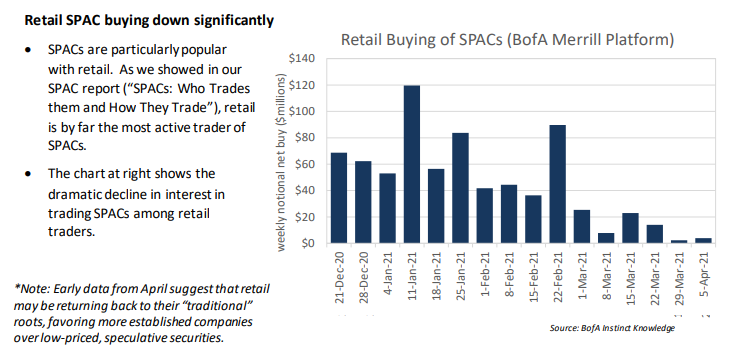

0/ The retail bid has disappeared from the SPAC market which was an anomaly itself as opposed to the norm.

This has caused SPACs with & without deals (prior to closure) to underperform the broader growth sell-off since mid-Feb & now most are trading +/- 2% from NAV.

This has caused SPACs with & without deals (prior to closure) to underperform the broader growth sell-off since mid-Feb & now most are trading +/- 2% from NAV.

1/ Historically there was a decent bid at the IPO by merger arb funds given the "free put" option to redeem at par coupled the warrants & timeclock on the sponsors leading to attractive IRRs vs. cash. This is why low rates helped fuel the boom.

2/ When the retail bid started to come in last summer / fall arbs were able to increase their participation as these IRR& #39;s were being pulled forward (e.g., they didn& #39;t have to wait for deal announcement for some of these SPAC& #39;s to trade at a 3-10% premium to trust value).

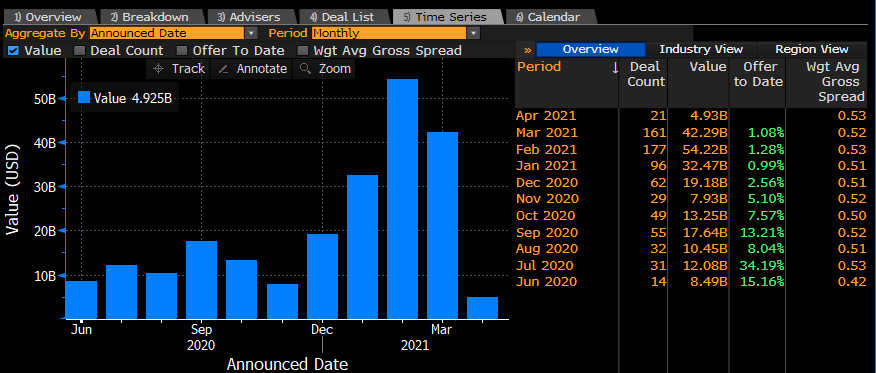

3/ You also saw increased IPO participation from HF& #39;s & LO& #39;s who were becoming active PIPE participants look to capitalize on this which led to even greater SPAC issuance peaking with $54B in Feb & #39;21.

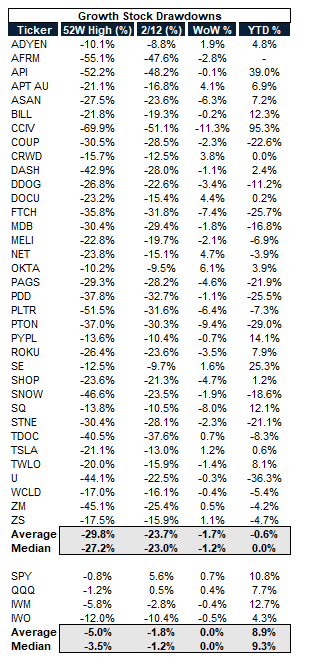

4/ When growth stocks started to sell off in Feb both the retail + inst& #39;l community cut low conviction SPAC positions first. With high profile growth names down 20-30% you saw these names go down even more.

5/ The issuance calendar was a bit slow to cut and now the cadence of new SPAC IPO& #39;s in April is on track for the lowest month since last June; while PIPEs have been in market longer & longer.

6/ Now there& #39;s only a handful of unannounced SPACs trading at a ~5%+ premium to NAV (these #s have come in slightly since last week) https://twitter.com/JulianKlymochko/status/1383833846852947981?s=20">https://twitter.com/JulianKly...

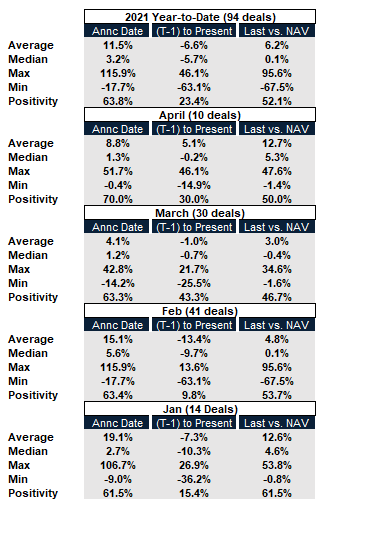

7/ There were a number of deals announced in Feb / March that are trading below trust with concerns about redemptions from shareholders resulting in deal cuts & waiver of minimum cash conditions to just the total that was committed from PIPE participants.

8/ If out year-projections were predicated on the total cash raise and now that cash # might be cut in half or more how should that be reflected in price?

9/ The market has started to adjust & the "free ride" of 2H20-early 1Q21 of every deal rallying +10-15% on announcement is gone.

You can see the avg deal move on annc in Jan was +19.1%, Feb +15.1%, March +4.1%, April +8.9% to date.

You can see the avg deal move on annc in Jan was +19.1%, Feb +15.1%, March +4.1%, April +8.9% to date.

10/ As the market starts to regain rationality the underwriting bar needs to revert back to the pre 2Q21 highs on the investment merits of the deal / sponsor / alignment of incentives.

Read on Twitter

Read on Twitter