1/ Have we got a little ahead of ourselves? Everybody is talking about the party to come when we get out of this mess. But are we bracing ourselves for any hangover?

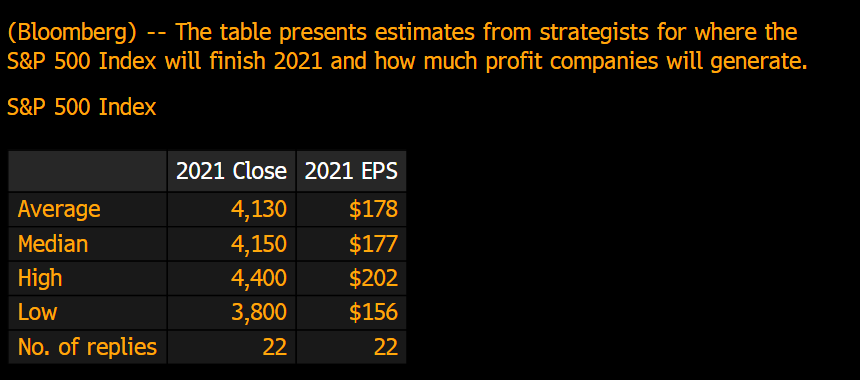

2/ At the close today, we are above both the average and the median S&P target price, as derived by 22 strategist. If I were to take out the top three (4400) and bottom tree targets (3800), then the average PT would be 4141 or Median would be 4155.

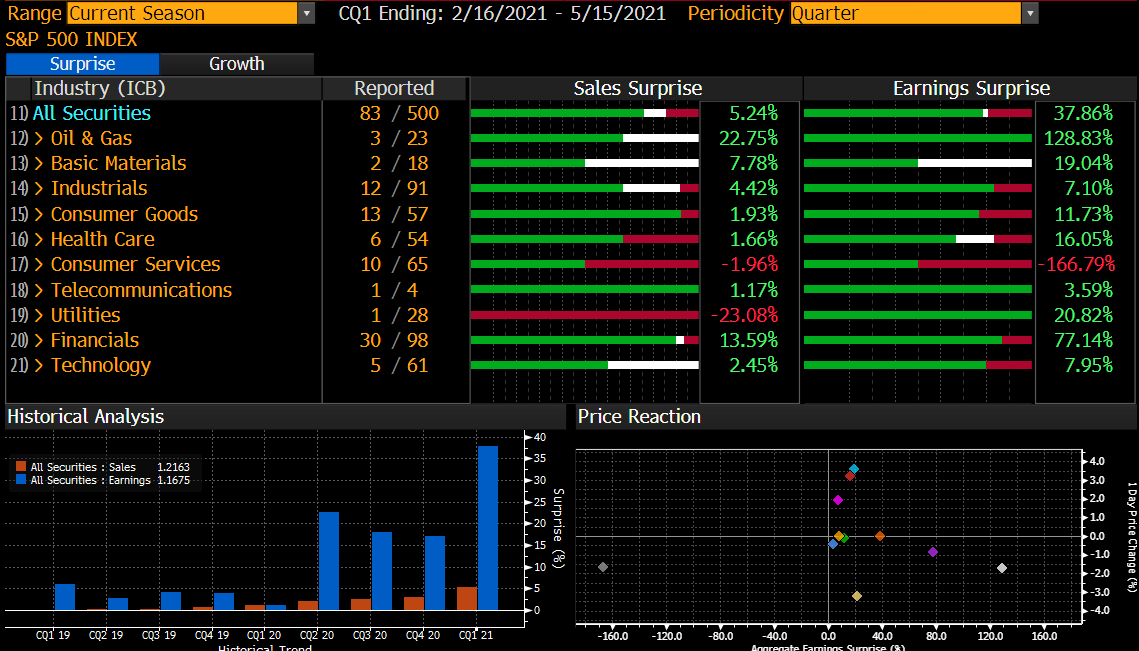

3/ So, we are essentially at the Median and Average "year end" target in Mid April. So, the question is, do we move higher from here, or simply fade? With 83 /500 S&P Companies reporting, we are seeing decent sales surprise (+5% and even bigger earnings surprise +40%)

4/ Its a bit early to tell, but the big surprises are in the older sectors (Oil and Gas and Financials). But guess what.. those sectors are rolling over (XLE - oil and gas) or staling XLF.

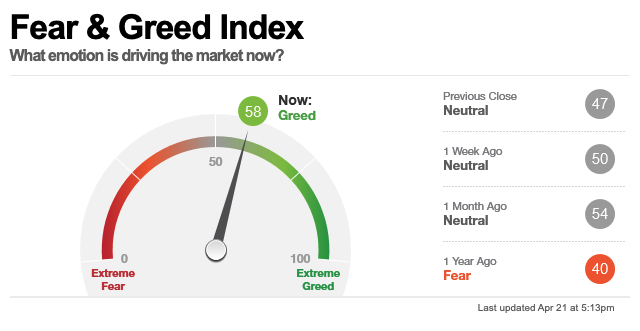

5/ I am not calling doom and gloom, but as we come out of our basements and into the brave world, a lot of what we have been calling for could already be priced in..especially in the next few months...

6 / Its a good time to overlay some of your portfolio with some downside protection (Short ETFs or Sell Puts on index), as it seems that we are in for a snoozer.... Anything with diamond hands is and will continue to be tested....

7 / Or, if you believe in inflation, and missed the #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> rally...i suggest you buy something that we all love.. #GOLD... Might look short term overbought... but a good place to hid in the next few months.

https://abs.twimg.com/hashflags... draggable="false" alt=""> rally...i suggest you buy something that we all love.. #GOLD... Might look short term overbought... but a good place to hid in the next few months.

Read on Twitter

Read on Twitter

rally...i suggest you buy something that we all love.. #GOLD... Might look short term overbought... but a good place to hid in the next few months." title="7 / Or, if you believe in inflation, and missed the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> rally...i suggest you buy something that we all love.. #GOLD... Might look short term overbought... but a good place to hid in the next few months." class="img-responsive" style="max-width:100%;"/>

rally...i suggest you buy something that we all love.. #GOLD... Might look short term overbought... but a good place to hid in the next few months." title="7 / Or, if you believe in inflation, and missed the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> rally...i suggest you buy something that we all love.. #GOLD... Might look short term overbought... but a good place to hid in the next few months." class="img-responsive" style="max-width:100%;"/>