"There was a sense in which the Fed in particular was deliberately trying to ignore the reality of inflation of housing costs or just hoping that people wouldn& #39;t notice, because it went against the general narrative of what their policy was attempting to achieve."

- Nick Halaris

- Nick Halaris

"We were at the time investing in value-add multifamily properties in Atlanta, and we were buying properties where the rent would be $500, for example, for one bedroom, and by the time we sold it, it would be like $1000. This was happening in just a number of years." @RealVision

"I started noticing that there was this disconnect between the popular narratives in the market, which is that quantitative easing is relatively benign when it comes to inflation, and what I was seeing in real estate, which was like massive inflationary forces."

- Nick Halaris

- Nick Halaris

"I was seeing real life inflation in the cost of living, like 100%. Meanwhile, we were getting CPI prints that look below 2% and we& #39;re talking about this permanently low inflation problem that we were having."

"I think now, it& #39;s getting to a point where it& #39;s hard to ignore when the median house is up 15% or 20% year-on-year, up to 340,000 from where before it was in the two hundreds. They& #39;re starting to lose control of this narrative."

- Nick Halaris on @RealVision

- Nick Halaris on @RealVision

"One of the fascinating things I found was that in the CPI calculation methodology, they have this concept called owners& #39; equivalent rent." https://twitter.com/RudyHavenstein/status/1113873848481402880">https://twitter.com/RudyHaven...

"I& #39;m not a believer in conspiracy theories [𝘐 𝘢𝘮 - 𝘙𝘏] but I do think that the runaway inflation, what I consider to be runaway inflation in housing is something that the Fed in particular and the government in general was trying to avoid because it& #39;s a serious problem" -NH

"...you start to think about life, okay, so if your house is up 100%, the cost of education is up 100%, healthcare, I don& #39;t know how the CPI could be registering under 2%. It makes no sense, really."

cc @federalreserve @BLS_gov @neelkashkari

cc @federalreserve @BLS_gov @neelkashkari

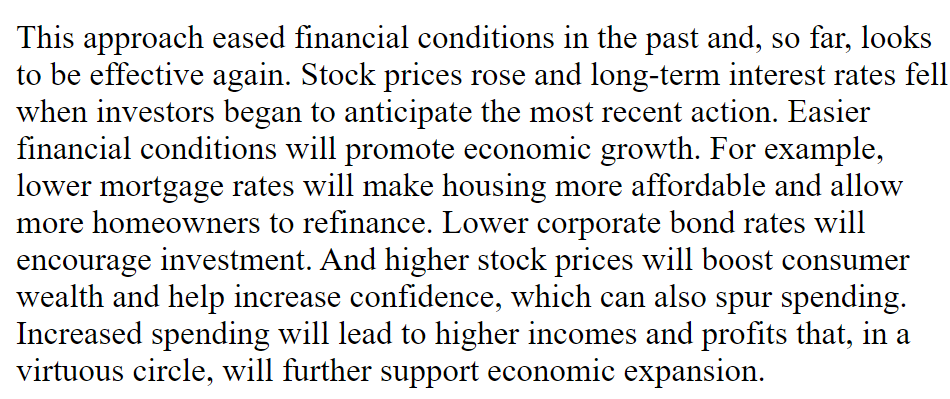

"As I started to think about the whole issue, it brought me back to QE and it brought me back to the original intent of the program. I think that that& #39;s where the secret lies in this whole thing." #QE #ZIRP #FedHistory https://twitter.com/RudyHavenstein/status/777877839009816578">https://twitter.com/RudyHaven...

Bernanke (Citadel/Pimco), 2010

https://www.washingtonpost.com/wp-dyn/content/article/2010/11/03/AR2010110307372.html">https://www.washingtonpost.com/wp-dyn/co...

https://www.washingtonpost.com/wp-dyn/content/article/2010/11/03/AR2010110307372.html">https://www.washingtonpost.com/wp-dyn/co...

https://twitter.com/RudyHavenstein/status/1046890535695278080">https://twitter.com/RudyHaven...

"Wealth inequality is a product of many years of policy, but in particular, this QE policy. The intent of it was...this trickledown effect on the economy."

- Nick Halaris on Realvision #FedHistory

- Nick Halaris on Realvision #FedHistory

"Real estate is such a huge piece of the spending...it& #39;s so dangerous from an inflationary standpoint. If you take a big city where people are spending...50% of income on housing, & you put some inflation into that, it gets really dangerous for standard of living very quickly."

I& #39;m only 1/3 of the way through the Realvision interview, but as far as the inflation part, so far, @NickHalaris seems to understand what most pundits don& #39;t seem to [want] to understand. Very nice. @JackFarley96

Read on Twitter

Read on Twitter

!["I& #39;m not a believer in conspiracy theories [𝘐 𝘢𝘮 - 𝘙𝘏] but I do think that the runaway inflation, what I consider to be runaway inflation in housing is something that the Fed in particular and the government in general was trying to avoid because it& #39;s a serious problem" -NH "I& #39;m not a believer in conspiracy theories [𝘐 𝘢𝘮 - 𝘙𝘏] but I do think that the runaway inflation, what I consider to be runaway inflation in housing is something that the Fed in particular and the government in general was trying to avoid because it& #39;s a serious problem" -NH](https://pbs.twimg.com/media/EzcK9YeVUAMubXl.jpg)