0/ $BTC is exhibiting bottom 10% trailing 2-10D performance including the worst 5D move in $BTC since 2/26 and prior to that March 12-16 of last year which included Black Thursday with the worst 10D performance since 1/21 prior to last March.

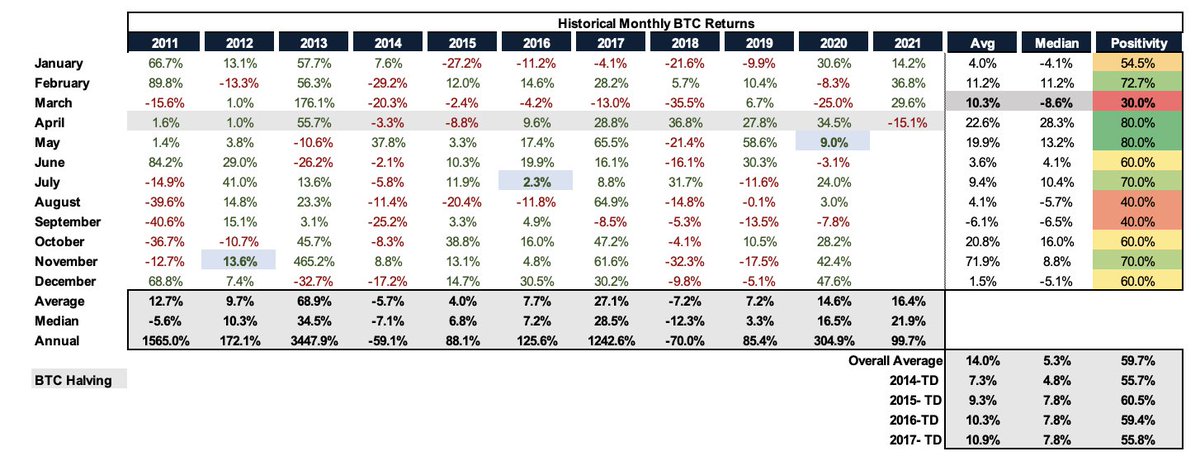

1/ April is now trending for the first $BTC down month since last Sept which would snap a 6 month streak (we had only ever saw 7 consecutive months from March - Sept & #39;12). It would also be the first down month of April since 2015.

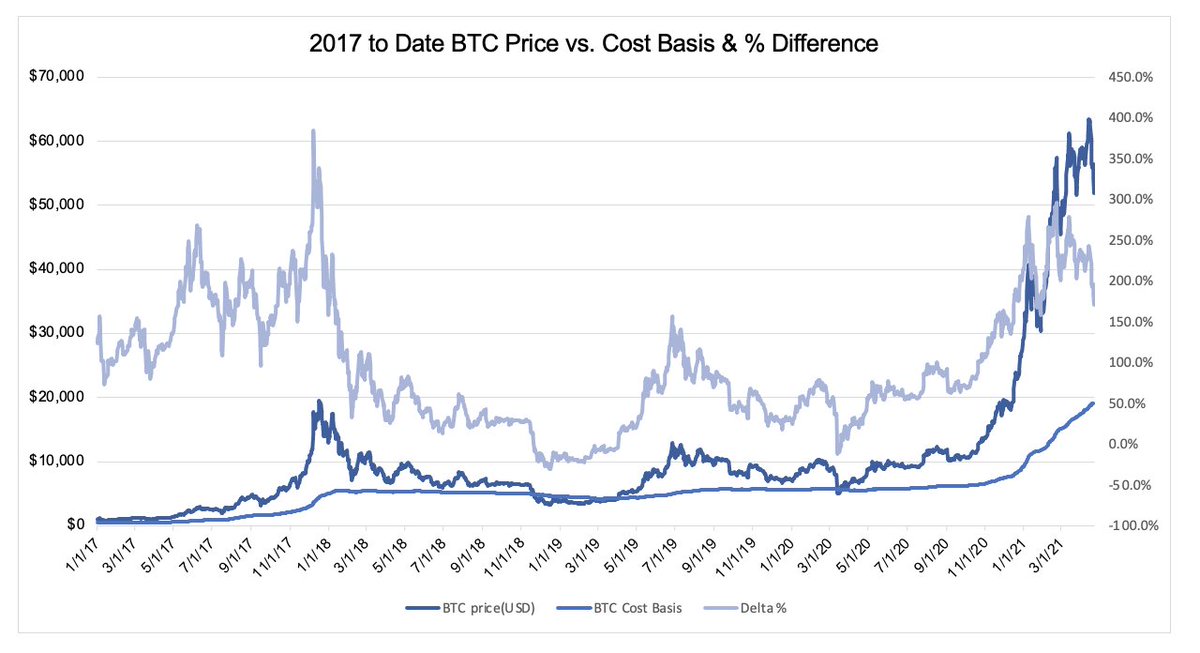

2/ The "theoretical cost basis" of $BTC or realized cap per @coinmetrics now sits at an ATH of $19,147 which makes the difference ~160.7% which is still top 15% all time (but the lowest since January).

