What if I told you Keep3r network is heavily involved in a new stealth project being launched by $SUSHI & $YFI...?

It appears that @AndreCronjeTech has some very special plans in the next few weeks https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

How? Allow me to explain in this thread below... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

It appears that @AndreCronjeTech has some very special plans in the next few weeks

How? Allow me to explain in this thread below...

To fully understand the in-depth connections I am about to reveal, let’s first gather a basic understanding of Keep3r network and it’s KP3R token...

Put simply, Keep3r network is infrastructure for solving a big problem on $ETH:

Transaction automation.

Put simply, Keep3r network is infrastructure for solving a big problem on $ETH:

Transaction automation.

By providing liquidity to KP3R & $ETH on $SUSHI, users can get “credits” which are attributed to a job that they want submitted by bots (or Keep3rs).

Jobs refer to a smart contract that wish for an external entity to perform an action.

Jobs refer to a smart contract that wish for an external entity to perform an action.

It is then up to the keeper to set up their devops & infrastructure & create rules based on what tx’s they deem profitable.

Keep3r’s submit transactions in a batch manner, which opens up a world of opportunities for tx fees on $ETH

For example:

Keep3r’s submit transactions in a batch manner, which opens up a world of opportunities for tx fees on $ETH

For example:

To understand why this is so useful, let’s take a look at some of its uses:

1. Options - once a call or put reaches expiry, pay outs or closing of the position can be automated

2. Oracles - oracles need to be manually queued

3. Liquidations - DeFi needs automated liquidations

1. Options - once a call or put reaches expiry, pay outs or closing of the position can be automated

2. Oracles - oracles need to be manually queued

3. Liquidations - DeFi needs automated liquidations

In just a few months, the protocol has become a core tool in both the $YFI & $SUSHI ecosystem, being put to use every day.

Some even more recent news has given us reason to believe further integration is underway... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

Some even more recent news has given us reason to believe further integration is underway...

