1/ Not seeing much useful content on the feed today so I& #39;ll make an attempt. Let me start off with some general observations on sentiment leading into this and then I& #39;ll get into charts.

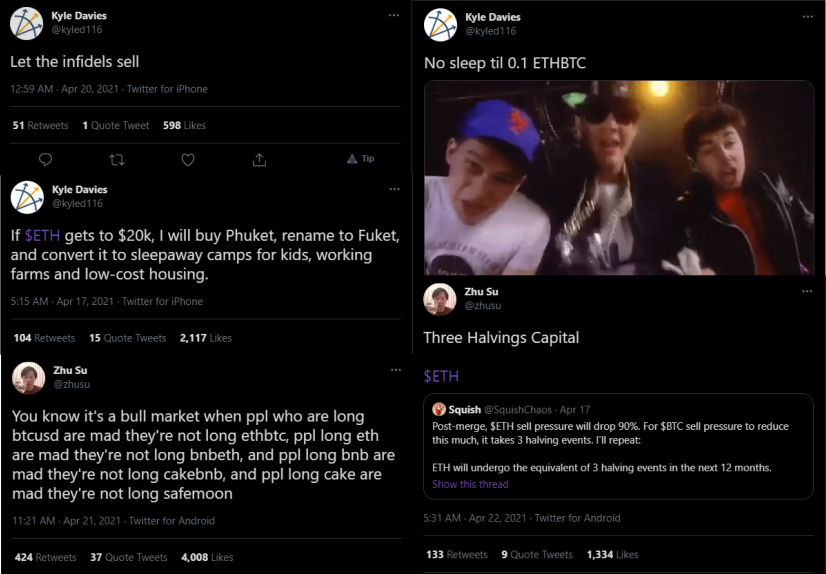

2/ Especially for the newcomers, this is going to be important: Your bull market heroes did not look out for you. This cycles bull market heroes are fundamentally different from 2017, they are not the Parabolictravs of this world but their message is the same packaged differently

3/ The figureheads of this narrative are much smarter and their delivery is based on abstractions of high time frame theses. Over the past days you had people that got it right for the longest time hype everybody into what we call the "fake top" (2nd overextension on divergence)

4/ This was particularly visible on ETH, where network fundamentals got thrown at you at exactly the worst time in terms of market structure. And look who showed up for the party: Peter the Deleter, like clockwork.

5/ Speaking of parties, the rest of my feed was flowing over with gloating about the "death of eth" clubhouse room at the exact sats pairing bottom. We identified this as the polar opposite of that sentiment showing up - again - exactly at htf resistance: https://twitter.com/Stillm4n/status/1385190744470827014">https://twitter.com/Stillm4n/...

6/ Even great traders get caught up in euphoria, they are just people in the end and they have every reason to be euphoric too. Bottom line is you better look out for yourself and be the sovereign of your own life.

7/ The main leaders of the institutional narrative? They& #39;ll feed you 24/7 365 days of the year. It& #39;s in their interest to keep this going. Their "this time is different" is strong but don& #39;t make the mistake to think they are on your team. https://twitter.com/Stillm4n/status/1383775408387100672">https://twitter.com/Stillm4n/...

