GUEST THREAD about.... Buying Businesses.

*How to find a business to buy

*How to finance it so you only put down ~10% or less

*How to grow it

*How to sell it for a profit.

Handing the mic to my buddy @SievaKozinsky who does this for a living....

*How to find a business to buy

*How to finance it so you only put down ~10% or less

*How to grow it

*How to sell it for a profit.

Handing the mic to my buddy @SievaKozinsky who does this for a living....

OK - let& #39;s say you wanted to buy a business and make $1M in the next 18 months.

Here& #39;s the playbook:

Here& #39;s the playbook:

STEP 1 - Finding a Biz.

I recommend focusing on a space like "Home Services"

* landscaping

* HVAC

* Plumbing

* Electrical contractor

These businesses are profitable, you don& #39;t compete with FB/Amazon, and there are lots of bigger buyers when you want to sell.

I recommend focusing on a space like "Home Services"

* landscaping

* HVAC

* Plumbing

* Electrical contractor

These businesses are profitable, you don& #39;t compete with FB/Amazon, and there are lots of bigger buyers when you want to sell.

The sweet-spot size would be:

$1.5M in revenue

$250k in EBITDA

That gives you enough cash to make it worth your time, while still being small enough to get it at an affordable price.

Here& #39;s an example of an HVAC company. A wonderful boring business.

$1.5M in revenue

$250k in EBITDA

That gives you enough cash to make it worth your time, while still being small enough to get it at an affordable price.

Here& #39;s an example of an HVAC company. A wonderful boring business.

HOW MUCH IS IT WORTH?

You should be able to get the business for 2-2.5x EBITDA mutiple ($500-$650k)

The deal in the screenshot above was asking for $450k.

We& #39;ll be able to negotiate ~10% off the asking price - So let& #39;s say $425k

You should be able to get the business for 2-2.5x EBITDA mutiple ($500-$650k)

The deal in the screenshot above was asking for $450k.

We& #39;ll be able to negotiate ~10% off the asking price - So let& #39;s say $425k

We will use an SBA loan to buy it.

SBA is great - BUT you have to personally guarantee the loan. That& #39;s why we make sure to buy a durable business that won& #39;t dissapear over night.

Personal guarantees can be scary - but sometimes you gotta risk it for the biscuit.

SBA is great - BUT you have to personally guarantee the loan. That& #39;s why we make sure to buy a durable business that won& #39;t dissapear over night.

Personal guarantees can be scary - but sometimes you gotta risk it for the biscuit.

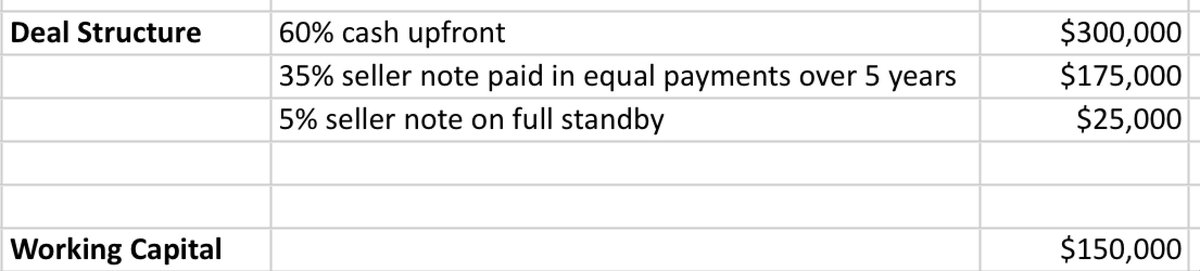

STRUCTURING THE DEAL

SBA will require we put in 10% equity, , and they will cover the other 90%

So let& #39;s say the business costs $425k, roughly

$385k from SBA

$40k from us

But it gets better, due to something called "seller financing"..

