When It’s Bad To “Set It & Forget It”

Or

How I made a 57% loss in a supposedly very stable value stock.

A https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

Or

How I made a 57% loss in a supposedly very stable value stock.

A

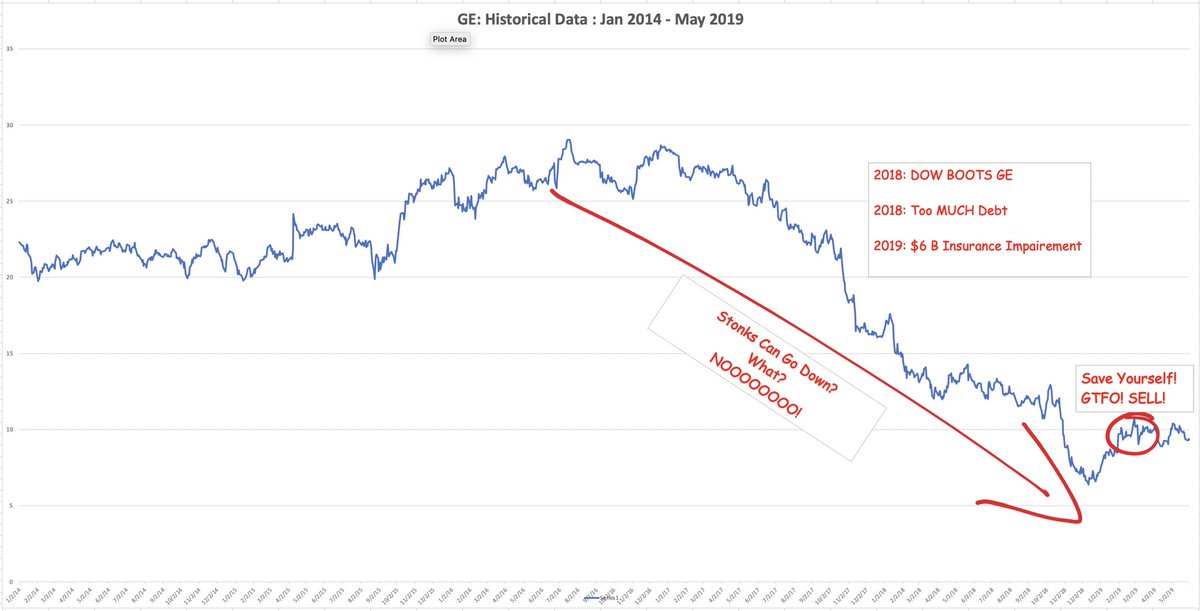

In 2014, a super smart friend who’d just started his own investment fund advised me to invest in GE, IBM, CocaCola, Exxon & forget it. So I did just that.

Reinvest the dividends and let compounding do its thing.

Buy it & forget it. Right?

Reinvest the dividends and let compounding do its thing.

Buy it & forget it. Right?

I bought GE stock in March 2014. What a great company and dividend yielding stock, I believed.

GE was doing pretty well after recovering from the Financial crisis of 2008.

So when there was dip in Mar 2014, I BTFD https://abs.twimg.com/emoji/v2/... draggable="false" alt="😝" title="Schielendes Gesicht mit Zunge" aria-label="Emoji: Schielendes Gesicht mit Zunge">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😝" title="Schielendes Gesicht mit Zunge" aria-label="Emoji: Schielendes Gesicht mit Zunge">

GE was doing pretty well after recovering from the Financial crisis of 2008.

So when there was dip in Mar 2014, I BTFD

I was happy with the dividends and GE Stock grew modestly.

I was feeling rather good.

And Then all Hell Broke Lose. https://www.fool.com/investing/2018/12/10/the-fall-of-a-blue-chip-general-electrics-horrible.aspx">https://www.fool.com/investing...

I was feeling rather good.

And Then all Hell Broke Lose. https://www.fool.com/investing/2018/12/10/the-fall-of-a-blue-chip-general-electrics-horrible.aspx">https://www.fool.com/investing...

2017: Bad CEO out , I’m thinking, yay, now things will be good again

Too much debt in Balance Sheet (BS). Bad Shaheeda didn’t pay attention to the BS

2018: New CEO takes over. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Daumen hoch" aria-label="Emoji: Daumen hoch">

Oh no, $6.2 B Reinsurance Liabilities Charge

Stock https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

New CEO fired after 6 months.

Too much debt in Balance Sheet (BS). Bad Shaheeda didn’t pay attention to the BS

2018: New CEO takes over.

Oh no, $6.2 B Reinsurance Liabilities Charge

Stock

New CEO fired after 6 months.

I still think the restructuring plan would work; after it’s a 100+ yr company.

By now my investment is in GE is already in losses.

I say, “Well, it’s on paper right? I don’t need the money now, so I’ll hold.”

By now my investment is in GE is already in losses.

I say, “Well, it’s on paper right? I don’t need the money now, so I’ll hold.”

2019: GE’s underlying problems didn’t go away. Debt is still massive.

I finally GTFO. I sold.

Bought GE at $25.44;

Sold GE at $9.28 4/19

After dividends, total loss 57%

You know what hurts?

Had I bought $SPY, I would’ve made 72% in the same period instead of losing 57% https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">

I finally GTFO. I sold.

