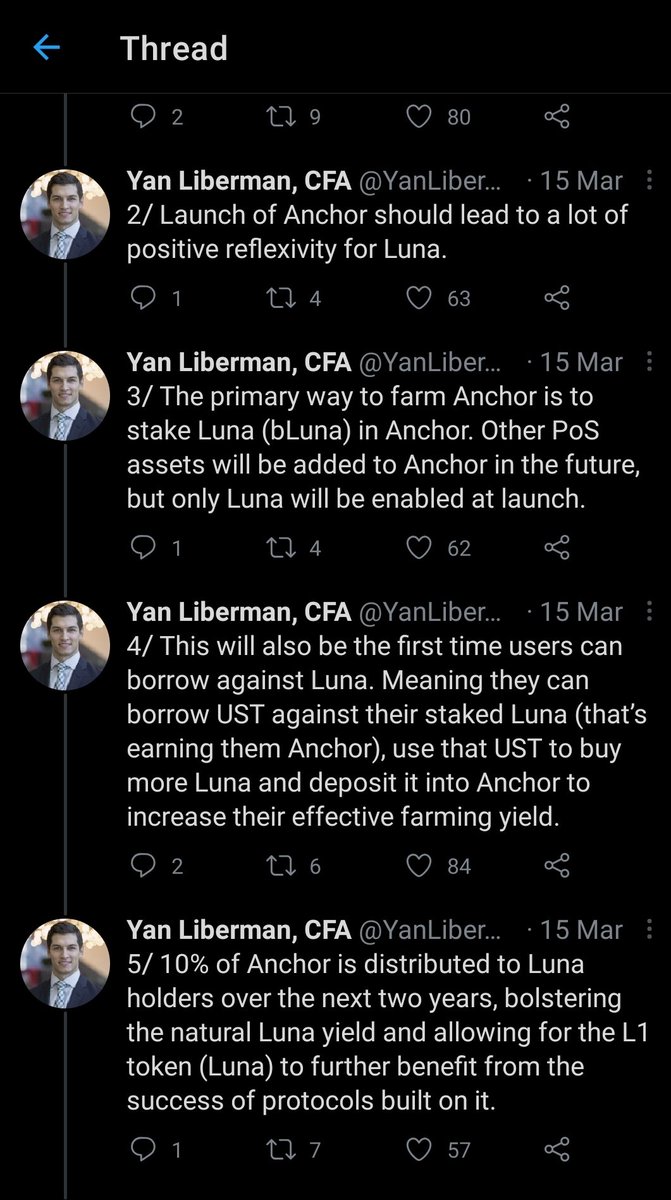

Thread - March 2021

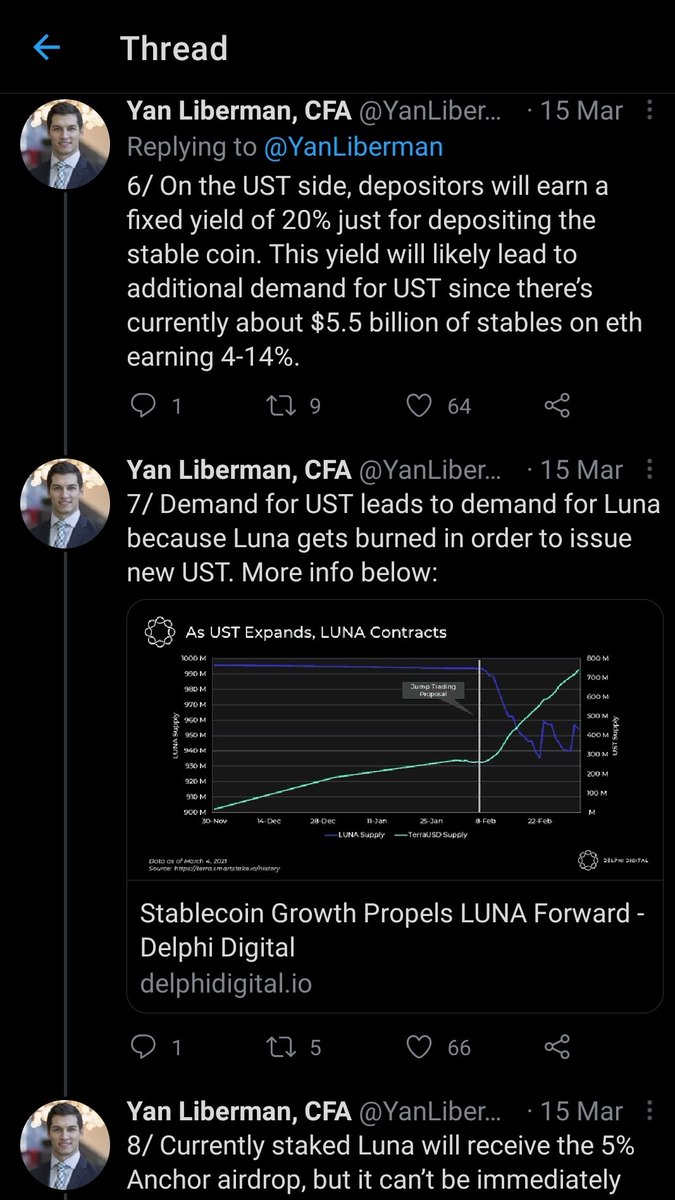

@anchor_protocol provides stable $UST yield (predictable yield is unique in #DeFi) & its growth has self-reinforcing effects on LUNA (decreases supply of $LUNA as demand for UST grows)

$ANC

https://twitter.com/YanLiberman/status/1371644922265231361?s=19">https://twitter.com/YanLiberm...

@anchor_protocol provides stable $UST yield (predictable yield is unique in #DeFi) & its growth has self-reinforcing effects on LUNA (decreases supply of $LUNA as demand for UST grows)

$ANC

https://twitter.com/YanLiberman/status/1371644922265231361?s=19">https://twitter.com/YanLiberm...

Post by @veradittakit - April 2021

Deposits earn 20% APY because loans are over-collateralized by PoS assets (like $ETH $ATOM $DOT $SOL)

Unlike "variable yields of other DeFi protocols ... [Anchor isn& #39;t] subject to speculative demand cycles."

$ANC $LUNA https://www.veradiverdict.com/p/20-apy-savings-account">https://www.veradiverdict.com/p/20-apy-...

Deposits earn 20% APY because loans are over-collateralized by PoS assets (like $ETH $ATOM $DOT $SOL)

Unlike "variable yields of other DeFi protocols ... [Anchor isn& #39;t] subject to speculative demand cycles."

$ANC $LUNA https://www.veradiverdict.com/p/20-apy-savings-account">https://www.veradiverdict.com/p/20-apy-...

@PodcastDelphi interview - published January 2021

Show notes, timestamps, transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://www.delphidigital.io/podcasts/taking-crypto-mainstream-do-kwon-covering-terra-mirror-and-anchor/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://www.delphidigital.io/podcasts/taking-crypto-mainstream-do-kwon-covering-terra-mirror-and-anchor/

("KRT"">https://www.delphidigital.io/podcasts/... is mistranscribed as "CARROT" in the transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">)

Show notes, timestamps, transcripts

("KRT"">https://www.delphidigital.io/podcasts/... is mistranscribed as "CARROT" in the transcripts

Paraphrasing @d0h0k1:

Most projects look inwards (target users already familiar with #crypto). But if we don& #39;t help millions of new users benefit from crypto networks in a way they can’t in TradFi...then crypto is never going to go anywhere.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://pca.st/episode/2afeca36-1461-4036-b355-557d25bc188a?t=229

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://pca.st/episode/2afeca36-1461-4036-b355-557d25bc188a?t=229

https://pca.st/episode/2... href="https://twitter.com/search?q=%24LUNA&src=ctag">$LUNA $ANC

Most projects look inwards (target users already familiar with #crypto). But if we don& #39;t help millions of new users benefit from crypto networks in a way they can’t in TradFi...then crypto is never going to go anywhere.

