Did you know that millions of dollars of $ETH are essentially drained from Uniswap pairs every day?

Now, what if I told you there is a small cap project solving this problem, & they are integrating with $SUSHI soon...?

I’ll go over the details of this below... Let’s begin! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

Now, what if I told you there is a small cap project solving this problem, & they are integrating with $SUSHI soon...?

I’ll go over the details of this below... Let’s begin!

As many of you already know from first hand experience, front running & sniping bots are now a plague on decentralized exchanges

Using the mempool, which is essentially a subscription to pending transactions on $ETH, miners reorganize txs for their own benefit before validation.

Using the mempool, which is essentially a subscription to pending transactions on $ETH, miners reorganize txs for their own benefit before validation.

But this is where Archer DAO comes in.

Archer DAO, governed by the $ARCH token, creates an ecosystem which may completely revolutionize the way transactions work on $ETH

It does so by implementing game theory into the concept of MEV (Miner Extractable Value)

Archer DAO, governed by the $ARCH token, creates an ecosystem which may completely revolutionize the way transactions work on $ETH

It does so by implementing game theory into the concept of MEV (Miner Extractable Value)

Miner-Extractable Value is a dynamic where blockchain miners on $ETH are able to extract profits at the expense of users by arbitrarily reordering, including, or excluding transactions in blocks

$ARCH connects bots with miners & works with them at a level we’ve never seen before

$ARCH connects bots with miners & works with them at a level we’ve never seen before

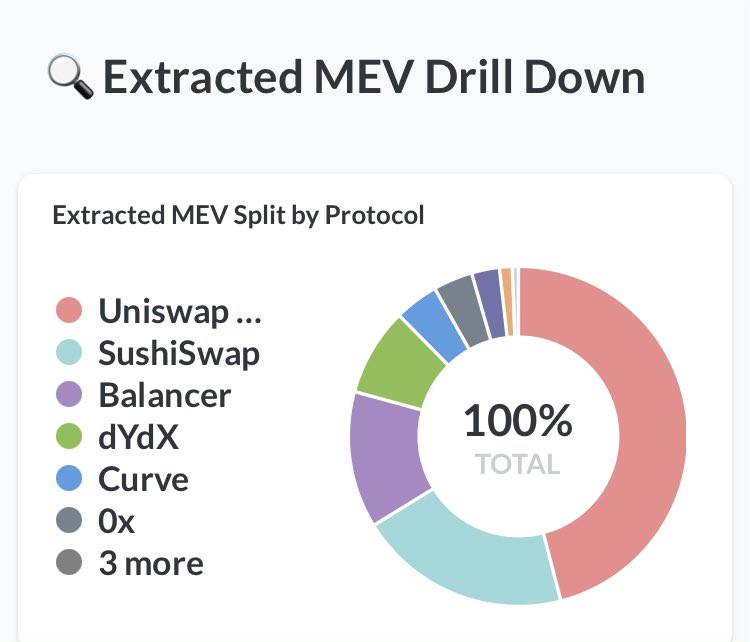

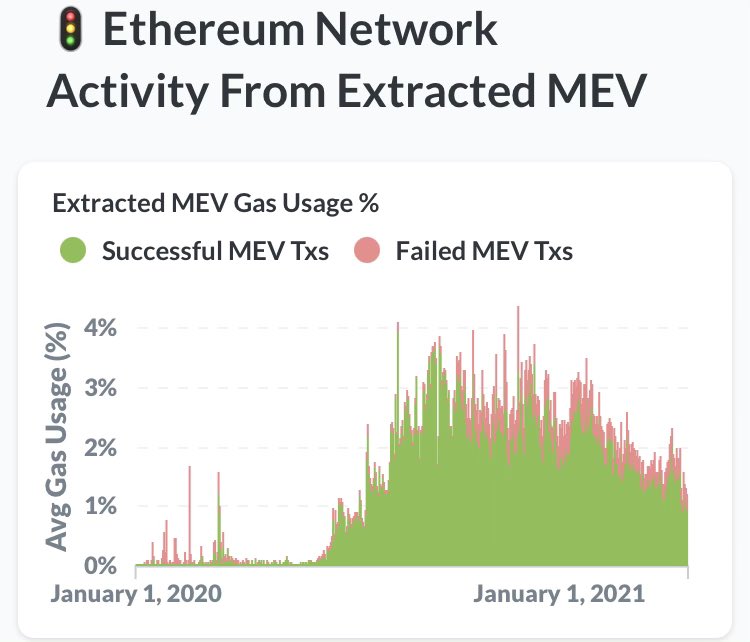

To fully understand the extent of this, here are the figures of MEV on $ETH. Since just last year, over $370M has been extracted by miners.

Recent revelations in this area have already caused major changes to the structure of $ETH.

FURTHER READING: https://arxiv.org/abs/1904.05234 ">https://arxiv.org/abs/1904....

Recent revelations in this area have already caused major changes to the structure of $ETH.

FURTHER READING: https://arxiv.org/abs/1904.05234 ">https://arxiv.org/abs/1904....

