Micro-cap thread; Civitas Fundamenta $FMTA

A regulatory compliant cross-chain bridge targeting institutional money (FINTRAC/VASP), as a basis for creating a unique asset backed (non-synthetic) cross-chain ETF with market led peg mechanism, and double dipping collateral for DeFi

A regulatory compliant cross-chain bridge targeting institutional money (FINTRAC/VASP), as a basis for creating a unique asset backed (non-synthetic) cross-chain ETF with market led peg mechanism, and double dipping collateral for DeFi

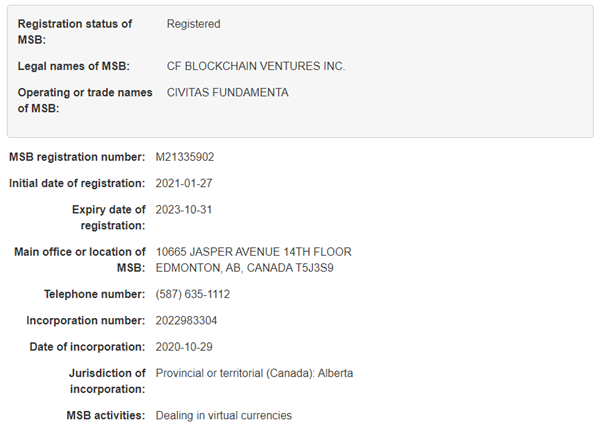

2/ Regulatory compliance is core to the success of FMTA, and has been planned since inception (Aug 2020).

Civitas Fundamenta is incorporated in Canada, and registered as a Money Service Business with FinTRAC.

Directors were KYC& #39;d by Gov, and liable under company law = no rug

Civitas Fundamenta is incorporated in Canada, and registered as a Money Service Business with FinTRAC.

Directors were KYC& #39;d by Gov, and liable under company law = no rug

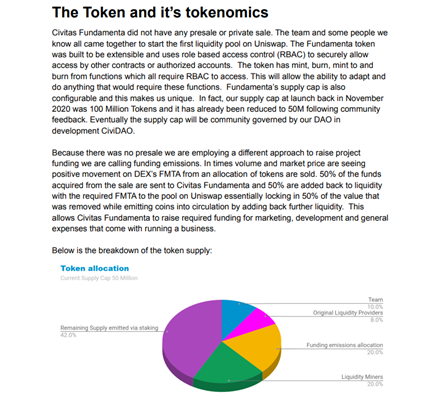

3/ Further, there was no pre-sale for FMTA, as this would deem it a "security" by regulators, and compromise their legal position

Instead, a concept called "funding emissions" was used to fund the company expenses ad hoc.

This means there are no launch tokens waiting to dump https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">

Instead, a concept called "funding emissions" was used to fund the company expenses ad hoc.

This means there are no launch tokens waiting to dump

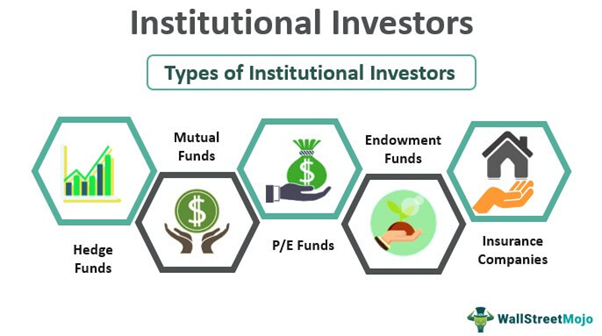

4/ All this hassle for FMTA to be compliant is crucial to achieving the end goal to attract institutional investment, as this protocol is able to replicate and improve on many traditional finance mechanisms with a DeFi spin

This just may just enable FMTA to achieve $B status! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

This just may just enable FMTA to achieve $B status!

