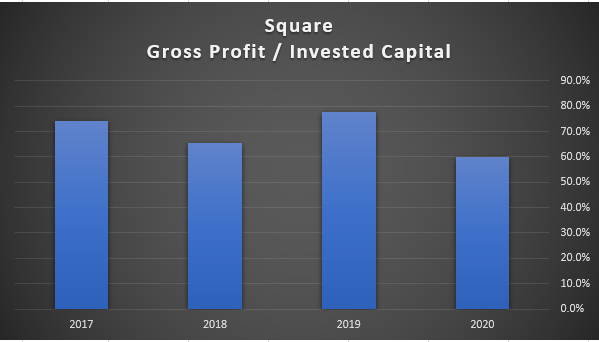

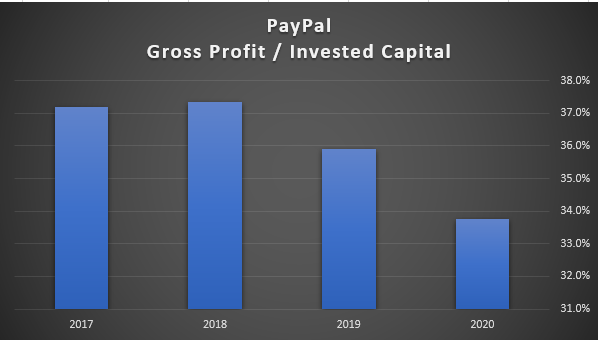

$SQ earns a significantly higher return on invested capital vs $PYPL, despite the latter producing billions in profit today while $SQ is barely breaking even.

To see this, one has to use gross profit rather than operating profit in the numerator.

$SQ: 60%

$PYPL: 34%

To see this, one has to use gross profit rather than operating profit in the numerator.

$SQ: 60%

$PYPL: 34%

The reason why gross profit is the more relevant number is because, unlike capital intensive firms like $TSLA, most of their investments are expensed, and right now, $SQ is aggressively spending on marketing & promos to achieve the 50% revenue CAGR they& #39;ve been enjoying:

However, high growth on poor ROIC is value destructive in the long run.

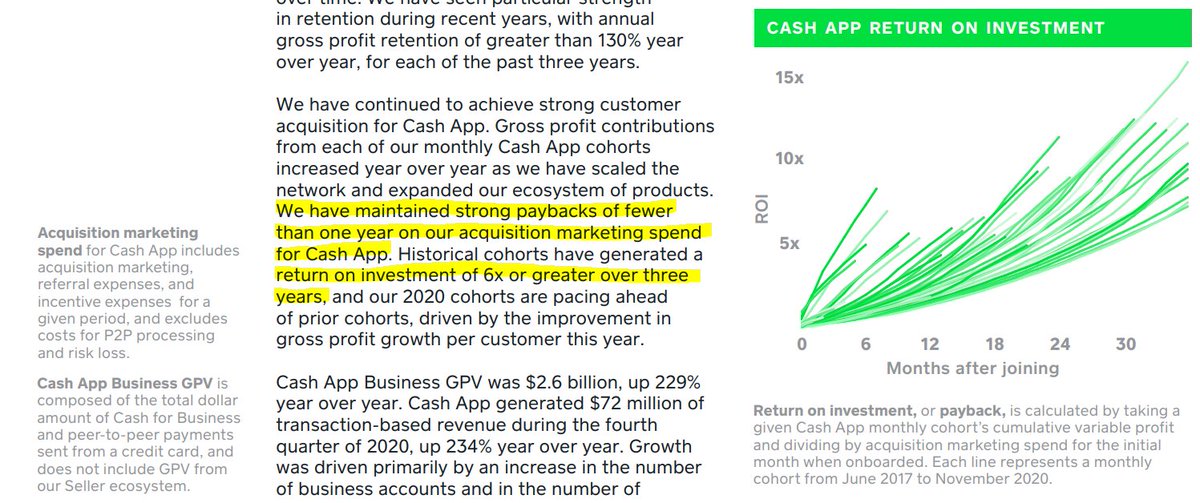

Square specifically discloses the ROI on their marketing spend on their quarterly letter:

Square specifically discloses the ROI on their marketing spend on their quarterly letter:

This confirms the first chart I posted of significantly better ROIC. With an ROI that high, it makes sense to spend aggressively in that category. This depresses net income in the short-run, but maximizes shareholder value in the long run.

This is why GAAP or even non-GAAP earnings is nonsense for most high growth businesses. Those who live and die by P/E multiples will miss out on the great value-creating businesses of our time. We must learn to separate discretionary from mandatory spending.

Ultimately I think both companies will flourish in this secular shift away from traditional brick-n-mortar banking, but $SQ shares should outperform with a higher multiple on faster compounding gross profit, and ultimately, net profit as they scale.

Read on Twitter

Read on Twitter