1/ Since the end of 2018, Apple& #39;s market cap has increased by $1.5 trillion.

While often mocked under the leadership of Tim Cook, Apple& #39;s product strategy over the past few years has delivered outrageous results.

Here& #39;s a breakdown https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

While often mocked under the leadership of Tim Cook, Apple& #39;s product strategy over the past few years has delivered outrageous results.

Here& #39;s a breakdown

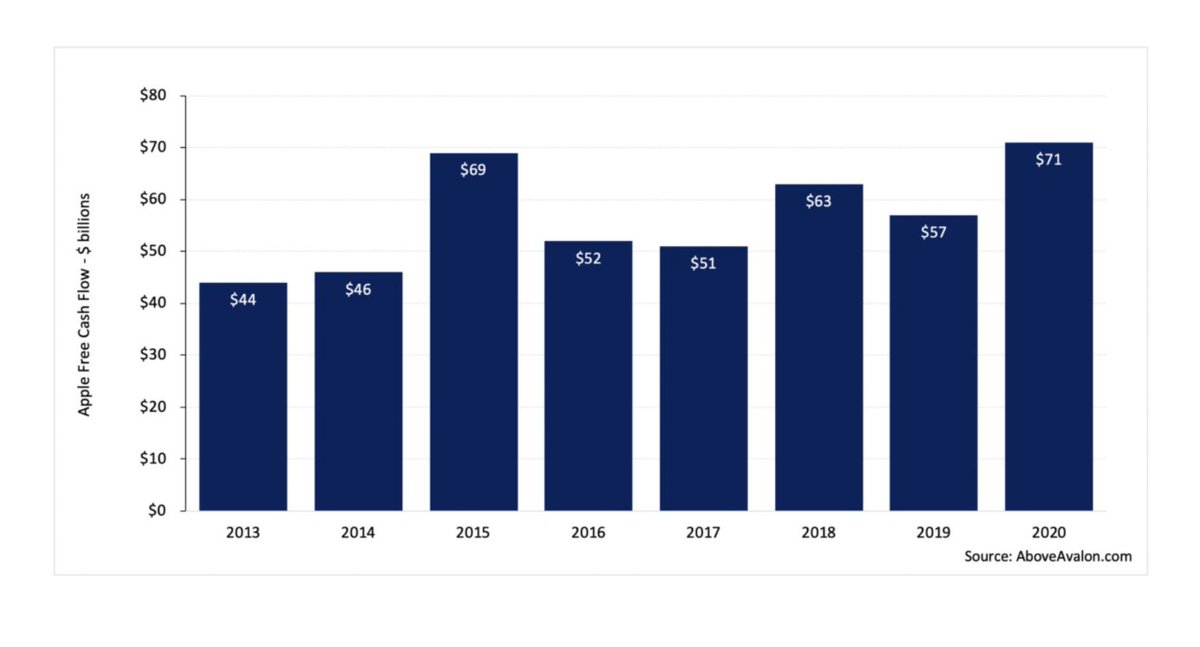

2/ First, let& #39;s ignore the memes and acknowledge Apple for the cash printing machine it is.

In the past 3yrs, Apple& #39;s *free cash flow* totalled $191B.

Apple has the world& #39;s most profitable:

• smartphone

• tablet

• laptop

• desktop

• smartwatch

• wireless headphones

In the past 3yrs, Apple& #39;s *free cash flow* totalled $191B.

Apple has the world& #39;s most profitable:

