Income tax finally making an appearance in the #Senedd2021 campaign

We’ll be analysing the fiscal plans of the main parties over the next week.

My thoughts on this announcement, the claims made yesterday, and income tax in this election, to follow… https://www.bbc.co.uk/news/uk-wales-politics-56801454">https://www.bbc.co.uk/news/uk-w...

We’ll be analysing the fiscal plans of the main parties over the next week.

My thoughts on this announcement, the claims made yesterday, and income tax in this election, to follow… https://www.bbc.co.uk/news/uk-wales-politics-56801454">https://www.bbc.co.uk/news/uk-w...

2/ The Welsh Conservatives promise a 1p cut in the basic rate of income tax, by 2025. This is contingent on meeting their target of 65,000 new jobs over the next Senedd term. The cost of such a tax cut in 2025 would be ≈£220m on current forecasts.

3/ This is much smaller than the 2016 offer of cutting 2p from basic rate and 5p from higher rate.

That would have cost ≈£489m a year in the context of further *planned* cuts to the Welsh block grant.

Signals the huge shift in circumstances and thinking https://www.bbc.co.uk/news/election-2016-wales-36192720">https://www.bbc.co.uk/news/elec...

That would have cost ≈£489m a year in the context of further *planned* cuts to the Welsh block grant.

Signals the huge shift in circumstances and thinking https://www.bbc.co.uk/news/election-2016-wales-36192720">https://www.bbc.co.uk/news/elec...

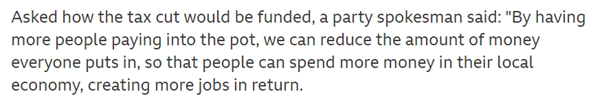

4/ Is the tax cut “affordable”? The cost will apparently be funded by the additional jobs created over the next few years. However, this is unlikely to be the case, and implementing the tax cut will require cutting back on devolved services …

5/ Firstly, 65,000 additional jobs - on average annual earnings - would yield around ≈£88m in devolved income taxes, so far less than the cost of the tax cut to begin with.

6/ Secondly, the fiscal framework means it is the *relative* growth in the devolved tax base which matters, not overall growth. The Block Grant Adjustment (amounts taken away from the block grant to reflect tax devolution) grows in line with comparable UK government revenues…

7/ ... If the Conservative government manages similar growth in jobs in England and NI, then the net effect on the Welsh budget will be 0. Relying on this suggests a dim view of the economic competence of the Westminster government.

8/ Moreover, any positive behavioural effect *after* the tax cut will likely only cover a fraction of the cost of the tax cut. See: https://www.cardiff.ac.uk/__data/assets/pdf_file/0019/2413261/Income_Tax_Inquiry_Submission_22012020.pdf">https://www.cardiff.ac.uk/__data/as...

9/ There are huge post-pandemic spending pressures and UK gov spending plans have already been reined back significantly. There are difficult trade-offs facing the next Welsh Government, and tax cuts will need to be balanced against these.

10/ Meanwhile, the Conservatives’ claim from yesterday of a "£1,084 tax bombshell” under Labour is difficult to take seriously, and based on 4 invented tax policies which do not appear in any manifesto. https://twitter.com/WelshConserv/status/1384062166471385090?s=20">https://twitter.com/WelshCons...

11/ The Labour manifesto rules out income tax increases over coming years, citing the economic impact of the pandemic.

However, we can’t say *a priori* that an income tax increase would have a further negative economic effect. https://www.bbc.co.uk/news/uk-wales-politics-56667000">https://www.bbc.co.uk/news/uk-w...

However, we can’t say *a priori* that an income tax increase would have a further negative economic effect. https://www.bbc.co.uk/news/uk-wales-politics-56667000">https://www.bbc.co.uk/news/uk-w...

12/ The fall in private disposable income would be matched exactly by an increase in government spending. The net effect would be determined by which multiplier effect is the largest.

13/ Plaid Cymru’s manifesto makes no reference at all to income tax - though there is mention of using “general taxation” to fund social care.

14/ Given current UK government spending plans, devolved income tax rates could play an important part in meeting spending pressures, funding enhanced public services and/or relieving the need for further regressive increases in Council Tax levels.

15/ Those hoping for a rounded discussion of the trade-offs in using income tax powers to fund devolved services at this election will be disappointed. The vision of the Holtham and Silk commissions of income tax powers transforming election debate has not transpired.

16/ There is plenty more to discuss on all the parties’ fiscal plans – from costings (or lack thereof), assumptions underpinning spending plans, to other tax proposals.

Join us next week to look at the manifestos and the fiscal outlook – sign up here: https://cardiff.zoom.us/webinar/register/WN_CUsggTzlToegVe3AuLpfTQ">https://cardiff.zoom.us/webinar/r...

Join us next week to look at the manifestos and the fiscal outlook – sign up here: https://cardiff.zoom.us/webinar/register/WN_CUsggTzlToegVe3AuLpfTQ">https://cardiff.zoom.us/webinar/r...

Read on Twitter

Read on Twitter