UPDATE **4/19 2021**

(1/6)

-I am a huge bull for $VIAC & $ROKU.

-The market understands the $ROKU thesis while for $VIAC they do not.

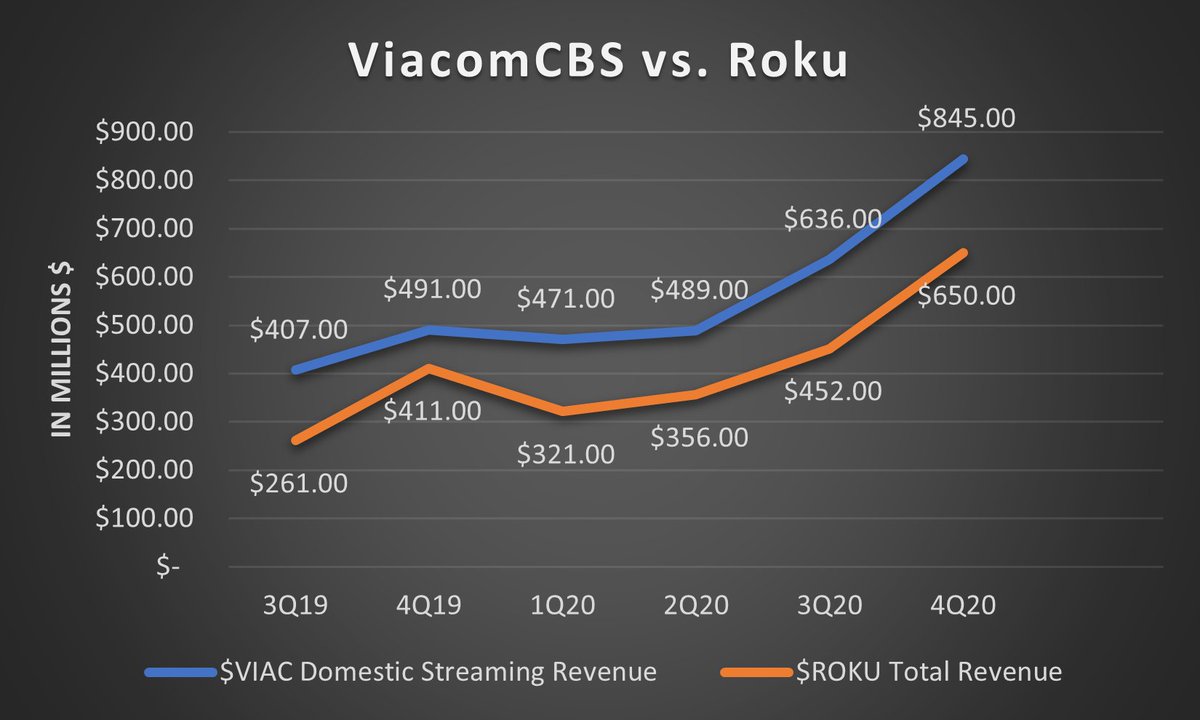

-In this chart below, I compare $ROKU& #39;s TOTAL revenue to STRICTLY $VIAC& #39;s DOMESTIC streaming revenue (just 10% of the company revenue) https://twitter.com/AlanSoclof/status/1347363950925635586">https://twitter.com/AlanSoclo...

(1/6)

-I am a huge bull for $VIAC & $ROKU.

-The market understands the $ROKU thesis while for $VIAC they do not.

-In this chart below, I compare $ROKU& #39;s TOTAL revenue to STRICTLY $VIAC& #39;s DOMESTIC streaming revenue (just 10% of the company revenue) https://twitter.com/AlanSoclof/status/1347363950925635586">https://twitter.com/AlanSoclo...

(2/6)

-P+, ShowtimeOTT, Noggin & PlutoTV has $VIAC Domestic streaming doing more rev than all of $ROKU

- Yet, $ROKU has nearly a $20 Bill greater market cap than $VIAC

- if $VIAC domestic streaming was its own entity, what would its valuation be?

-P+, ShowtimeOTT, Noggin & PlutoTV has $VIAC Domestic streaming doing more rev than all of $ROKU

- Yet, $ROKU has nearly a $20 Bill greater market cap than $VIAC

- if $VIAC domestic streaming was its own entity, what would its valuation be?

(3/6)

-I understand there are major differences between $ROKU and $VIAC (i.e.- $ROKU as THE platform) but there are also many similarities that include FAST (AVOD), possibly content creation (as $ROKU has hinted), and overall serious players in streaming industry.

-I understand there are major differences between $ROKU and $VIAC (i.e.- $ROKU as THE platform) but there are also many similarities that include FAST (AVOD), possibly content creation (as $ROKU has hinted), and overall serious players in streaming industry.