• smartphone

• tablet

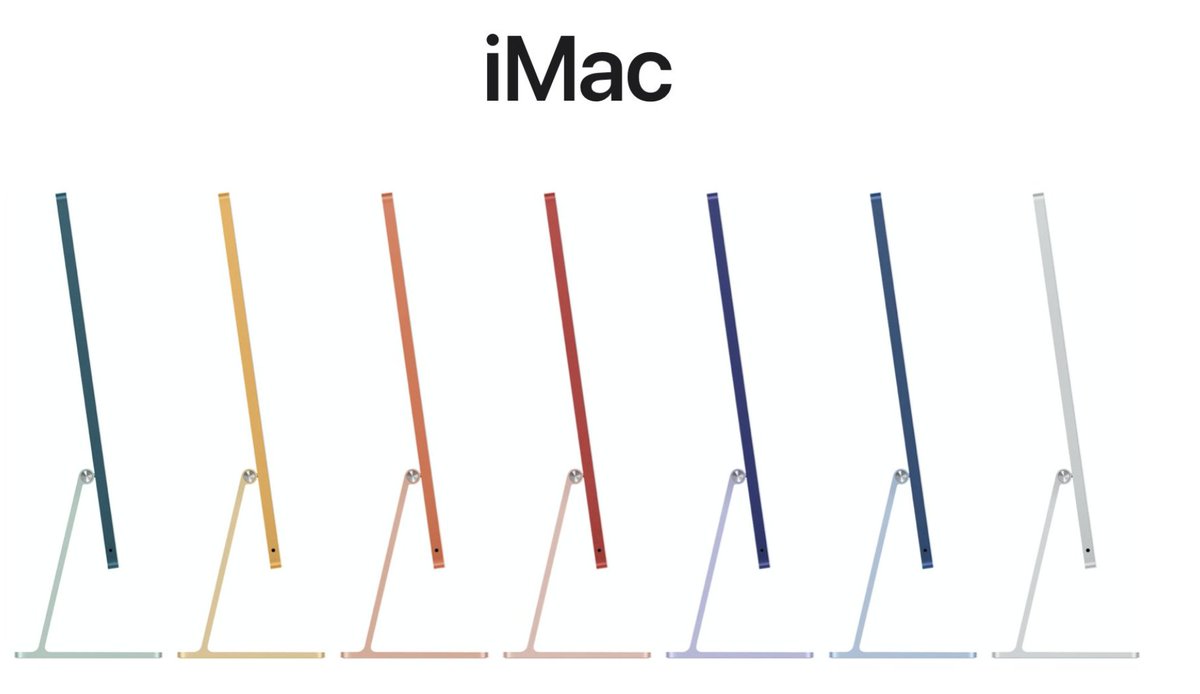

• laptop

• desktop

• smartwatch

• wireless headphones

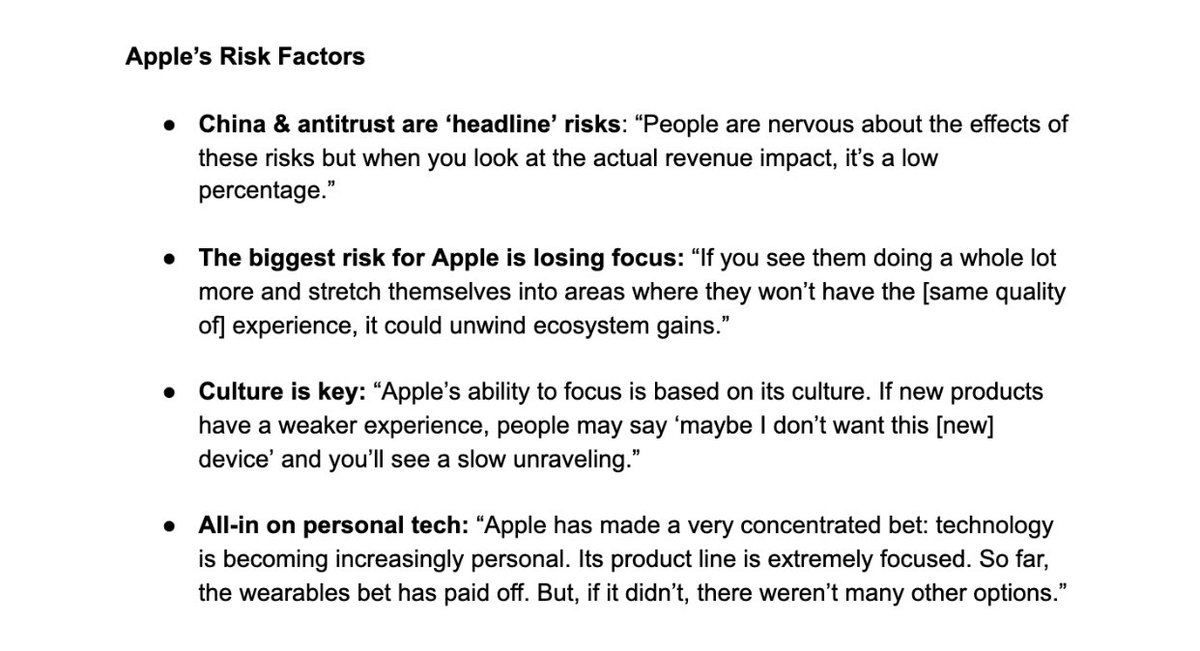

3/ Apple analyst @neilcybart says *no one* has a more well thought out product line than $AAPL:

