In <3 weeks, @olympusDAO grew their protocol-owned value to $9.4M. But it really took off with launch of Sales/Bonds, growing from $1.3M to $9.4M (+723%) in 2 wks Tomorrow, they& #39;re launching the next iteration of Bonds to supercharge that growth. Let& #39;s explore the implications:

Today, treasury contract holds 214K DAI and 4.75 OHM-DAI SLP. This is 58% of all liquidity (presently at $15.9M) so the treasury holds $214K + $9.2M = $9.4M. Impressive but concerning that most of it is in $OHM, a early-stage volatile token. https://etherscan.io/address/0x886ce997aa9ee4f8c2282e182ab72a705762399d">https://etherscan.io/address/0...

To be honest with ourselves, we must consider the risk-free value of the pool. With DAI backing, that value is $1. Since SLP uses the typical x*y=k AMM bonding curve and each OHM is backed by DAI, the two token supply equal and we get 2*sqrt(k) as the risk-free value of the pool

2*sqrt(k) = 2*sqrt(supplyOHM*supplyDAI) = 2*sqrt(7987246 * 9767)= $559K. At 58% ownership, that& #39;s only $320K. Compare to our initial market-value assessment of $9.2M! https://etherscan.io/address/0x34d7d7aaf50ad4944b70b320acb24c95fa2def7c">https://etherscan.io/address/0...

That& #39;s why DAI bonds are so important to $OHM& #39;s evolution. @ohmzeus hinted at this as a form of risk reduction - DAI bonds give the treasury direct exposure to DAI diversifying the treasury away from OHM and toward the stablest asset. https://twitter.com/ohmzeus/status/1384567806952296450">https://twitter.com/ohmzeus/s...

Not only that but DAI bonds have a massive leverage on supply: by bonding DAI directly, the protocol is now minting OHM 1:1 rather than the risk-free value of SLP bonds. Depositing $1800 in SLP bonds would produce 60 OHM but depositing $1800 in DAI bonds produces 1800 OHM.

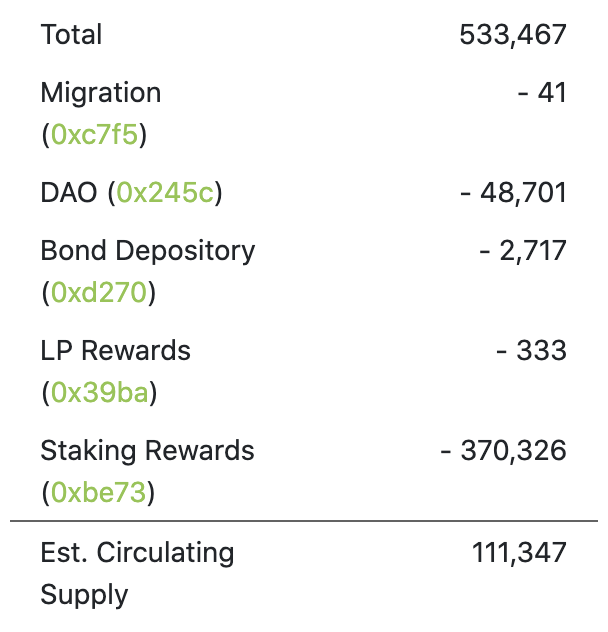

This, of course, significantly benefits $OHM holders. As the treasury ramps up supply production, most of this will be distributed to OHM stakers. Up until now, 370K of 533K tokens (or 69% of supply  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😏" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">) have been distributed as staking rewards.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😏" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">) have been distributed as staking rewards.

This is really really exciting: $DAI bonds reduce treasury volatility risk AND reward $OHM holders with more staking rewards. Put some shades on cause the future of Greece is bright  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Lächelndes Gesicht mit Sonnenbrille" aria-label="Emoji: Lächelndes Gesicht mit Sonnenbrille">

Read on Twitter

Read on Twitter ) have been distributed as staking rewards." title="This, of course, significantly benefits $OHM holders. As the treasury ramps up supply production, most of this will be distributed to OHM stakers. Up until now, 370K of 533K tokens (or 69% of supply https://abs.twimg.com/emoji/v2/... draggable="false" alt="😏" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">) have been distributed as staking rewards." class="img-responsive" style="max-width:100%;"/>

) have been distributed as staking rewards." title="This, of course, significantly benefits $OHM holders. As the treasury ramps up supply production, most of this will be distributed to OHM stakers. Up until now, 370K of 533K tokens (or 69% of supply https://abs.twimg.com/emoji/v2/... draggable="false" alt="😏" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">) have been distributed as staking rewards." class="img-responsive" style="max-width:100%;"/>