HOW TO POWERTRADE

How do I go long using options?

What are calls? How do I enter a trade?

If you have at least some of these questions, this #PowerKnowledge is for you! https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

How do I go long using options?

What are calls? How do I enter a trade?

If you have at least some of these questions, this #PowerKnowledge is for you!

So let’s say you want to bet on #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">. First of all, you will need to BUY an option - selling options should be reserved to experienced traders.

https://abs.twimg.com/hashflags... draggable="false" alt="">. First of all, you will need to BUY an option - selling options should be reserved to experienced traders.

Tip: long BTC = buy calls, short BTC = buy puts. No selling https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn">

Tip: long BTC = buy calls, short BTC = buy puts. No selling

Assume you want to long Bitcoin, you would want to buy a call option. There are also two things you need to keep in mind - strike price and expiry.

Strike price is the price that BTC needs to reach for you to profit. If it is above strike at the time of expiry - you win.

Strike price is the price that BTC needs to reach for you to profit. If it is above strike at the time of expiry - you win.

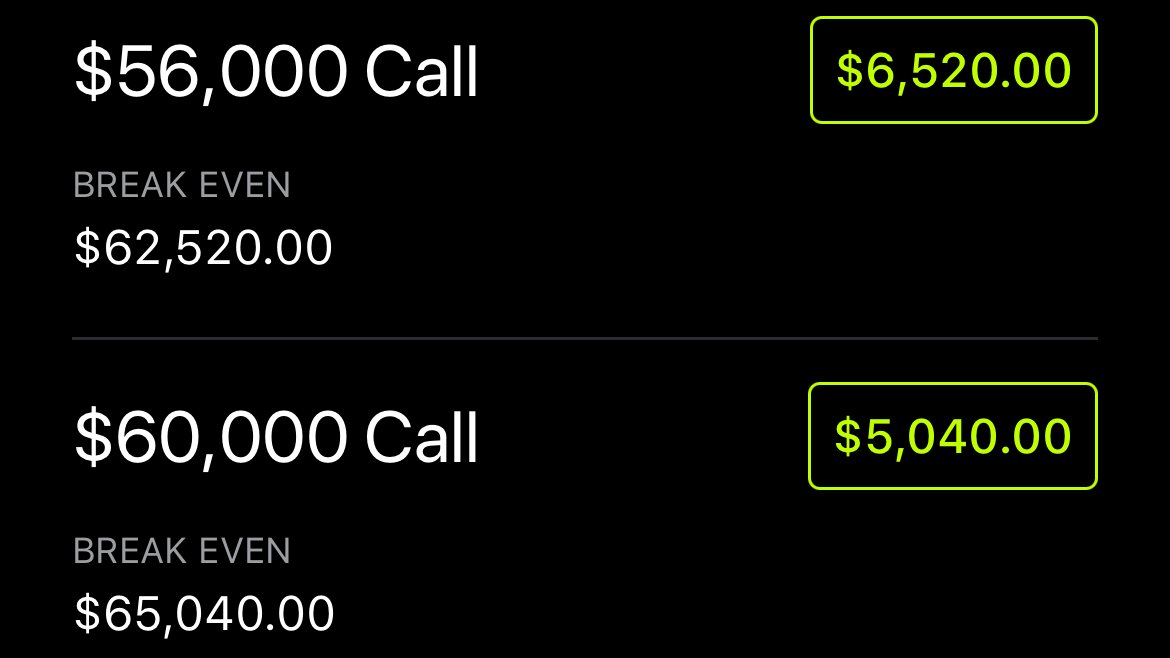

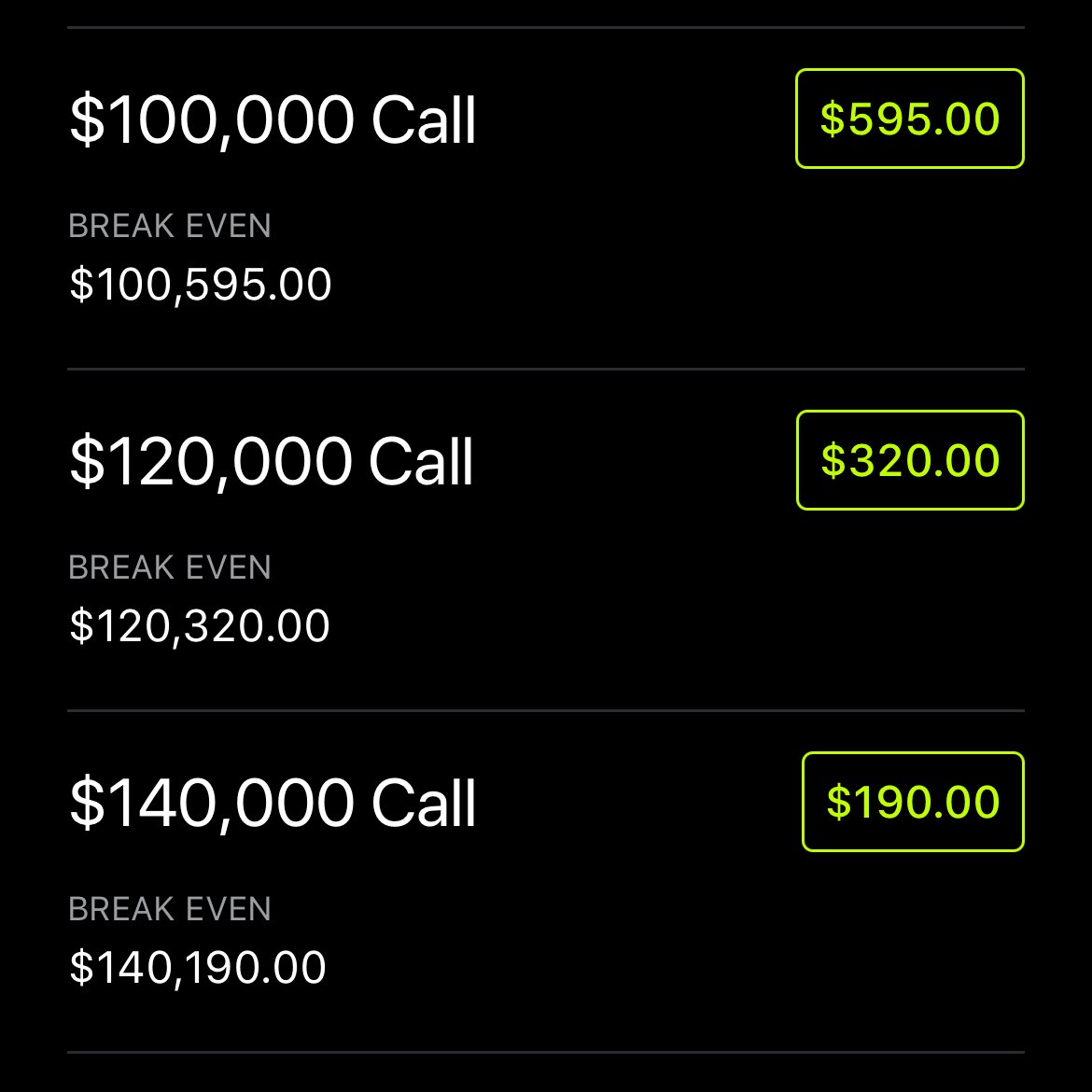

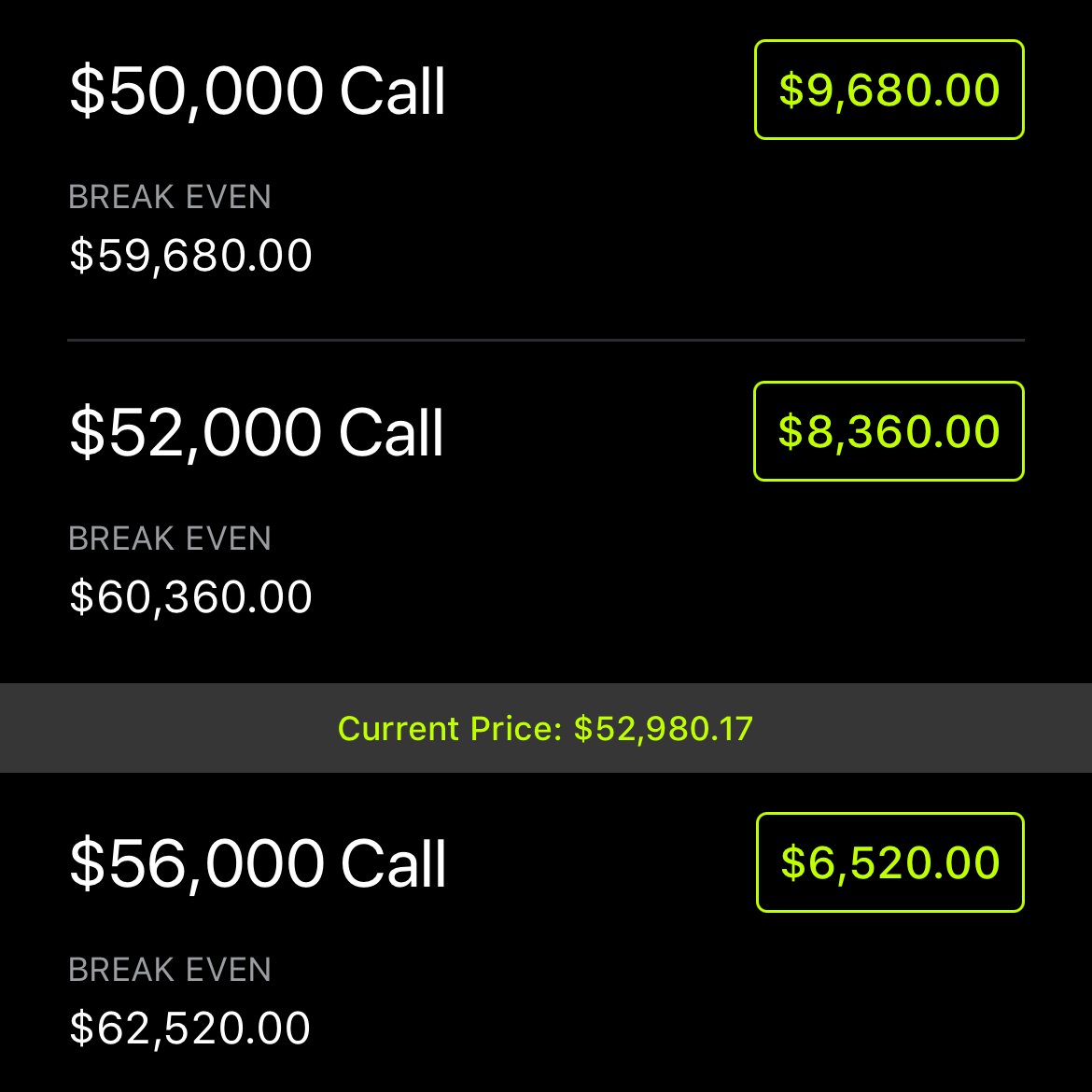

However, options with strike price closer to the price now are obviously more expensive.

It is logical, since BTC has a higher chance to end this week at 58k rather than 100k.

So 100k strike options will be cheaper and have much higher reward, but also higher risk.

It is logical, since BTC has a higher chance to end this week at 58k rather than 100k.

So 100k strike options will be cheaper and have much higher reward, but also higher risk.

