The storage business isn’t always fun and definitely isn’t sexy.

We bought this 185 unit portfolio at public auction in October of 2019. 140 units were abandoned and not paying.

We were handed paper ledgers and leases (some 20 years old) at closing.

We bought this 185 unit portfolio at public auction in October of 2019. 140 units were abandoned and not paying.

We were handed paper ledgers and leases (some 20 years old) at closing.

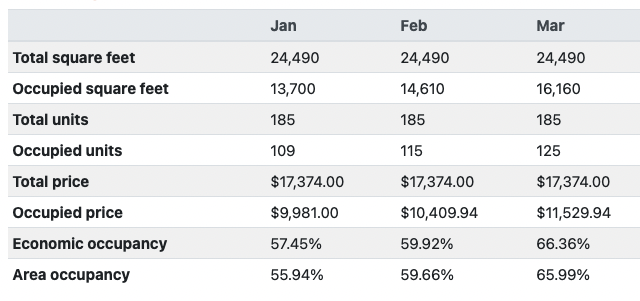

We paid $632k ($25.80 / sf) and bought it at a public auction.

It had $3,368 on the rent roll at closing.

We spent a week preparing for and organizing a public auction of the units. We got all the units cleared, cleaned, and ready to rent. https://twitter.com/i/status/1293716411903246337">https://twitter.com/i/status/...

It had $3,368 on the rent roll at closing.

We spent a week preparing for and organizing a public auction of the units. We got all the units cleared, cleaned, and ready to rent. https://twitter.com/i/status/1293716411903246337">https://twitter.com/i/status/...

We sent auction notices to every customer (using the best information we could find online or in the records).

Took photos, organized everything, and had a big online auction that brought in $8,000 in revenue. https://twitter.com/i/status/1293717347635802115">https://twitter.com/i/status/...

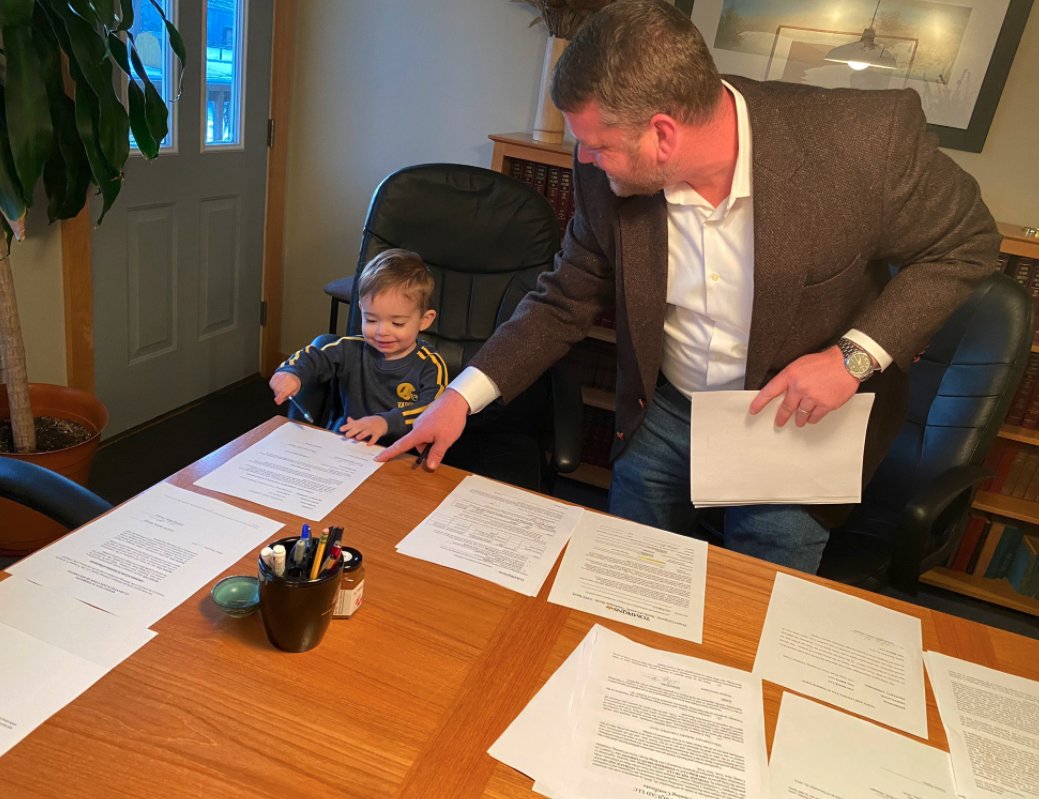

This is a photo I& #39;m excited to show my son someday.

He closed on his first property after a long day in the car!

He closed on his first property after a long day in the car!