(4/6)

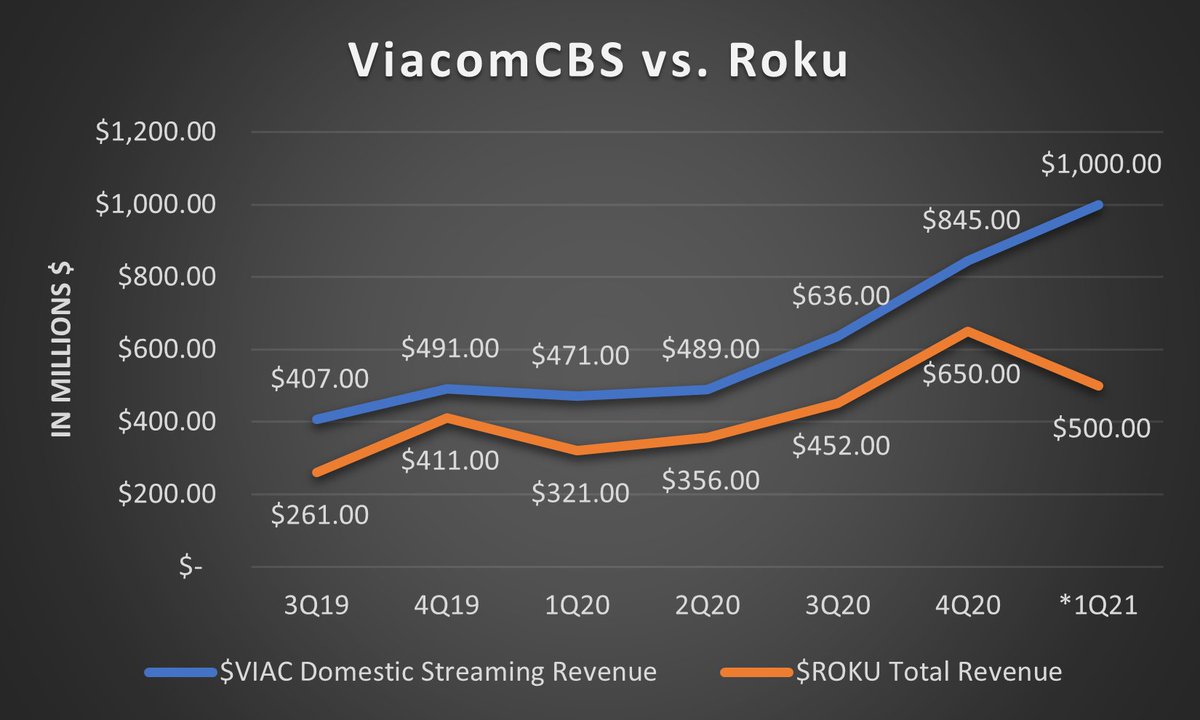

-1Q21 is where things can get really interesting. $ROKU shared that they are expecting $478-$493 mill in Q1 revenue- A drop from Q4 of $678 due to seasonality of ad spend

- $VIAC on the other hand will likely see domestic streaming rev growth due to the base of paid subs

-1Q21 is where things can get really interesting. $ROKU shared that they are expecting $478-$493 mill in Q1 revenue- A drop from Q4 of $678 due to seasonality of ad spend

- $VIAC on the other hand will likely see domestic streaming rev growth due to the base of paid subs

(5/6)

- I anticipate $VIAC domestic streaming to over (maybe well over) $1 Bill for the quarter (feel free to dm me for how I got this)

- If $ROKU does $500 mill in Q1 Rev while $VIAC does over $1 Bill in rev in Q1 look what happens to my chart

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

- I anticipate $VIAC domestic streaming to over (maybe well over) $1 Bill for the quarter (feel free to dm me for how I got this)

- If $ROKU does $500 mill in Q1 Rev while $VIAC does over $1 Bill in rev in Q1 look what happens to my chart

Read on Twitter

Read on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">" title="(5/6)- I anticipate $VIAC domestic streaming to over (maybe well over) $1 Bill for the quarter (feel free to dm me for how I got this)- If $ROKU does $500 mill in Q1 Rev while $VIAC does over $1 Bill in rev in Q1 look what happens to my charthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">" title="(5/6)- I anticipate $VIAC domestic streaming to over (maybe well over) $1 Bill for the quarter (feel free to dm me for how I got this)- If $ROKU does $500 mill in Q1 Rev while $VIAC does over $1 Bill in rev in Q1 look what happens to my charthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">" class="img-responsive" style="max-width:100%;"/>