Why interest rates getting to 5-6% in the coming years is a low probability event:

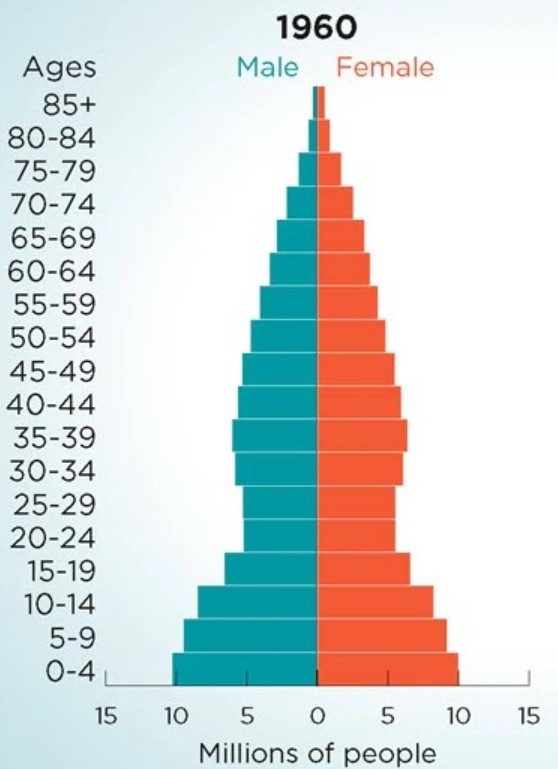

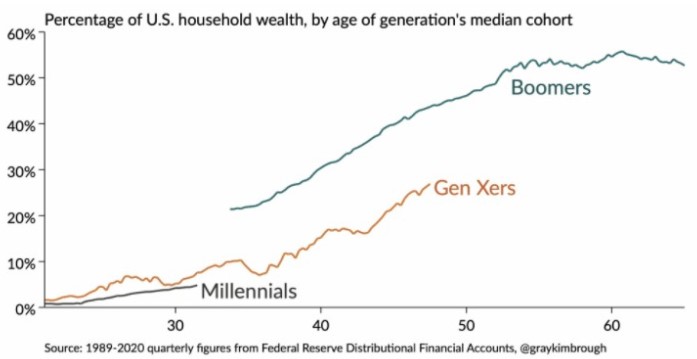

1/we& #39;ve never had a demographic this big live for so long

boomers didn& #39;t have this when they were coming up

https://awealthofcommonsense.com/2021/04/the-two-most-underappreciated-forces-driving-markets-today/">https://awealthofcommonsense.com/2021/04/t...

1/we& #39;ve never had a demographic this big live for so long

boomers didn& #39;t have this when they were coming up

https://awealthofcommonsense.com/2021/04/the-two-most-underappreciated-forces-driving-markets-today/">https://awealthofcommonsense.com/2021/04/t...

