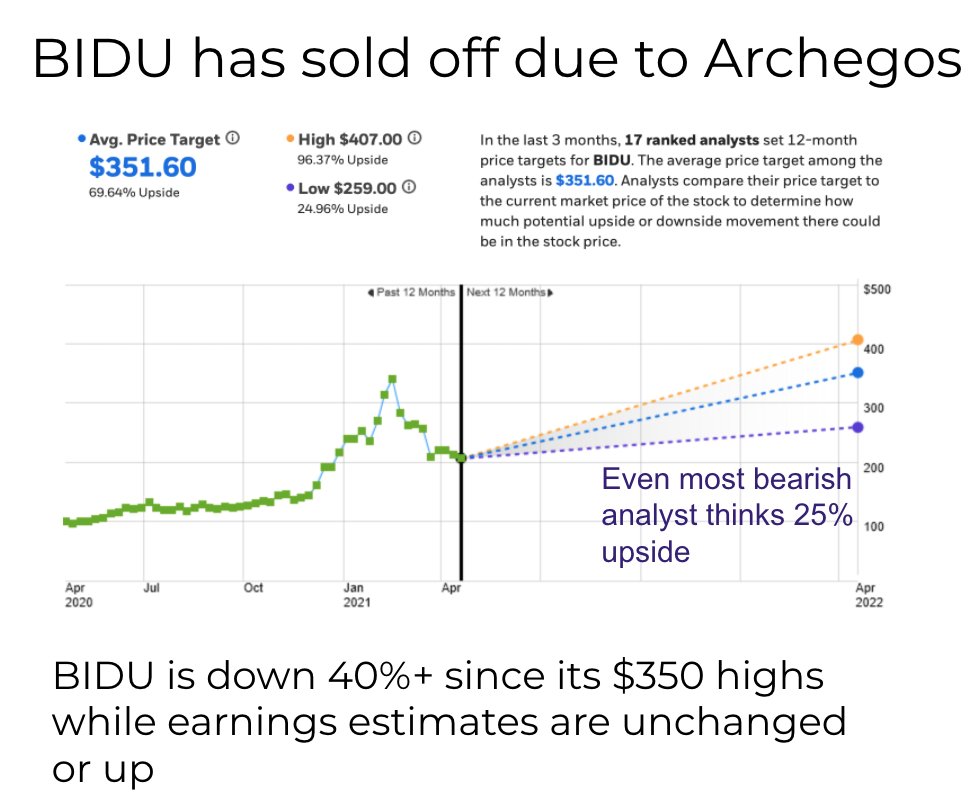

I have bought Baidu $BIDU $280 Calls, June 17 & #39;22 expiry. I think the end of the Archegos unwind, self-driving licensing and cloud/AI transition re-rating sends BIDU up 68% to the analyst price target of $350 within 12 months. A thread on why https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

1/ Chart: https://www.dankoptions.com/t/BIDU ">https://www.dankoptions.com/t/BIDU&qu...

1/ Chart: https://www.dankoptions.com/t/BIDU ">https://www.dankoptions.com/t/BIDU&qu...

2/ Bill Hwang& #39;s Archegos blew up, forcing liquidation of $3-4B of Baidu stock - sending the price from the $350 area to today& #39;s close of $208. Despite the sell off, analysts have barely changed 2022 EPS estimates even after meeting management several times. The story is in tact.

