Buy now, pay later … or buy now, regret later?

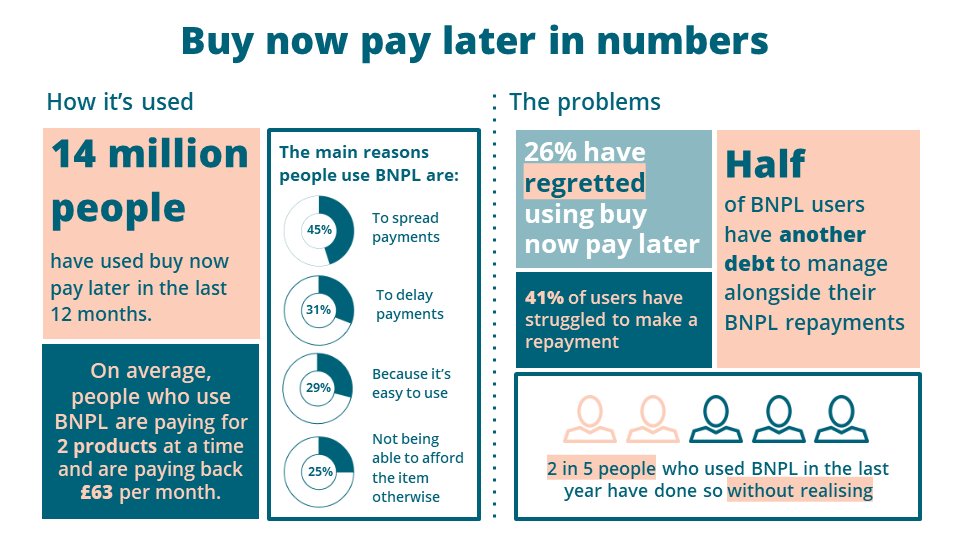

Today’s @CitizensAdvice report finds a quarter have regretted using buy now pay later (BNPL).

The main reason they give is spending more than they could afford.

Summary of the 3 biggest issues with the current BNPL market https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

Today’s @CitizensAdvice report finds a quarter have regretted using buy now pay later (BNPL).

The main reason they give is spending more than they could afford.

Summary of the 3 biggest issues with the current BNPL market

2 in 5 people who used BNPL in the last year have done so without realising.