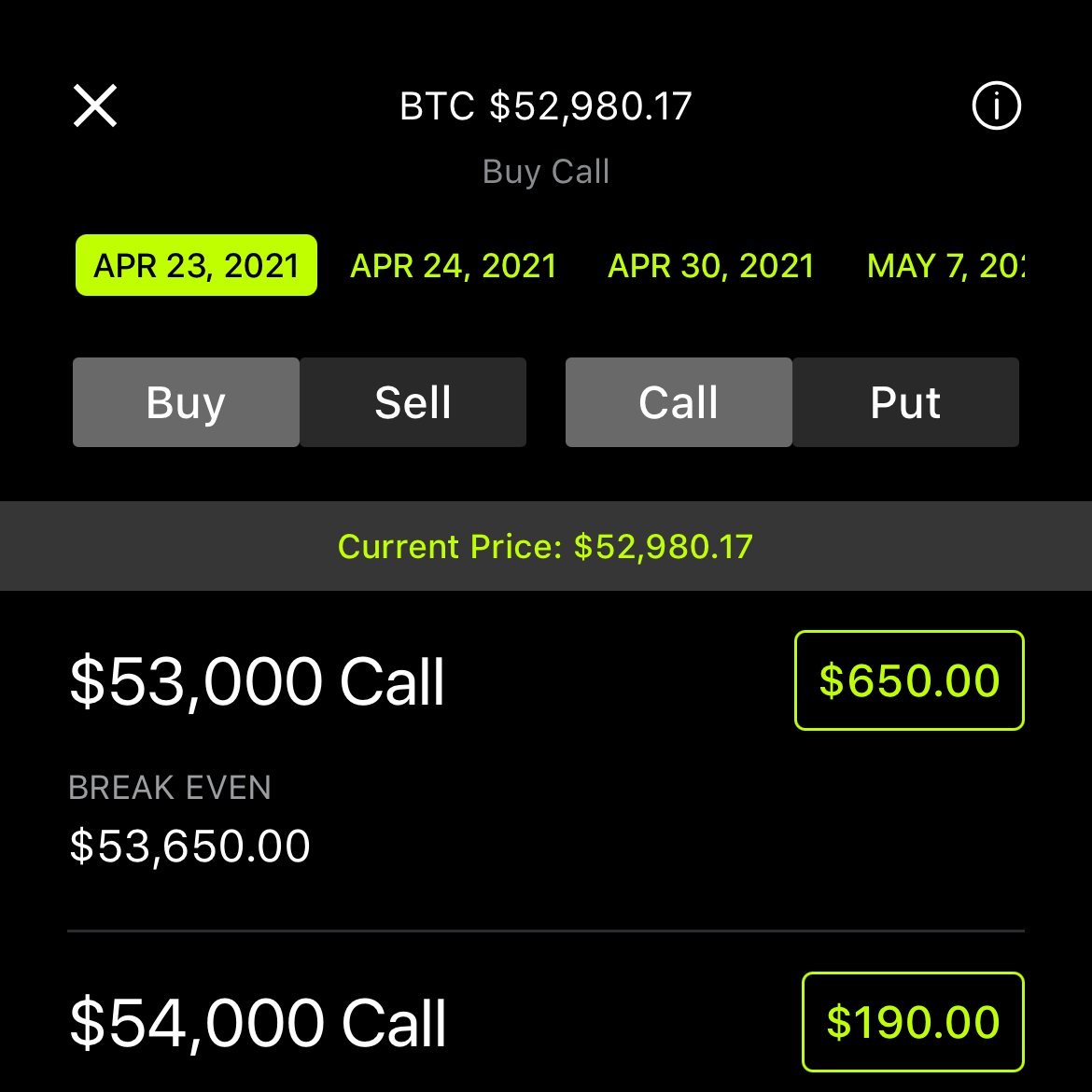

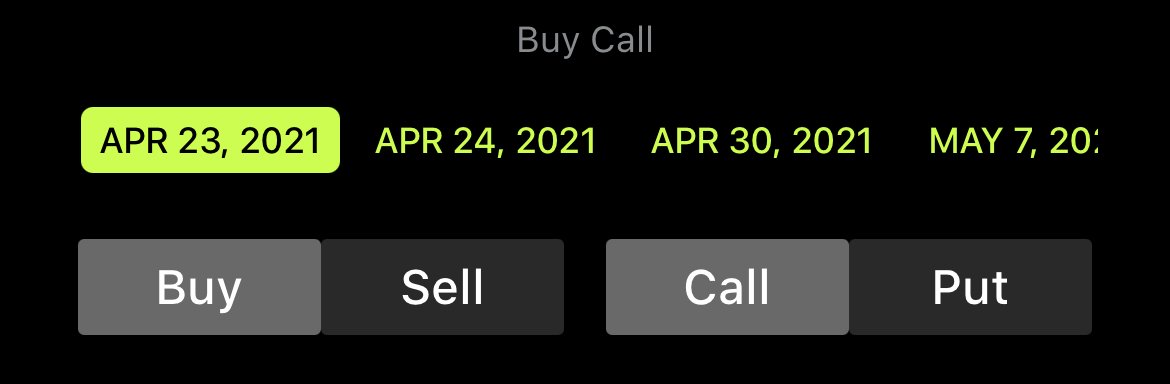

Expiry date is also something you should look at.

Unlike perps, options have an expiration date, therefore your expected move should unfold before the expiration date for your bet to be profitable.

Usually the closer to expiry the option is, the cheaper it is.

Unlike perps, options have an expiration date, therefore your expected move should unfold before the expiration date for your bet to be profitable.

Usually the closer to expiry the option is, the cheaper it is.