“Gas fees on $ETH blockchain have reduced by almost 50% due to adoption of flashbots by traders in place of PGA bots. In the last 24 hours, the average gas fees for transactions has come down from around 120 gwei to around 65 gwei currently.”

“Right now over 58% of the hashrate is achieved on flashbots and PGA bots seem no longer able to compete. PGA bots usage increases the fees paid by Ethereum users while flashbots reduce it. As flashbots gain larger share of hash rate then gas prices should continue dropping.”

This is a result of MEV-GETH (by Flashbots):

A slightly modified fork of the Ethereum GETH client and MEV relay, a tx bundling layer.

$ARCH uses this to offer a private mempool of highest value transactions, which essentially creates a marketplace between miners and suppliers.

A slightly modified fork of the Ethereum GETH client and MEV relay, a tx bundling layer.

$ARCH uses this to offer a private mempool of highest value transactions, which essentially creates a marketplace between miners and suppliers.

With a five minute integration process, miners on $ETH can automatically sort transactions of the highest value.

Suppliers find the best opportunities and share the revenue with miners.

The possibilities and use cases of this type of concept should not be underestimated...

Suppliers find the best opportunities and share the revenue with miners.

The possibilities and use cases of this type of concept should not be underestimated...

Furthermore with advancements in the $ETH ecosystem such as EIP-1559, we can expect a dramatic reorganization of $ETH transaction fees

It is important to remember that:

-During network congestion $ETH will be burned

-Staked $ETH receives block rewards

-Staked $ETH earns MEV

It is important to remember that:

-During network congestion $ETH will be burned

-Staked $ETH receives block rewards

-Staked $ETH earns MEV

As it stands with the current auction fee model on $ETH txs, MEV can be monopolized by miners leeching value

& the strategies miners use for this are getting smarter every day, more apparent so than ever on a DEX like $UNI

$ARCH fixes this by decentralizing & tokenizing MEV

& the strategies miners use for this are getting smarter every day, more apparent so than ever on a DEX like $UNI

$ARCH fixes this by decentralizing & tokenizing MEV

I will detail a big issue relevant to this in which $ARCH could solve briefly below https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

First noted by the team at @ethereansOS, a very simple routing problem on $UNI was found to have been allowing bots on the network to wipe hundreds of $ETH every day from liquidity pools.

First noted by the team at @ethereansOS, a very simple routing problem on $UNI was found to have been allowing bots on the network to wipe hundreds of $ETH every day from liquidity pools.

This problem has since grown exponentially, and it is not only limiting growth of certain projects, but it is actually TAKING AWAY value from them.

Since trades are only ever routed through a select number of pairs on $UNI, there is a constant area for arbitrage to take place.

Since trades are only ever routed through a select number of pairs on $UNI, there is a constant area for arbitrage to take place.

FROM @ethereansOS:

“Uniswap automatically routes trades to arbitrage in the user’s interest, but only via pairs tied to these six, hard-coded tokens.

This process ensures that the prices of those pairs are kept in sync with each other.”

“Uniswap automatically routes trades to arbitrage in the user’s interest, but only via pairs tied to these six, hard-coded tokens.

This process ensures that the prices of those pairs are kept in sync with each other.”

“Unfortunately, it also ensures their prices are out of sync with every other pair...

Because normal trades only occurs among pairs tied to those six tokens, prices only change within those pairs, desyncing them from prices in all other pairs.”

Because normal trades only occurs among pairs tied to those six tokens, prices only change within those pairs, desyncing them from prices in all other pairs.”

“This opens up price disparities between these two types of pairs. Arbitration bots swoop in, profiting off the difference, stripping them of value and taking off with free $ETH.”

LINK: https://medium.com/dfohub/a-black-hole-in-uniswap-v2s-front-end-router-is-draining-the-value-of-tokens-26f5a459b5d7">https://medium.com/dfohub/a-...

LINK: https://medium.com/dfohub/a-black-hole-in-uniswap-v2s-front-end-router-is-draining-the-value-of-tokens-26f5a459b5d7">https://medium.com/dfohub/a-...

Now that we have an idea of just how $ARCH can be used for the massive bot problem on $ETH, let’s look at some of the even more interesting stuff...

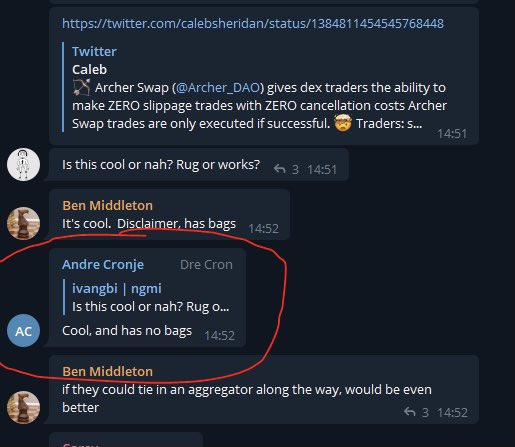

Earlier today, Archer DAO released the prototype of their zero slippage DEX for $UNI & $SUSHI trades. https://twitter.com/calebsheridan/status/1384811454545768448">https://twitter.com/calebsher...

