Day 4 of @insidehousing look into the EWS crisis.

Today I hand over the baton to @dominicbrady8 who has looked at how banks have responded to the new RICs guidance.

He& #39;s found that some l& #39;holders may still be asked for EWS even for exempt buildings https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://www.insidehousing.co.uk/news/ews-crisis-some-banks-could-still-ask-for-ews1-forms-on-buildings-exempt-under-new-rics-guidance-70256">https://www.insidehousing.co.uk/news/ews-...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://www.insidehousing.co.uk/news/ews-crisis-some-banks-could-still-ask-for-ews1-forms-on-buildings-exempt-under-new-rics-guidance-70256">https://www.insidehousing.co.uk/news/ews-...

Today I hand over the baton to @dominicbrady8 who has looked at how banks have responded to the new RICs guidance.

He& #39;s found that some l& #39;holders may still be asked for EWS even for exempt buildings

When the RICs guidance was released in March there was a big caveat that it would only work with banks buy- in.

And it would appear that while the majority are publicly saying they will change their policies to match the RICs guidance, it is not all of them.

And it would appear that while the majority are publicly saying they will change their policies to match the RICs guidance, it is not all of them.

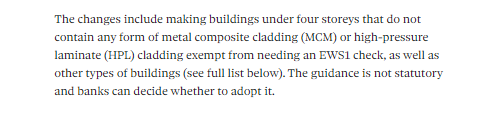

A reminder, here is what the RICS changes, which aimed to take thousands of buildings outside the scope of EWS, said  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

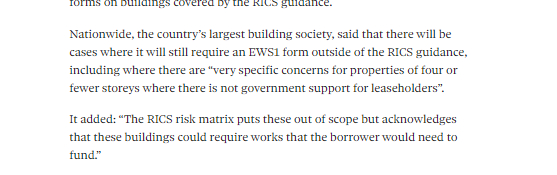

Nationwide, the country& #39;s largest building society, has left the option open that checks may still be needed on buildings exempt under the RICS guidance. Lloyds have indicated a similar stance too.

Many of the others have said that not only do they welcome the RICS guidance and say they either align with or are changing policy to align with the RICS guidance. Here are those banks https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

However, if there is anything that the last year looking into EWS has told me, often the public statements on policy can be different to what is happening on the ground.

We are keen to hear from anyone who has been asked for EWS on exempt buildings by these banks https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

DMs open

We are keen to hear from anyone who has been asked for EWS on exempt buildings by these banks

DMs open

Should also add that Natwest& #39;s position is interesting.

While it says that it was looking to adopt the RICS guidance, it said that for those buildings that had already received an EWS it would not reverse decisions.

Surely this punishes those that got EWS checks early?

While it says that it was looking to adopt the RICS guidance, it said that for those buildings that had already received an EWS it would not reverse decisions.

Surely this punishes those that got EWS checks early?

Feel this sort of thing  https://abs.twimg.com/emoji/v2/... draggable="false" alt="☝️" title="Zeigefinger nach oben" aria-label="Emoji: Zeigefinger nach oben"> has been a common theme throughout the building safety crisis. Those that act early, can be punished down the when guidance and regulation changes.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☝️" title="Zeigefinger nach oben" aria-label="Emoji: Zeigefinger nach oben"> has been a common theme throughout the building safety crisis. Those that act early, can be punished down the when guidance and regulation changes.

It& #39;s a system that encourages stakeholders to sit and wait, to get full sight of regulatory landscape.

It& #39;s a system that encourages stakeholders to sit and wait, to get full sight of regulatory landscape.

Read on Twitter

Read on Twitter " title="A reminder, here is what the RICS changes, which aimed to take thousands of buildings outside the scope of EWS, said https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="A reminder, here is what the RICS changes, which aimed to take thousands of buildings outside the scope of EWS, said https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="Many of the others have said that not only do they welcome the RICS guidance and say they either align with or are changing policy to align with the RICS guidance. Here are those bankshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="Many of the others have said that not only do they welcome the RICS guidance and say they either align with or are changing policy to align with the RICS guidance. Here are those bankshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

DMs open" title="However, if there is anything that the last year looking into EWS has told me, often the public statements on policy can be different to what is happening on the ground.We are keen to hear from anyone who has been asked for EWS on exempt buildings by these bankshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> DMs open" class="img-responsive" style="max-width:100%;"/>

DMs open" title="However, if there is anything that the last year looking into EWS has told me, often the public statements on policy can be different to what is happening on the ground.We are keen to hear from anyone who has been asked for EWS on exempt buildings by these bankshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> DMs open" class="img-responsive" style="max-width:100%;"/>