THREAD  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> 1/

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> 1/

How to find and pick HIGH QUALITY STOCKS to invest in:

Do you REALLY know what to look for when it comes to investing? After reading, hopefully you& #39;ll be able to tell a good stock from a bad stock. Let& #39;s get started.

$SPY $QQQ $AAPL $FB #Investing #stocks #invest

How to find and pick HIGH QUALITY STOCKS to invest in:

Do you REALLY know what to look for when it comes to investing? After reading, hopefully you& #39;ll be able to tell a good stock from a bad stock. Let& #39;s get started.

$SPY $QQQ $AAPL $FB #Investing #stocks #invest

2/

Our general criteria is largely (but not fully) inspired by the book 100 Baggers by Christopher Mayer.

It& #39;s a great book for investors to read. With experience, you can adjust stock picking criteria to your own tastes and still have great results. https://amzn.to/3sB8Aqb ">https://amzn.to/3sB8Aqb&q...

Our general criteria is largely (but not fully) inspired by the book 100 Baggers by Christopher Mayer.

It& #39;s a great book for investors to read. With experience, you can adjust stock picking criteria to your own tastes and still have great results. https://amzn.to/3sB8Aqb ">https://amzn.to/3sB8Aqb&q...

3/

So, how do you find good stocks?

10 things to look for:

1. Steady revenue and earnings growth (earnings are not as important as revenue though)

2. Free cash flow and/or operating cash flow in an up trend

3. Stable and high gross profit margins relative to industry peers

So, how do you find good stocks?

10 things to look for:

1. Steady revenue and earnings growth (earnings are not as important as revenue though)

2. Free cash flow and/or operating cash flow in an up trend

3. Stable and high gross profit margins relative to industry peers

4/

4. Consistently high returns on capital

5. If the company has a moat, this is a big bonus

6. Founder led, high insider ownership

7. Trading at a reasonable valuation or undervalued

8. Low maintenance capex margins are a bonus

9. Acceptable balance sheet

4. Consistently high returns on capital

5. If the company has a moat, this is a big bonus

6. Founder led, high insider ownership

7. Trading at a reasonable valuation or undervalued

8. Low maintenance capex margins are a bonus

9. Acceptable balance sheet

5/

10. Lastly, be able to understand the business for the most part.

Not EVERY part of the criteria has to be met, but the more the better.

Now, let& #39;s explain the criteria in more detail.

10. Lastly, be able to understand the business for the most part.

Not EVERY part of the criteria has to be met, but the more the better.

Now, let& #39;s explain the criteria in more detail.

6/

1. Steady rev. and earnings growth

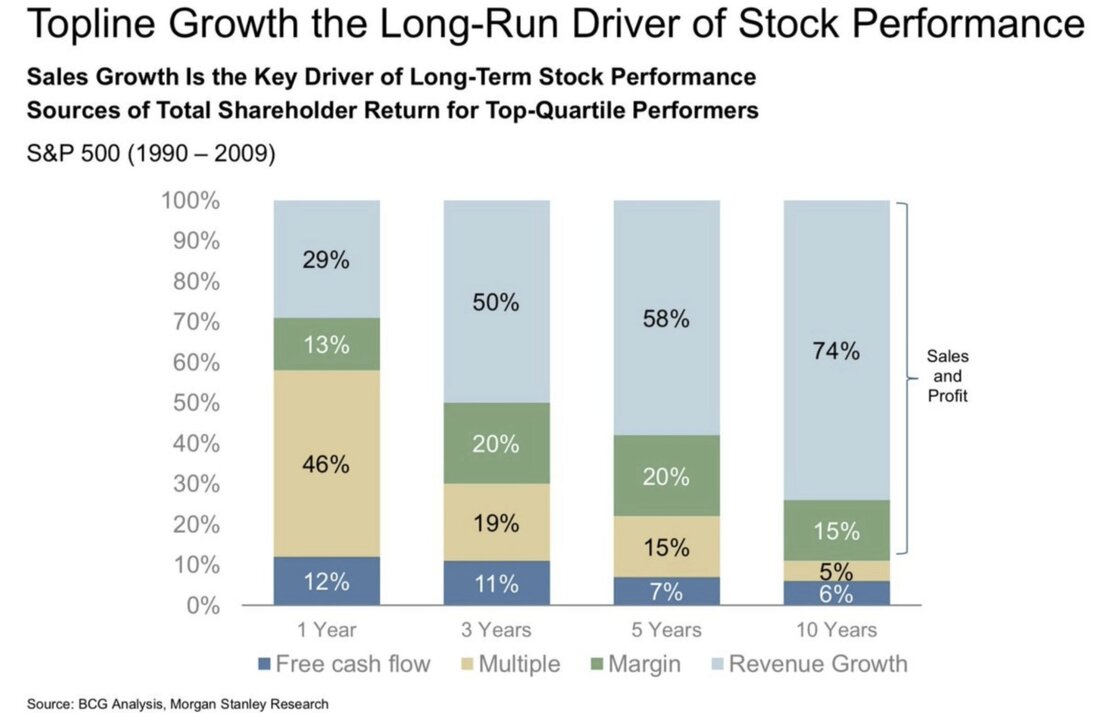

Rev. growth is one of the most important parts of the criteria bc it& #39;s a primary driver in stock price performance over the long term. The study ends at 2009, but over a 3-10 year period, rev. growth was the biggest key to performance.

