1/ Anon you still don& #39;t understand the unprecedented force that is the $AMP tokenomics. This is building up to be a perpetuum mobilé of wealth made possible by an inspired design and a commitment to decentralization unheard of among enterprise focused projects. Let me explain.

2/ Flexa isn& #39;t a company, it& #39;s the network. While the $AMP token isn& #39;t like owning traditional equity, it& #39;s the closet thing to it: When a transaction through Flexa occurs, all of the fees are paid to the AMP stakers providing the collateral on Capacity.

3/ Flexa isn& #39;t a company. There is no business taking a cut. Let that sink in, compare it to Flexa& #39;s 2017-2018 peers. All value flows into the token. There is more: The AMP to pay staking rewards is purchased from the market in order to return all charged fees to the stakers.

4/ Sounds like treacherous regulatory ground? Flexa went through the pain of setting up shop in New York (the toughest place for crypto regulation in the US) and their token sale was 100% compliant with the SEC. You don& #39;t take chances challenging the payment industry.

5/ Now consider this: The last row on this slide represents a 1% market penetration of retail payments in the US alone. Flexa is prepared for global adoption (and adoption is a key word here in terms of this market cycle). $14.2B collateral value, $1.3M in daily fees/rewards.

6/ Recap: $AMP supply is finite. At some point all tokens are on the market and each one gives you a greater number of returns as adoption grows. The network is buying tokens each day. The only sell pressure left is people exiting. But who exits a yield that just keeps growing?

7/ Lastly, why am I optimistic in adoption? There are several reasons, the first one is that the team has the (very grand) vision and the skills to pull it off. Just watch this presentation from Consensus 2019 and I bet you& #39;ll sense it too: https://www.youtube.com/watch?v=XaXbl-og23o">https://www.youtube.com/watch...

8/ The other major reason is that adopting Flexa is in the best interest of the Merchants. This is a b2b play, Flexa doesn& #39;t need to cater to retail/users. Walmart pays $5b in processing costs on payments a year. And they get the most competitive rates.

