Our new paper on paying for the upcoming Biden American Families Plan makes 4 points:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Fortunes of wealthy folks have surged

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Fortunes of wealthy folks have surged

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛑" title="Stoppzeichen" aria-label="Emoji: Stoppzeichen">They don’t pay tax annually on much of their income

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛑" title="Stoppzeichen" aria-label="Emoji: Stoppzeichen">They don’t pay tax annually on much of their income

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎁" title="Verpacktes Geschenk" aria-label="Emoji: Verpacktes Geschenk">They enjoy discounted rates on the taxes they do pay

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎁" title="Verpacktes Geschenk" aria-label="Emoji: Verpacktes Geschenk">They enjoy discounted rates on the taxes they do pay

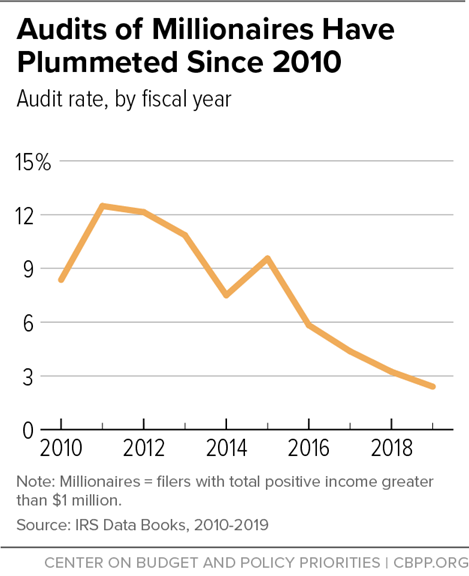

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">Audits of their taxes have plummeted

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">Audits of their taxes have plummeted

This thread will go into depth on these four points, but if you want to skip ahead to read the full paper, you can do so here: http://bit.ly/2QMV31A ">https://bit.ly/2QMV31A&q...

Big picture: Our revenues are too low to support the investments the nation needs. In 2000, revenues were 20% of GDP, in 2019 they were 16.3%. That difference means $850b/year in lower revenues.

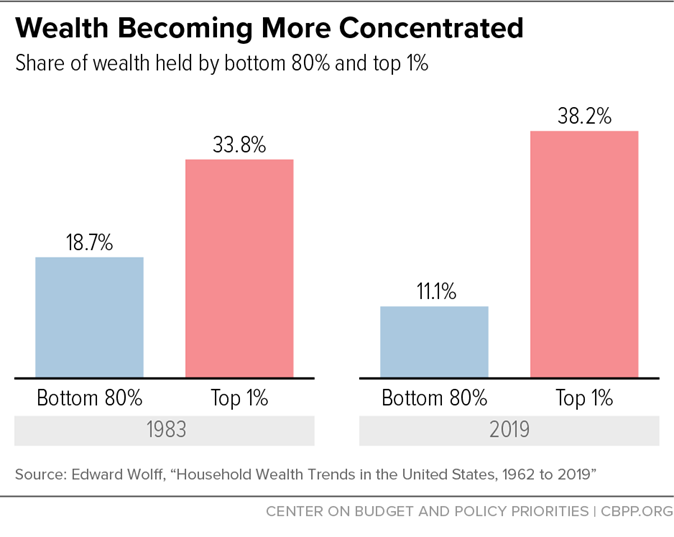

Raising taxes on wealthy households and profitable corporations allows us to make investments that broaden opportunity & reduce racial/ethnic wealth & income disparities.