"Computers small and light enough to be worn on the body are sold next to comps so large that built-in handles are required. All products are designed to work seamlessly together."

"Computers small and light enough to be worn on the body are sold next to comps so large that built-in handles are required. All products are designed to work seamlessly together."

4/ The Grand Unified Theory of Apple Products

"Apple Products are designed to handle tasks once handled by more powerful siblings. New form factors are then able to handle new tasks in [unique, different & more personal ways]."

Mac -> Macbook -> iPad -> iPhone -> Watch/AirPod

"Apple Products are designed to handle tasks once handled by more powerful siblings. New form factors are then able to handle new tasks in [unique, different & more personal ways]."

Mac -> Macbook -> iPad -> iPhone -> Watch/AirPod

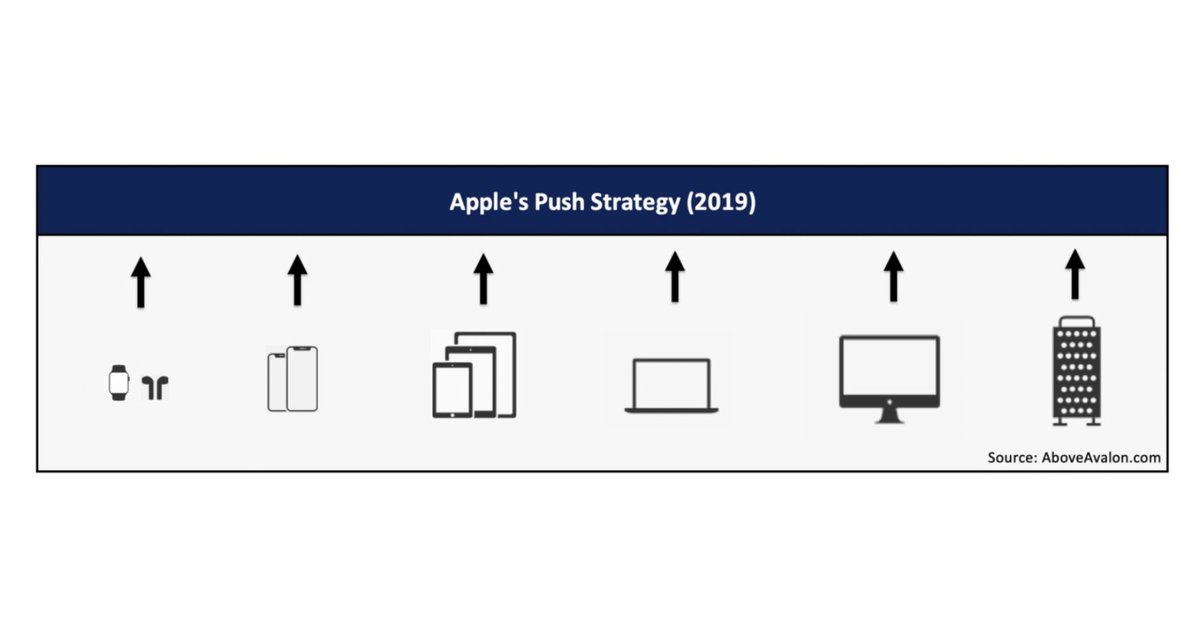

5/ Apple& #39;s product strategy has changed in recent years.

Pre-2018, Apple deployed a "pull" strategy. Think of Apple& #39;s products attached on a rope, management was pulling forward (focussing) on more "personal products" (iPhone,Watch).

Other lines (iPad, laptop, Mac) languished.

Pre-2018, Apple deployed a "pull" strategy. Think of Apple& #39;s products attached on a rope, management was pulling forward (focussing) on more "personal products" (iPhone,Watch).

