A very basic thread on 5 Sygnia ETFs (there are 11 Sygnia ETFs so far offered on the Easyequities platform). .

all the information that will be shared in this thread is from @EasyEquities and @sygnia website.

Links: https://www.sygnia.co.za/sygnia-itrix-range

https://www.sygnia.co.za/sygnia-it... href=" https://etfs.easyequities.co.za/finder ">https://etfs.easyequities.co.za/finder&qu...

all the information that will be shared in this thread is from @EasyEquities and @sygnia website.

Links: https://www.sygnia.co.za/sygnia-itrix-range

1. Sygnia Itrix 4th Industrial Revolution

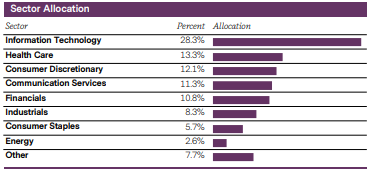

This ETF Tracks stocks and instruments leading the 4th Industrial Revolution. It is technology-centric with exposure to offshore companies.

This ETF Tracks stocks and instruments leading the 4th Industrial Revolution. It is technology-centric with exposure to offshore companies.

The 4IR brings to life a range of new technologies such as autonomous vehicles, cleantech,drones, robotics, nanotechnology, smart buildings etc. Some of these technologies like self-driving cars, medical diagnoses based on genome mapping and drone deliveries are already here

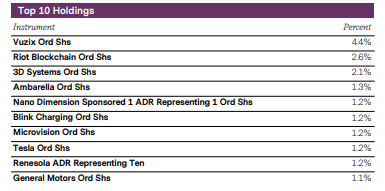

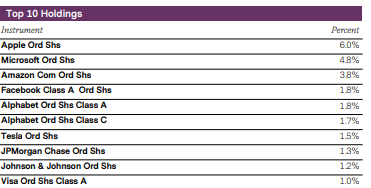

4IR ETF Top 10 holdings:

The ETF’s top 10 holdings are dominated by industrial and tech companies. However, it compensates for this by investing in many stocks across different geographies. Overall, the fund is skewed towards growth companies.

The ETF’s top 10 holdings are dominated by industrial and tech companies. However, it compensates for this by investing in many stocks across different geographies. Overall, the fund is skewed towards growth companies.

4IR dividends distribution: Semi-Annual Dec & Jan

Alternatives: The fund’s indirect alternatives are the Satrix Nasdaq 100 ETF with a total expense ratio of 0.48% and Stanlib S&P 500 Feeder ETF (TER 0.27%)

Alternatives: The fund’s indirect alternatives are the Satrix Nasdaq 100 ETF with a total expense ratio of 0.48% and Stanlib S&P 500 Feeder ETF (TER 0.27%)

2. Sygnia Itrix EUROSTOXX50 ETF

This is said to be the only ETF on the JSE that offers easy access to more than 50 blue chip companies on various eurozone stock exchanges in one low-cost transaction.

This is said to be the only ETF on the JSE that offers easy access to more than 50 blue chip companies on various eurozone stock exchanges in one low-cost transaction.

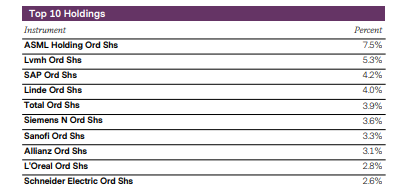

Top holdings: Some of the prominent companies in the fund include Total, L& #39;oreal, Linde and Unilever. The biggest holding, ASML Holdings, occupies 7.5% of the fund. The fund is spread over 10 sectors and countries, which makes it well-diversified.

Alternatives: None

Pays dividends semi-annually (Dec and Jun)

Pays dividends semi-annually (Dec and Jun)

3. Sygnia Itrix FTSE100 ETF

The Sygnia Itrix FTSE100 ETF aims to replicate the price and yield performance of the FTSE 100 Index, which contains the 100 most highly capitalized blue chip companies in the UK listed on the London Stock Exchange.

The Sygnia Itrix FTSE100 ETF aims to replicate the price and yield performance of the FTSE 100 Index, which contains the 100 most highly capitalized blue chip companies in the UK listed on the London Stock Exchange.

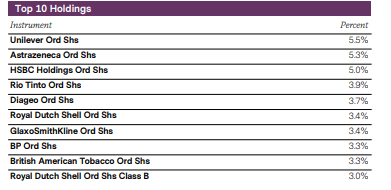

FTSE100 Top holdings: The top 10 holdings of this fund occupy 40% of the fund. The biggest one, Unilever, constitutes about 5.5%.

Dividends: Semi-Annual Dec & Jun

Dividends: Semi-Annual Dec & Jun

As an alternative to this ETF, you may consider the MSCI Japan Index ETF, MSCI USA Index ETF funds which invests in Japan and the US respectively. Another option is the MSCI World Index ETF which diversifies across those markets and others.

4. Sygnia Itrix Global Property ETF

The objective of this portfolio is to provide simple access to investors who wish to track the movements of the S&P Global Property 40 Index (designed to provide diversified exposure to 40 leading global property companies).

The objective of this portfolio is to provide simple access to investors who wish to track the movements of the S&P Global Property 40 Index (designed to provide diversified exposure to 40 leading global property companies).

Alternatives: 1. CoreShares Global Property ETF (TER: 0.69%) which has a similar investment approach to the Sygnia fund. 2. 1nvest Global REIT Index Feeder ETF (TER: 0.34%) which is not limited to the top 40 global REITs but tracks global real estate companies and REITs generally

5. Sygnia Itrix MSCI US ETF

The Sygnia Itrix MSCI US ETF aims to replicate the performance of the index. Foucsed on companies with a total market capitalisation of approximately US$14 trillion. Investors will essentially track the USA equity markets.

Divi: Semi-Annual Dec & Jun

The Sygnia Itrix MSCI US ETF aims to replicate the performance of the index. Foucsed on companies with a total market capitalisation of approximately US$14 trillion. Investors will essentially track the USA equity markets.

Divi: Semi-Annual Dec & Jun

There are still 6 more Sygnia ETFs that you can check out on EE and sygnia website. Just shared this one coz they are part of the ETF research I& #39;ve been doing for my family (For educational purpose : not financial/investment advice). DD.

Read on Twitter

Read on Twitter