1/33

Let& #39;s talk about $SOL, where it& #39;s going and why I& #39;m bullish on how $SOL and $ETH actually work together to provide each other value that help grow their share.

I think this will easily bring $SOL to a top 3-5 project and in turn push $ETH over $BTC long-term.

Let& #39;s talk about $SOL, where it& #39;s going and why I& #39;m bullish on how $SOL and $ETH actually work together to provide each other value that help grow their share.

I think this will easily bring $SOL to a top 3-5 project and in turn push $ETH over $BTC long-term.

2/33

The first thing we need to clear up, is that no matter how great a chain is, being a maxi on any single technology is dumb.

Consider other technologies in our lives, why is the internet made up of different protocols like HTTP and SMTP?

The first thing we need to clear up, is that no matter how great a chain is, being a maxi on any single technology is dumb.

Consider other technologies in our lives, why is the internet made up of different protocols like HTTP and SMTP?

3/33

Because different technologies excel at different things.

It& #39;s the same reason we don& #39;t use lightbulbs to cook, even though light elements and heating elements are built on roughly the same tech, they are optimized in different ways.

Because different technologies excel at different things.

It& #39;s the same reason we don& #39;t use lightbulbs to cook, even though light elements and heating elements are built on roughly the same tech, they are optimized in different ways.

4/33

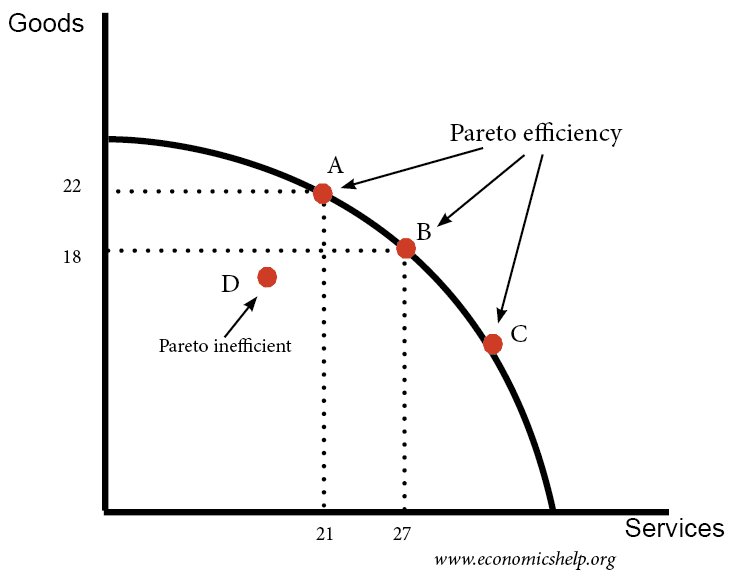

These technologies reach a point where they can be either bad at everything, or choose to optimize to be best at something and good at other things within a limits bound.

These trade-offs are called Pareto Efficiency

These technologies reach a point where they can be either bad at everything, or choose to optimize to be best at something and good at other things within a limits bound.

These trade-offs are called Pareto Efficiency

5/33

The industry has done a bad job of framing that there is only one binary choice that blockchains can make that is "good" and its this trade off of "centralized" vs "decentralized"

The industry has done a bad job of framing that there is only one binary choice that blockchains can make that is "good" and its this trade off of "centralized" vs "decentralized"

6/33

Not only is this wrong, and decentralization is a spectrum, but its actually over simplified, because blockchains actually have a web of trade-offs they can choose to make on multiple spectrums.

So we get to more complex efficiency models on resources vs access.

Not only is this wrong, and decentralization is a spectrum, but its actually over simplified, because blockchains actually have a web of trade-offs they can choose to make on multiple spectrums.

So we get to more complex efficiency models on resources vs access.

7/33

Ethereum has made choices around being the most decentralized, while also being the most accessible to take part in the ecosystem of, as well as choices in how it optimizes finality, state storage and transparency.

Ethereum has made choices around being the most decentralized, while also being the most accessible to take part in the ecosystem of, as well as choices in how it optimizes finality, state storage and transparency.

8/33

This means Ethereum will likely always be the layer of transparent, top confidence, freedom of access, broad trusted interoperable settlement layer. Like I outline in my OSI layer model ( https://cehv.com/cehvs-blockchain-osi-model-thesis/)">https://cehv.com/cehvs-blo...