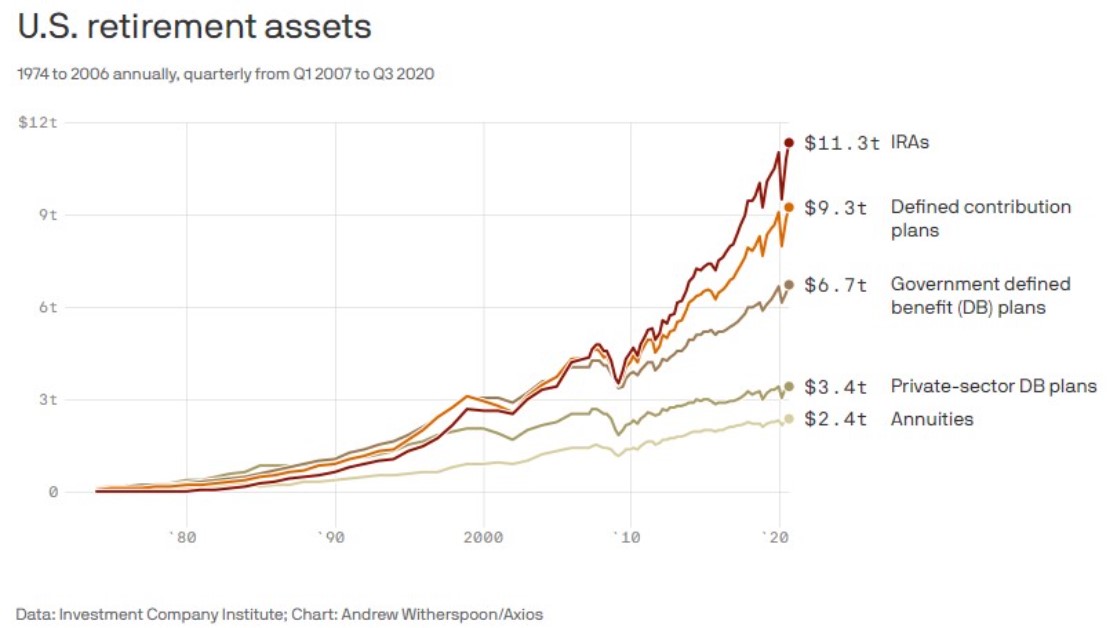

3/there is now ~$20 trillion IRAs+401ks

~$3 trillion is in targetdate funds

previous cycles didn& #39;t have funds/advisors that automatically rebalanced in size like this

bonds will always catch a bid

~$3 trillion is in targetdate funds

previous cycles didn& #39;t have funds/advisors that automatically rebalanced in size like this

bonds will always catch a bid

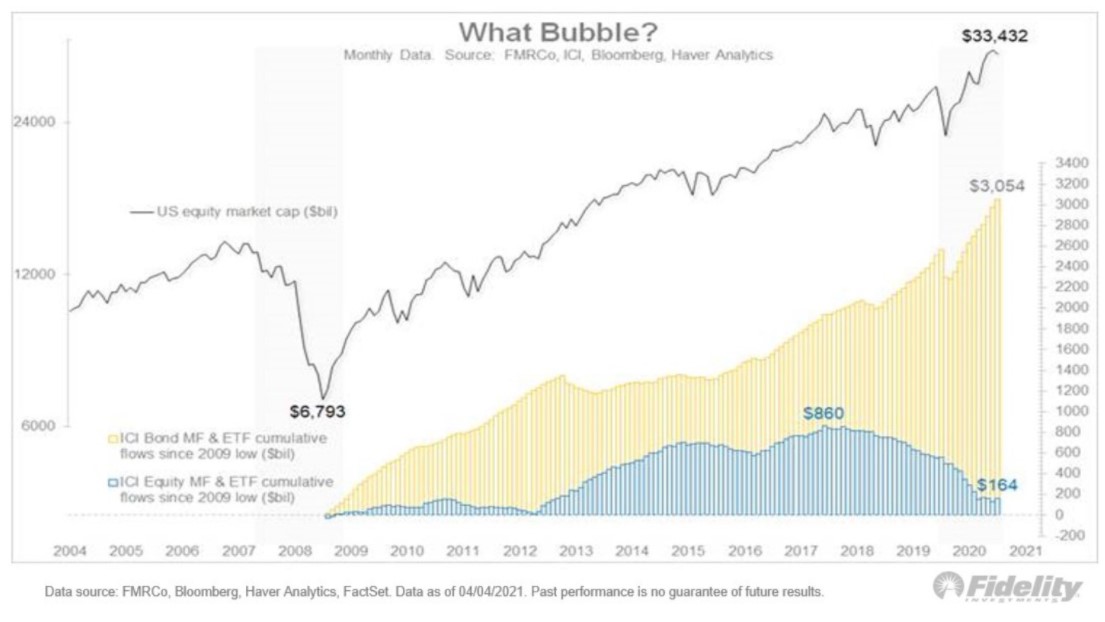

4/this is one of the reasons even though the S&P 500 is up almost 700% since the lows in March 2009, more than $3 trillion has gone into bond funds while just $164 billion has gone into stock funds

5/to sum up: demographics and automated investments are likely to keep a cap on rates in the coming years

*govt spending is obviously the biggest risk to this thesis

*govt spending is obviously the biggest risk to this thesis

Read on Twitter

Read on Twitter