DCMP (Double Confirmed Minimum Profit) is an Intraday Scalping Technique which can be applied on Equites/Future/Commodities.

Like any strategy, the most important part of this strategy lies in Risk Management. This cannot be emphasized more. Thread coming.

Like any strategy, the most important part of this strategy lies in Risk Management. This cannot be emphasized more. Thread coming.

1/n

Requirement of the strategy:

1. Capital Required:- ₹50,000+

2. Risk:Reward:- 1:2/3

3. Method:- Scalping

4. Charts: Tick by Tick Line Charts

5. Discount Broker

6. Preferred Desktop App for order execution.

Requirement of the strategy:

1. Capital Required:- ₹50,000+

2. Risk:Reward:- 1:2/3

3. Method:- Scalping

4. Charts: Tick by Tick Line Charts

5. Discount Broker

6. Preferred Desktop App for order execution.

2/n

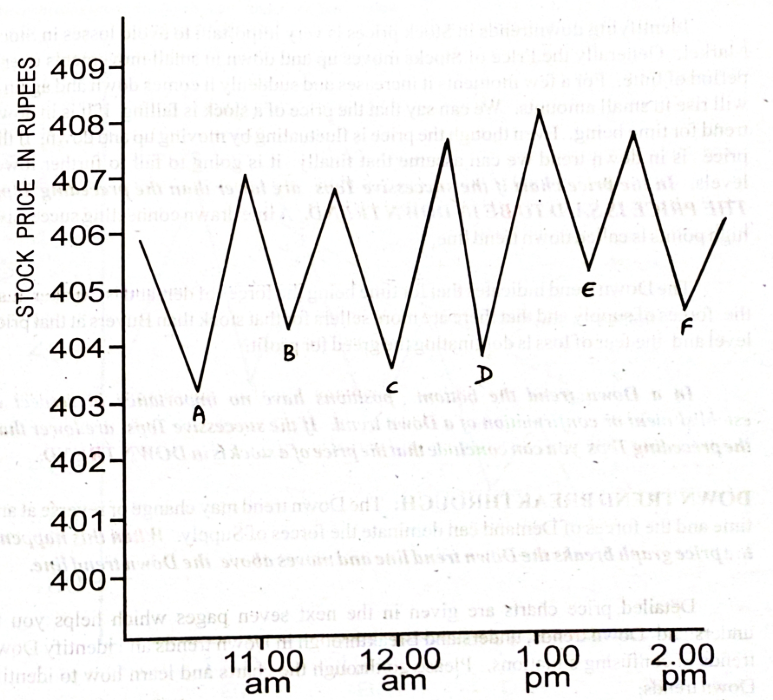

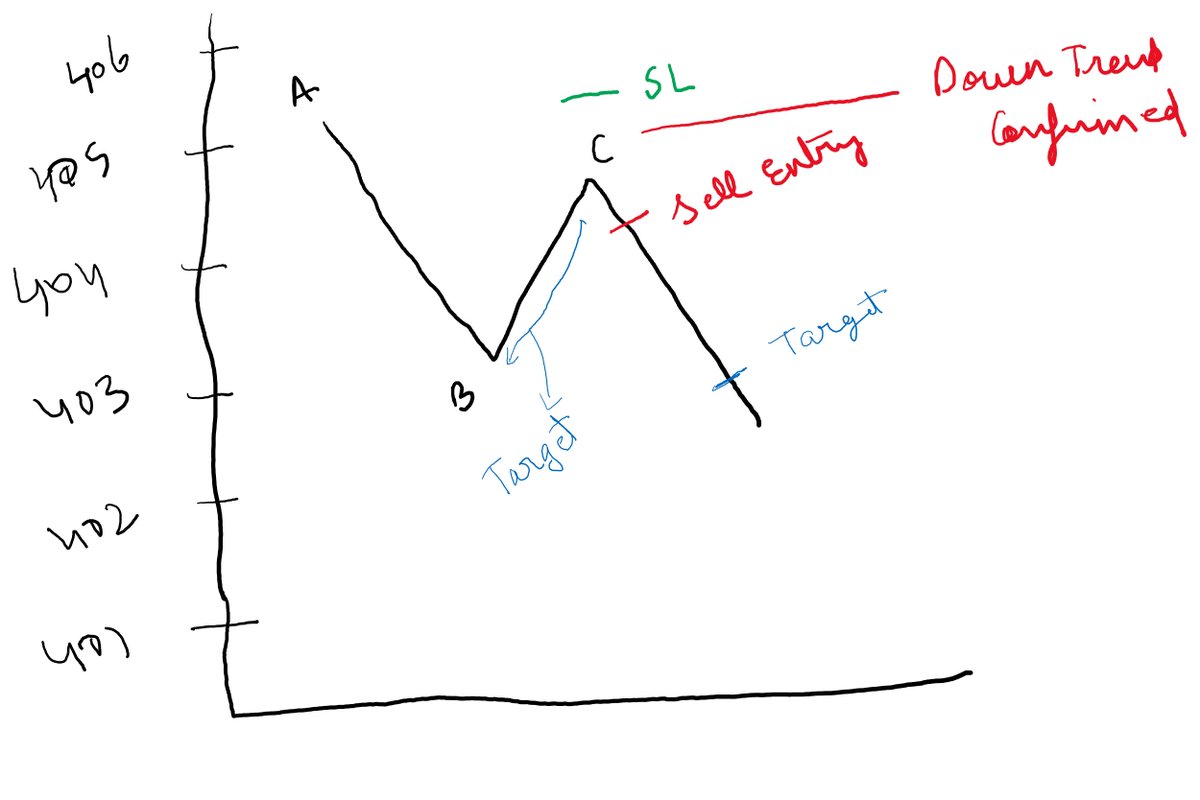

As a day trader, you need to understand what is trend. In simple analogy, a series of Higher High, Higher Low is an uptrend. A series of Lower Low, Lower High is a downtrend. This is how it looks.

As a day trader, you need to understand what is trend. In simple analogy, a series of Higher High, Higher Low is an uptrend. A series of Lower Low, Lower High is a downtrend. This is how it looks.