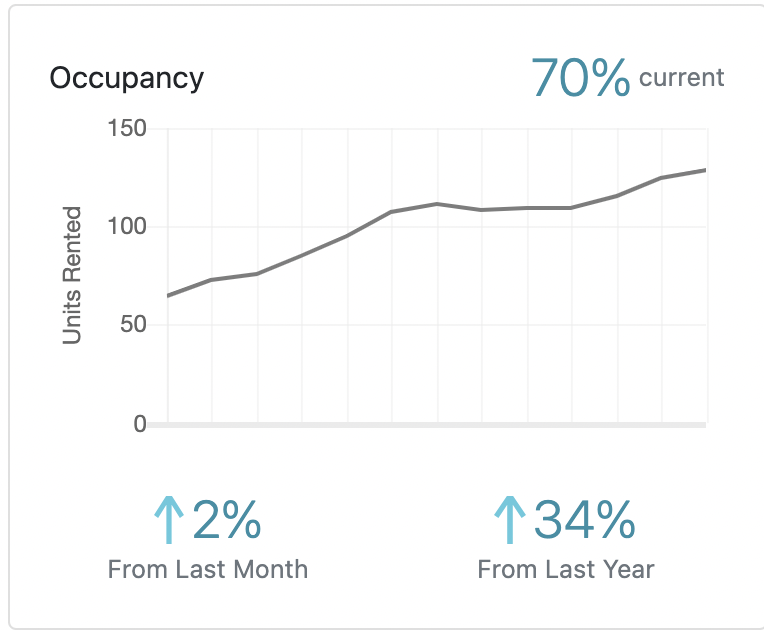

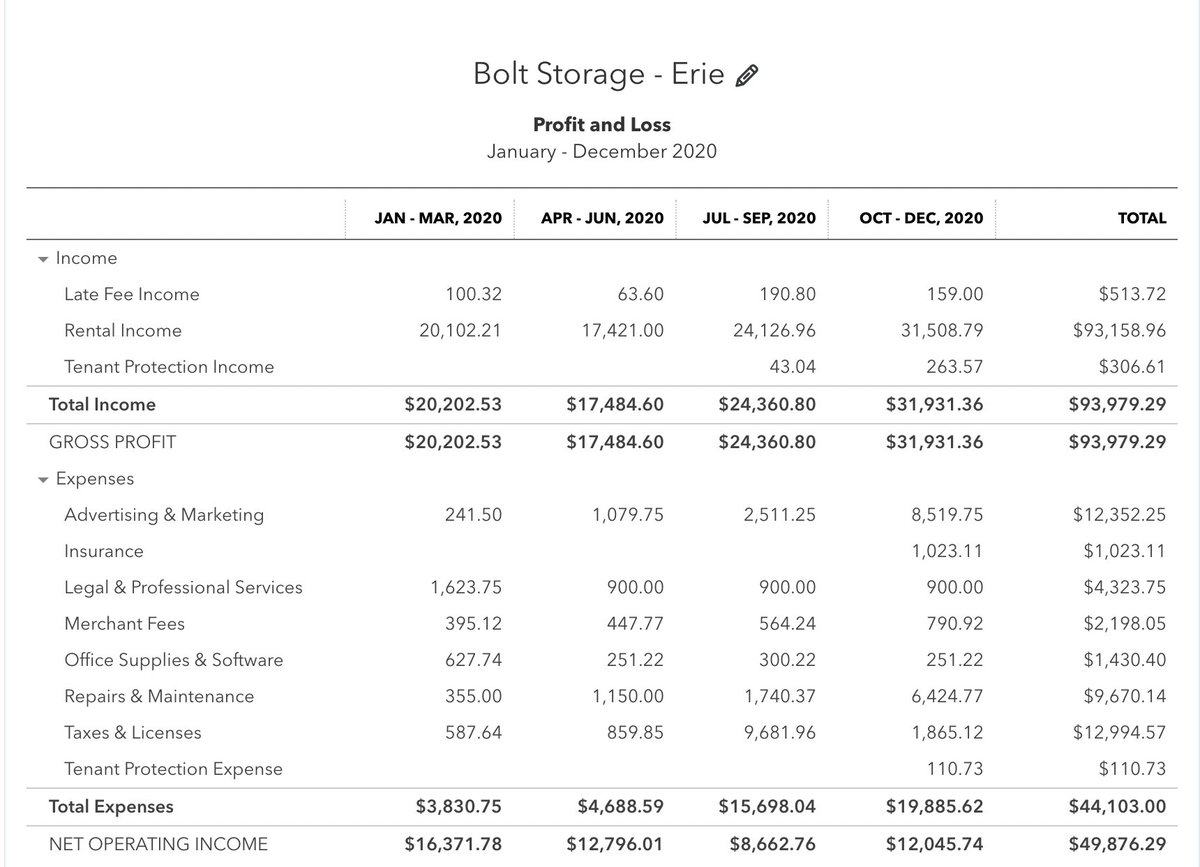

Today, more than 16 months later, we surpassed 70% occupancy today and we have $11,616 on the rent roll.

It’s getting harder / more uncomfortable to be as open as I’d like to be about the financials and inner workings of all my deals.

I’ll be launching a private real estate community in a few weeks!

Signup here to get updates when it launched. http://sweatystartup.substack.com"> http://sweatystartup.substack.com

I’ll be launching a private real estate community in a few weeks!

Signup here to get updates when it launched. http://sweatystartup.substack.com"> http://sweatystartup.substack.com

Read on Twitter

Read on Twitter