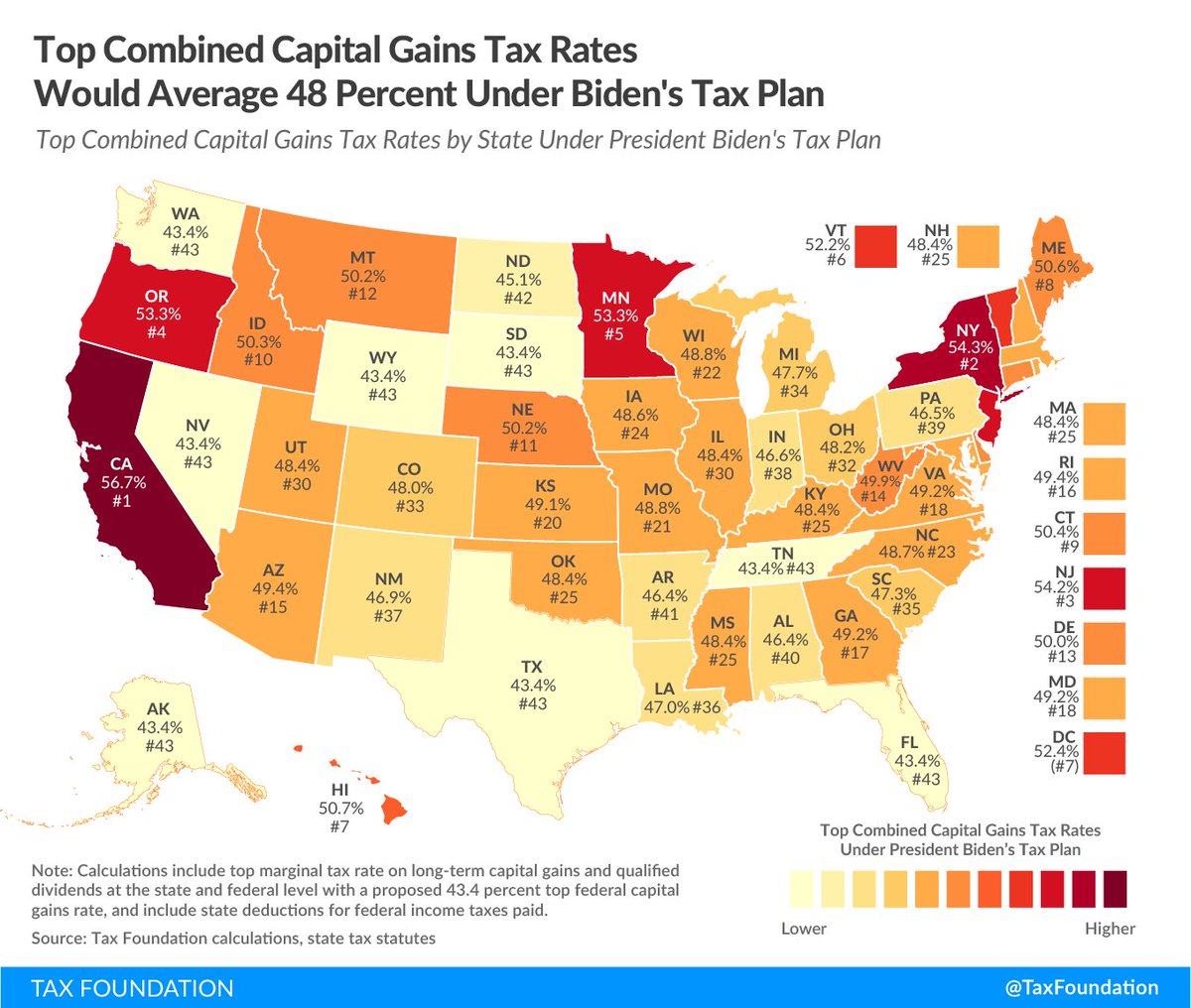

Under President Biden& #39;s tax plan, 13 states and D.C. would have a top combined capital gains tax rate at or above 50%:

56.7% CA

54.3% NY

54.2% NJ

53.3% OR

53.3% MN

52.4% DC

52.2% VT

50.7% HI

50.6% ME

50.4% CT

50.3% ID

50.2% NE

50.2% MT

50.0% DE

(58.2% NYC)

(57.3% Portland, OR)

56.7% CA

54.3% NY

54.2% NJ

53.3% OR

53.3% MN

52.4% DC

52.2% VT

50.7% HI

50.6% ME

50.4% CT

50.3% ID

50.2% NE

50.2% MT

50.0% DE

(58.2% NYC)

(57.3% Portland, OR)

President Biden’s #AmericanFamilyPlan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends, from 23.8% today to 39.6% for higher earners.

When including the net investment income tax, the top federal rate on capital gains would be 43.4%.

Rates would be even higher in many U.S. states due to state and local capital gains taxes, leading to a combined average rate of 48% compared to about 29% under current law.

Rates would be even higher in many U.S. states due to state and local capital gains taxes, leading to a combined average rate of 48% compared to about 29% under current law.

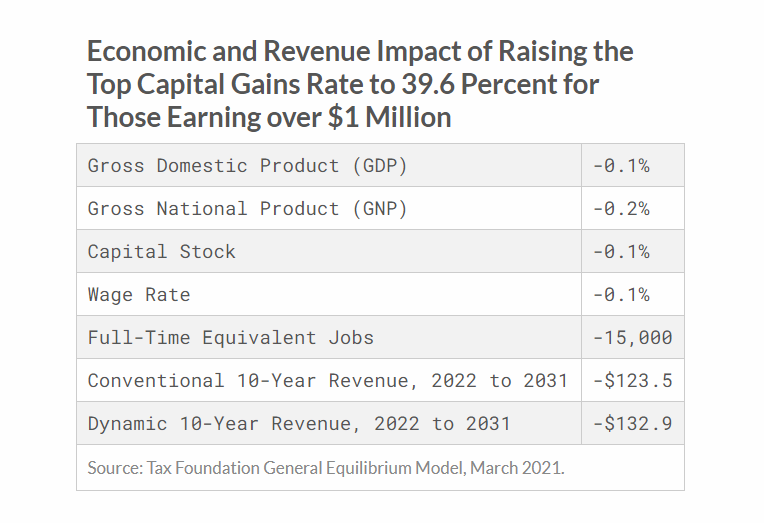

Raising the top capital gains tax rate to 39.6 percent for those earning over $1 million would reduce federal revenue by about $124 billion over 10 years, according to our General Equilibrium Model.

Compare top marginal capital gains tax rates under current law vs. the Biden proposal in each state here: https://taxfoundation.org/biden-capital-gains-tax-rates/">https://taxfoundation.org/biden-cap...

Read on Twitter

Read on Twitter