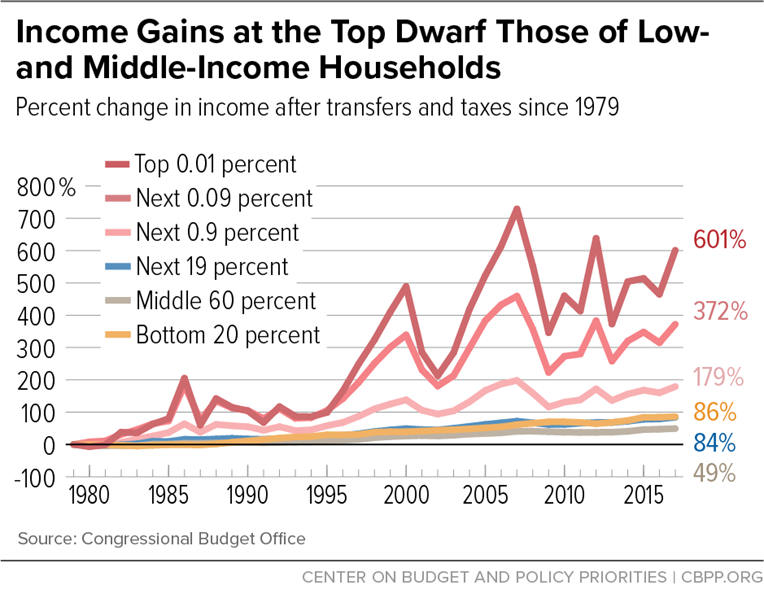

High-income households can afford to pay more – incomes of people at the top have risen disproportionately in recent decades, and their fortunes surged even during the pandemic.

And while the pandemic’s economic fallout has been devastating for millions (disproportionately Black, Latino, Indigenous & immigrant households), “the wealth of nine of the country’s top titans has increased by more than $360 billion in the past year.” http://wapo.st/2Q8MrTb ">https://wapo.st/2Q8MrTb&q...

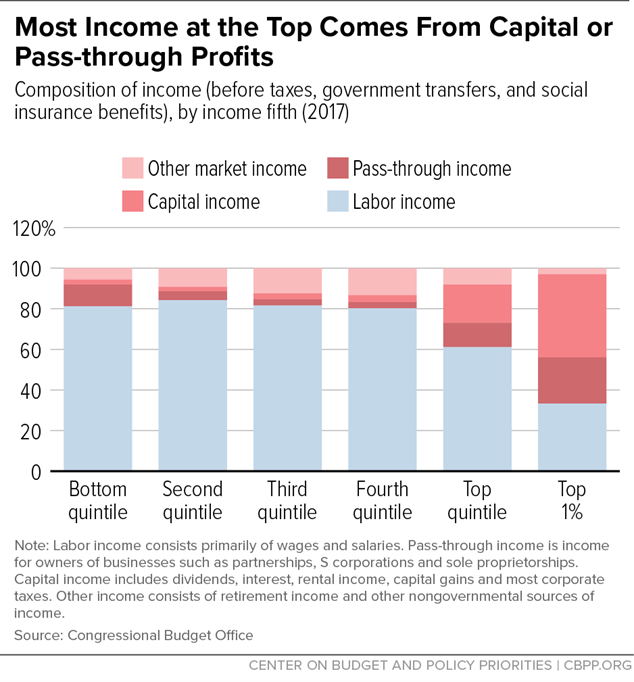

Unlike wages of middle-class people, much of this $360 billion income will likely not be taxed this year because wealthy people enjoy a major tax advantage: “deferral” of taxes owed on the appreciation of their stocks (and other types of investment property) that are not sold.

Moreover, because of the “trust fund loophole,” or “stepped-up basis,” any such deferred income tax a wealthy person owes on appreciated assets is simply erased when they die.

When wealthy people do pay taxes, they often benefit from special discounted rates, which have been made more generous in recent decades.

Starting in 1997, tax rates on capital gains, dividends, and on high-income pass-through owners have all been cut – and each of these types of income are heavily concentrated at the top.

It’s been a Republican priority to reduce taxes on wealthy heirs since 1997. The estate tax’s tax-free exemption is now $23.4 million per couple.

Even before the regressive 2017 tax cut: from the mid-90s through 2017, the average federal tax rate — that is, the share of a household’s income actually paid in federal taxes — for the top 0.01% fell by almost a fifth.

While these supply-side tax cuts shifted more and more income to the wealthiest people in the country & increased inequality, they failed to increase economic growth as their proponents claimed. In short, trickle-down economics failed:

http://bit.ly/3n514Tt ">https://bit.ly/3n514Tt&q...

http://bit.ly/3n514Tt ">https://bit.ly/3n514Tt&q...