3/n

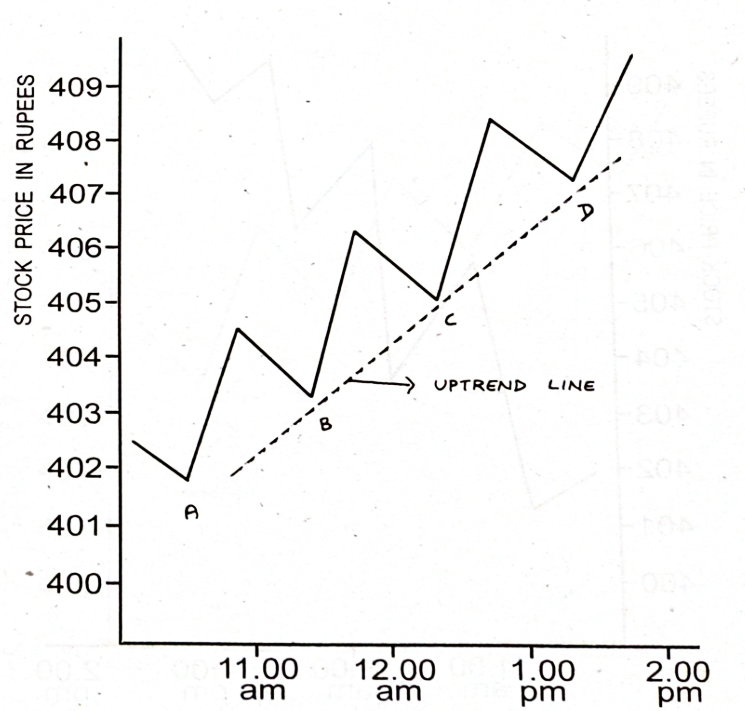

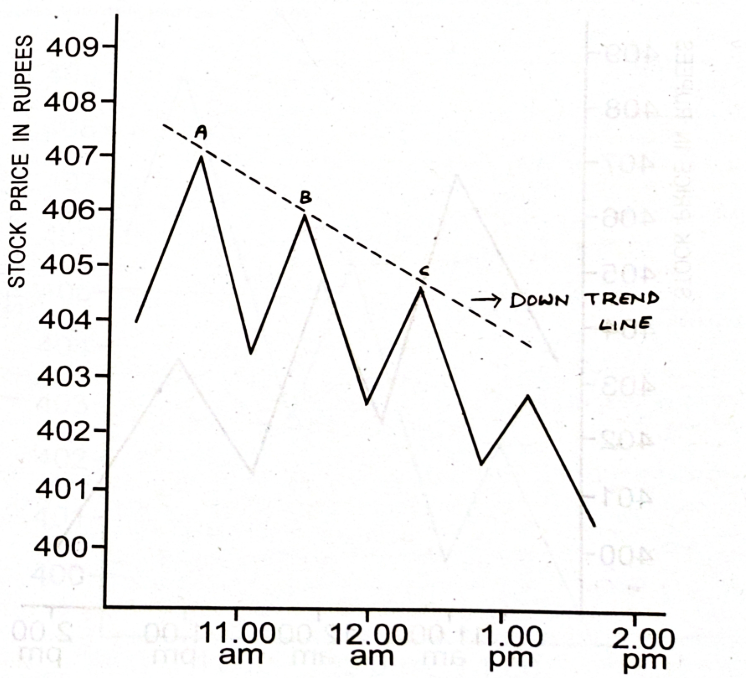

This strategy is based on Uptrend/Downtrend. If price registers successive higher highs, then it is in Uptrend. If price registers successive lower lows, then its in Downtrend.

We only trade in stocks with highest liquidity. Stocks which are top traded in NSE.

This strategy is based on Uptrend/Downtrend. If price registers successive higher highs, then it is in Uptrend. If price registers successive lower lows, then its in Downtrend.

We only trade in stocks with highest liquidity. Stocks which are top traded in NSE.

4/n

Step 1: Identify the Uptrend on Tick by Tick Line Chart which means second bottom should be above first bottom.

Step 2: If at second bottom, price starts to move towards upside, consider it as a strong buy signal.

Step 3: Price distance from Top to Second bottom is target.

Step 1: Identify the Uptrend on Tick by Tick Line Chart which means second bottom should be above first bottom.

Step 2: If at second bottom, price starts to move towards upside, consider it as a strong buy signal.

Step 3: Price distance from Top to Second bottom is target.

5/n

Step 4: SL is slightly lower than successive bottom. SL and Target are to be set immediately after buy.

Step 5: Process is inverse for Sell Trades.

Let& #39;s see the example with an illustration then we will check the real charts.

Step 4: SL is slightly lower than successive bottom. SL and Target are to be set immediately after buy.

Step 5: Process is inverse for Sell Trades.

Let& #39;s see the example with an illustration then we will check the real charts.