Other lines (iPad, laptop, Mac) languished.

6/ Since then, Apple has pursued a "push" strategy where each product line is improving simultaneously.

• Apple Watch increasingly independent from iOS (e.g, WatchOS)

• iPadOS differentiates iPad from iPhone

• Renewed focus on Mac design/uses

• Apple Watch increasingly independent from iOS (e.g, WatchOS)

• iPadOS differentiates iPad from iPhone

• Renewed focus on Mac design/uses

7/ Why a "push" strategy matters

"By pushing the products geared towards handling the most demanding workflows, Apple has a greater incentive to push the products capable of making technology more personal & relevant."

Apple& #39;s 10yr+ chip effort has been critical to this plan:

"By pushing the products geared towards handling the most demanding workflows, Apple has a greater incentive to push the products capable of making technology more personal & relevant."

Apple& #39;s 10yr+ chip effort has been critical to this plan:

8/ And Apple& #39;s innovation strategy isn& #39;t to "be the first" or "do something different"

Per Tim Cook, Apple& #39;s products are meant to "enrich people& #39;s lives to help them learn, create, work, play, share, and stay healthy."

Truly quality > quantity.

Per Tim Cook, Apple& #39;s products are meant to "enrich people& #39;s lives to help them learn, create, work, play, share, and stay healthy."

Truly quality > quantity.

9/ Customer love Apple& #39;s strategy/product vision

• iPhone: taking smartphone share from Android

• iPad: +20m users/yr (on 300m installed base, 10yr old line)

• Mac: +10m users/yr (oldest product category)

• Watch & AirPods: 100m+ users each

• Services: 500m+ paying subs

• iPhone: taking smartphone share from Android

• iPad: +20m users/yr (on 300m installed base, 10yr old line)

• Mac: +10m users/yr (oldest product category)

• Watch & AirPods: 100m+ users each

• Services: 500m+ paying subs

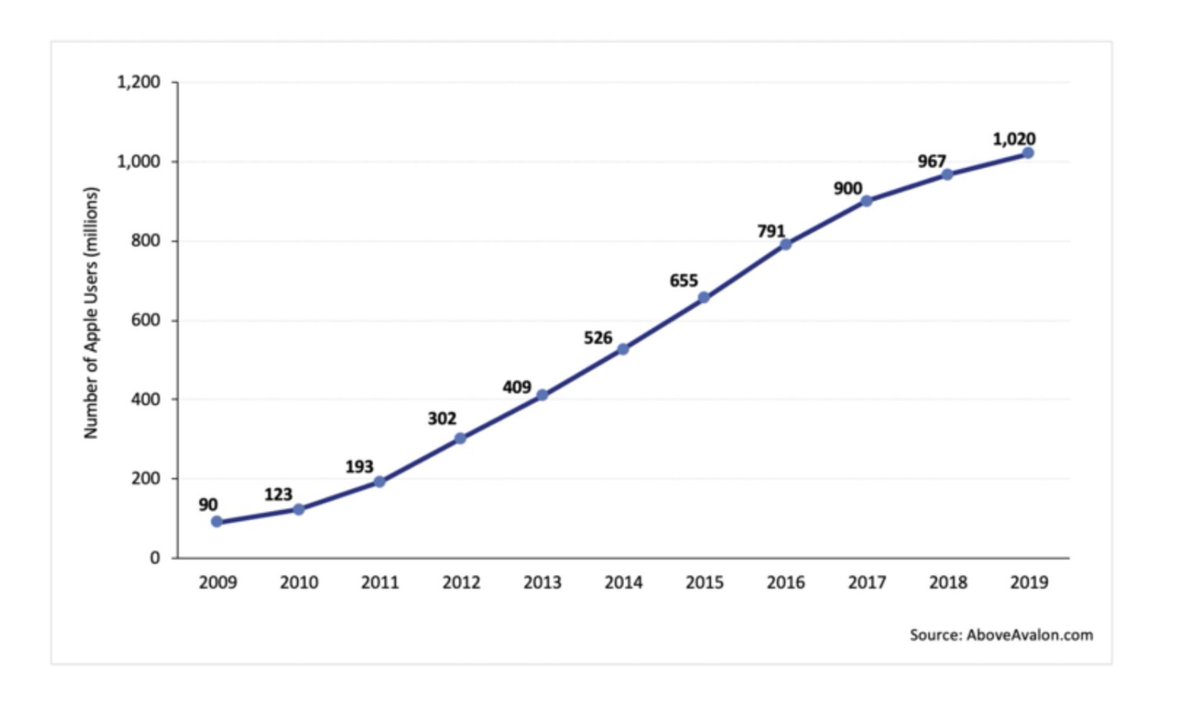

10/ Here is a chart of Apple& #39;s installed user base.