1. Steady rev. and earnings growth

Rev. growth is one of the most important parts of the criteria bc it& #39;s a primary driver in stock price performance over the long term. The study ends at 2009, but over a 3-10 year period, rev. growth was the biggest key to performance.

7/

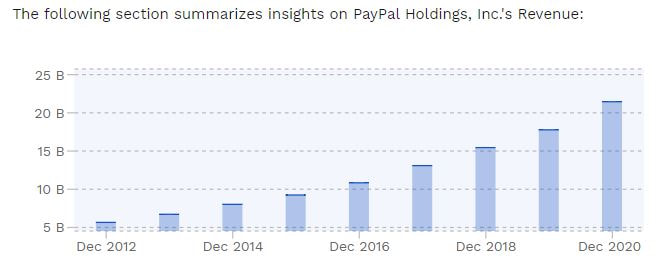

Steady revenue growth examples: $GOOG $PYPL $AMZN

Sometimes revenue growth can be a bit choppier with some years lower than others, but as long as the choppiness isn& #39;t caused by any concerning reasons and the trend is still up, then it should be fine.

Steady revenue growth examples: $GOOG $PYPL $AMZN

Sometimes revenue growth can be a bit choppier with some years lower than others, but as long as the choppiness isn& #39;t caused by any concerning reasons and the trend is still up, then it should be fine.

8/

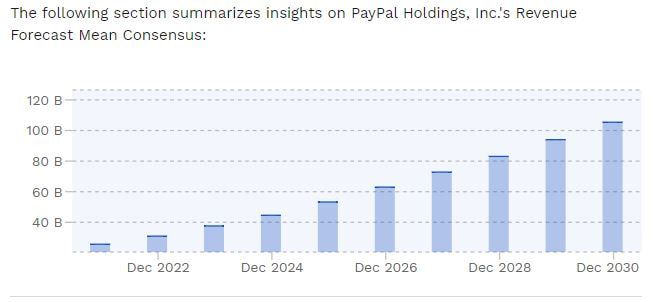

Past rev. growth is good as a track record to rely on, but the mkt is forward looking so you need to find out if the co. is expected to grow going fwd. Many sites show analyst projections (we use @FinboxIO and @SeekingAlpha). You can even use mgmt guidance or common sense

Past rev. growth is good as a track record to rely on, but the mkt is forward looking so you need to find out if the co. is expected to grow going fwd. Many sites show analyst projections (we use @FinboxIO and @SeekingAlpha). You can even use mgmt guidance or common sense

9/

For example, here& #39;s $PYPL& #39;s revenue projections based on the mean analyst consensus (info via @FinboxIO , other sites may vary)

Gonna plug Finbox in here, we love it, use it all the time: https://finbox.com/NASDAQGS:AAPL/explorer?ai=qvco3wu&pi=mfnbx">https://finbox.com/NASDAQGS:...

For example, here& #39;s $PYPL& #39;s revenue projections based on the mean analyst consensus (info via @FinboxIO , other sites may vary)

Gonna plug Finbox in here, we love it, use it all the time: https://finbox.com/NASDAQGS:AAPL/explorer?ai=qvco3wu&pi=mfnbx">https://finbox.com/NASDAQGS:...

10/

Steady EPS growth: Important but not as important as one may think. Earnings can sometimes be misleading bc of "one-time expenses/gains" and similar things. Sometimes, adjustments need to be made when looking at earnings. But, it& #39;s still a bonus to see EPS in an uptrend.

Steady EPS growth: Important but not as important as one may think. Earnings can sometimes be misleading bc of "one-time expenses/gains" and similar things. Sometimes, adjustments need to be made when looking at earnings. But, it& #39;s still a bonus to see EPS in an uptrend.

