Tax Guide For Small Business Structure in SA

[Thread]

[Thread]

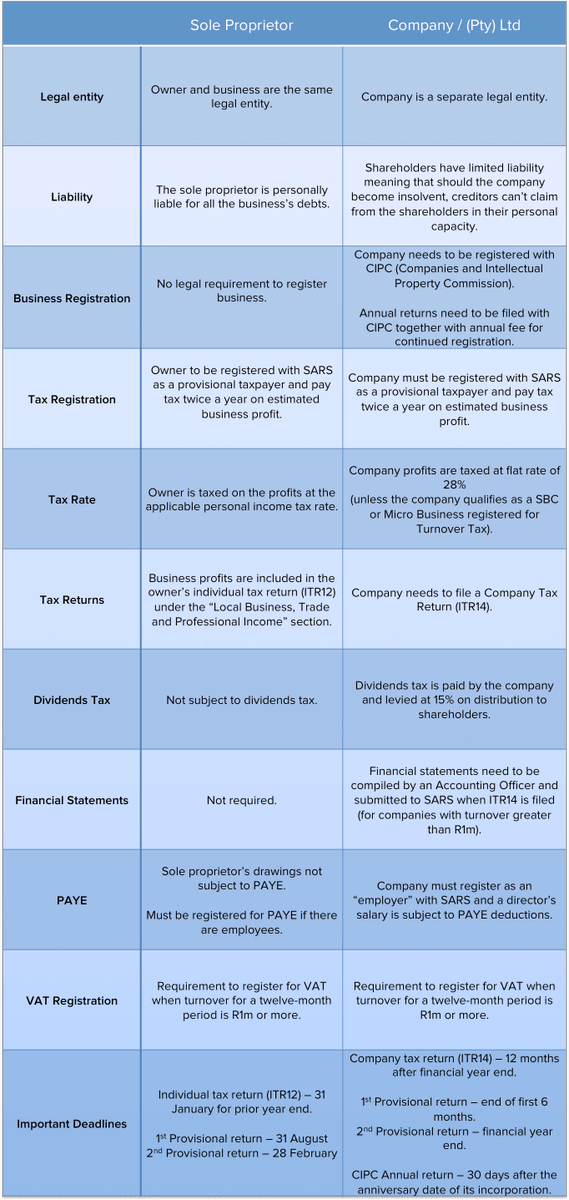

The excitement of starting a new business often overshadows some of the more tedious aspects – like tax. As a new business owner, you’re enthusiastic about launching your new product or service into the market, but you’re also faced with the daunting administrative task of

ensuring your business is setup correctly and you comply with all legal requirements. A decision that often stumps many small business owners is whether to operate as a sole proprietor or as a private company, a PTY Ltd.

One of the biggest deciding factors for many businesses is what the long term tax implications will be. At TaxTim we’ve received many questions about this and are happy to share some insight to help you decide what operating model best suits you.

The sole proprietor route is less administrative-intensive to start (winning). The downside is that you take on more personal risk than that of a company director.

But let’s hone in on the tax element so you know which option will be the most tax-efficient.

But let’s hone in on the tax element so you know which option will be the most tax-efficient.

How do I run my small business in the most tax-efficient way?

The answer boils down to how much you expect your business to earn.

Individuals (Sole Proprietors) are taxed on a sliding scale, which means that the rate of tax you pay increases as your earnings increase.

The answer boils down to how much you expect your business to earn.

Individuals (Sole Proprietors) are taxed on a sliding scale, which means that the rate of tax you pay increases as your earnings increase.

This is called a progressive rate of tax and applies to any individuals earning more than R75 000 per year.

As an individual, you benefit from the general tax rebate, which brings down the amount of tax you owe by a flat amount, depending on your age.

As an individual, you benefit from the general tax rebate, which brings down the amount of tax you owe by a flat amount, depending on your age.

If you’re under 65 years, this is called the primary rebate. There’s a secondary rebate for those over 65 years and a tertiary rebate for those over 75 years.

In a company, profits are taxed at a rate of 28%, irrespective of value.