SBA will require we put in 10% equity, , and they will cover the other 90%

So let& #39;s say the business costs $425k, roughly

$385k from SBA

$40k from us

But it gets better, due to something called "seller financing"..

Basically - we will tell the seller:

* you get 60% of the purchase price up front

* the other 35% will be paid out over 5 years

* and 5% is on "Full Standby" (google it)

The beauty of this is that it gives us $150k of working capital to grow the business

* you get 60% of the purchase price up front

* the other 35% will be paid out over 5 years

* and 5% is on "Full Standby" (google it)

The beauty of this is that it gives us $150k of working capital to grow the business

Plus - the 5% that& #39;s on "Full Standby" is considered equity by the SBA, so that means we only need 5% total out of pocket (just $25k)

OK now time to grow the business.

We take the $150k of working cpaital, and invest in some additional trucks or technicians + marketing.

Usually these types of old school service companies haven& #39;t done much marketing.

We take the $150k of working cpaital, and invest in some additional trucks or technicians + marketing.

Usually these types of old school service companies haven& #39;t done much marketing.

Our goal is to get to $2.6M in revenue run rate in the next 18 months. Time to sprint!

Before the deal even closes, we start buying trucks and hiring more technicians. Our target is $250k revenue per technician.

With 10-11 technicians, we can hit $2.6M in revenu

Before the deal even closes, we start buying trucks and hiring more technicians. Our target is $250k revenue per technician.

With 10-11 technicians, we can hit $2.6M in revenu

Next we ADD SYSTEMS.

During the LOI phase of negotiations, spend a few days shadowing a business using Service Titan.

The single best system you can implement is using Service Titan. This adds efficiency and customers like it too.

During the LOI phase of negotiations, spend a few days shadowing a business using Service Titan.

The single best system you can implement is using Service Titan. This adds efficiency and customers like it too.

In the HVAC biz, you figure out your blueprint:

Eg. The average revenue per visit:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔧" title="Schraubenschlüssel" aria-label="Emoji: Schraubenschlüssel"> Maintenance:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔧" title="Schraubenschlüssel" aria-label="Emoji: Schraubenschlüssel"> Maintenance:

Residential - $350

Commercial - $2,000

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Replacement

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> Replacement

Residential - $7,000

Commercial - $26,000

So you calculate "we need X visits a month to hit our revenue goals. "

Eg. The average revenue per visit:

Residential - $350

Commercial - $2,000

Residential - $7,000

Commercial - $26,000

So you calculate "we need X visits a month to hit our revenue goals. "

SEO

Are you ranking on Google for your name and key terms like “Air Conditioning maintenance in {{CITY_NAME}” ?

If not, you need to invest in SEO.

There are some simple things you can do, but frankly I recommend White Label SEO Firm (google it) for local SEO

Are you ranking on Google for your name and key terms like “Air Conditioning maintenance in {{CITY_NAME}” ?

If not, you need to invest in SEO.

There are some simple things you can do, but frankly I recommend White Label SEO Firm (google it) for local SEO

Reviews

If you have less than 100 reviews and less than 4.5 stars, you need to collect reviews immediately.

Use this tool, which will automate your review collection through Service Titan http://birdeye.com/integration/servicetitan">https://birdeye.com/integrati...

If you have less than 100 reviews and less than 4.5 stars, you need to collect reviews immediately.

Use this tool, which will automate your review collection through Service Titan http://birdeye.com/integration/servicetitan">https://birdeye.com/integrati...

Ok, 12 months have passed and you’ve grown revenue a ton.

You’re at $2.3mm in revenue run-rate.

Yay

Don’t slow down yet.

Call the same broker who sold you your business and ask them to start marketing your company (expect to pay 5-7% of the deal for this); Takes a few months

You’re at $2.3mm in revenue run-rate.

Yay

Don’t slow down yet.