11/

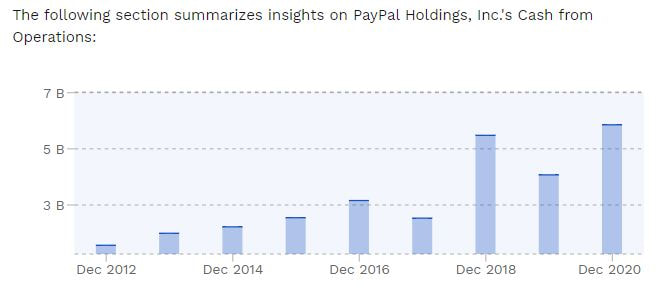

2. Cash flow from operations and free cash flow in a long-term uptrend.

We prefer cash from operations and free cash flow over earnings because it gives a better idea of the actual cash flows a business is taking in. This is because CFO adds back non-cash items.

2. Cash flow from operations and free cash flow in a long-term uptrend.

We prefer cash from operations and free cash flow over earnings because it gives a better idea of the actual cash flows a business is taking in. This is because CFO adds back non-cash items.

12/

Using $PYPL as an example again, you can see that although its CFO is a bit choppy, it is in an uptrend nonetheless.

Some companies may have cash from operations in an uptrend but relatively flat free cash flow levels. This can often be due to high expenditures on

Using $PYPL as an example again, you can see that although its CFO is a bit choppy, it is in an uptrend nonetheless.

Some companies may have cash from operations in an uptrend but relatively flat free cash flow levels. This can often be due to high expenditures on

13/

growth capex. This is not a cause for concern as the FCF is only being lowered because of heavy amounts of investing in growth.

With co& #39;s that spend a lot on growth and have improving CFO, if you subtract only maintenance capex instead of both maintenance and

growth capex. This is not a cause for concern as the FCF is only being lowered because of heavy amounts of investing in growth.

With co& #39;s that spend a lot on growth and have improving CFO, if you subtract only maintenance capex instead of both maintenance and

14/

growth capex from CFO, you would have an up trending FCF number.

CFO minus maintenance capex is also known as "Owner Earnings", which was invented by Warren Buffett. More on maintenance capex in our full article:

https://www.stockbrosresearch.com/themoneyblog/how-to-find-and-pick-high-quality-stocks-to-invest-in-investing-strategy">https://www.stockbrosresearch.com/themoneyb...

growth capex from CFO, you would have an up trending FCF number.

CFO minus maintenance capex is also known as "Owner Earnings", which was invented by Warren Buffett. More on maintenance capex in our full article:

https://www.stockbrosresearch.com/themoneyblog/how-to-find-and-pick-high-quality-stocks-to-invest-in-investing-strategy">https://www.stockbrosresearch.com/themoneyb...

15/

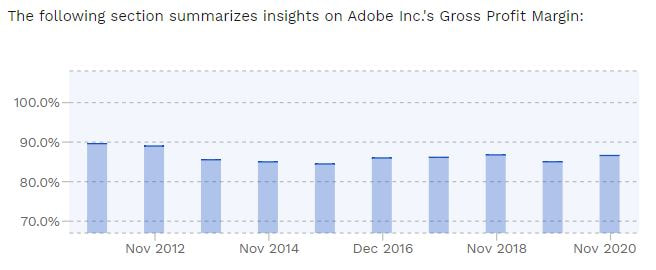

3. Stable and high gross profit margins relative to industry peers.

The higher the gross margins the better. Why? Because gross margins are a measure of profitability, efficiency, and competitiveness. If you take a bunch of businesses offering the same products/services

3. Stable and high gross profit margins relative to industry peers.

The higher the gross margins the better. Why? Because gross margins are a measure of profitability, efficiency, and competitiveness. If you take a bunch of businesses offering the same products/services

16/

the one with the highest gross margin is often going to be the best one. The co. with high GM will most likely have a competitive advantage over its peers that allows it to either charge more for its products/services or pay less to sell them.

You also want to see the

the one with the highest gross margin is often going to be the best one. The co. with high GM will most likely have a competitive advantage over its peers that allows it to either charge more for its products/services or pay less to sell them.

You also want to see the

17/

margins being stable over the years. This usually cements the fact that competition is not eroding the company& #39;s profits over time, allowing it to have stable gross profit margins. Stocks in relatively new industries will usually see their margins shrink over time as

margins being stable over the years. This usually cements the fact that competition is not eroding the company& #39;s profits over time, allowing it to have stable gross profit margins. Stocks in relatively new industries will usually see their margins shrink over time as

18/

the industry matures and more competition comes in. This is normal and as long as its margins are high relative to others in the industry and isn& #39;t losing market share, it& #39;s not a concern.

Here are $ADBE& #39;s gross margins. They& #39;ve been stable (due to lack of competition) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐐" title="Ziege" aria-label="Emoji: Ziege">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐐" title="Ziege" aria-label="Emoji: Ziege">

the industry matures and more competition comes in. This is normal and as long as its margins are high relative to others in the industry and isn& #39;t losing market share, it& #39;s not a concern.