In a company, profits are taxed at a rate of 28%, irrespective of value.

In addition, dividends tax is levied at 15% on profits retained in the company and distributed as a dividend in the future.

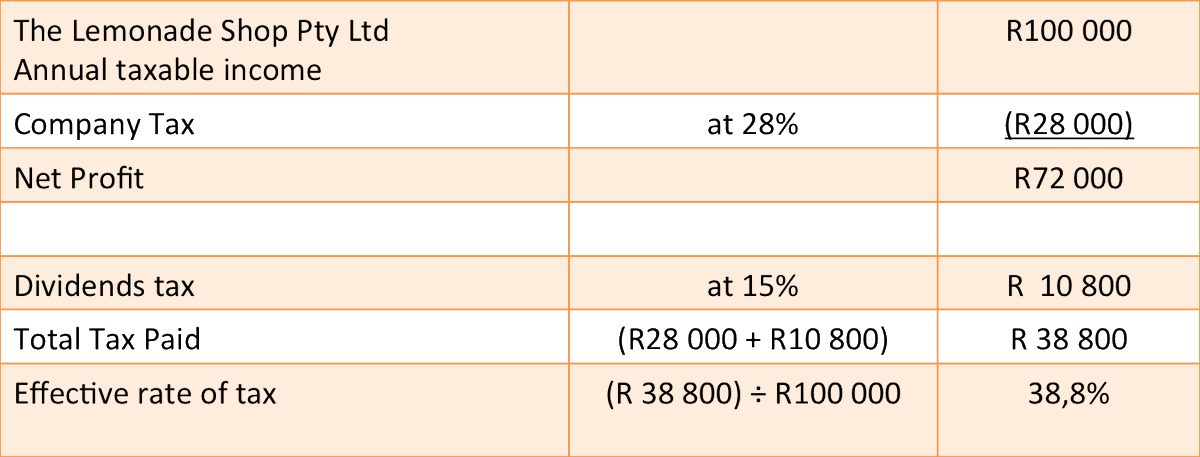

Example 1: Annual income is R100 000

Let’s do a worked example of the difference this makes on R100,000 profit between a registered company and

Example 1: Annual income is R100 000

Let’s do a worked example of the difference this makes on R100,000 profit between a registered company and

a sole proprietor’s tax position.

We’ll assume that The Lemonade Shop Pty Ltd didn’t pay out any profit in the year and distributes a dividend the following year (View Table)

We’ll assume that The Lemonade Shop Pty Ltd didn’t pay out any profit in the year and distributes a dividend the following year (View Table)

In our example above, Neo’s effective tax rate of 4.5% is significantly lower than The Lemonade Shop Pty Ltd’s at 38.8%.

We must remember that as Neo’s business grows and becomes more profitable, he’ll move into a higher tax bracket – increasing his effective rate of tax.

We must remember that as Neo’s business grows and becomes more profitable, he’ll move into a higher tax bracket – increasing his effective rate of tax.

Let’s do another example, but this time where the taxable income is R1 500 000 for the tax year. How does the tax situation change for Neo?