Risks are always important to keep in mind. I& #39;m not the type to ignore constructive criticism.

This thread links to @_0x_Larry& #39;s thoughts about potential risks plus an update about one of his concerns at the end https://twitter.com/chainthinking/status/1386410758712430592?s=19">https://twitter.com/chainthin...

This thread links to @_0x_Larry& #39;s thoughts about potential risks plus an update about one of his concerns at the end https://twitter.com/chainthinking/status/1386410758712430592?s=19">https://twitter.com/chainthin...

Planned airdrops for @terra_money $LUNA stakers https://twitter.com/Speicherx/status/1387933707856605191?s=19">https://twitter.com/Speicherx...

A simplified explanation of how @anchor_protocol manages to offer 20% APY on USD #stablecoin $UST deposits

Hint: for every dollar that& #39;s saved in Anchor, another 2-4 dollars in PoS collateral assets are also earning yield (on borrower& #39;s side)

$LUNA $ANC https://twitter.com/helloqrius/status/1373341170923827203?s=19">https://twitter.com/helloqriu...

Hint: for every dollar that& #39;s saved in Anchor, another 2-4 dollars in PoS collateral assets are also earning yield (on borrower& #39;s side)

$LUNA $ANC https://twitter.com/helloqrius/status/1373341170923827203?s=19">https://twitter.com/helloqriu...

Read on Twitter

Read on Twitter https://youtu.be/KqpGMoYZM... href="https://twitter.com/search?q=%24LUNA&src=ctag">$LUNA + Terra stablecoins like $UST & $KRT " title="How @terra_money& #39;s stability mechanism workshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🎞️" title="Filmstreifen" aria-label="Emoji: Filmstreifen"> https://youtu.be/KqpGMoYZM... href="https://twitter.com/search?q=%24LUNA&src=ctag">$LUNA + Terra stablecoins like $UST & $KRT " class="img-responsive" style="max-width:100%;"/>

https://youtu.be/KqpGMoYZM... href="https://twitter.com/search?q=%24LUNA&src=ctag">$LUNA + Terra stablecoins like $UST & $KRT " title="How @terra_money& #39;s stability mechanism workshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🎞️" title="Filmstreifen" aria-label="Emoji: Filmstreifen"> https://youtu.be/KqpGMoYZM... href="https://twitter.com/search?q=%24LUNA&src=ctag">$LUNA + Terra stablecoins like $UST & $KRT " class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://www.delphidigital.io/podcasts/... is mistranscribed as "CARROT" in the transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">)" title=" @PodcastDelphi interview - published January 2021Show notes, timestamps, transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://www.delphidigital.io/podcasts/... is mistranscribed as "CARROT" in the transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://www.delphidigital.io/podcasts/... is mistranscribed as "CARROT" in the transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">)" title=" @PodcastDelphi interview - published January 2021Show notes, timestamps, transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://www.delphidigital.io/podcasts/... is mistranscribed as "CARROT" in the transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://www.delphidigital.io/podcasts/... is mistranscribed as "CARROT" in the transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">)" title=" @PodcastDelphi interview - published January 2021Show notes, timestamps, transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://www.delphidigital.io/podcasts/... is mistranscribed as "CARROT" in the transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://www.delphidigital.io/podcasts/... is mistranscribed as "CARROT" in the transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">)" title=" @PodcastDelphi interview - published January 2021Show notes, timestamps, transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔗" title="Link Symbol" aria-label="Emoji: Link Symbol"> https://www.delphidigital.io/podcasts/... is mistranscribed as "CARROT" in the transcripts https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Gesicht mit Freudentränen" aria-label="Emoji: Gesicht mit Freudentränen">)">