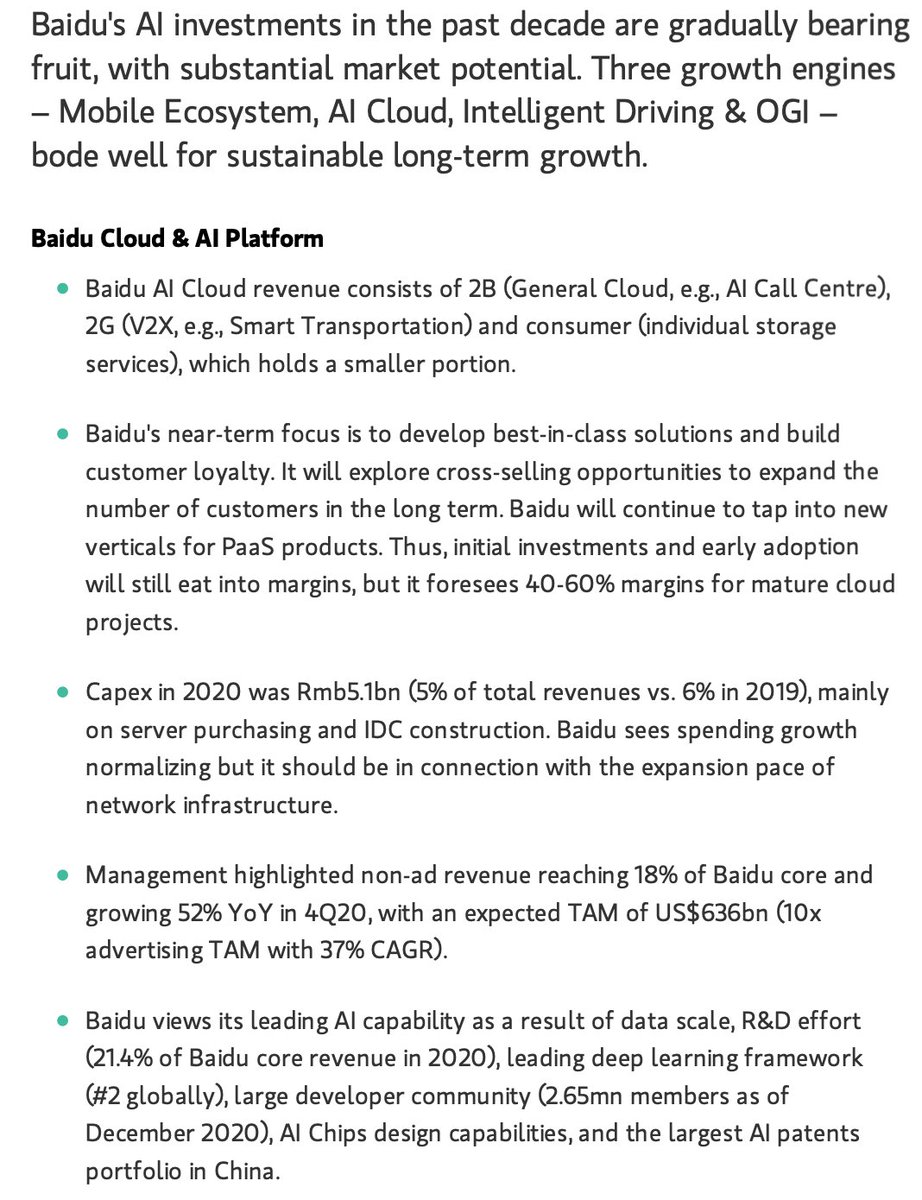

3/ Morgan Stanley, the bank who expertly mercked out Credit Suisse even had the stones to meet with Baidu management. Given their write up below and $300 price target representing 44% upside it is hard to see them *not upgrading the stock from neutral*. This is a clear catalyst.

