1/20 A few highlights from our report on the future of office demand in the main centres outside London... https://www.jll.co.uk/en/trends-and-insights/research/the-future-of-uk-regional-office-demand">https://www.jll.co.uk/en/trends...

2/20 The revival of the city centres outside London over the past decade is not just a marketing slogan - it& #39;s a reality, evident from economic, demographic and property market data. The shift has been most obvious in Birmingham and particularly Manchester.

3/20 For example, over the past five years across the "Big Six" - that& #39;s Manchester, Birmingham, Leeds, Bristol, Glasgow and Edinburgh - take-up has been higher and vacancy rates lower than at any other five year period JLL has records for.

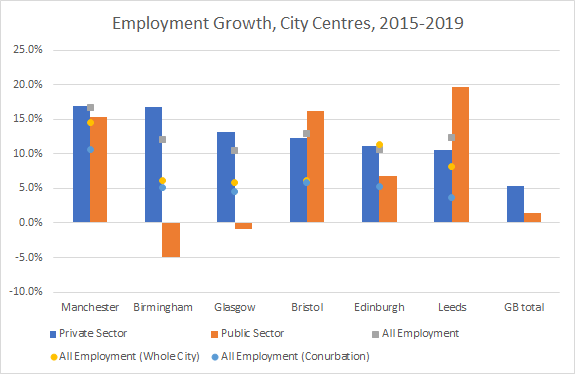

4/20 This is partly because employment growth has become more centred on CBDs - in this chart you can see how growth private sector employment in the central areas has outpaced the wider city, conurbation and the UK average in every city (Edinburgh a slight exception).

5/20 Interestingly, the level of private sector job growth has been high everywhere, but public sector increases vary more by city,. Manchester and Leeds have seen a big increases here (Bristol is smaller), while Birmingham has actually lost public sector jobs.

6/20 The question is: is this success story going to be derailed by the aftermath of the Covid-19 pandemic? Or will the government& #39;s levelling-up agenda and investment in transport actually accelerate it in the medium term?

7/20 As in London, working from home has been introduced in a widespread way and, according to Google data, workplace attendance stod at around 60% below pre-pandemic levels in the Big Six cities. Public transport use is similarly down.

8/20 As restrictions ease, will we see people returning to the office en masse? JLL surveys suggest most people want a mix of home- and office working, which many employers seem happy to accommodate, at least in the medium term.

9/20 Government data, however, suggests that SMEs seem more reluctant to adopt this model than many, and that it will vary by industry. Nevertheless a & #39;hybrid model& #39; would appear to be the emerging model for most larger companies in established locations.

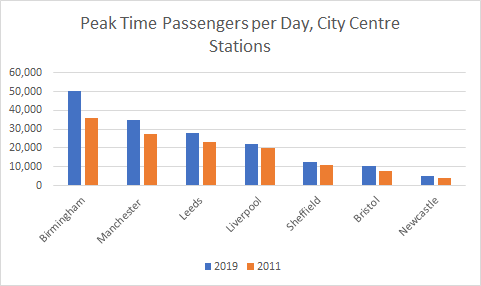

10/20 Nervousness around public transport use could be a barrier to this however; while cars make up most commuting trips outside London, more than half of all peak-time journeys to city centre jobs in the Big Six are by bus, train or foot; higher in Glasgow & Edinburgh.

11/20 This is 2011 census data: other rail data shows the extent to which train use in particular has increased in many of the cities in recent years. So it probably understates public transport use. This doesn& #39;t include Manchester& #39;s Metrolink, where passenger numbers have soared

12/20 This suggests that, as in London, some thought might need to be given as to how public transport operates. Bristol, which has a very high number of walking commuters and less public transport use, may have leass of a problem in this area....

13/20 ... but in every location, the age of city centre workers is lower than the national average, and this demographic is likely to be less concerned about travel. Also, compared to London, far more live in the city itself, meaning transit times and distances are lower.

14/20 Vibrant F&B will be vital in getting workers back to office districts; this sector has been most challenged by lockdown and needs support from local authorities, who can close streets and introduce al fresco drinking & dining.

15/20 While the hybrid model implies lower aggregate demand for offices, there are plenty of reasons why this might not translate directly. Firstly, workers are expecting more spacious offices, meaning any reduction in desks might be cancelled out by more space per worker....

16/20 Secondly, managing who comes in when is going to be a major management challenge - what if everyone comes in Tue-Thu - there is no space saving and indeed if space per worker increases more office may be needed...

17/20 Thirdly, the travel-to-work area for major cities will increase, as people will feel able to commute further. This may create more demand for certain city centres and locations.

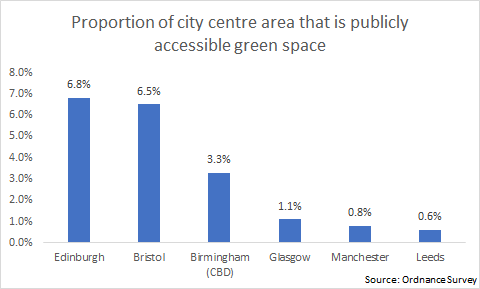

18/20 But the geography of demand will change too, with quality of place more important than ever - public realm, cycling infrastructure, F&B etc.. Some locations would benefit from more publicly accessible green space.

19/20 There is much more on what this means for office markets, for investors and for cities and local authorities in the report.

20/20 But in summary we expect a polarisation in office markets (with high demand for "post-covid" prime buildings), a shift in hierarchies between and within cities, more operational/flex space, and a further strenghtening of the main city centres compared to secondary locations

Read on Twitter

Read on Twitter