It passed 1 billion in 2019 and "while new user growth rates have slowed, Apple is still bringing tens of millions of users into the fold."

It passed 1 billion in 2019 and "while new user growth rates have slowed, Apple is still bringing tens of millions of users into the fold."

11/ Competition weakening #1

As Apple& #39;s ecosystem is only getting better "made possible by a clear product vision and a functioning organizational structure that prioritizes design (i.e. the user experience), the competition is rudderless."

As Apple& #39;s ecosystem is only getting better "made possible by a clear product vision and a functioning organizational structure that prioritizes design (i.e. the user experience), the competition is rudderless."

12/Competition weakening #2

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">Samsung

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">Samsung

Aimlessly launching new products to say they& #39;re "first" (foldable screen)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">GOOGL

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">GOOGL

Software features compelling on paper but UX sucks

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">AMZN

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">AMZN

Massive bet on Echo was "wrong" (should have done wearable but lacks corporate h/w culture)

Aimlessly launching new products to say they& #39;re "first" (foldable screen)

Software features compelling on paper but UX sucks

Massive bet on Echo was "wrong" (should have done wearable but lacks corporate h/w culture)

13/ Competition weakening #3

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">Microsoft

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">Microsoft

Surface is failing with consumers. Rev growth driven by commercial clients (taking share from OEMs not Apple)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> FB

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> FB

Pivoting to privacy, which Apple has a clear lead on

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> Snap

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> Snap

Biggest AR competitor but dropped ball on Spectacles

Surface is failing with consumers. Rev growth driven by commercial clients (taking share from OEMs not Apple)

Pivoting to privacy, which Apple has a clear lead on

Biggest AR competitor but dropped ball on Spectacles

14/ Apple is still in early stages of bringing users deep into their ecosystem.

Per Cybart, ~50% of Apple users still own just 1 product (iPhone).

As these customers move deeper into the ecosystem, it& #39;ll remove "oxygen" from the other markets Apple plays in.

Per Cybart, ~50% of Apple users still own just 1 product (iPhone).

As these customers move deeper into the ecosystem, it& #39;ll remove "oxygen" from the other markets Apple plays in.