This means Ethereum will likely always be the layer of transparent, top confidence, freedom of access, broad trusted interoperable settlement layer. Like I outline in my OSI layer model ( https://cehv.com/cehvs-blockchain-osi-model-thesis/)">https://cehv.com/cehvs-blo...

9/33

Similar to the internet& #39;s infrastructure Ethereum acts as this onboarding backbone that is critical public goods infrastructure.

But, that has, and will always have some trade offs on capacity and performance in certain areas.

Similar to the internet& #39;s infrastructure Ethereum acts as this onboarding backbone that is critical public goods infrastructure.

But, that has, and will always have some trade offs on capacity and performance in certain areas.

10/33

That& #39;s part of why we need L2s, which will be kickass, but also have their own trade-offs.

Since those weren& #39;t ready for prime time, we saw a lot of subpar centralized EVM forks pop-up to capitalize on retail demand.

That& #39;s part of why we need L2s, which will be kickass, but also have their own trade-offs.

Since those weren& #39;t ready for prime time, we saw a lot of subpar centralized EVM forks pop-up to capitalize on retail demand.

11/33

It cemented for the industry that there exist trade off spectrums for products that other user cohorts are willing to make.

And this is where @solana comes in.

It cemented for the industry that there exist trade off spectrums for products that other user cohorts are willing to make.

And this is where @solana comes in.

12/33

Where Ethereum focuses on maximizing decentralization, trustlessness and accessibility of the state machine, Solana aims at making slight trade-offs in these, and how state is stored, in order to optimize for raw processing power.

Where Ethereum focuses on maximizing decentralization, trustlessness and accessibility of the state machine, Solana aims at making slight trade-offs in these, and how state is stored, in order to optimize for raw processing power.

13/33

Think of it like a computer, Ethereum is a CPU and Solana is a GPU. Both of them optimized towards different types of operations and states. We wouldn& #39;t expect either to do it all (although maxi& #39;s will disagree), just like we would expect to use them for file storage

Think of it like a computer, Ethereum is a CPU and Solana is a GPU. Both of them optimized towards different types of operations and states. We wouldn& #39;t expect either to do it all (although maxi& #39;s will disagree), just like we would expect to use them for file storage

14/33

These chains are actually complementary as they fill different needs, and its part of why we see groups like @AudiusProject leveraging both.

These chains are actually complementary as they fill different needs, and its part of why we see groups like @AudiusProject leveraging both.

15/33

If ETH is a 10 on the decentralized access scale, then SOL is a 7 or 8, simply because the cost of running a validator requires a much more robust system.

Either way, this is certainly better than the -4 that BSC would score.

If ETH is a 10 on the decentralized access scale, then SOL is a 7 or 8, simply because the cost of running a validator requires a much more robust system.

Either way, this is certainly better than the -4 that BSC would score.

16/33

Why I think this is an interesting investment opportunity right now is timing.

BSC bloomed to an $88B mcap due to retail appetite for consumer scale defi.

But after a few months there infrastructure is starting to struggle under the bloat.

Why I think this is an interesting investment opportunity right now is timing.

BSC bloomed to an $88B mcap due to retail appetite for consumer scale defi.

But after a few months there infrastructure is starting to struggle under the bloat.

17/33

I& #39;d guess if this pace keeps up we& #39;ll see that infrastructure strain expand, and by my estimates hitting a critical point around July - September, depending on how much they invest in infrastructure. That& #39;s only 4-5 months way.

I& #39;d guess if this pace keeps up we& #39;ll see that infrastructure strain expand, and by my estimates hitting a critical point around July - September, depending on how much they invest in infrastructure. That& #39;s only 4-5 months way.

18/33

When we look at the adoption J-curve of ecosystems, it usually takes around 6-8 months after a funding boom for teams to start rolling out consumer ready products and given that Solana based funding exploded in the past 2-3 months, that puts us right on queue.

When we look at the adoption J-curve of ecosystems, it usually takes around 6-8 months after a funding boom for teams to start rolling out consumer ready products and given that Solana based funding exploded in the past 2-3 months, that puts us right on queue.

19/33

This timeframe is why a lot of people were predicting a "$SOL Summer". Right now, Binance is training millions of new retail users on DeFi and wallets but will likely be unable to service them by the same time that SOL is just in an upswing.

This timeframe is why a lot of people were predicting a "$SOL Summer". Right now, Binance is training millions of new retail users on DeFi and wallets but will likely be unable to service them by the same time that SOL is just in an upswing.