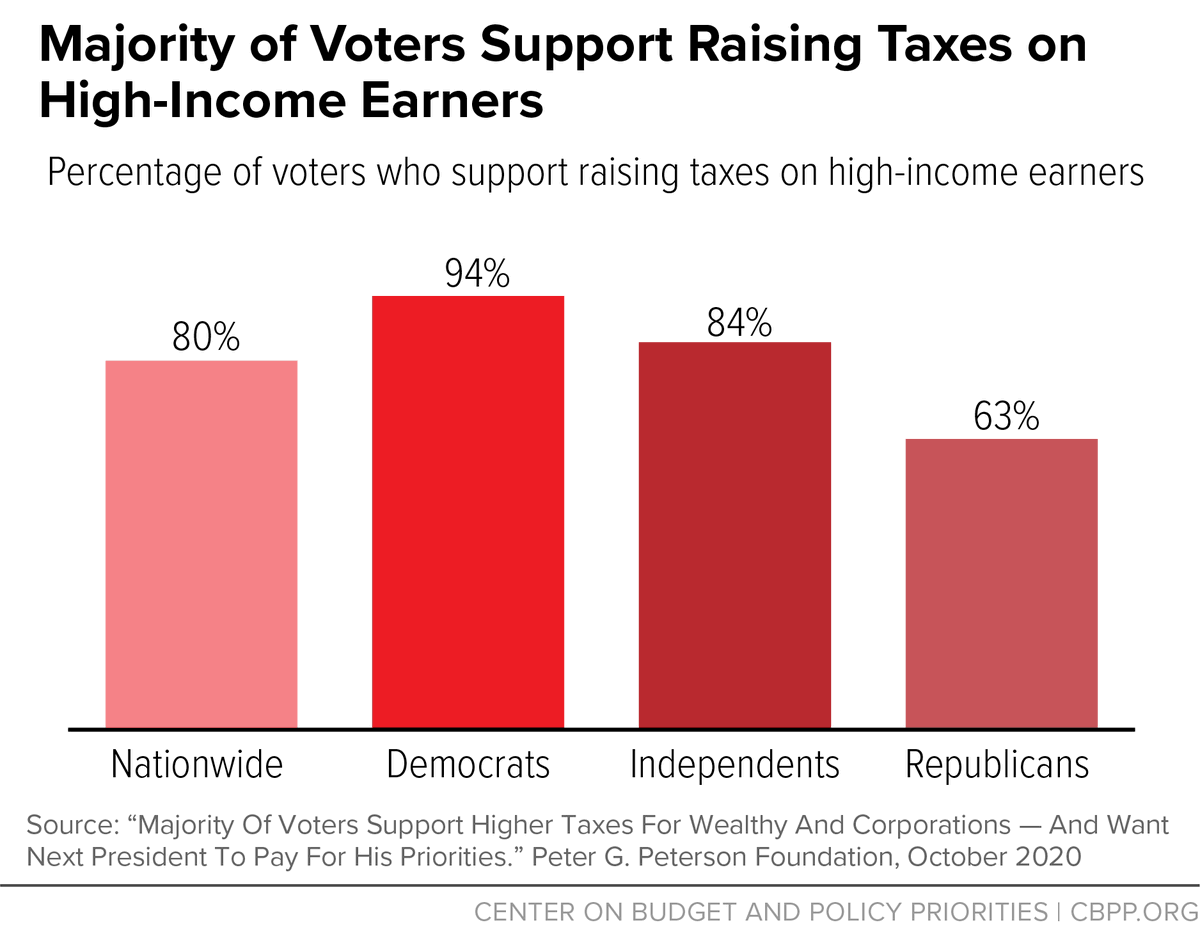

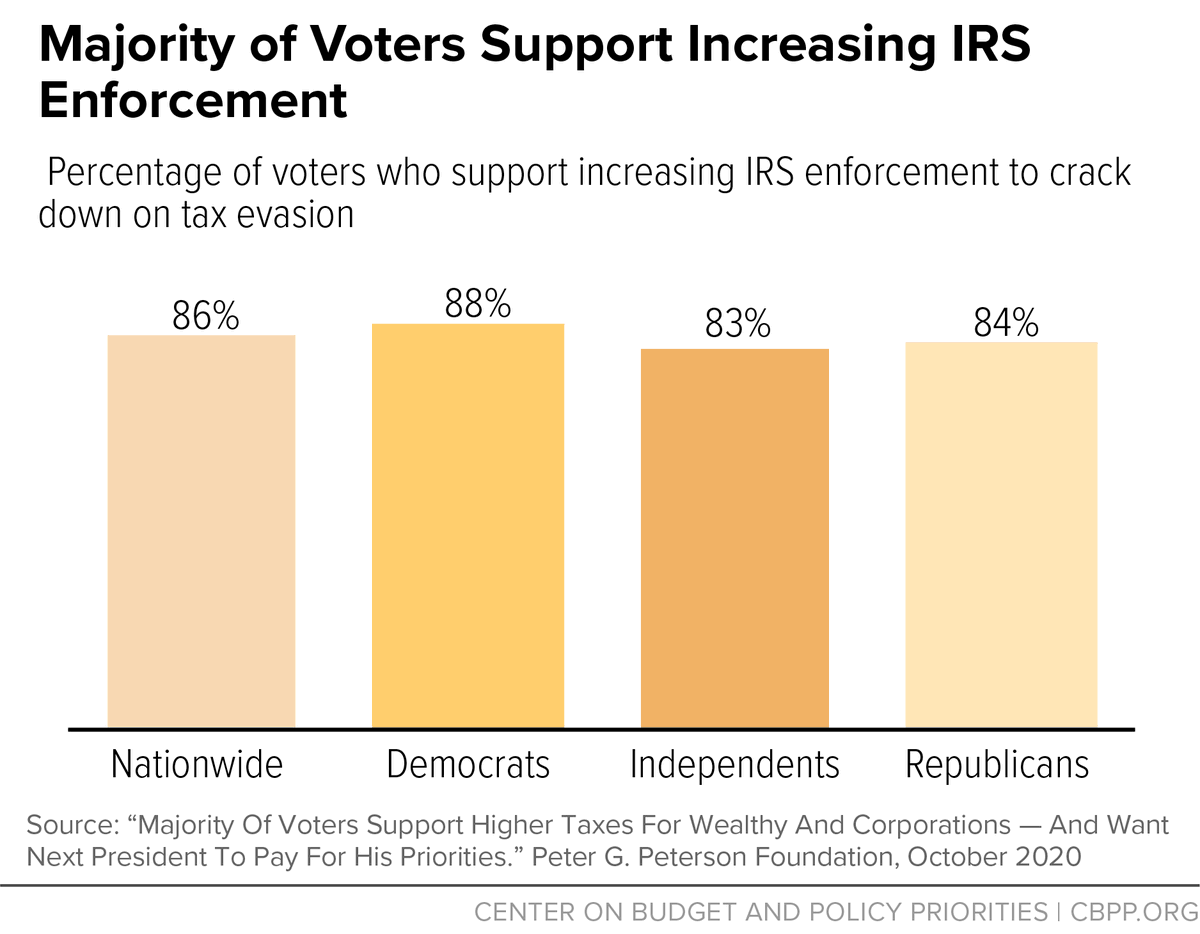

Reversing trickle-down economics by asking the wealthiest people to pay a fairer amount of tax to finance critical national priorities that can broaden opportunity would not only be wise, it would be popular.

Finally, because of deep IRS budget cuts, audit rates of millionaires have plummeted. Meanwhile, new research shows that the wealthy engage in far more tax evasion than previously estimated:

A guaranteed, multi-year “mandatory” funding stream to rebuild IRS enforcement and upgrade the agency’s technology systems can generate significant revenues to help pay for the upcoming recovery legislation: http://bit.ly/3n16zTd ">https://bit.ly/3n16zTd&q...

We look forward to the President’s upcoming recovery legislation next week and hope it will ask the wealthiest among us to pay a fairer amount to fund critical national priorities. http://bit.ly/2QMV31A

End">https://bit.ly/2QMV31A&q...

End">https://bit.ly/2QMV31A&q...

Read on Twitter

Read on Twitter