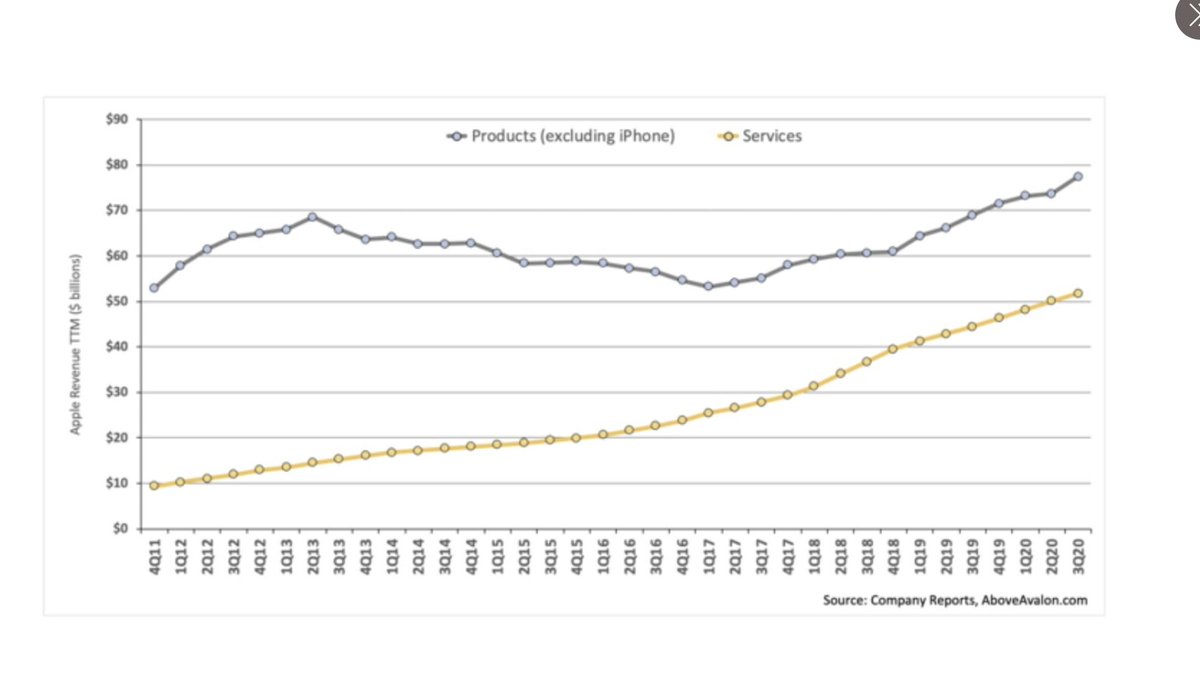

15/ While iPhone sales have flatlined, there are clear signs that its ecosystem growth is accelerating.

Not only is Apple service revenue (e.g, subscriptions) growing but so are non-iPhone hardware products.

Not only is Apple service revenue (e.g, subscriptions) growing but so are non-iPhone hardware products.

16/ "In what will come as a shock to many people, Products rev. excl. iPhone (iPad, Mac, Wearables, Home, etc.) is now growing at nearly the same pace as Services. This represents a major narrative violation as consensus spent years positioning Services as Apple’s growth engine."

17/ Apple is in the ecosystem expansion phase.

There are two pieces of the pie:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">New users

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">New users

iPhone SE should not be underestimated for poaching Android users

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> Existing users go deeper

https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> Existing users go deeper

iPhone users buying iPads, Macs, Wearable, services

There are two pieces of the pie:

iPhone SE should not be underestimated for poaching Android users

iPhone users buying iPads, Macs, Wearable, services

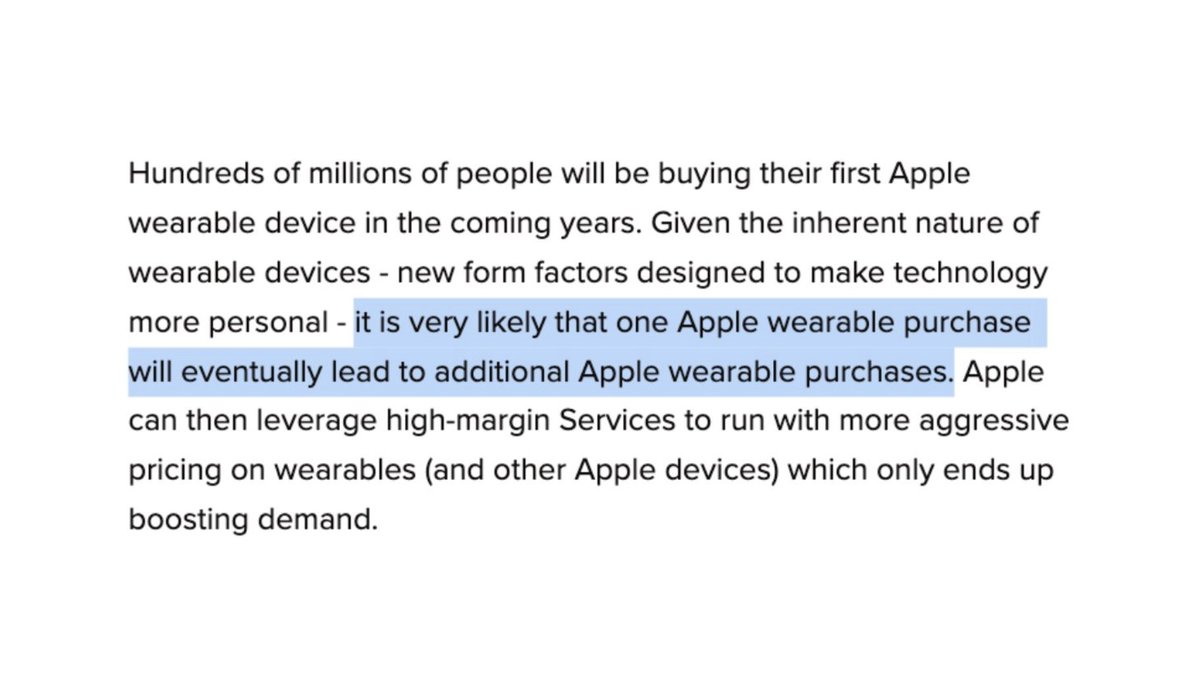

18/ Wearables is $AAPL& #39;s growth engine because if you buy one product (Watch), it& #39;s likely you& #39;ll buy another (AirPods).

More wearables also gives Apple an edge in AR glasses (compared to competitors, it can offload compute to wearables and make its glasses lighter).

More wearables also gives Apple an edge in AR glasses (compared to competitors, it can offload compute to wearables and make its glasses lighter).

19/ As Apple& #39;s keynote yesterday showed, the M1 chip is a game changer for the new iMac and iPad lines.

The push strategy is working: Apple is firing on all cylinders right now.

The push strategy is working: Apple is firing on all cylinders right now.

20/ For more galaxy brain takes, smash that FOLLOW.

I also make really dumb memes that directly contradict my long form stuff: https://twitter.com/TrungTPhan/status/1384549940454510596?s=20">https://twitter.com/TrungTPha...

I also make really dumb memes that directly contradict my long form stuff: https://twitter.com/TrungTPhan/status/1384549940454510596?s=20">https://twitter.com/TrungTPha...

21/ For the best breakdown, read Cybart& #39;s full work at @AboveAvalon:

Apple& #39;s ecosystem growth is accelerating: https://aboveavalon.com/notes/2020/8/12/apples-ecosystem-growth-is-accelerating…

Apple">https://aboveavalon.com/notes/202... is pulling away from the competition: https://www.aboveavalon.com/notes/2020/7/1/apple-is-pulling-away-from-the-competition

The">https://www.aboveavalon.com/notes/202... Mac& #39;s Graduation:

https://www.aboveavalon.com/notes/2020/11/18/the-macs-graduation">https://www.aboveavalon.com/notes/202...

Apple& #39;s ecosystem growth is accelerating: https://aboveavalon.com/notes/2020/8/12/apples-ecosystem-growth-is-accelerating…

Apple">https://aboveavalon.com/notes/202... is pulling away from the competition: https://www.aboveavalon.com/notes/2020/7/1/apple-is-pulling-away-from-the-competition

The">https://www.aboveavalon.com/notes/202... Mac& #39;s Graduation:

https://www.aboveavalon.com/notes/2020/11/18/the-macs-graduation">https://www.aboveavalon.com/notes/202...

Read on Twitter

Read on Twitter " title="1/ Since the end of 2018, Apple& #39;s market cap has increased by $1.5 trillion. While often mocked under the leadership of Tim Cook, Apple& #39;s product strategy over the past few years has delivered outrageous results. Here& #39;s a breakdown https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>

" title="1/ Since the end of 2018, Apple& #39;s market cap has increased by $1.5 trillion. While often mocked under the leadership of Tim Cook, Apple& #39;s product strategy over the past few years has delivered outrageous results. Here& #39;s a breakdown https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>

![4/ The Grand Unified Theory of Apple Products"Apple Products are designed to handle tasks once handled by more powerful siblings. New form factors are then able to handle new tasks in [unique, different & more personal ways]." Mac -> Macbook -> iPad -> iPhone -> Watch/AirPod 4/ The Grand Unified Theory of Apple Products"Apple Products are designed to handle tasks once handled by more powerful siblings. New form factors are then able to handle new tasks in [unique, different & more personal ways]." Mac -> Macbook -> iPad -> iPhone -> Watch/AirPod](https://pbs.twimg.com/media/EzeH-TcUUAIxc_1.jpg)