20/33

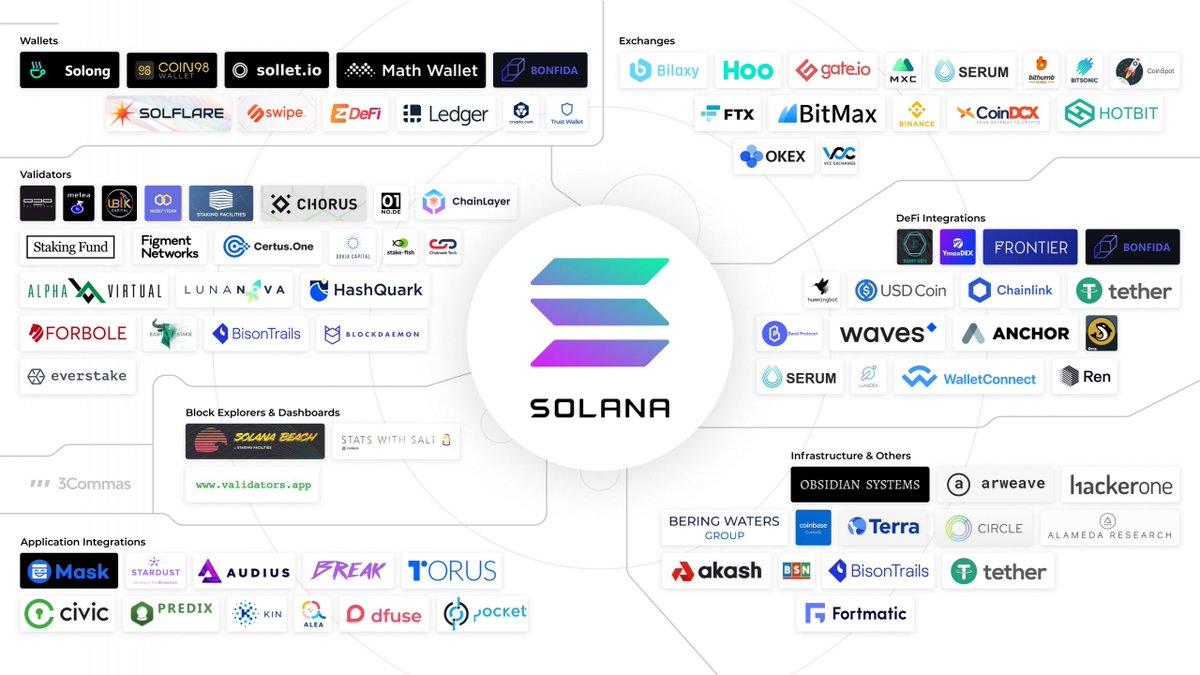

If Ethereum continues to be the prime access, interoperable settlement layer, then there is no better decentralized candidate to become the processing layer (replacing BSC) than $SOL.

And, they are already booming with infrastructure to capture this.

If Ethereum continues to be the prime access, interoperable settlement layer, then there is no better decentralized candidate to become the processing layer (replacing BSC) than $SOL.

And, they are already booming with infrastructure to capture this.

21/33

@phantom wallet to interact with the ecosystem.

@StepFinance_ as a SOL homepage.

@RaydiumProtocol for liquidity pools.

@mangomarkets for money protocols.

@MAPS_ME integrating millions of users for currency swaps.

@Oxygen_protocol for a prime brokerage.

@phantom wallet to interact with the ecosystem.

@StepFinance_ as a SOL homepage.

@RaydiumProtocol for liquidity pools.

@mangomarkets for money protocols.

@MAPS_ME integrating millions of users for currency swaps.

@Oxygen_protocol for a prime brokerage.

22/33

@ProjectSerum to provide plug in liquidity to developers to seed their DApps easily.

@staratlas powering an MMO game economy on the markets.

@PopsicleFinance adding crosschain liquidity.

@graphprotocol supporting querying

@PsyOptions launching a vanilla options protocol.

@ProjectSerum to provide plug in liquidity to developers to seed their DApps easily.

@staratlas powering an MMO game economy on the markets.

@PopsicleFinance adding crosschain liquidity.

@graphprotocol supporting querying

@PsyOptions launching a vanilla options protocol.

23/33

@bonfida providing beautiful interfaces and automation for it.

@synthetify set to launch a synthetics protocol.

@WormholeOracle integrating it with ETH and Terra

@HxroNetwork building out advanced options

@TorusLabs powering social logins.

And many more.