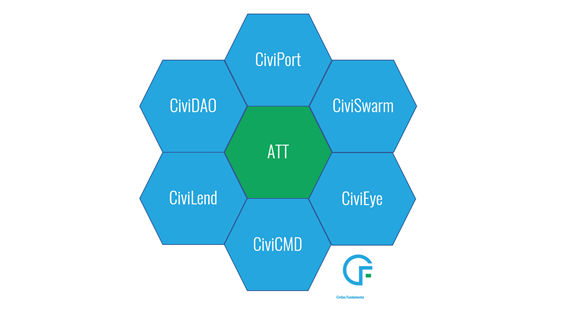

5/ Core products;

CiviPort; Cross-chain teleport bridge

CiviSwarm; Asset wrapping and cross-chain atomic bridge

CiviLend; Lending utilizing custodial held collateral

CiviDAO; Governance & voting

CiviEye; Auditing for AML reg

ATT; Asset tracking tokens (ETF) - the *BIG* one

CiviPort; Cross-chain teleport bridge

CiviSwarm; Asset wrapping and cross-chain atomic bridge

CiviLend; Lending utilizing custodial held collateral

CiviDAO; Governance & voting

CiviEye; Auditing for AML reg

ATT; Asset tracking tokens (ETF) - the *BIG* one

6/ FMTA is a gestalt play, and the synergy of all of the sub-components is why FMTA gets so interesting.

These technologies work beautifully together to create a unique stable market mechanism where all participants are rewarded. This drives adoption to FMTA and rewards HODLers

These technologies work beautifully together to create a unique stable market mechanism where all participants are rewarded. This drives adoption to FMTA and rewards HODLers

7/ At the core of the FMTA tech is the ability to move and utilize assets cross-chain.

Civiport bridges assets between smart-contract chains (e.g. ETH, BSC, xDAI, Polygon, ADA).

This is achieved through teleportation and enacted transparently on-chain, with low fees to FMTA

Civiport bridges assets between smart-contract chains (e.g. ETH, BSC, xDAI, Polygon, ADA).

This is achieved through teleportation and enacted transparently on-chain, with low fees to FMTA

8/ $REN is a good benchmark of the TAM for cross-chain bridge, sitting at $750M+ TVL, excluding institutional $ due to non-compliance with AML.

FMTA increases the size of the pie, as well as providing competition to the space.

This bridge component alone peaked Ren at a $1B MC

FMTA increases the size of the pie, as well as providing competition to the space.

This bridge component alone peaked Ren at a $1B MC

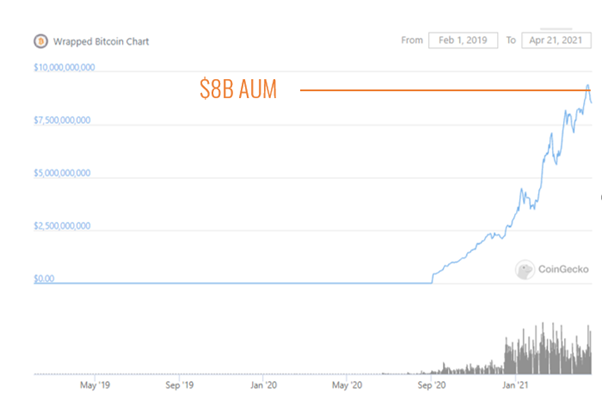

9/ CiviSwarm enables wrapping assets from non-smart-contract enabled chains like BTC/LTC/XMR

Wrapped assets are held by an insured custodian (important later), with fees benefiting FMTA

CiviSwarm is a decentralised on-chain and more transparent alternative to $WBTC with $8B AUM

Wrapped assets are held by an insured custodian (important later), with fees benefiting FMTA

CiviSwarm is a decentralised on-chain and more transparent alternative to $WBTC with $8B AUM