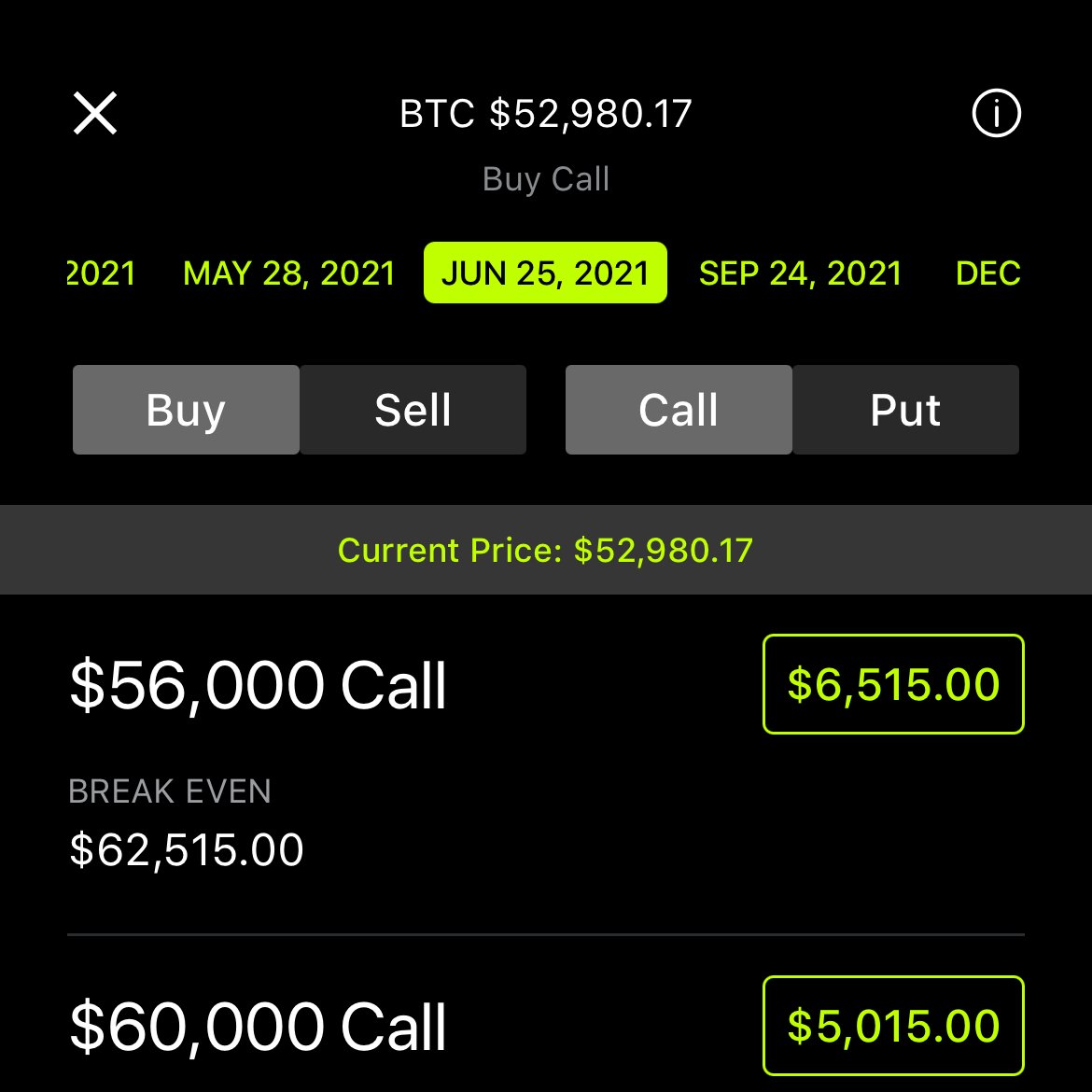

On PowerTrade, all available strikes for a selected expiration date are shown on the main page.

To purchase an option, simply select “buy” and “call/put” at the top of the screen and select a strike price.

The cost or "premium" of the option is shown to the right.

To purchase an option, simply select “buy” and “call/put” at the top of the screen and select a strike price.

The cost or "premium" of the option is shown to the right.