SamsungAimlessly launching new products to say they& #39;re "first" (foldable screen)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">GOOGLSoftware features compelling on paper but UX sucks https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">AMZNMassive bet on Echo was "wrong" (should have done wearable but lacks corporate h/w culture)" title="12/Competition weakening #2https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">SamsungAimlessly launching new products to say they& #39;re "first" (foldable screen)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">GOOGLSoftware features compelling on paper but UX sucks https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">AMZNMassive bet on Echo was "wrong" (should have done wearable but lacks corporate h/w culture)">

SamsungAimlessly launching new products to say they& #39;re "first" (foldable screen)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">GOOGLSoftware features compelling on paper but UX sucks https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">AMZNMassive bet on Echo was "wrong" (should have done wearable but lacks corporate h/w culture)" title="12/Competition weakening #2https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">SamsungAimlessly launching new products to say they& #39;re "first" (foldable screen)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">GOOGLSoftware features compelling on paper but UX sucks https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">AMZNMassive bet on Echo was "wrong" (should have done wearable but lacks corporate h/w culture)">

SamsungAimlessly launching new products to say they& #39;re "first" (foldable screen)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">GOOGLSoftware features compelling on paper but UX sucks https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">AMZNMassive bet on Echo was "wrong" (should have done wearable but lacks corporate h/w culture)" title="12/Competition weakening #2https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">SamsungAimlessly launching new products to say they& #39;re "first" (foldable screen)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">GOOGLSoftware features compelling on paper but UX sucks https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">AMZNMassive bet on Echo was "wrong" (should have done wearable but lacks corporate h/w culture)">

SamsungAimlessly launching new products to say they& #39;re "first" (foldable screen)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">GOOGLSoftware features compelling on paper but UX sucks https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">AMZNMassive bet on Echo was "wrong" (should have done wearable but lacks corporate h/w culture)" title="12/Competition weakening #2https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">SamsungAimlessly launching new products to say they& #39;re "first" (foldable screen)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">GOOGLSoftware features compelling on paper but UX sucks https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">AMZNMassive bet on Echo was "wrong" (should have done wearable but lacks corporate h/w culture)">

MicrosoftSurface is failing with consumers. Rev growth driven by commercial clients (taking share from OEMs not Apple)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> FBPivoting to privacy, which Apple has a clear lead onhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> SnapBiggest AR competitor but dropped ball on Spectacles" title="13/ Competition weakening #3https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">MicrosoftSurface is failing with consumers. Rev growth driven by commercial clients (taking share from OEMs not Apple)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> FBPivoting to privacy, which Apple has a clear lead onhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> SnapBiggest AR competitor but dropped ball on Spectacles" class="img-responsive" style="max-width:100%;"/>

MicrosoftSurface is failing with consumers. Rev growth driven by commercial clients (taking share from OEMs not Apple)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> FBPivoting to privacy, which Apple has a clear lead onhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> SnapBiggest AR competitor but dropped ball on Spectacles" title="13/ Competition weakening #3https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">MicrosoftSurface is failing with consumers. Rev growth driven by commercial clients (taking share from OEMs not Apple)https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> FBPivoting to privacy, which Apple has a clear lead onhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> SnapBiggest AR competitor but dropped ball on Spectacles" class="img-responsive" style="max-width:100%;"/>

New usersiPhone SE should not be underestimated for poaching Android usershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> Existing users go deeper iPhone users buying iPads, Macs, Wearable, services" title="17/ Apple is in the ecosystem expansion phase. There are two pieces of the pie: https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">New usersiPhone SE should not be underestimated for poaching Android usershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> Existing users go deeper iPhone users buying iPads, Macs, Wearable, services" class="img-responsive" style="max-width:100%;"/>

New usersiPhone SE should not be underestimated for poaching Android usershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> Existing users go deeper iPhone users buying iPads, Macs, Wearable, services" title="17/ Apple is in the ecosystem expansion phase. There are two pieces of the pie: https://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat">New usersiPhone SE should not be underestimated for poaching Android usershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="◻️" title="Weißes durchschnittliches Quadrat" aria-label="Emoji: Weißes durchschnittliches Quadrat"> Existing users go deeper iPhone users buying iPads, Macs, Wearable, services" class="img-responsive" style="max-width:100%;"/>