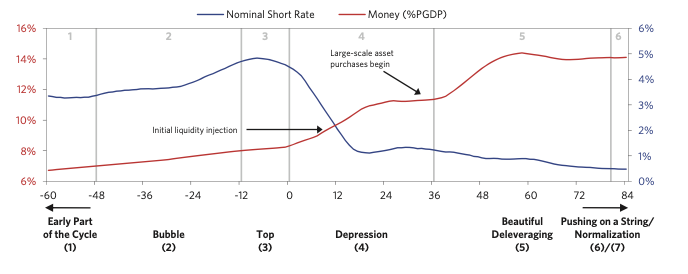

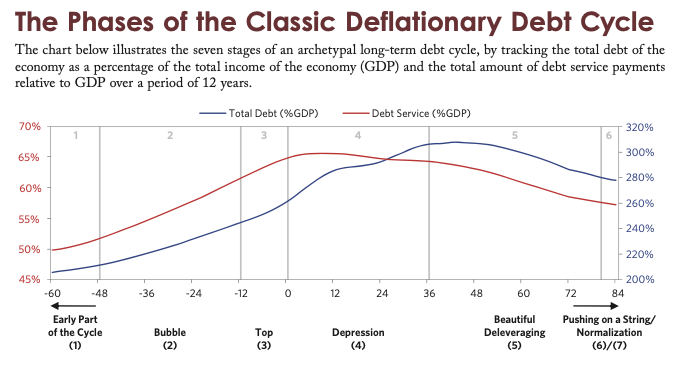

"Debt crises occur because debt & debt service costs rise faster than incomes that are needed to service them, causing a deleveraging.While the CB can alleviate debt crises by lowering real & nominal IR, severe debt crises (depression) occur when this is no longer possible."

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

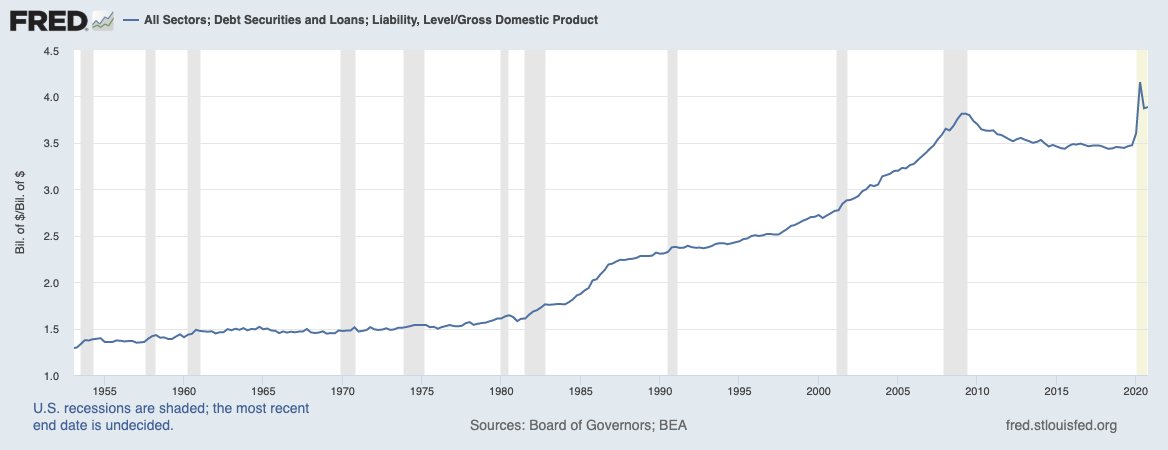

1/ Currently, the Total Debt/GDP Ratio in the United States is 388%.

The economy naturally attempted to deleverage in & #39;08, but the can was kicked... as the political incentives would dictate

The economy naturally attempted to deleverage in & #39;08, but the can was kicked... as the political incentives would dictate

2/ Now the problem is the largest and worst it has ever been.

There are only a few ways to reduce real debt ratios:

"The policies that reduce debt burdens fall under four broad categories:"

1) Austerity

2) Debt defaults/restructuring

3) QE

4) Wealth transfers

There are only a few ways to reduce real debt ratios:

"The policies that reduce debt burdens fall under four broad categories:"

1) Austerity

2) Debt defaults/restructuring

3) QE

4) Wealth transfers

3/ Austerity is not happening. Policy makers have shown that they are committed to keeping the pedal on the metal.