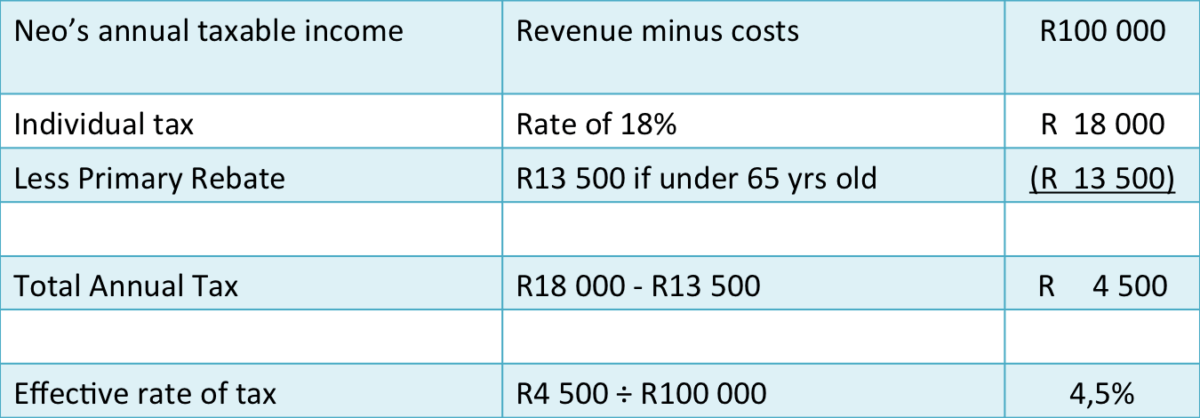

Example 2: Annual Income is 1.5M

Our company this time, The Chocolate Shop Pty Ltd, has a sole director, Lungisa,

Example 2: Annual Income is 1.5M

Our company this time, The Chocolate Shop Pty Ltd, has a sole director, Lungisa,

who draws an annual salary of R360,000 (or R30,000 per month). This amount is deducted before corporate tax is applied. The total amount of tax Lungisa incurs is the company tax as well as the individual tax. (View Table)

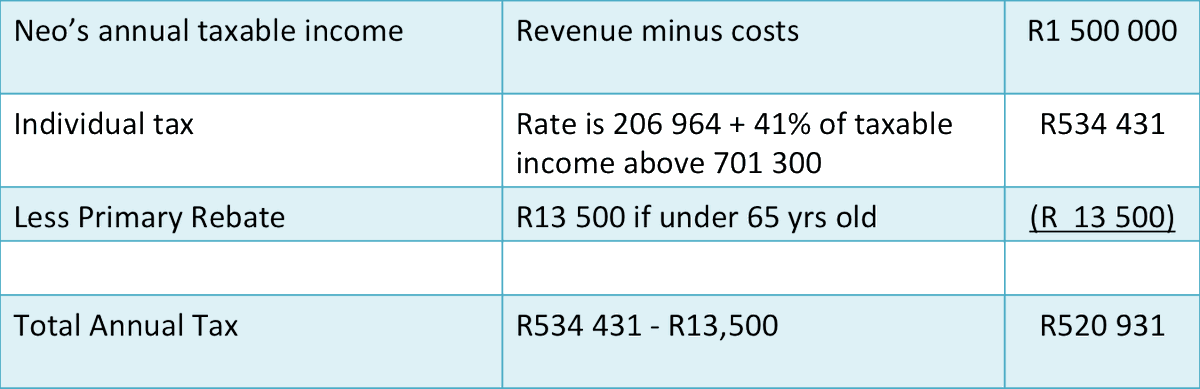

Now, let’s have a look at Neo’s tax for an income of R1,500,000 for the year. This amount puts Neo into the 41% tax bracket, as per SARS tax tables for individuals (View Table)

Neo is paying R71 773 (R520 931 – R449 158) more tax in his own capacity than if he was operating through a company and drawing a salary of R30,000 per month.

Conclusions from the above examples

Keep in mind that there are numerous other deductions and allowances to consider,

Conclusions from the above examples

Keep in mind that there are numerous other deductions and allowances to consider,

and that this is a basic illustration that shows how one version can be more efficient than another.

It’s evident that at lower levels of taxable income,it’s far more tax efficient to operate as a sole proprietor and enjoy the benefits of sliding tax tables and rebates available

It’s evident that at lower levels of taxable income,it’s far more tax efficient to operate as a sole proprietor and enjoy the benefits of sliding tax tables and rebates available

to individuals. As your taxable income increases, it’s important to re-evaluate your company structure.

Finally, although we haven’t gone into detail in this article, it’s important to remember that as a small business you can register for Turnover Tax.

Finally, although we haven’t gone into detail in this article, it’s important to remember that as a small business you can register for Turnover Tax.

This is a simplified tax system that replaces income tax, dividend tax, etc. It’s been put in place to give small businesses with turnover of R1 million or less per annum a better chance at success.

*Source: Taxtim

#AskMentorNDThreads

*Source: Taxtim

#AskMentorNDThreads

Read on Twitter

Read on Twitter