Here are $ADBE& #39;s gross margins. They& #39;ve been stable (due to lack of competition)

19/

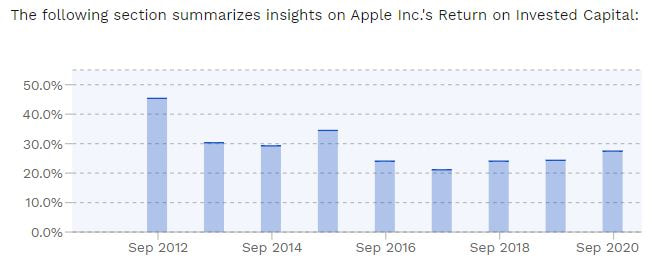

4. Consistently high returns on capital.

Here& #39;s a famous Warren Buffett quote about ROC:

“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.”

4. Consistently high returns on capital.

Here& #39;s a famous Warren Buffett quote about ROC:

“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.”

20/

Like gross margins, high and stable/growing returns on capital when compared to peers can signify that the company has a competitive advantage and/or is more efficient. There are a few ways to measure ROC. Popular metrics include Return on Invested Capital (ROIC),

Like gross margins, high and stable/growing returns on capital when compared to peers can signify that the company has a competitive advantage and/or is more efficient. There are a few ways to measure ROC. Popular metrics include Return on Invested Capital (ROIC),

21/

Cash Return on Invested Capital (CROIC), Return on Capital Employed (ROCE), Return on Equity (ROE), and Return on Assets (ROA). One of our go to& #39;s is ROIC because it& #39;s pretty reliable. We explain these in more detail in the full post.

https://www.stockbrosresearch.com/themoneyblog/how-to-find-and-pick-high-quality-stocks-to-invest-in-investing-strategy">https://www.stockbrosresearch.com/themoneyb...

Cash Return on Invested Capital (CROIC), Return on Capital Employed (ROCE), Return on Equity (ROE), and Return on Assets (ROA). One of our go to& #39;s is ROIC because it& #39;s pretty reliable. We explain these in more detail in the full post.

https://www.stockbrosresearch.com/themoneyblog/how-to-find-and-pick-high-quality-stocks-to-invest-in-investing-strategy">https://www.stockbrosresearch.com/themoneyb...

22/

ROIC can be compared to a company& #39;s weighted average cost of capital (WACC).

Generally, if a co& #39;s ROIC is greater than its WACC, it& #39;s considered to be a value creator. If ROIC is less than its WACC, it& #39;s a value destroyer.

WACC explained: https://www.stockbrosresearch.com/themoneyblog/step-by-step-tutorial-for-calculating-weighted-average-cost-of-capital-wacc">https://www.stockbrosresearch.com/themoneyb...

ROIC can be compared to a company& #39;s weighted average cost of capital (WACC).

Generally, if a co& #39;s ROIC is greater than its WACC, it& #39;s considered to be a value creator. If ROIC is less than its WACC, it& #39;s a value destroyer.

WACC explained: https://www.stockbrosresearch.com/themoneyblog/step-by-step-tutorial-for-calculating-weighted-average-cost-of-capital-wacc">https://www.stockbrosresearch.com/themoneyb...

23/

*Emphasis on the word "generally" above. Nothing is set in stone, each situation is unique.*

Here& #39;s an example of a good ROIC chart on $AAPL. ROIC has consistently been above 20% so it is compounding its returns quickly. Part of the reason for its great performance.

*Emphasis on the word "generally" above. Nothing is set in stone, each situation is unique.*

Here& #39;s an example of a good ROIC chart on $AAPL. ROIC has consistently been above 20% so it is compounding its returns quickly. Part of the reason for its great performance.

24/

5. Moats are a big bonus.

"Moat" was coined by Warren Buffett. Investopedia describes an economic moat as "a company& #39;s competitive advantage derived as a result of various business tactics that allow it to earn above-average profits for a sustainable period of time."

5. Moats are a big bonus.

"Moat" was coined by Warren Buffett. Investopedia describes an economic moat as "a company& #39;s competitive advantage derived as a result of various business tactics that allow it to earn above-average profits for a sustainable period of time."

25/

An example of a moat is high switching costs or a product that is inconvenient to switch. Take banks for example, it is quite annoying to switch over bank accounts because everything is already in place at your current bank (weekly paychecks, bill payments, etc.), so even

An example of a moat is high switching costs or a product that is inconvenient to switch. Take banks for example, it is quite annoying to switch over bank accounts because everything is already in place at your current bank (weekly paychecks, bill payments, etc.), so even

26/

if people want to switch to another bank, they don& #39;t do it that often. Another examples of a moat can be strong brand loyalty ( like with $AAPL, $NKE)

Apple can raise prices on its phones with only marginal improvements, and many will still buy, as they have been doing.

if people want to switch to another bank, they don& #39;t do it that often. Another examples of a moat can be strong brand loyalty ( like with $AAPL, $NKE)

Apple can raise prices on its phones with only marginal improvements, and many will still buy, as they have been doing.