Call the same broker who sold you your business and ask them to start marketing your company (expect to pay 5-7% of the deal for this); Takes a few months

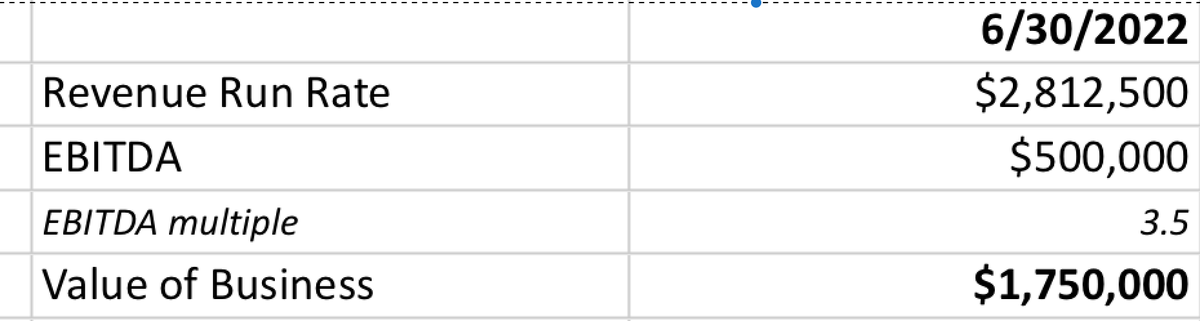

The 18-month mark is here.

You’re at $2.8 Million in revenue with $500k in EBITDA.

The business should easily sell for $1.75 mm

You’re at $2.8 Million in revenue with $500k in EBITDA.

The business should easily sell for $1.75 mm

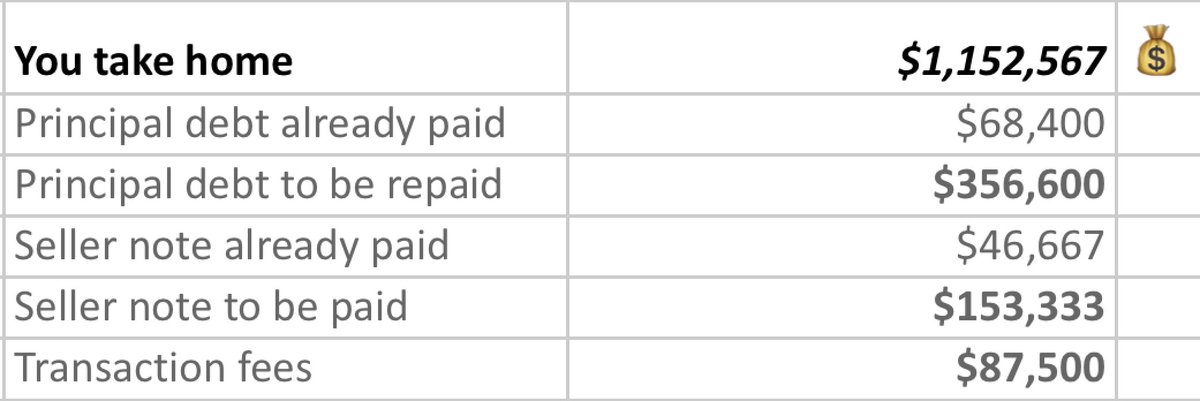

Use that money to pay off the SBA debt, and the seller note.

And you keep $1.1 Million https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">

Looks like this ↓

And you keep $1.1 Million

Looks like this ↓

the end. Let me know if you want more guest threads.

Go follow @SievaKozinsky for more posts like this https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">

Go follow @SievaKozinsky for more posts like this

Read on Twitter

Read on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Looks like this ↓" title="Use that money to pay off the SBA debt, and the seller note.And you keep $1.1 Million https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Looks like this ↓" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Looks like this ↓" title="Use that money to pay off the SBA debt, and the seller note.And you keep $1.1 Million https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Geldsack" aria-label="Emoji: Geldsack">Looks like this ↓" class="img-responsive" style="max-width:100%;"/>