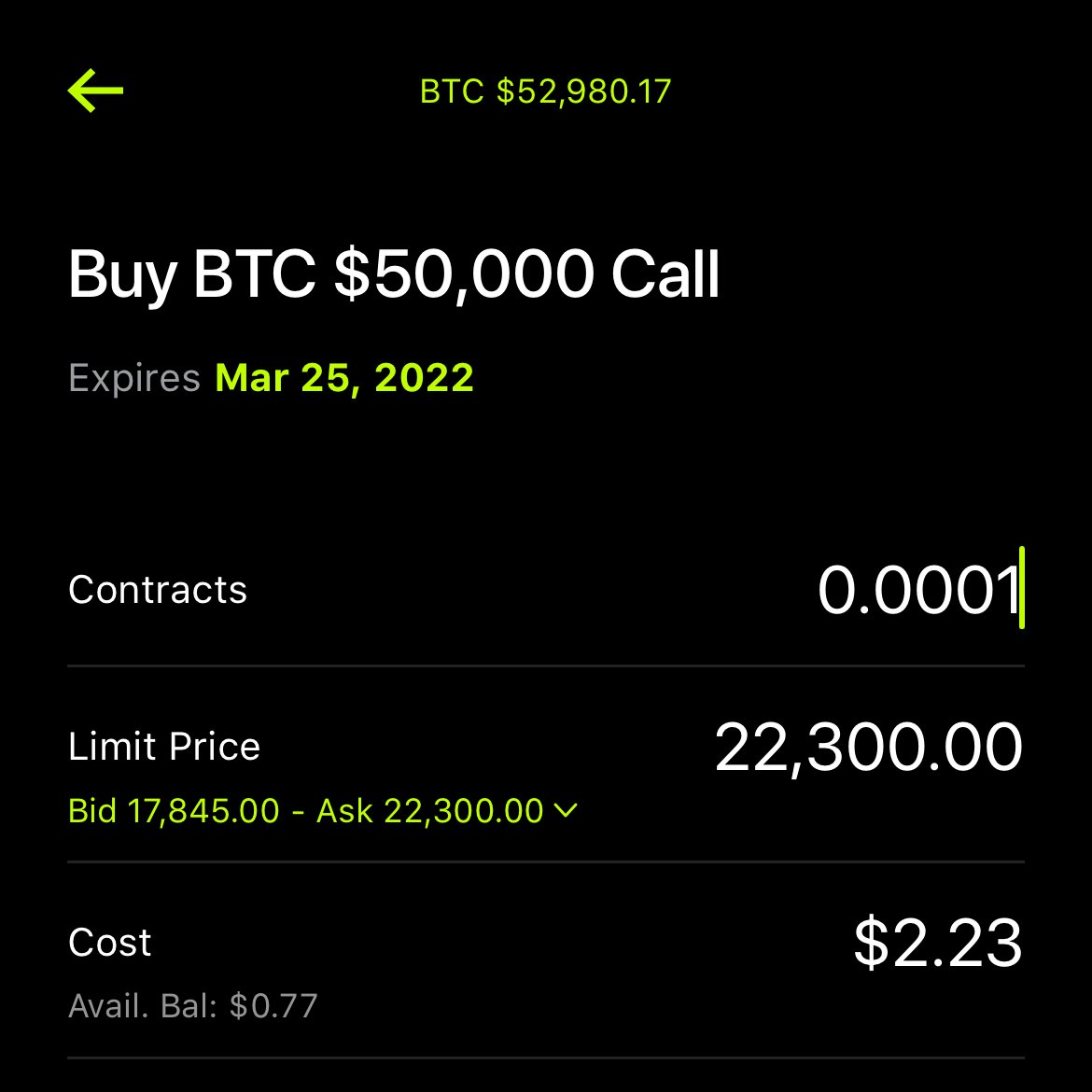

After selecting a strike, enter the number of contracts to purchase and check the total cost (premium).

PowerTrade supports fractional contracts up to 4 decimal points on BTC, you don’t to buy a full contract! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">

Review, then just swipe up!

Congrats! You are now long BTC! https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">

PowerTrade supports fractional contracts up to 4 decimal points on BTC, you don’t to buy a full contract!

Review, then just swipe up!

Congrats! You are now long BTC!

Read on Twitter

Read on Twitter " title="HOW TO POWERTRADEHow do I go long using options?What are calls? How do I enter a trade? If you have at least some of these questions, this #PowerKnowledge is for you! https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">" class="img-responsive" style="max-width:100%;"/>

" title="HOW TO POWERTRADEHow do I go long using options?What are calls? How do I enter a trade? If you have at least some of these questions, this #PowerKnowledge is for you! https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">" class="img-responsive" style="max-width:100%;"/>

Review, then just swipe up!Congrats! You are now long BTC!https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">" title="After selecting a strike, enter the number of contracts to purchase and check the total cost (premium).PowerTrade supports fractional contracts up to 4 decimal points on BTC, you don’t to buy a full contract!https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">Review, then just swipe up!Congrats! You are now long BTC!https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">" class="img-responsive" style="max-width:100%;"/>

Review, then just swipe up!Congrats! You are now long BTC!https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">" title="After selecting a strike, enter the number of contracts to purchase and check the total cost (premium).PowerTrade supports fractional contracts up to 4 decimal points on BTC, you don’t to buy a full contract!https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Applaus-Zeichen" aria-label="Emoji: Applaus-Zeichen">Review, then just swipe up!Congrats! You are now long BTC!https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚡" title="Hochspannungszeichen" aria-label="Emoji: Hochspannungszeichen">" class="img-responsive" style="max-width:100%;"/>