27/

6. Founder led, high insider ownership

The founder of the co. should either be the CEO or another important role with a large enough stake in the company to have a say in its operations. Think $TSLA with Elon Musk, $AMZN with Jeff Bezos and $FB with Mark Zuckerberg.

6. Founder led, high insider ownership

The founder of the co. should either be the CEO or another important role with a large enough stake in the company to have a say in its operations. Think $TSLA with Elon Musk, $AMZN with Jeff Bezos and $FB with Mark Zuckerberg.

28/

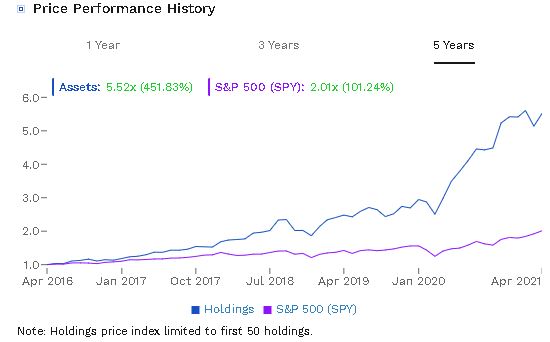

Founders have an owner& #39;s mindset, a front-line obsession, and often have a special/unique feature or capability that can give a business a sense of purpose which trickles down to employees

These kinds of companies have been proven to beat the market over the years.

Founders have an owner& #39;s mindset, a front-line obsession, and often have a special/unique feature or capability that can give a business a sense of purpose which trickles down to employees

These kinds of companies have been proven to beat the market over the years.

29/

Here& #39;s just one example of this in the image below, with the purple line being the S&P 500 returning 101.24% over 5 years starting April 2016, and a portfolio of founder-led companies (blue line) returning about 452% over the same period. This data was taken from @FinboxIO

Here& #39;s just one example of this in the image below, with the purple line being the S&P 500 returning 101.24% over 5 years starting April 2016, and a portfolio of founder-led companies (blue line) returning about 452% over the same period. This data was taken from @FinboxIO

30/

If the co isn& #39;t founder led, but has a CEO or mgmt team that is heavily invested in the stock, then that is probably good too. When mgmt owns a lot of shares, that generally means they truly believe in the stock, and will act in the best interest of long-term shareholders

If the co isn& #39;t founder led, but has a CEO or mgmt team that is heavily invested in the stock, then that is probably good too. When mgmt owns a lot of shares, that generally means they truly believe in the stock, and will act in the best interest of long-term shareholders

31/

We wrote a whole article about founder-led stocks which you can read here:

https://www.stockbrosresearch.com/themoneyblog/how-to-beat-the-market-with-founder-led-stocks-investing-strategy

Moving">https://www.stockbrosresearch.com/themoneyb... on, here& #39;s #7: The stock is trading at a reasonable valuation or is undervalued.

How do you know if a stock is good value or not? This can get tricky, as there are

We wrote a whole article about founder-led stocks which you can read here:

https://www.stockbrosresearch.com/themoneyblog/how-to-beat-the-market-with-founder-led-stocks-investing-strategy

Moving">https://www.stockbrosresearch.com/themoneyb... on, here& #39;s #7: The stock is trading at a reasonable valuation or is undervalued.

How do you know if a stock is good value or not? This can get tricky, as there are

32/

many ways of valuing a stock. Drastically overpaying for a stock can potentially hurt you if investors are pricing in perfect performance from the company and all of a sudden, the company fails to deliver.

Paying a reasonable price for a great stock is all you need to do

many ways of valuing a stock. Drastically overpaying for a stock can potentially hurt you if investors are pricing in perfect performance from the company and all of a sudden, the company fails to deliver.

Paying a reasonable price for a great stock is all you need to do

33/

to make money in investing. Here& #39;s the famous Warren Buffett quote:

“It& #39;s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Taking this advice, you should always look to buy the best companies, as long as they& #39;re not way

to make money in investing. Here& #39;s the famous Warren Buffett quote:

“It& #39;s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Taking this advice, you should always look to buy the best companies, as long as they& #39;re not way

34/

overpriced. If you can find a wonderful company at a wonderful price though, that is a recipe for substantial gains, assuming your analysis is correct.

DCF (Discounted Cash Flow) is one of the most common ways to value a stock. Here& #39;s how to do it: https://www.stockbrosresearch.com/themoneyblog/how-to-value-a-company-using-discounted-cash-flow-analysis-dcf">https://www.stockbrosresearch.com/themoneyb...

overpriced. If you can find a wonderful company at a wonderful price though, that is a recipe for substantial gains, assuming your analysis is correct.