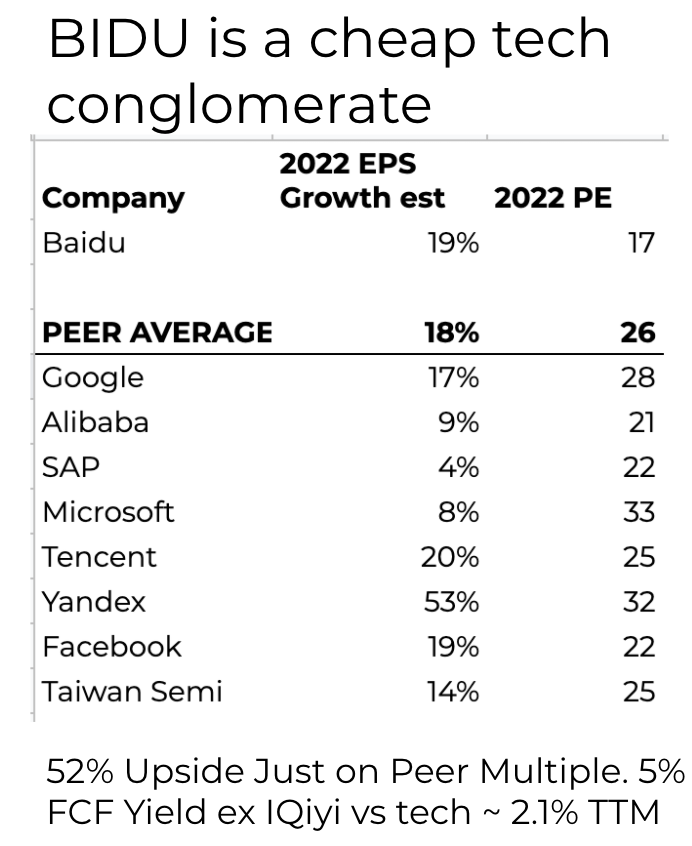

4/ Unlike many tech story stocks, Baidu has valuation support. It& #39;s likely to put up 19% EPS growth in 2022 vs its peers at 18% but only trades at 17x earnings vs an average of 26x earnings. With 13x TTM EBITDA with peers at 23.6x - the stock could trade up 50% and still be cheap

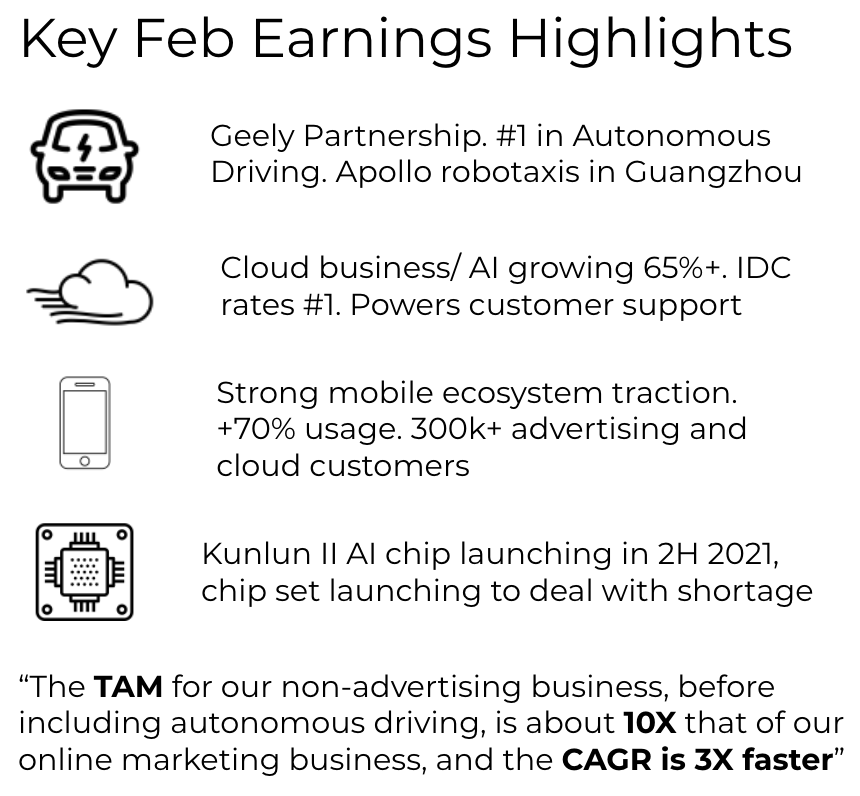

5/ The stock reminds me of Microsoft in 2014 before its cloud transition. Analysts didn& #39;t understand the fundamental story change / improved margin profile. BIDU& #39;s Feb earnings were filled with examples of a successful AI and Cloud pivot . It wasn& #39;t just Hwang buying at $350.