For comparison in Feb when first hitting $50K that stood at 270%.

For comparison in Feb when first hitting $50K that stood at 270%.

3/ The upward movement of that cost basis can serve as an OK proxy for theoretical b/e price for all current $BTC holders

It continues to trend higher but due to the BTC move the increase MoM is set to be amongst the lowest since October (although a lot can happen in a week)

It continues to trend higher but due to the BTC move the increase MoM is set to be amongst the lowest since October (although a lot can happen in a week)

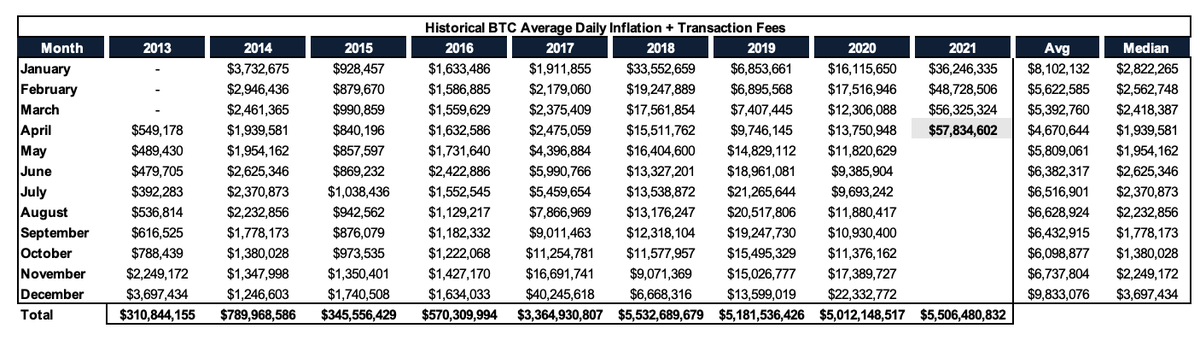

5/ $BTC is averaging ~$58M of daily inflation + transaction fees that need to clear market. So far in & #39;21 we& #39;ve seen ~$4.3B of supply which is already approaching the & #39;20 level (despite halving last May).

6/ With that daily supply its important to focus on the potential new sources of demand.

$MS raised $29.4M from 322 investors in the first 2 weeks on their $BTC fund ($91.3K avg check) that& #39;s underwhelming but given the MS restrictions / fees (3% fee) not unexpected

$MS raised $29.4M from 322 investors in the first 2 weeks on their $BTC fund ($91.3K avg check) that& #39;s underwhelming but given the MS restrictions / fees (3% fee) not unexpected

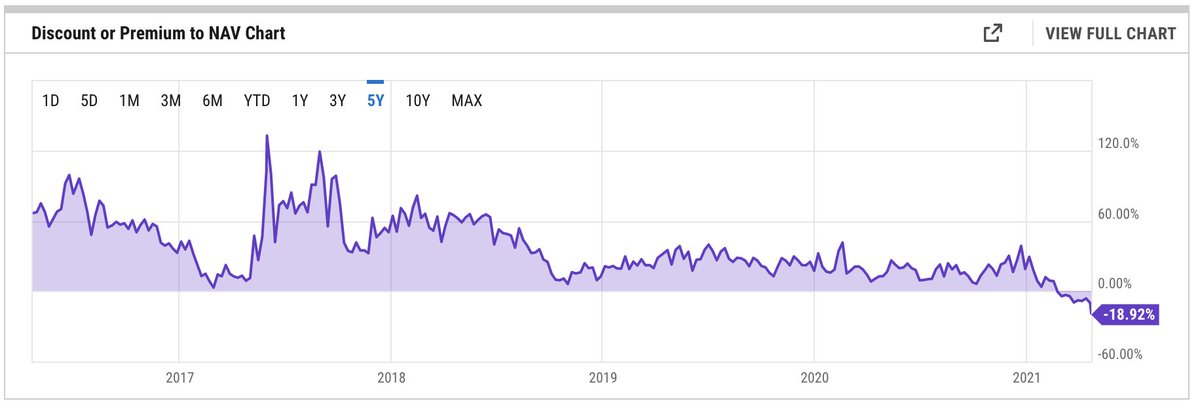

7/ The $GBTC NAV discount is down to ~19% which also doesn& #39;t bode well for sentiment (there are now other alternatives and many point to $COIN as a broader crypto proxy w/ operating leverage so historical premium / discounts not apples to apples)

8/ The corporate / insurance / large asset mgmt bid was a large part of the 4Q20-1Q21 move (e.g., $TSLA, $MSTR, $SQ, Mass Mutual, Ruffer Management, One River, etc... and those are just the public ones known).

Thus far in 2Q we haven& #39;t had that same demand equation.

Thus far in 2Q we haven& #39;t had that same demand equation.

9/ As @Travis_Kling points out you& #39;re now buying $BTC < 10% higher than when @elonmusk announced his $1.5B buy https://twitter.com/Travis_Kling/status/1385416358259609601?s=20">https://twitter.com/Travis_Kl...

Read on Twitter

Read on Twitter