DCF (Discounted Cash Flow) is one of the most common ways to value a stock. Here& #39;s how to do it: https://www.stockbrosresearch.com/themoneyblog/how-to-value-a-company-using-discounted-cash-flow-analysis-dcf">https://www.stockbrosresearch.com/themoneyb...

35/

There are other methods too such as relative valuation, PEG, etc. We also discuss these in the full post. Too much to explain for a twitter thread:

Full article: https://www.stockbrosresearch.com/themoneyblog/how-to-find-and-pick-high-quality-stocks-to-invest-in-investing-strategy">https://www.stockbrosresearch.com/themoneyb...

There are other methods too such as relative valuation, PEG, etc. We also discuss these in the full post. Too much to explain for a twitter thread:

Full article: https://www.stockbrosresearch.com/themoneyblog/how-to-find-and-pick-high-quality-stocks-to-invest-in-investing-strategy">https://www.stockbrosresearch.com/themoneyb...

36/

#8. Low maintenance capex margins are a bonus

Capital expenditures (capex) is the money that a company spends to buy, maintain, or improve its fixed assets, like property, plant, and equipment. It also can include intangible expenditures like licenses and patents.

#8. Low maintenance capex margins are a bonus

Capital expenditures (capex) is the money that a company spends to buy, maintain, or improve its fixed assets, like property, plant, and equipment. It also can include intangible expenditures like licenses and patents.

37/

Maintenance capex is the amount of money a company needs to spend just to maintain current operations. Look for companies with low MC relative to their peers. If a company can maintain itself with low amounts of capital, it can spend more money on growth or other objectives.

Maintenance capex is the amount of money a company needs to spend just to maintain current operations. Look for companies with low MC relative to their peers. If a company can maintain itself with low amounts of capital, it can spend more money on growth or other objectives.

38/

A quick and dirty way to calculate maintenance capex is to deduct depreciation and amortization from total capex. This method is quick but not as good as finding it yourself, which usually might take some extra work like looking into filings or earnings transcripts.

A quick and dirty way to calculate maintenance capex is to deduct depreciation and amortization from total capex. This method is quick but not as good as finding it yourself, which usually might take some extra work like looking into filings or earnings transcripts.

39/

9. The company should have an acceptable balance sheet

When analyzing a stock, it& #39;s important its balance sheet to see its current financial health. A balance sheet shows a snapshot of a company& #39;s assets and liabilities at the particular date shown on the balance sheet.

9. The company should have an acceptable balance sheet

When analyzing a stock, it& #39;s important its balance sheet to see its current financial health. A balance sheet shows a snapshot of a company& #39;s assets and liabilities at the particular date shown on the balance sheet.

40/

A company with a lot of cash on hand and little debt is more likely to survive than a company with the opposite. Familiarize yourself with solvency ratios such as the quick ratio, current ratio, and interest coverage ratio.

You can ask yourself a few questions: If the

A company with a lot of cash on hand and little debt is more likely to survive than a company with the opposite. Familiarize yourself with solvency ratios such as the quick ratio, current ratio, and interest coverage ratio.

You can ask yourself a few questions: If the

41/

company has debt, is it growing at an unhealthy pace every year? Is the co& #39;s debt growing for strategic reasons like growth combined with tax write-offs, or is it losing control of its debt? Are interest payments well covered by EBIT (earnings before interest and taxes)?

company has debt, is it growing at an unhealthy pace every year? Is the co& #39;s debt growing for strategic reasons like growth combined with tax write-offs, or is it losing control of its debt? Are interest payments well covered by EBIT (earnings before interest and taxes)?

42/

You can read more about analyzing balance sheets in our article here: https://www.stockbrosresearch.com/themoneyblog/how-to-analyze-a-companys-balance-sheet

Finally,">https://www.stockbrosresearch.com/themoneyb... #10. You should be able to understand what you are investing, for the most part.

For obvious reasons, understanding what you& #39;re investing in is better than not

You can read more about analyzing balance sheets in our article here: https://www.stockbrosresearch.com/themoneyblog/how-to-analyze-a-companys-balance-sheet

Finally,">https://www.stockbrosresearch.com/themoneyb... #10. You should be able to understand what you are investing, for the most part.

For obvious reasons, understanding what you& #39;re investing in is better than not

43/

understanding at all. We don& #39;t think it is necessary to FULLY understand every single thing about what you& #39;re invested in as long as you mostly understand it and the other criteria in the checklist are met. The main things you need to understand are how the company makes

understanding at all. We don& #39;t think it is necessary to FULLY understand every single thing about what you& #39;re invested in as long as you mostly understand it and the other criteria in the checklist are met. The main things you need to understand are how the company makes

44/

money, how the company is positioned against its competition, the market size, and whether its market is projected to grow or not.

