If we have reached “peak reopening,” it wouldn’t surprise me if the equity bull market takes a breather soon. It isn’t my base case, and a 10-15% correction wouldn’t derail my bullish outlook, but two market cycle analogs both show that a correction could be imminent. THREAD/1

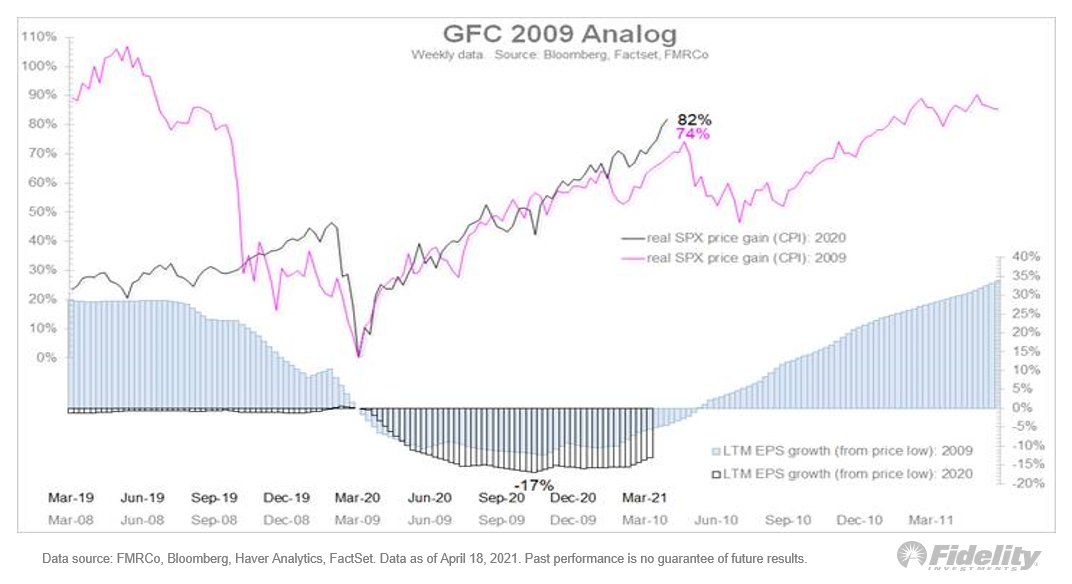

The first analog is the Global Financial Crisis. It has worked perfectly so far as a timeline for when price bottoms out vs. when earnings bottom out. After a 74% gain from March 2009 to April 2010, the market fell 17% that summer, before resuming the bull market. /2

The drop happened in April 2010 when the Fed ended QE1. The market’s current obsession is when the Fed will start tapering its asset purchases. As the chart shows, the mid-cycle correction in 2010 was about the fear of liquidity drying up. /3

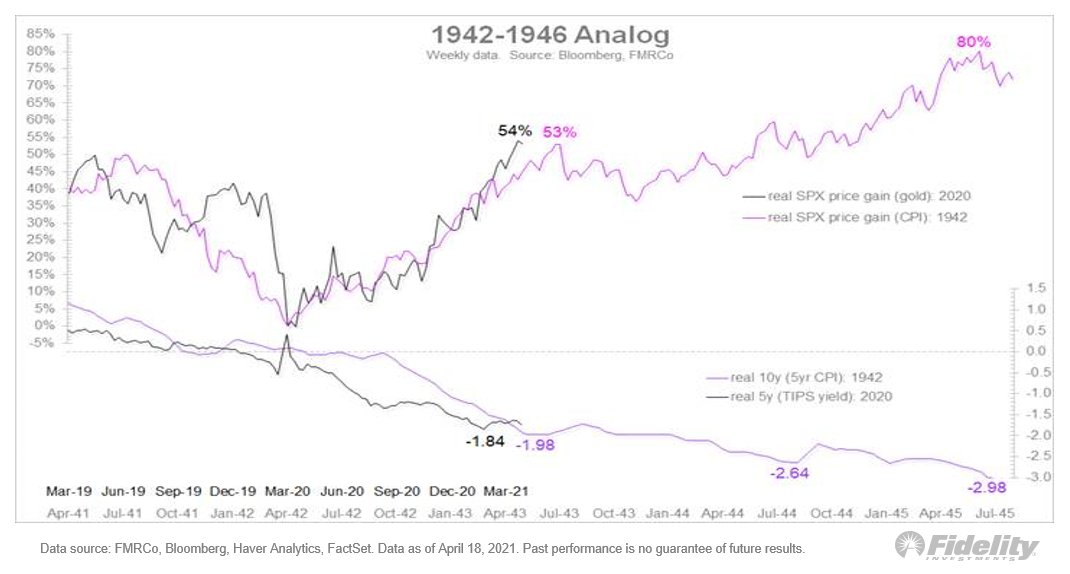

The second analog to consider is the World War II era of the 1940s. It mirrors, almost perfectly, the fiscal/monetary regime in which we find ourselves today. After a 53% gain in real terms, the S&P 500 fell 13% from July 1943 to November 1943. /4

Will history repeat? I don’t know, but after a 90% stock-market gain in 13 months and with the possibility that we have reached “peak reopening” for this cycle, it wouldn’t surprise me if the bull market (and the rotation) takes a breather here. /END

Read on Twitter

Read on Twitter