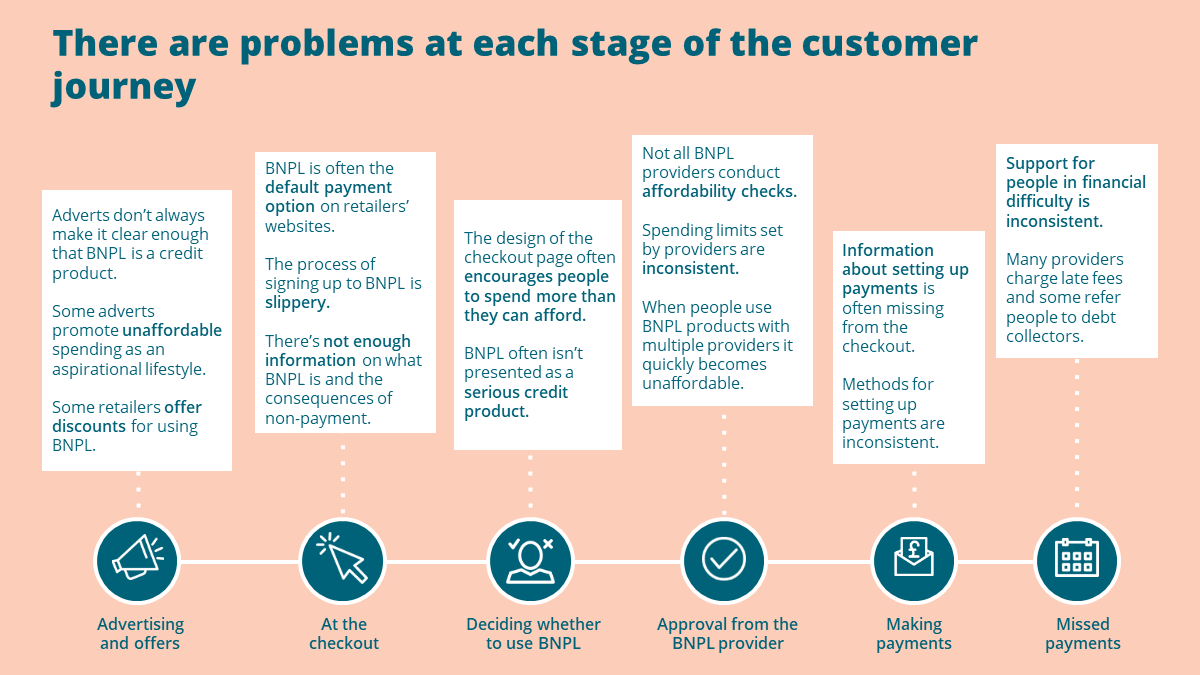

The slick checkout and lack of info can lead people to use BNPL without understanding what it is.

Taking out credit shouldn’t be so easy that you can do it by accident.

Offers, adverts, the placement at checkouts and the way info is presented all encourage people to spend more money.

But with inconsistent affordability checks, what does this mean for the 52% of BNPL users that have another debt to manage at the same time?

41% have struggled to make a repayment.

Fees range from none to £12 at a time. Fee caps range from £15 to £36.

Some use debt collectors, others don& #39;t.

People struggling to pay deserve fair, consistent treatment.

Ultimately this is about responsible product design. BNPL can be useful for some people, but currently there are issues at each stage of the customer journey.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦺" title="Sicherheitsweste" aria-label="Emoji: Sicherheitsweste">Safety and affordability need to be central to the design.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦺" title="Sicherheitsweste" aria-label="Emoji: Sicherheitsweste">Safety and affordability need to be central to the design.

That& #39;s why we& #39;re glad @TheFCA is committed to regulating BNPL products. We think regulation should focus on

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✏️" title="Bleistift" aria-label="Emoji: Bleistift">How product design impacts decision making

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✏️" title="Bleistift" aria-label="Emoji: Bleistift">How product design impacts decision making

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ℹ️" title="Informationsquelle" aria-label="Emoji: Informationsquelle">The info people need to make informed decisions

https://abs.twimg.com/emoji/v2/... draggable="false" alt="ℹ️" title="Informationsquelle" aria-label="Emoji: Informationsquelle">The info people need to make informed decisions

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💷" title="Banknote mit Pfund-Zeichen" aria-label="Emoji: Banknote mit Pfund-Zeichen">Making affordability central

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💷" title="Banknote mit Pfund-Zeichen" aria-label="Emoji: Banknote mit Pfund-Zeichen">Making affordability central

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">Fair treatment for people struggling to pay

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❤️" title="Rotes Herz" aria-label="Emoji: Rotes Herz">Fair treatment for people struggling to pay

Read the report here: https://www.citizensadvice.org.uk/Global/CitizensAdvice/Debt%20and%20Money%20Publications/BNPL%20report%20(FINAL).pdf">https://www.citizensadvice.org.uk/Global/Ci...

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" title="Buy now, pay later … or buy now, regret later?Today’s @CitizensAdvice report finds a quarter have regretted using buy now pay later (BNPL).The main reason they give is spending more than they could afford.Summary of the 3 biggest issues with the current BNPL market https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" title="Buy now, pay later … or buy now, regret later?Today’s @CitizensAdvice report finds a quarter have regretted using buy now pay later (BNPL).The main reason they give is spending more than they could afford.Summary of the 3 biggest issues with the current BNPL market https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>

Safety and affordability need to be central to the design." title="Ultimately this is about responsible product design. BNPL can be useful for some people, but currently there are issues at each stage of the customer journey.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦺" title="Sicherheitsweste" aria-label="Emoji: Sicherheitsweste">Safety and affordability need to be central to the design." class="img-responsive" style="max-width:100%;"/>

Safety and affordability need to be central to the design." title="Ultimately this is about responsible product design. BNPL can be useful for some people, but currently there are issues at each stage of the customer journey.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🦺" title="Sicherheitsweste" aria-label="Emoji: Sicherheitsweste">Safety and affordability need to be central to the design." class="img-responsive" style="max-width:100%;"/>