Bought GE at $25.44;

Sold GE at $9.28 4/19

After dividends, total loss 57%

You know what hurts?

Had I bought $SPY, I would’ve made 72% in the same period instead of losing 57%

Not to worry, I have a happy ending!

In Aug 2019, I bought $ZM (Zoom).

I made 300% on it. I missed the opportunity to sell when it was up 450% https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏽♀️" title="Achselzuckende Frau (mittlerer Hautton)" aria-label="Emoji: Achselzuckende Frau (mittlerer Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏽♀️" title="Achselzuckende Frau (mittlerer Hautton)" aria-label="Emoji: Achselzuckende Frau (mittlerer Hautton)">

I’m happy https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👩🏫" title="Lehrerin" aria-label="Emoji: Lehrerin">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👩🏫" title="Lehrerin" aria-label="Emoji: Lehrerin">

Always do your homework.

Read https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗞" title="Eingerollte Zeitung" aria-label="Emoji: Eingerollte Zeitung">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🗞" title="Eingerollte Zeitung" aria-label="Emoji: Eingerollte Zeitung">

Don’t be complacent.

Past performance is no guarantee for the future

In Aug 2019, I bought $ZM (Zoom).

I made 300% on it. I missed the opportunity to sell when it was up 450%

I’m happy

Always do your homework.

Read

Don’t be complacent.

Past performance is no guarantee for the future

Reading the news  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📰" title="Zeitung" aria-label="Emoji: Zeitung"> is really important.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📰" title="Zeitung" aria-label="Emoji: Zeitung"> is really important.

DOW literally BOOTED $GE off its index in 2018. Get this, GE was replaced by Walgreens-BOOTS !

If that wasn’t an https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht"> &

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Polizeiautos mit drehendem Licht" aria-label="Emoji: Polizeiautos mit drehendem Licht"> &  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪧" title="Placard" aria-label="Emoji: Placard">, I don’t what else could be! And I still chose to believe my own gut without proper research.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🪧" title="Placard" aria-label="Emoji: Placard">, I don’t what else could be! And I still chose to believe my own gut without proper research.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👩🎓" title="Schülerin/Studentin" aria-label="Emoji: Schülerin/Studentin"> Learned

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👩🎓" title="Schülerin/Studentin" aria-label="Emoji: Schülerin/Studentin"> Learned

End https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

DOW literally BOOTED $GE off its index in 2018. Get this, GE was replaced by Walgreens-BOOTS !

If that wasn’t an

End

Ps: sorry about typos or grammatical mistakes above  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">

I really wish we could edit. But not to fret, I’ll do a short blog with more details on the same topic soon.

I really wish we could edit. But not to fret, I’ll do a short blog with more details on the same topic soon.

Read on Twitter

Read on Twitter " title="I bought GE stock in March 2014. What a great company and dividend yielding stock, I believed.GE was doing pretty well after recovering from the Financial crisis of 2008.So when there was dip in Mar 2014, I BTFD https://abs.twimg.com/emoji/v2/... draggable="false" alt="😝" title="Schielendes Gesicht mit Zunge" aria-label="Emoji: Schielendes Gesicht mit Zunge">" class="img-responsive" style="max-width:100%;"/>

" title="I bought GE stock in March 2014. What a great company and dividend yielding stock, I believed.GE was doing pretty well after recovering from the Financial crisis of 2008.So when there was dip in Mar 2014, I BTFD https://abs.twimg.com/emoji/v2/... draggable="false" alt="😝" title="Schielendes Gesicht mit Zunge" aria-label="Emoji: Schielendes Gesicht mit Zunge">" class="img-responsive" style="max-width:100%;"/>

" title="2019: GE’s underlying problems didn’t go away. Debt is still massive. I finally GTFO. I sold.Bought GE at $25.44; Sold GE at $9.28 4/19After dividends, total loss 57%You know what hurts?Had I bought $SPY, I would’ve made 72% in the same period instead of losing 57% https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">" class="img-responsive" style="max-width:100%;"/>

" title="2019: GE’s underlying problems didn’t go away. Debt is still massive. I finally GTFO. I sold.Bought GE at $25.44; Sold GE at $9.28 4/19After dividends, total loss 57%You know what hurts?Had I bought $SPY, I would’ve made 72% in the same period instead of losing 57% https://abs.twimg.com/emoji/v2/... draggable="false" alt="😭" title="Laut schreiendes Gesicht" aria-label="Emoji: Laut schreiendes Gesicht">" class="img-responsive" style="max-width:100%;"/>

I really wish we could edit. But not to fret, I’ll do a short blog with more details on the same topic soon." title="Ps: sorry about typos or grammatical mistakes above https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">I really wish we could edit. But not to fret, I’ll do a short blog with more details on the same topic soon." class="img-responsive" style="max-width:100%;"/>

I really wish we could edit. But not to fret, I’ll do a short blog with more details on the same topic soon." title="Ps: sorry about typos or grammatical mistakes above https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Rückhand Zeigefinger nach oben" aria-label="Emoji: Rückhand Zeigefinger nach oben">I really wish we could edit. But not to fret, I’ll do a short blog with more details on the same topic soon." class="img-responsive" style="max-width:100%;"/>