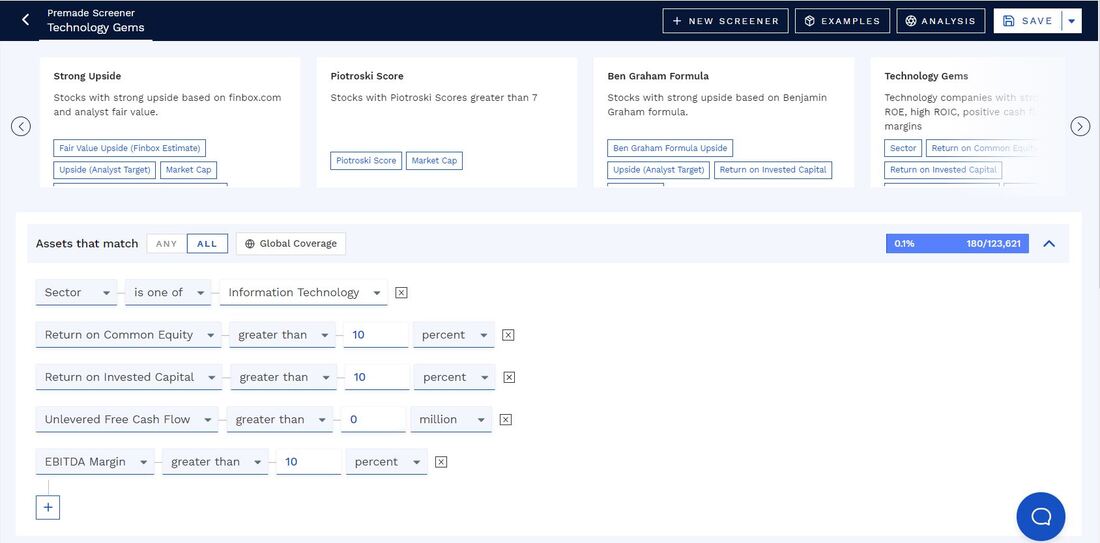

So, how do we actually FIND these stocks? There are lots of screeners out there, we use @FinboxIO& #39;s screener.

money, how the company is positioned against its competition, the market size, and whether its market is projected to grow or not.

So, how do we actually FIND these stocks? There are lots of screeners out there, we use @FinboxIO& #39;s screener.

45/ @FinboxIO offers many more metrics than other screeners and the screener itself is easy to set up. You can set up your own screener based on your preferred criteria or you can use any of their premade screeners such as this one below:

46/

You can add many of the things mentioned in our criteria above such as historical revenue and earnings growth, balance sheet metrics, valuation metrics, and more. This screener is a key tool to help filter out stocks efficiently.

Finbox: https://finbox.com/screener/technology-gems?ai=qvco3wu&pi=mfnbx">https://finbox.com/screener/...

You can add many of the things mentioned in our criteria above such as historical revenue and earnings growth, balance sheet metrics, valuation metrics, and more. This screener is a key tool to help filter out stocks efficiently.

Finbox: https://finbox.com/screener/technology-gems?ai=qvco3wu&pi=mfnbx">https://finbox.com/screener/...

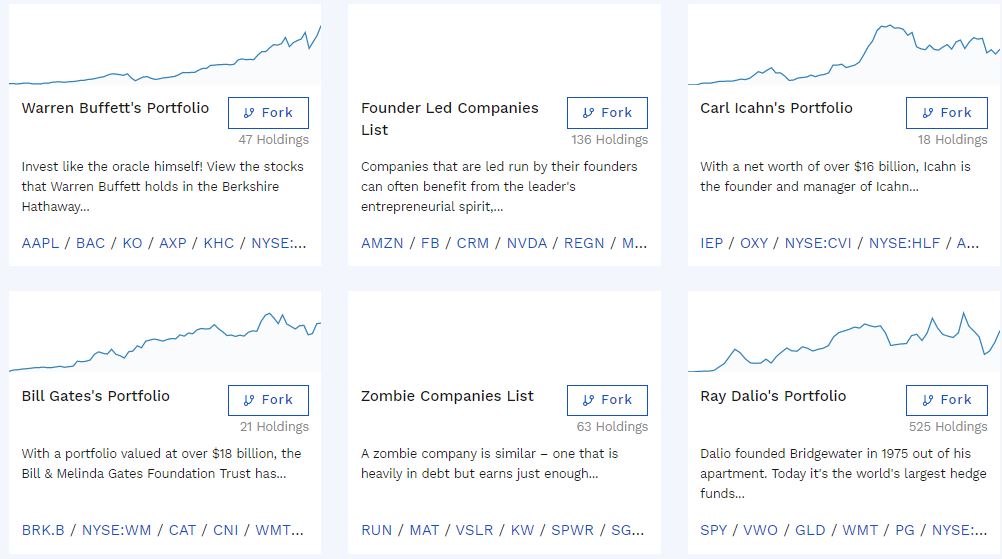

47/

@FinboxIO also has an "ideas" section where there are hundreds of portfolio ideas you can take an in-depth look at. Here& #39;s an example of just 6 of them, with Founder-Led Companies being the second one.

