Squarespace has crossed $700,000,000 ARR selling just to SMBs, still growing 30% (!)

Enterprise is < 1% of their business

But without the commerce boom, growth would have been much slower

5 Interesting Learnings: https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

Enterprise is < 1% of their business

But without the commerce boom, growth would have been much slower

5 Interesting Learnings:

#1. Over $500,000 revenue per employee

Squarespace has 1,200 employees and $700m in ARR. That’s pretty darn efficient

As a result, it’s quite profitable, with $150m in free cash flow in 2020

When your CAC is low, it can be done

Squarespace has 1,200 employees and $700m in ARR. That’s pretty darn efficient

As a result, it’s quite profitable, with $150m in free cash flow in 2020

When your CAC is low, it can be done

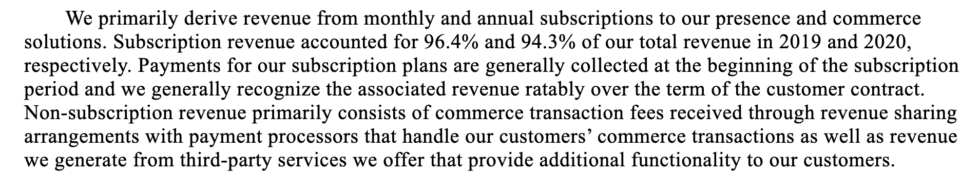

#2. Monetizing ecommerce via subscriptions, but not payment processing

Squarespace rapidly expanded into ecommerce, with $3.9 Billion in GMV, up a stunning 91% from 2019. But in contrast to Wix & Shopify, it doesn’t keep much of the revenue from merchant services itself

Squarespace rapidly expanded into ecommerce, with $3.9 Billion in GMV, up a stunning 91% from 2019. But in contrast to Wix & Shopify, it doesn’t keep much of the revenue from merchant services itself

Rather, it charges for software subscriptions to take payments on its websites.

This ecommerce revenue was $143m in 2020, about 22% of total revenue. But it doesn’t monetize the payments themselves directly very much, unlike Wix

As a result, its margins are higher

This ecommerce revenue was $143m in 2020, about 22% of total revenue. But it doesn’t monetize the payments themselves directly very much, unlike Wix

As a result, its margins are higher

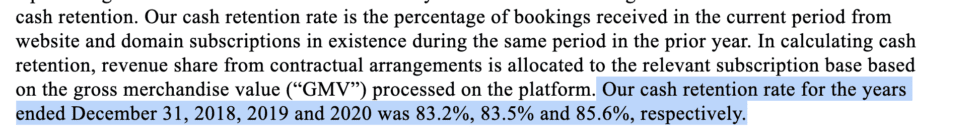

#3. 85% NRR. Common for self-service & SMBs, but pretty low for public SaaS company

Most higher-churn SaaS & self-serv companies seem to obscure, or at least, not highlight any NRR below 100%.

Wix doesn’t disclose its churn, but it’s likely similar.

Most higher-churn SaaS & self-serv companies seem to obscure, or at least, not highlight any NRR below 100%.

Wix doesn’t disclose its churn, but it’s likely similar.

#4. 70% annual, 30% monthly subscriptions.

Helpful to see, and not inconsistent with other similar self-serve webservices that offer discounts to go annual.

Helpful to see, and not inconsistent with other similar self-serve webservices that offer discounts to go annual.

#5. Seasonality: Q1 and Q3 are their strongest quarters.

Squarespace still sees seasonality even at $700m ARR, with Q1 benefitting from new marketing spend at the start of the year, and Q3 benefitting from a holiday rush.

So seasonality is real here at scale.

Squarespace still sees seasonality even at $700m ARR, with Q1 benefitting from new marketing spend at the start of the year, and Q3 benefitting from a holiday rush.

So seasonality is real here at scale.

And a few bonus learnings:

#6. Growth would be mediocre without ecommerce.

Websites revenue (so-called “presence” revenue) only grew 18% -- while ecommerce revenue grew 78%.

Blended together, that worked out to 28% growth

#6. Growth would be mediocre without ecommerce.

Websites revenue (so-called “presence” revenue) only grew 18% -- while ecommerce revenue grew 78%.

Blended together, that worked out to 28% growth

Both Squarespace and Wix would be >much< less interesting companies without their strong ecommerce components.

You have to add a second product to really scale beyond $1B in ARR

You have to add a second product to really scale beyond $1B in ARR

#7. Less than 1% of revenue from enterprise customers.

A potential growth path after $1B ARR for Squarespace, but they& #39;ll have waited until after $1B+ ARR to truly go upmarket!

Contrast that with Shopify in ecommerce where Plus is a big part of growth story

A potential growth path after $1B ARR for Squarespace, but they& #39;ll have waited until after $1B+ ARR to truly go upmarket!

Contrast that with Shopify in ecommerce where Plus is a big part of growth story

#8. Founder-CEO Anthony Casalena started Squarespace in his dorm room, controls 68% of the voting rights, and still owns 36% of the company!!

Woah. Casalena maintained such a large share by mostly bootstrapping until growth stage.

Not easy, but it can be done.

Woah. Casalena maintained such a large share by mostly bootstrapping until growth stage.

Not easy, but it can be done.

A deeper dive here: https://www.saastr.com/5-interesting-learnings-from-squarespace-at-700000000-in-arr/">https://www.saastr.com/5-interes...

Read on Twitter

Read on Twitter