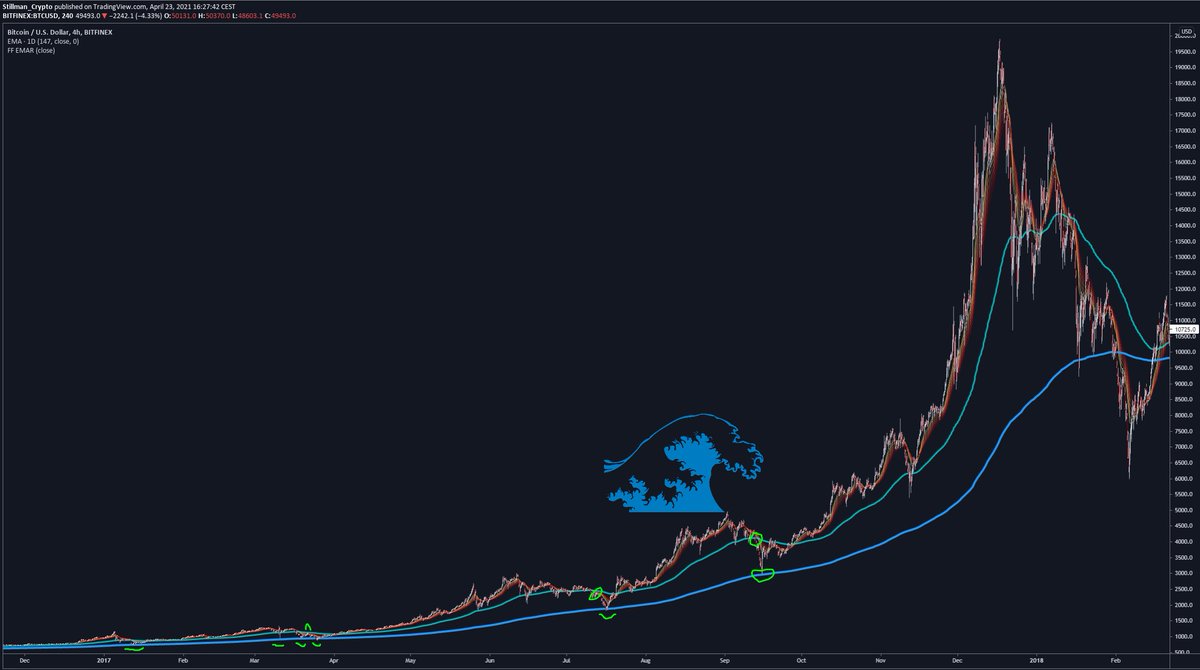

8/ So where do we go from here? Let& #39;s start with BTC: The 200EMA 4h held up this trend since we saw 10k the last time in 2020. Back then we lost 12k at the end of Defi Summer, bearish retested the 200EMA and where price held was the 21EMA weekly.

9/ Notice how we broke and bearish retested the 200EMA for the first time since then. The EMA is also curving downwards which is a representation of price itself taking the shape of an ocean wave breaking.

10/ That 21EMA is going to be a line in the sand for me where I& #39;ll bid spot again and I would also take risk if we pump out of this and reclaim high levels make complacency unlikely (think above 60k+). That area in the middle is no man& #39;s land where I& #39;ll just do short term plays.

11/ I was curious if the 21EMA could play a similar role as it did in 2017 where it provided the shakeout support over and over again. And indeed we can see a similar interaction of the 200EMA and 21EMA there so it& #39;s reasonably similar. We even have that wave breaking shape:

12/ That being said, let& #39;s entertain the notion of this being a macro top for a minute. The macro risk atmosphere has been shifting for a while, despite the VIX not accounting for it much (yet). Just look at precious metals reversing trends atm but there is more.

13/ Traders who have been around for 2018 will know that altcoins like to have their blow off when it& #39;s actually already "too late" and the risk environment is already shifting.

https://twitter.com/Stillm4n/status/1362609566786191361">https://twitter.com/Stillm4n/...

https://twitter.com/Stillm4n/status/1362609566786191361">https://twitter.com/Stillm4n/...

14/ That& #39;s why I think that this is still in play. You can already see it on some alt/btc pairings out there. Note that I am not talking about the start of altseason here but its explosive end. https://twitter.com/Stillm4n/status/1383063168260452357">https://twitter.com/Stillm4n/...

15/ Lastly, if this was a macro top, the market doesn& #39;t stop providing the opportunity for amazing returns. Yes a bear market is just a bull market for shorting and last night was a taste of that. But 2018 also saw echo bubbles, a lot of people hit their BTC ath in April/May.

16/ The painful part is when volatility starts to die down and traders aren& #39;t able to extract value from the market anymore easily. This would also be the scenario the thought leaders fear the most cause they extract their value from the information economy. Crowd not caring =  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💀" title="Schädel" aria-label="Emoji: Schädel">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💀" title="Schädel" aria-label="Emoji: Schädel">

Read on Twitter

Read on Twitter

" title="16/ The painful part is when volatility starts to die down and traders aren& #39;t able to extract value from the market anymore easily. This would also be the scenario the thought leaders fear the most cause they extract their value from the information economy. Crowd not caring = https://abs.twimg.com/emoji/v2/... draggable="false" alt="💀" title="Schädel" aria-label="Emoji: Schädel">" class="img-responsive" style="max-width:100%;"/>

" title="16/ The painful part is when volatility starts to die down and traders aren& #39;t able to extract value from the market anymore easily. This would also be the scenario the thought leaders fear the most cause they extract their value from the information economy. Crowd not caring = https://abs.twimg.com/emoji/v2/... draggable="false" alt="💀" title="Schädel" aria-label="Emoji: Schädel">" class="img-responsive" style="max-width:100%;"/>