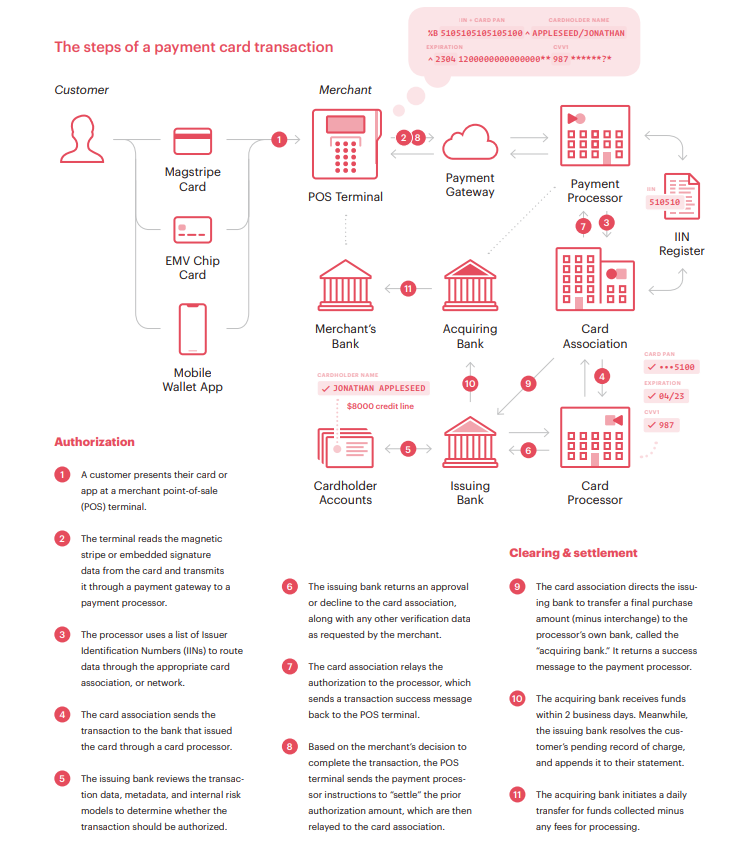

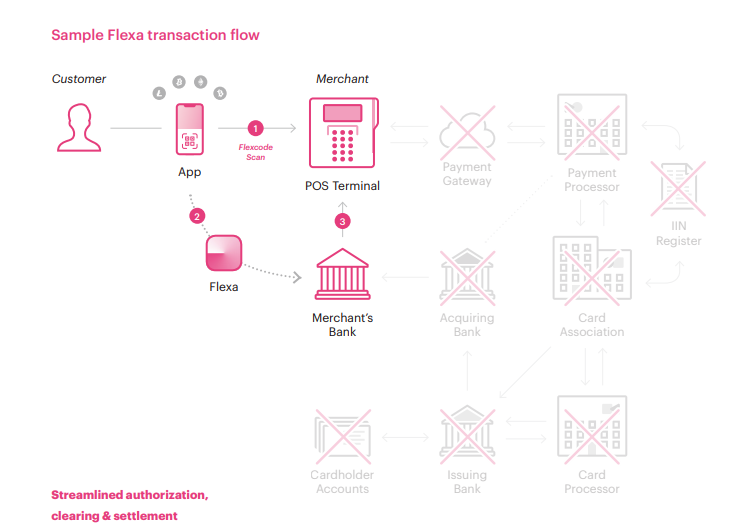

9/ So this is one of those "billion dollars problems" that innovators look to solve. For smaller merchants, the situation gets even worse, some of them pay up to 4% for each payment. Flexa offers to reduce these fees significantly by replacing a very archaic architecture:

10/ When the Flexa SDK comes out this summer, anybody will be able to implement the Flexa network architecture in their apps. I expect numerous payment implementations coming up that run on it and I am optimistic that some of the names associated are going to blow minds on CT.

11/ Then the tokenomics kick in again and they get even better. On Capacity, an $AMP holder can chose the wallet they want to provide collateral to. So if they require throughput, they might even be inclined to incentivize liquidity.

12/ Remember that there is a finite amount of $AMP, so what happens if adoption grows so much that daily transactions require more collateral? Once all $AMP are staked in Capacity, the only way that collateral can grow is by $AMP& #39;s unit price appreciating. ... (dramatic pause)

13/ While all of this is going on in the background, only $AMP holders need to concern themselves with these intricate operations. Retail users will just see and use an app that allows them to quickly (<1s) pay with stablecoins, CBDCs, cryptocurrencies and other digital assets.

14/ I could go on about this for a while but I& #39;ll stop here and refer you to a recent discussion with @InfiniteAtman and @CryptoCX1 we recorded on Youtube: https://www.youtube.com/watch?v=t4EiSu4gYl0&t=1246s">https://www.youtube.com/watch...

15/ If you are ready to be red-pilled on payments so hard it& #39;ll last you for a life time and several reincarnations, make sure to also follow @Valuemancer and @cryptoMIB  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💊" title="Tablette" aria-label="Emoji: Tablette">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💊" title="Tablette" aria-label="Emoji: Tablette">

16/ Appendix: I have been getting requests for more resources on Flexa so I& #39;ll drop some good links at the end of this thread. Let& #39;s start with @InfiniteAtman& #39;s definite threads on the subject:

#1 https://twitter.com/InfiniteAtman/status/1358753268923514880">https://twitter.com/InfiniteA...

#1 https://twitter.com/InfiniteAtman/status/1358753268923514880">https://twitter.com/InfiniteA...

17/ Atman thread #2 https://twitter.com/InfiniteAtman/status/1280550997463568384">https://twitter.com/InfiniteA...

18/ This conversation on the future of payments featuring Joey Krug (Pantera), Neil Bergquist (Coinme), Ryne Saxe (Eco) and Flexa& #39;s Co-Founder Tyler Spalding is an informative watch: https://www.youtube.com/watch?v=Fb044H-_OVM&t=229s">https://www.youtube.com/watch...

Read on Twitter

Read on Twitter