@FinboxIO also has an "ideas" section where there are hundreds of portfolio ideas you can take an in-depth look at. Here& #39;s an example of just 6 of them, with Founder-Led Companies being the second one.

48/

To conclude, Investing is not a one-size-fits-all strategy. There are many investing philosophies that work, and we think this set of criteria works well. However, investing in stocks can be a very risky business. You still have to do your homework when choosing individual

To conclude, Investing is not a one-size-fits-all strategy. There are many investing philosophies that work, and we think this set of criteria works well. However, investing in stocks can be a very risky business. You still have to do your homework when choosing individual

49/

stocks and this article only scratches the surface on the amount of things you can look for in stocks. You should only get involved if you have the stomach to handle volatility and you should never use capital that you aren& #39;t willing to fully lose.

stocks and this article only scratches the surface on the amount of things you can look for in stocks. You should only get involved if you have the stomach to handle volatility and you should never use capital that you aren& #39;t willing to fully lose.

50/

If you& #39;ve made it this far, thanks for reading! We hope this post has helped you learn about finding quality stocks. Consider following us or subscribing to our free newsletter!

https://mailchi.mp/b392ddd14279/join-stockbros-newsletter

And">https://mailchi.mp/b392ddd14... here& #39;s our full article link again: https://www.stockbrosresearch.com/themoneyblog/how-to-find-and-pick-high-quality-stocks-to-invest-in-investing-strategy">https://www.stockbrosresearch.com/themoneyb...

If you& #39;ve made it this far, thanks for reading! We hope this post has helped you learn about finding quality stocks. Consider following us or subscribing to our free newsletter!

https://mailchi.mp/b392ddd14279/join-stockbros-newsletter

And">https://mailchi.mp/b392ddd14... here& #39;s our full article link again: https://www.stockbrosresearch.com/themoneyblog/how-to-find-and-pick-high-quality-stocks-to-invest-in-investing-strategy">https://www.stockbrosresearch.com/themoneyb...

People who may be interested in sharing @saxena_puru @JonahLupton @FromValue @HeroDividend @LukeDonay @BrianFeroldi @hiddensmallcaps @Yield_Fanatic @Soumyazen @StockDweebs @BlogJulianKomar @monsieurdiv

Read on Twitter

Read on Twitter 1/How to find and pick HIGH QUALITY STOCKS to invest in:Do you REALLY know what to look for when it comes to investing? After reading, hopefully you& #39;ll be able to tell a good stock from a bad stock. Let& #39;s get started. $SPY $QQQ $AAPL $FB #Investing #stocks #invest" title="THREAD https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> 1/How to find and pick HIGH QUALITY STOCKS to invest in:Do you REALLY know what to look for when it comes to investing? After reading, hopefully you& #39;ll be able to tell a good stock from a bad stock. Let& #39;s get started. $SPY $QQQ $AAPL $FB #Investing #stocks #invest" class="img-responsive" style="max-width:100%;"/>

1/How to find and pick HIGH QUALITY STOCKS to invest in:Do you REALLY know what to look for when it comes to investing? After reading, hopefully you& #39;ll be able to tell a good stock from a bad stock. Let& #39;s get started. $SPY $QQQ $AAPL $FB #Investing #stocks #invest" title="THREAD https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> 1/How to find and pick HIGH QUALITY STOCKS to invest in:Do you REALLY know what to look for when it comes to investing? After reading, hopefully you& #39;ll be able to tell a good stock from a bad stock. Let& #39;s get started. $SPY $QQQ $AAPL $FB #Investing #stocks #invest" class="img-responsive" style="max-width:100%;"/>

" title="18/the industry matures and more competition comes in. This is normal and as long as its margins are high relative to others in the industry and isn& #39;t losing market share, it& #39;s not a concern.Here are $ADBE& #39;s gross margins. They& #39;ve been stable (due to lack of competition)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐐" title="Ziege" aria-label="Emoji: Ziege">" class="img-responsive" style="max-width:100%;"/>

" title="18/the industry matures and more competition comes in. This is normal and as long as its margins are high relative to others in the industry and isn& #39;t losing market share, it& #39;s not a concern.Here are $ADBE& #39;s gross margins. They& #39;ve been stable (due to lack of competition)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🐐" title="Ziege" aria-label="Emoji: Ziege">" class="img-responsive" style="max-width:100%;"/>