More stimulus, more printing, more handouts.

Anything to stave off a deflationary debt spiral.

Reality can only be warped and ignored for so long...

More stimulus, more printing, more handouts.

Anything to stave off a deflationary debt spiral.

Reality can only be warped and ignored for so long...

4/ In Dalio& #39;s framework, he never accounted for the chance that a completely new monetary asset would emerge, and you can& #39;t blame him.

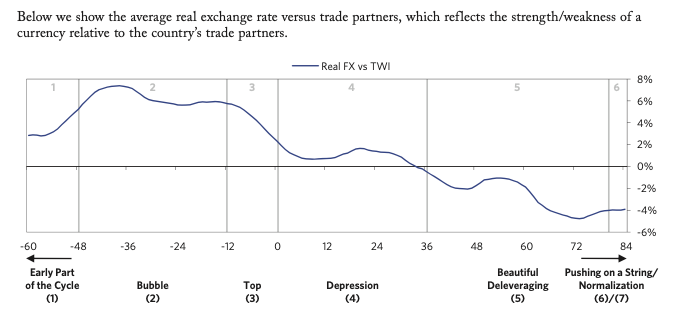

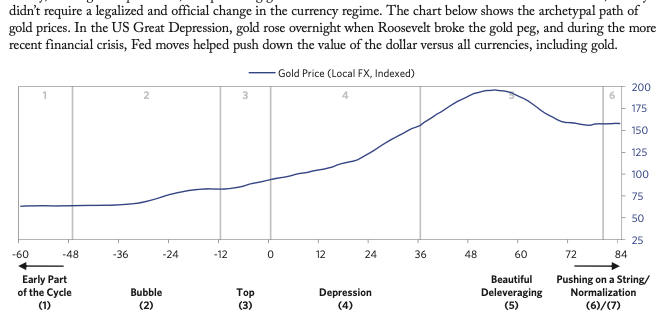

The empirical evidence shows that currency debasement in the current environment is a mathematical inevitability.

Quote from & #39;Big Debt Crises& #39;

The empirical evidence shows that currency debasement in the current environment is a mathematical inevitability.

Quote from & #39;Big Debt Crises& #39;

"Printing money/debt monetization & government guarantees are inevitable in depressions in which interest rate cuts won’t work, though these tools are of little value in countries that are constrained from printing or don’t have assets to back printing up & can’t easily negotiate

the redistributions of the debt burdens. All of the deleveragings that we have studied (which is most of those that occurred over the past 100 years) eventually led to big waves of money creation, fiscal deficits, & currency devaluations (against gold, commodities, & stocks)"

7/ Except this is not a debt crises that is isolated to just our domestic economy or a single nation, but rather a GLOBAL phenomena.

There is competitive devaluation occurring, & #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> is the pressure release valve. #Bitcoin

https://abs.twimg.com/hashflags... draggable="false" alt=""> is the pressure release valve. #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> is the check on central banks ability to print.

https://abs.twimg.com/hashflags... draggable="false" alt=""> is the check on central banks ability to print.

There is competitive devaluation occurring, & #Bitcoin

8/ "In the end, policy makers always print. That is because austerity causes more pain than benefit, big restructurings wipe out too much wealth too fast, and transfers of wealth from haves to have-nots don’t happen in sufficient size without revolutions."

9/ To conclude:

Thank God for #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">.

https://abs.twimg.com/hashflags... draggable="false" alt="">.

Thank God for #Bitcoin

Read on Twitter

Read on Twitter " title=""Debt crises occur because debt & debt service costs rise faster than incomes that are needed to service them, causing a deleveraging.While the CB can alleviate debt crises by lowering real & nominal IR, severe debt crises (depression) occur when this is no longer possible."https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>

" title=""Debt crises occur because debt & debt service costs rise faster than incomes that are needed to service them, causing a deleveraging.While the CB can alleviate debt crises by lowering real & nominal IR, severe debt crises (depression) occur when this is no longer possible."https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>