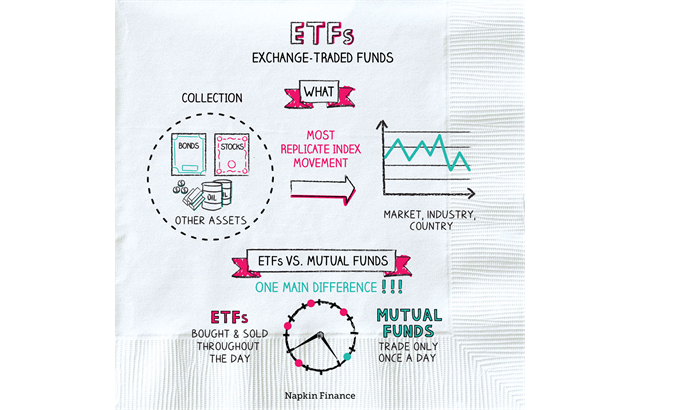

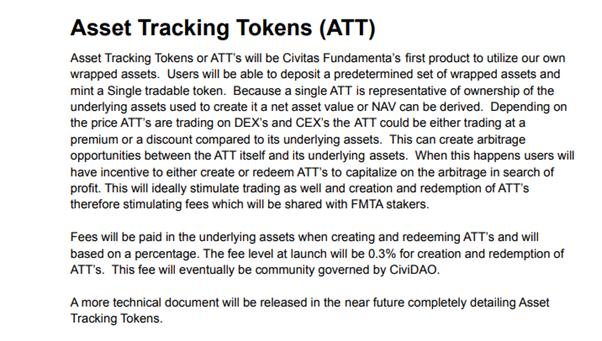

10/ However, my main attraction to FMTA is the unique Asset Tracking Token (ATT), and this what will drive demand to the platform, and feed the mechanisms to make FMTA a beast

ATT is similar to an ETF, as it represents a group of assets bundled into a fungible (tradeable) ERC-20

ATT is similar to an ETF, as it represents a group of assets bundled into a fungible (tradeable) ERC-20

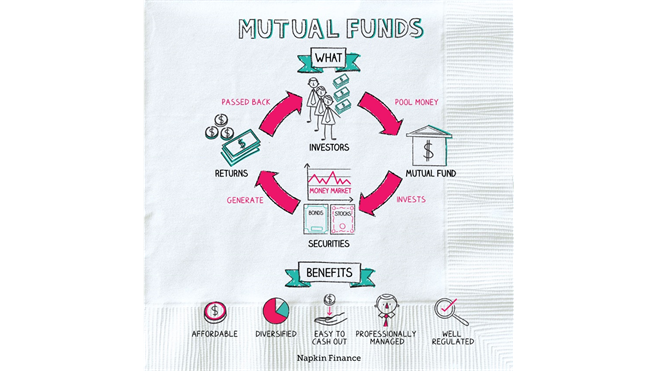

11/ ETF are massive business, and currently have $8T+ of AUM.

A mutual fund is also similar to ETF, but with non-fungible ownership

Mutual funds are "the largest proportion of equity of U.S. corporations.", with ~$55T+ AUM globally.

Combined, 30x+ the current entire crypto MC!

A mutual fund is also similar to ETF, but with non-fungible ownership

Mutual funds are "the largest proportion of equity of U.S. corporations.", with ~$55T+ AUM globally.

Combined, 30x+ the current entire crypto MC!

12/ The trafi & defi USP of ATT;

1. ATT is backed 1:1 by the underlying assets (e.g. not synthetic)

2. ATT is tradeable 24/7

3. ATT can be redeemed at any time for 100% of the underlying collateral by the holder

This gives much more flexibility to traders and investors alike.

1. ATT is backed 1:1 by the underlying assets (e.g. not synthetic)

2. ATT is tradeable 24/7

3. ATT can be redeemed at any time for 100% of the underlying collateral by the holder

This gives much more flexibility to traders and investors alike.

13/ There are multiple ATT assets (ETFs) which can exist, each represented different underlying assets.

To mint an ATT, the assets are deposited and locked in a contract, and the ATT transferred to owner.

The ATT can be redeemed for the assets at anytime, via burning the ATT.

To mint an ATT, the assets are deposited and locked in a contract, and the ATT transferred to owner.

The ATT can be redeemed for the assets at anytime, via burning the ATT.

14/ The fact that ATT is not a “synthetic asset”, is super important and makes FMTA unique.

There are plenty of synthetic trackers, but these are pegged by an oracle, and have no real legal standing or connection to the actual asset in any way.

Institutions do not invest in air

There are plenty of synthetic trackers, but these are pegged by an oracle, and have no real legal standing or connection to the actual asset in any way.

Institutions do not invest in air

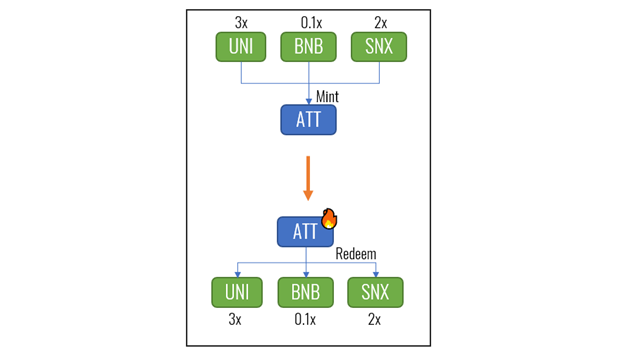

15/ But what about peg?

