This is a debate they& #39;re already having in the United States and we will also have to have here. https://www.bbc.co.uk/news/business-56855301">https://www.bbc.co.uk/news/busi...

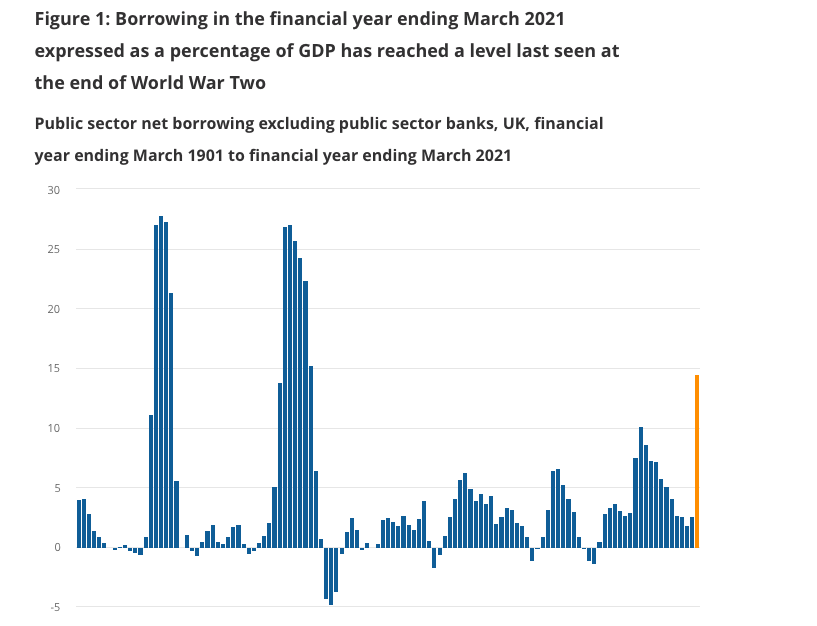

The last time the official estimate of borrowing (in this case, overwhelmingly, the government borrowing from itself ie issuing currency) was this high, 1945/46, the Budget returned to surplus within 3 years.

That wasn& #39;t because they were cutting spending. The opposite. The government of the day marshalled public support for one of the biggest rises in taxes the UK has seen, to pay for re-building, expanding the welfare state and launching the NHS.

Far from inhibiting the economic recovery postwar, it meant public spending led the recovery as private consumption was constrained by rationing. The emphasis was on urgent public priorities of universal benefit such as building new hospitals, schools and roads.

The pandemic has forced a recognition that the government, regardless of ideology, has to spend - and vast sums - to tackle a public emergency that is, economically, more like a war than anything we& #39;ve seen in peacetime.

The idea that there& #39;s no urgency to & #39;fixing& #39; a Budget deficit (where most of the money borrowed since the pandemic is owed to the Bank of England) has been tacitly accepted by Rishi Sunak in the last Budget, which increased spending substantially and left tax rises til later.

But over time, tax income income needs to be enough to allow us to meet those expanding public priorities - so efforts, for example, to tackle the climate emergency are not just gestures.

Taxes on the wealthiest in society - not just individuals but corporations - have been on a downward path for most of the past 40 years. A wealth tax on the richest 1% of the population could do a lot to enable those collective priorities to be met. But we& #39;d all have to pay.

Read on Twitter

Read on Twitter