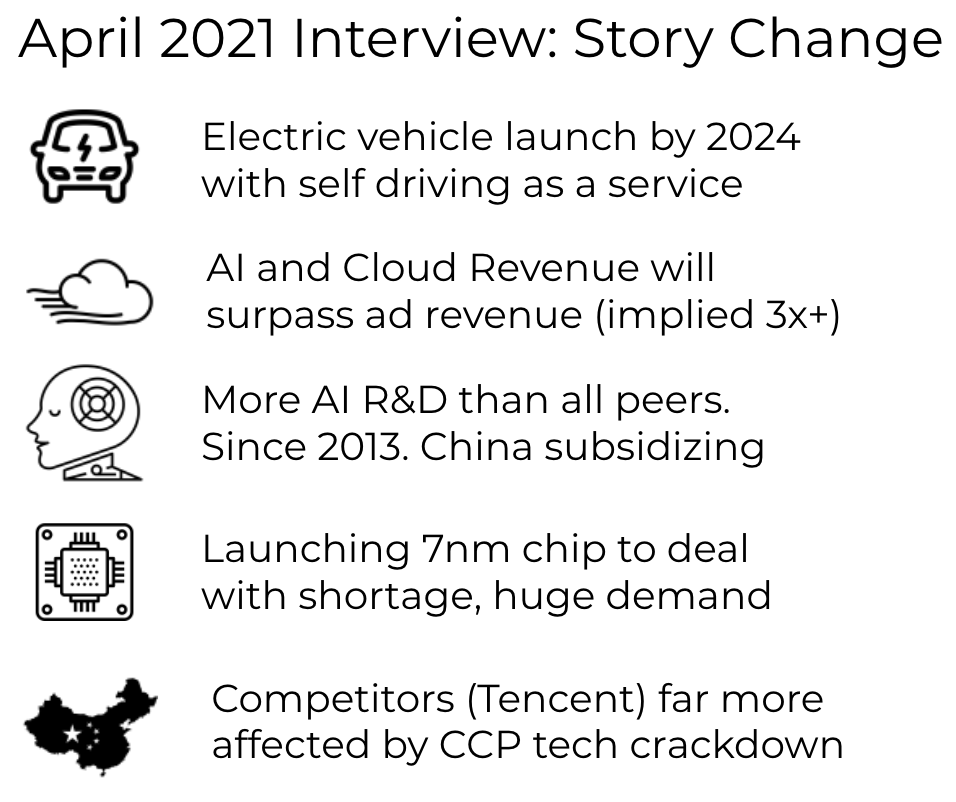

6/ I encourage you to watch this interview with Robin Li, the CEO of Baidu who gave April updates on the key developments. He confirmed huge traction for self driving as a service in China, and implied AI / Cloud billings would at least triple in 5 years. https://www.youtube.com/watch?v=g332_cRrr_M">https://www.youtube.com/watch...

7/ Some bearish analysts have backfit a story on BIDU& #39;s drop, fear mongering re: delisting of Chinese ADRs. I think this is silly. Biden slowed the Tik Tok ban, and Blackrock China is launching which signals a bullish view on accounting compliance PCAOB problems being resolved.