Since ATTs can be freely minted or redeemed for the underlying assets, this opens up arbitrage opportunities if the trading value is incongruent with the net asset value (NAV) of the underlying assets.

An ancillary market therefore forms around ATT

Since ATTs can be freely minted or redeemed for the underlying assets, this opens up arbitrage opportunities if the trading value is incongruent with the net asset value (NAV) of the underlying assets.

An ancillary market therefore forms around ATT

16/ This creates an incentive for market participants to maintain the peg value. This forces legitimacy of the ATT as a fungible token of value, compared to a synthetic.

The ancillary market can be expanded to futures, and other tradeable mechanisms institutional investors love.

The ancillary market can be expanded to futures, and other tradeable mechanisms institutional investors love.

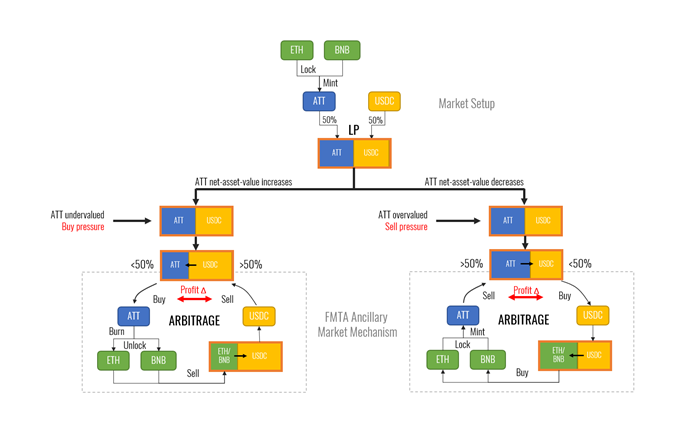

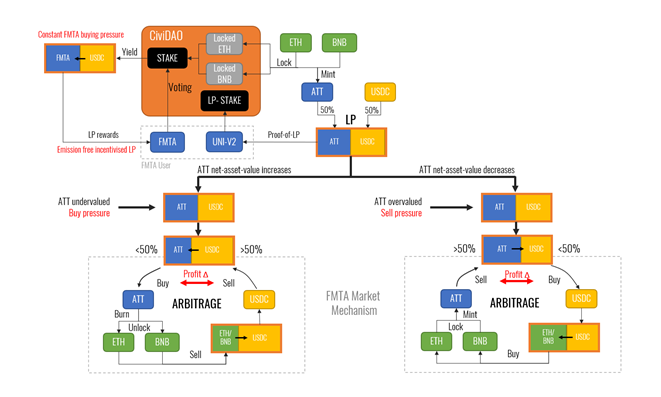

17/ But how to incentivise staking to increase ancillary market size?

Enter CiviDAO to leverage the unique properties of #DeFi

In DeFi, locked assets still have value, and could therefore be staked in low risk protocols as voted by DAO & return yield rewards to LP providers.

Enter CiviDAO to leverage the unique properties of #DeFi

In DeFi, locked assets still have value, and could therefore be staked in low risk protocols as voted by DAO & return yield rewards to LP providers.

18/ This effectively doubles the value of any assets used to create an ATT, by staking the underlying asset, and minting a new freely fungible asset of the same value

This creates a fractional reserve system, but without risk of default since 100% reserve can be unstaked at will

This creates a fractional reserve system, but without risk of default since 100% reserve can be unstaked at will

19/ Additionally, the proposed system can reward stakers in $FMTA which is purchased at market rate using the yield output from the treasury stake.

This creates a constant buy pressure on FMTA.

The more assets under management, the more yield potential, the more $FMTA will moon.

This creates a constant buy pressure on FMTA.

The more assets under management, the more yield potential, the more $FMTA will moon.

20/ We now have a primary market, supported by an ancillary market, with funded participation through exploiting reserve assets

A system balanced by market forces

What else could this be applied to? Perhaps a cross-chain stablecoin aggregated from a variety of stable assets? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

A system balanced by market forces

What else could this be applied to? Perhaps a cross-chain stablecoin aggregated from a variety of stable assets?