Earlier today, Archer DAO released the prototype of their zero slippage DEX for $UNI & $SUSHI trades. https://twitter.com/calebsheridan/status/1384811454545768448">https://twitter.com/calebsher...

Archer Swap gives traders negotiation power with miners. Miners will only be paid if "acceptance criteria" are met, so any transaction that fails is NOT included on chain.

This is a revolutionary type of DEX allowing for maximum optimization for traders.

This is a revolutionary type of DEX allowing for maximum optimization for traders.

“Behind the scenes, this is driven by the Archer Relay which accepts, negotiates and routes all kinds of transactions

“Archer Relay routes signed txs through the network for connecting the various criteria of applications, users & miners.”

(pay special attention to this part)

“Archer Relay routes signed txs through the network for connecting the various criteria of applications, users & miners.”

(pay special attention to this part)

So what makes this particularly important? Well, an announcement from $SUSHI gives us some insight at the future of $ARCH

Did you know that they plan to integrate $SUSHI with MEV via $ARCH?

With this, the efficiency of the dex would increase tremendously

https://medium.com/sushiswap-org/2021-3e1f45cf86a2">https://medium.com/sushiswap...

Did you know that they plan to integrate $SUSHI with MEV via $ARCH?

With this, the efficiency of the dex would increase tremendously

https://medium.com/sushiswap-org/2021-3e1f45cf86a2">https://medium.com/sushiswap...

There are an abundance of other use cases which may come to fruition thanks to this synergy, but there is one that takes the cake over any other...

If you remember my last thread on the $SUSHI & $YFI stealth project you’ll remember they plan to come out with MetaWallet

THREAD https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)"> https://twitter.com/croissanteth/status/1383987639691321344">https://twitter.com/croissant...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)"> https://twitter.com/croissanteth/status/1383987639691321344">https://twitter.com/croissant...

If you remember my last thread on the $SUSHI & $YFI stealth project you’ll remember they plan to come out with MetaWallet

THREAD

MetaWallet will be a smart contract wallet offering GAS-LESS trades on SushiSwap via Keep3r Network technology...

But, where does $ARCH tie into this?

Well, if you’re knowledgeable on KP3R, you’ll notice that the suppliers in $ARCH have awfully similar jobs to Keepers...

But, where does $ARCH tie into this?

Well, if you’re knowledgeable on KP3R, you’ll notice that the suppliers in $ARCH have awfully similar jobs to Keepers...

Keep3rs are responsible for doing all the back end computation to determine whether or not a tx is profitable for the executor

What if $ARCH x KP3R were used to prioritize SushiSwap orders and bring back power to the traders on the exchange?

This may very well be possible...

What if $ARCH x KP3R were used to prioritize SushiSwap orders and bring back power to the traders on the exchange?

This may very well be possible...

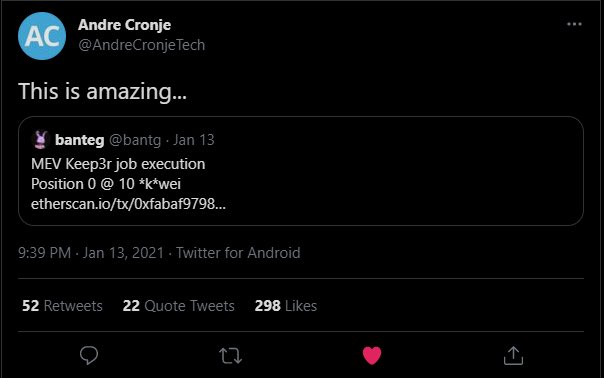

because an Archer DAO client was actually featured in a tweet from @bantg showing MEV Keep3r job execution...

https://twitter.com/bantg/status/1349470728320659456?s=21

Furthermore,">https://twitter.com/bantg/sta... the project has the seal of approval from Andre Cronje himself.

https://twitter.com/bantg/status/1349470728320659456?s=21

Furthermore,">https://twitter.com/bantg/sta... the project has the seal of approval from Andre Cronje himself.

Now before I run out of tweets, I’ll have to wrap this up below:

$ARCH has the chance to change core infrastructure on $ETH, & we have good reason to believe they will be deeply integrated with $SUSHI

& it’s only $24M mcap at the time of this writing! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍞" title="Brot" aria-label="Emoji: Brot"> https://www.coingecko.com/en/coins/archer-dao-governance-token">https://www.coingecko.com/en/coins/...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍞" title="Brot" aria-label="Emoji: Brot"> https://www.coingecko.com/en/coins/archer-dao-governance-token">https://www.coingecko.com/en/coins/...

$ARCH has the chance to change core infrastructure on $ETH, & we have good reason to believe they will be deeply integrated with $SUSHI

& it’s only $24M mcap at the time of this writing!

Read on Twitter

Read on Twitter