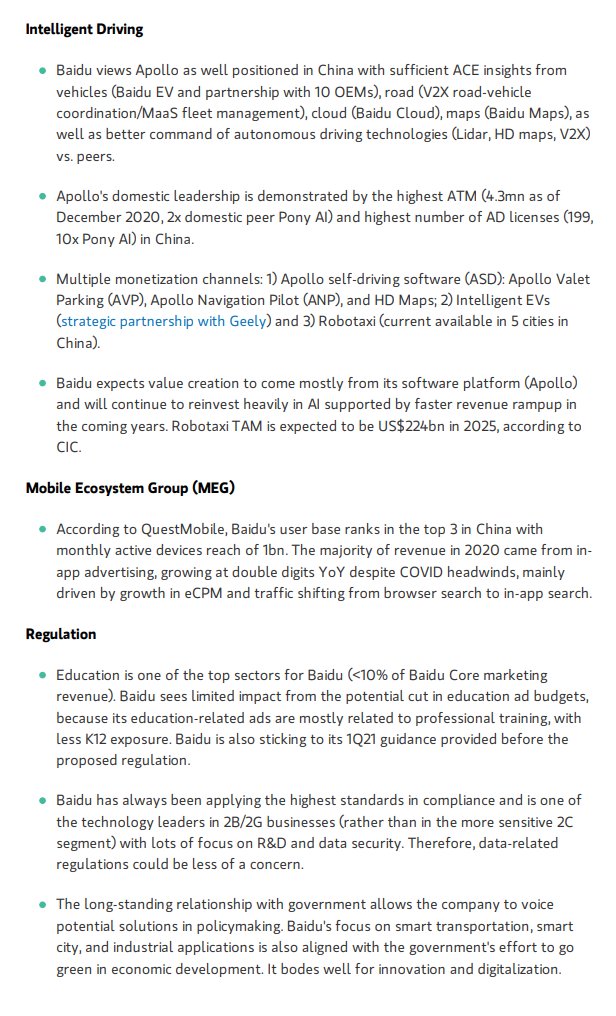

8/ Baidu& #39;s Apollo Self Driving as a Service will be live in 100 Chinese cities by 2023 and is approved for testing by the California DMV. Unlike Tesla, Baidu provides an AI dev platform for *all* OEMs which I& #39;d argue is a better business. Its ecosystem is already heavily adopted

9/ PaddlePaddle has 100,000 customers and 2.65 million active developers - which makes Baidu& #39;s cloud ecosystem one of the world& #39;s largest. China will likely encourage developers to churn from Microsoft accelerating growth further. XiaoDu and DuerOS are live consumer applications

10/ If you think Google will win in AI due to search, consider that Baidu has 544 million monthly active users for its search engine, 70% of whom login daily. IQiyi and YY provide a full consumer marketing ecosystem. Advertising consumers are also buying Baidu& #39;s cloud products

11/ Furthermore, Xi Jinping outlined a 5 Year Plan which focused on self driving and AI as core government R&D initiatives. China is planning on investing 2x Baidu& #39;s entire market cap every year on AI. Baidu is the single largest spender on AI R&D in China since 2013....

12/ Adding to the national R&D element, Robin Li stated that Baidu is set to launch a set of 7nm chips in China for cloud/AI customers in the second half of 2021. Given the current Chip shortage, this will provide a further catalyst to move Baidu higher https://www.cnbc.com/2021/03/16/baidu-ai-chip-unit-valued-at-2-billion-after-funding.html">https://www.cnbc.com/2021/03/1...

13/ Think about the next 12 months. You& #39;re going to have non-stop announcements from the Chinese government about R&D stimulus, and 5+ cities a month testing Baidu& #39;s self driving platform. Archegos will finish selling and a wave of upgrades will hit. You& #39;ll love to see it.

14/ Baidu puked due to Archegos. But Bill Hwang was probably right and the Baidu story is inflecting massively with Chinese govt stim, big wins in AI and self driving as catalysts.

In summary, I like the stock.

For more ideas like Baidu, check out https://www.dankoptions.com/trade-ideas ">https://www.dankoptions.com/trade-ide...

In summary, I like the stock.

For more ideas like Baidu, check out https://www.dankoptions.com/trade-ideas ">https://www.dankoptions.com/trade-ide...

Read on Twitter

Read on Twitter 1/ Chart: https://www.dankoptions.com/t/BIDU&qu..." title="I have bought Baidu $BIDU $280 Calls, June 17 & #39;22 expiry. I think the end of the Archegos unwind, self-driving licensing and cloud/AI transition re-rating sends BIDU up 68% to the analyst price target of $350 within 12 months. A thread on whyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">1/ Chart: https://www.dankoptions.com/t/BIDU&qu..." class="img-responsive" style="max-width:100%;"/>

1/ Chart: https://www.dankoptions.com/t/BIDU&qu..." title="I have bought Baidu $BIDU $280 Calls, June 17 & #39;22 expiry. I think the end of the Archegos unwind, self-driving licensing and cloud/AI transition re-rating sends BIDU up 68% to the analyst price target of $350 within 12 months. A thread on whyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">1/ Chart: https://www.dankoptions.com/t/BIDU&qu..." class="img-responsive" style="max-width:100%;"/>