21/ Any wrapped tokens (e.g. BTC) included in any of the ATT have also necessarily passed through the CiviSwarm, leading to a large treasury buildup of assets

These can be leveraged as collateral for lending in CiviLend& #39;s decentralised secure loan platform, and collect interest.

These can be leveraged as collateral for lending in CiviLend& #39;s decentralised secure loan platform, and collect interest.

Conclusion:

1. Have demand for ETF style cross-chain ATT ($60T TAM)

2. Requires bridged assets, driving demand to CiviSwarm and CiviPort (collect fees)

3. Builds custodial treasury for lending (interest)

4. Stake deposited assets for yield

5. Reward FMTA hodlers

6. Profit

1. Have demand for ETF style cross-chain ATT ($60T TAM)

2. Requires bridged assets, driving demand to CiviSwarm and CiviPort (collect fees)

3. Builds custodial treasury for lending (interest)

4. Stake deposited assets for yield

5. Reward FMTA hodlers

6. Profit

TLDR;

A unique decentralized cross-chain ETF/MF, but with more utility, tradability, and yields passive income (staking rewards)

+ provides lucrative ancillary market tradeable opportunities

+ compliant with regulations

= perfect storm to bring big institutional money to DeFi

A unique decentralized cross-chain ETF/MF, but with more utility, tradability, and yields passive income (staking rewards)

+ provides lucrative ancillary market tradeable opportunities

+ compliant with regulations

= perfect storm to bring big institutional money to DeFi

Links;

Website: https://fundamenta.network/

CG:">https://fundamenta.network/">... https://www.coingecko.com/en/coins/fundamenta

Market">https://www.coingecko.com/en/coins/... Cap & circ supply: https://app.fundamenta.network/#/Stats

Dextools:">https://app.fundamenta.network/... https://www.dextools.io/app/uniswap/pair-explorer/0x8f6bcb61836f43cfdb7de46e2244d363d90527ef

Now">https://www.dextools.io/app/unisw... please reread through this thread, and tell me why $FMTA isn’t already a $100M market cap on its way to $1B? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">

Website: https://fundamenta.network/

CG:">https://fundamenta.network/">... https://www.coingecko.com/en/coins/fundamenta

Market">https://www.coingecko.com/en/coins/... Cap & circ supply: https://app.fundamenta.network/#/Stats

Dextools:">https://app.fundamenta.network/... https://www.dextools.io/app/uniswap/pair-explorer/0x8f6bcb61836f43cfdb7de46e2244d363d90527ef

Now">https://www.dextools.io/app/unisw... please reread through this thread, and tell me why $FMTA isn’t already a $100M market cap on its way to $1B?

Read on Twitter

Read on Twitter

" title="3/ Further, there was no pre-sale for FMTA, as this would deem it a "security" by regulators, and compromise their legal positionInstead, a concept called "funding emissions" was used to fund the company expenses ad hoc.This means there are no launch tokens waiting to dump https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">" class="img-responsive" style="max-width:100%;"/>

" title="3/ Further, there was no pre-sale for FMTA, as this would deem it a "security" by regulators, and compromise their legal positionInstead, a concept called "funding emissions" was used to fund the company expenses ad hoc.This means there are no launch tokens waiting to dump https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">" class="img-responsive" style="max-width:100%;"/>

" title="4/ All this hassle for FMTA to be compliant is crucial to achieving the end goal to attract institutional investment, as this protocol is able to replicate and improve on many traditional finance mechanisms with a DeFi spinThis just may just enable FMTA to achieve $B status! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">" class="img-responsive" style="max-width:100%;"/>

" title="4/ All this hassle for FMTA to be compliant is crucial to achieving the end goal to attract institutional investment, as this protocol is able to replicate and improve on many traditional finance mechanisms with a DeFi spinThis just may just enable FMTA to achieve $B status! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">" class="img-responsive" style="max-width:100%;"/>

" title="20/ We now have a primary market, supported by an ancillary market, with funded participation through exploiting reserve assetsA system balanced by market forcesWhat else could this be applied to? Perhaps a cross-chain stablecoin aggregated from a variety of stable assets? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">" class="img-responsive" style="max-width:100%;"/>

" title="20/ We now have a primary market, supported by an ancillary market, with funded participation through exploiting reserve assetsA system balanced by market forcesWhat else could this be applied to? Perhaps a cross-chain stablecoin aggregated from a variety of stable assets? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">" class="img-responsive" style="max-width:100%;"/>