@bonfida providing beautiful interfaces and automation for it.

@synthetify set to launch a synthetics protocol.

@WormholeOracle integrating it with ETH and Terra

@HxroNetwork building out advanced options

@TorusLabs powering social logins.

And many more.

24/33

Plus, one thing it has that other chains didn& #39;t (until Binance) was the support of a major exchange (FTX/Blockfolio). BSC grew because of ease of use migration tooling from Binance. The kind of thing other challenger protocols can& #39;t replicate easily.

Plus, one thing it has that other chains didn& #39;t (until Binance) was the support of a major exchange (FTX/Blockfolio). BSC grew because of ease of use migration tooling from Binance. The kind of thing other challenger protocols can& #39;t replicate easily.

25/33

So if $SOL continues to grow, and can catch the new BSC users to become a key processing chain, where does it end up?

Even if it only captured a $60B mcap (meaning 30% less than Binance) it would weigh in at $152 per $SOL when fully diluted, or $226/$SOL at current dil.

So if $SOL continues to grow, and can catch the new BSC users to become a key processing chain, where does it end up?

Even if it only captured a $60B mcap (meaning 30% less than Binance) it would weigh in at $152 per $SOL when fully diluted, or $226/$SOL at current dil.

26/33

But, this assumes no market growth at all, which at current trajectories seems naïve.

At a conservative growth rate of the market of even 15% over the next year, I think we could look at the $300 - $350 range in the new year assuming its able to capture that market.

But, this assumes no market growth at all, which at current trajectories seems naïve.

At a conservative growth rate of the market of even 15% over the next year, I think we could look at the $300 - $350 range in the new year assuming its able to capture that market.

27/33

I think as this trend emerges, we& #39;ll see defi protocols, governance infrastructure, corporate tooling, DAO coordination, and NFTs cement heavily into the ETH ecosystem as they focus more on the trade-offs ETH supports.

I think as this trend emerges, we& #39;ll see defi protocols, governance infrastructure, corporate tooling, DAO coordination, and NFTs cement heavily into the ETH ecosystem as they focus more on the trade-offs ETH supports.

28/33

Computationally intense B2C applications or backends will land on SOL.

Since nearly all projects have elements of both, we& #39;ll see projects expand across both ecosystems and the use of those products will add cross chain compounding value to both ecosystems.

Computationally intense B2C applications or backends will land on SOL.

Since nearly all projects have elements of both, we& #39;ll see projects expand across both ecosystems and the use of those products will add cross chain compounding value to both ecosystems.

29/33

We& #39;ll also see mobile applications integrate with $SOL and do infrastructure settlement on $ETH, since SOL is the only actually decentralized blockchain with settlement times cheap enough, fast enough, and with enough liquidity to support microtransactions at scale.

We& #39;ll also see mobile applications integrate with $SOL and do infrastructure settlement on $ETH, since SOL is the only actually decentralized blockchain with settlement times cheap enough, fast enough, and with enough liquidity to support microtransactions at scale.

30/33

This will unlock an entirely new type of Dapp user the benefits the growth in both ecosystems. Where they can use blockchain tech in apps with it abstracted away from the user.

This is what will jump DeFi into the trillions in marketcap.

This will unlock an entirely new type of Dapp user the benefits the growth in both ecosystems. Where they can use blockchain tech in apps with it abstracted away from the user.

This is what will jump DeFi into the trillions in marketcap.

31/33

I personally believe in combination that Ethereum and Solana will be the foundational building blocks of our next tech revolution at an internet level scale.

The economic opportunity here is trillions of dollars.

I personally believe in combination that Ethereum and Solana will be the foundational building blocks of our next tech revolution at an internet level scale.

The economic opportunity here is trillions of dollars.

32/33

While I hold both extensively for the long run, I think the short term play is very lucrative for Solana, as its only just starting to have its day in the sun and I think that triumph will happen this summer with the decline of BSC.

While I hold both extensively for the long run, I think the short term play is very lucrative for Solana, as its only just starting to have its day in the sun and I think that triumph will happen this summer with the decline of BSC.

33/33

Needless to say, I am long on both, and will be holding/staking both for a very long time.

(Standard disclaimer, not financial advice, and I am bias as all hell with how aggressively I buy these)

Needless to say, I am long on both, and will be holding/staking both for a very long time.

(Standard disclaimer, not financial advice, and I am bias as all hell with how aggressively I buy these)

Read on Twitter

Read on Twitter