6/n

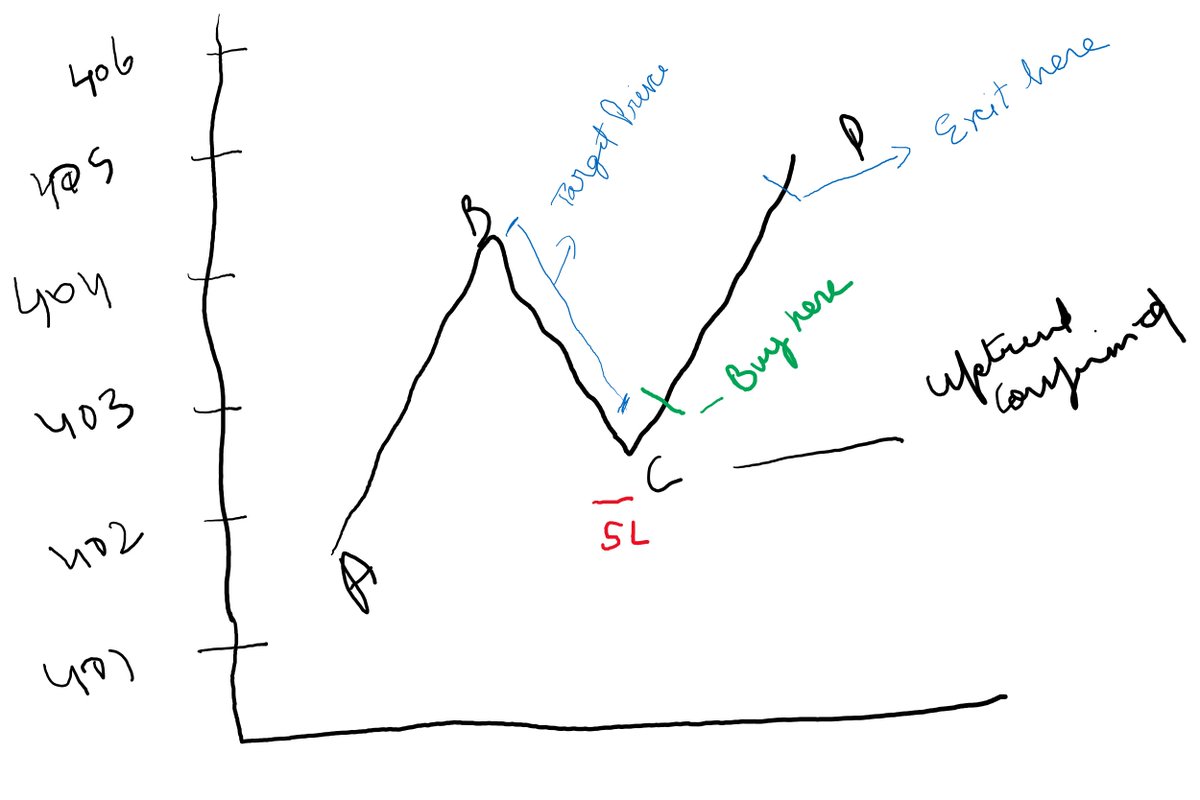

At Point C, uptrend is confirmed.

Distance between B - C is target.

Buy once price starts moving up from C, with SL slightly below C. SL and Target are to be placed immediately after buy.

Either exit at SL or Target and cancel the other order. See attached Pic.

At Point C, uptrend is confirmed.

Distance between B - C is target.

Buy once price starts moving up from C, with SL slightly below C. SL and Target are to be placed immediately after buy.

Either exit at SL or Target and cancel the other order. See attached Pic.

7/n

This method works even better beyond 2nd, 3rd HL/LH.

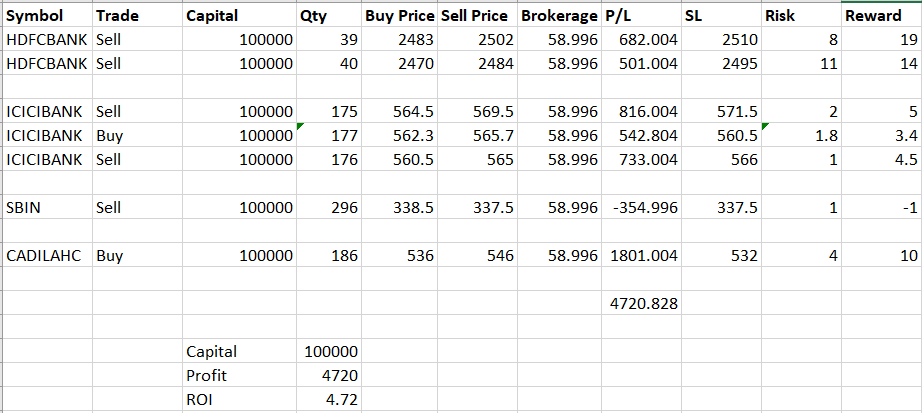

Enough with the illustrations. Lets take real time charts and see what happens. Starting Capital is 50,000 and 2 times equity intraday leverage which makes it 100,000.

You should know what quantity you can trade.

This method works even better beyond 2nd, 3rd HL/LH.

Enough with the illustrations. Lets take real time charts and see what happens. Starting Capital is 50,000 and 2 times equity intraday leverage which makes it 100,000.

You should know what quantity you can trade.

8/n

This strategy is basic scalping strategy. Its called double confirmed minimum profit because entry is confirmed at formation of trend in either Bullish/Bearish direction.

We trade the securities with high liquidity.

Orders punched can vary from 10-40 depending on no. ..

This strategy is basic scalping strategy. Its called double confirmed minimum profit because entry is confirmed at formation of trend in either Bullish/Bearish direction.

We trade the securities with high liquidity.

Orders punched can vary from 10-40 depending on no. ..

of entries/securities.

If you think this is not worth it, then reconsider. On smaller capital, daily ROI varies from 2-4% easily.

If you think this is not worth it, then reconsider. On smaller capital, daily ROI varies from 2-4% easily.

9/n

Remember few things:

If price is facing resistance at 75% of target, consider taking profits.

This strategy does not require any prior analysis.

We do not use Candle Stick chart, because entry can be late waiting for candle to close.

Remember few things:

If price is facing resistance at 75% of target, consider taking profits.

This strategy does not require any prior analysis.

We do not use Candle Stick chart, because entry can be late waiting for candle to close.

10/n

For example purpose, I have only taken Top Traded shares of 20 April 2021.

This is an intraday only strategy with quick entries and exit.

Discussion and Questions welcome. End of Thread.

For example purpose, I have only taken Top Traded shares of 20 April 2021.

This is an intraday only strategy with quick entries and exit.

Discussion and Questions welcome. End of Thread.

Read on Twitter

Read on Twitter