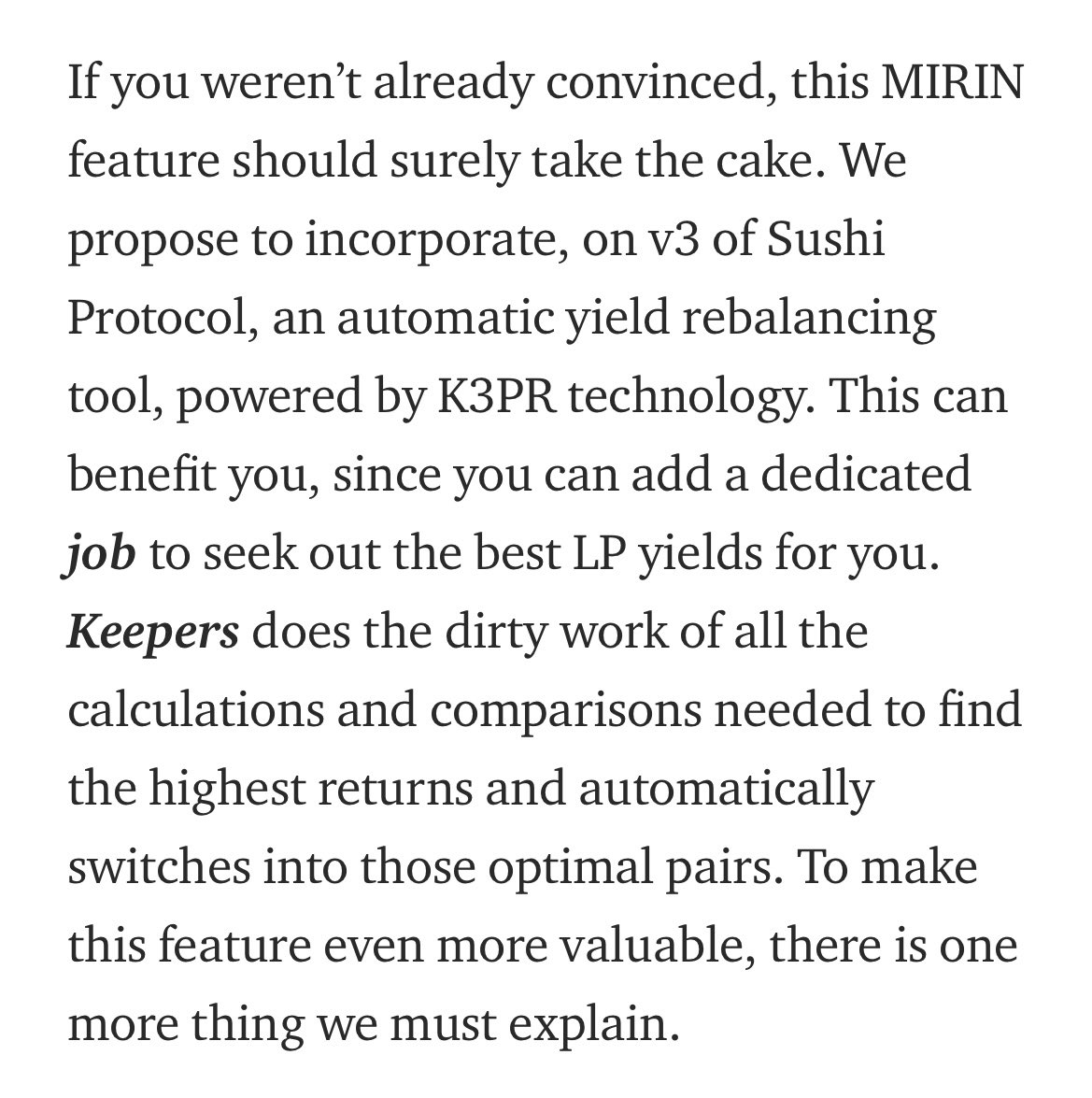

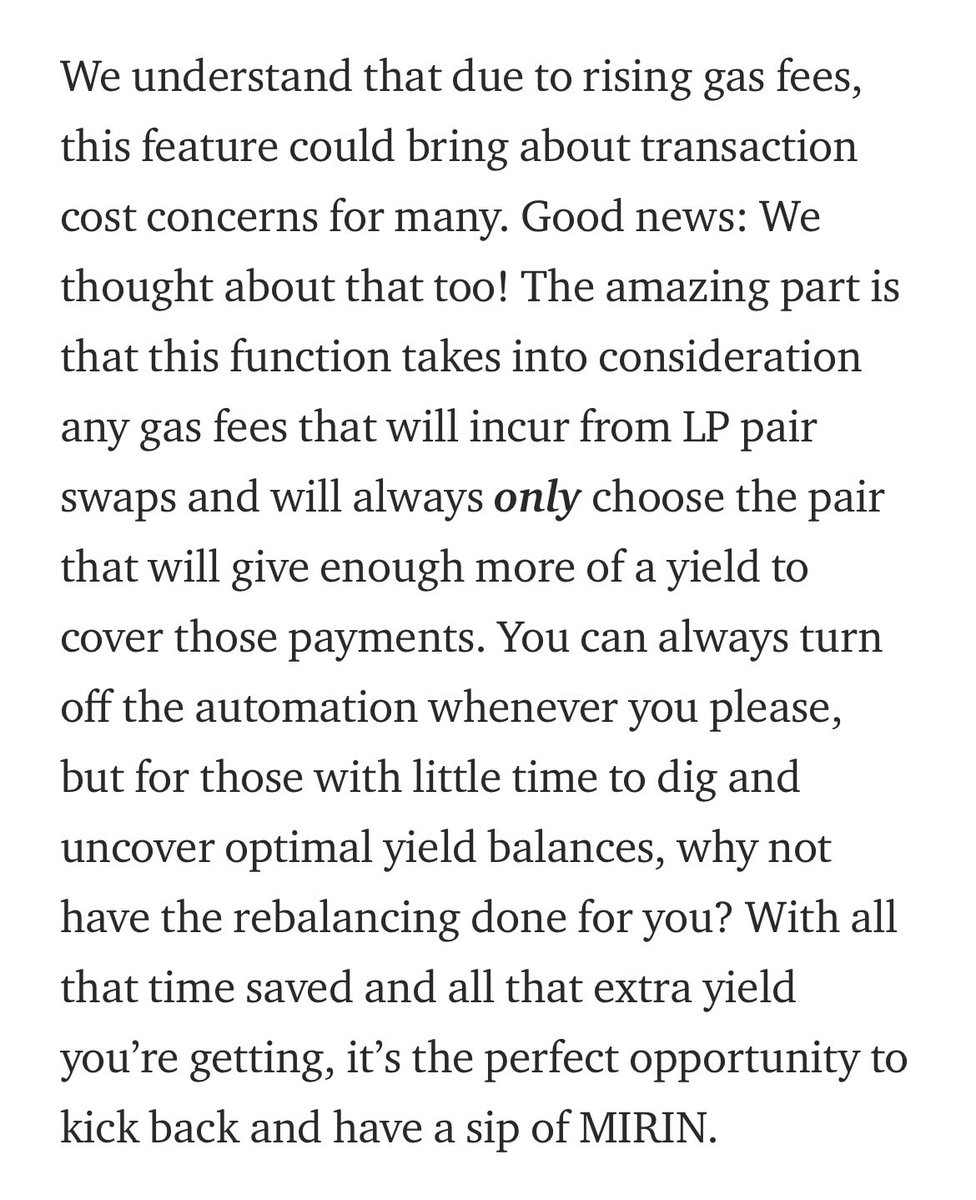

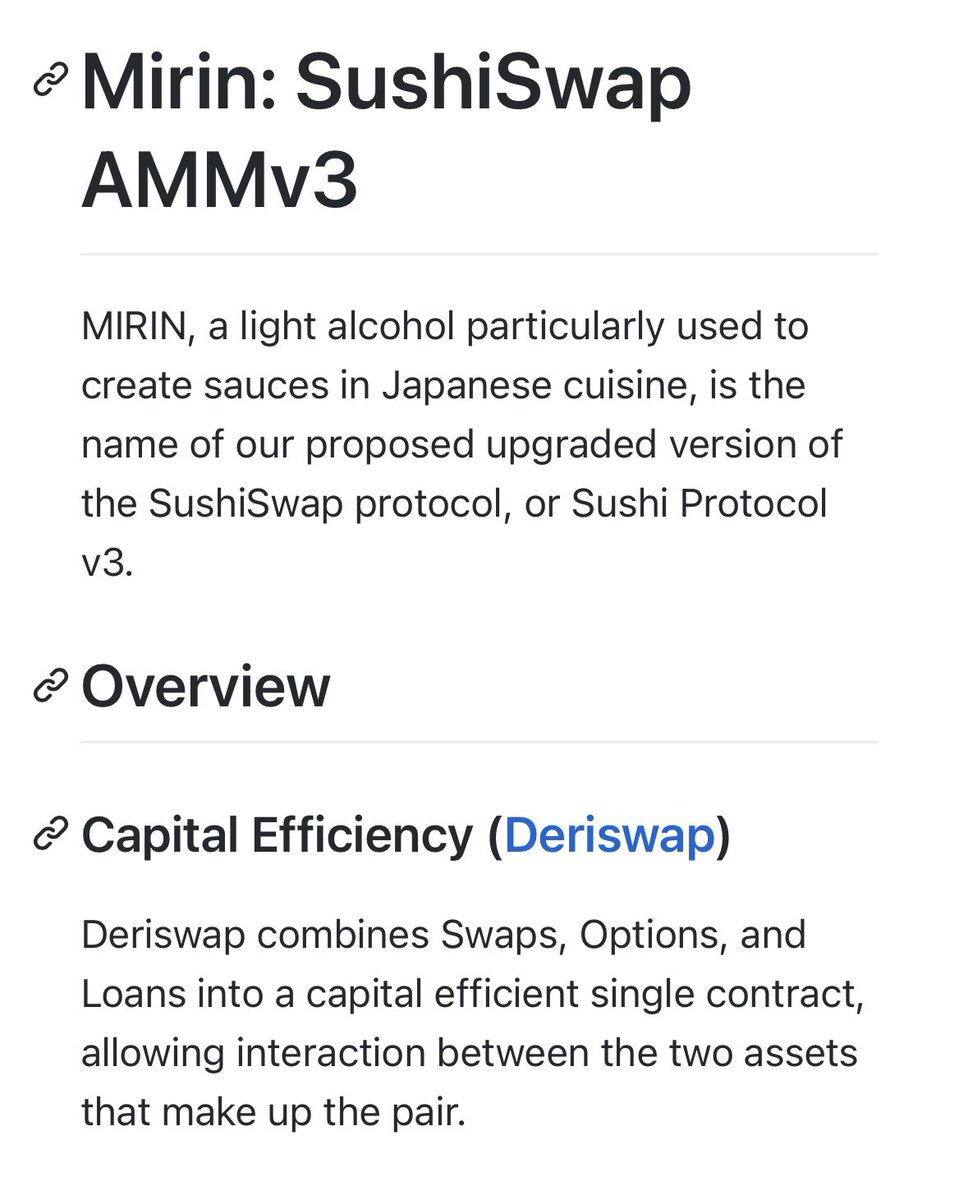

First described by @LevxApp, a core SushiSwap developer, MIRIN proposed a $SUSHI V3 concept which utilizes Keep3r to significantly increase APY among pools on the bar.

https://medium.com/levx-app/sushi-protocol-v3-proposal-mirin-d42061a5fa3a">https://medium.com/levx-app/...

https://medium.com/levx-app/sushi-protocol-v3-proposal-mirin-d42061a5fa3a">https://medium.com/levx-app/...

What MIRIN introduces is a $UNI V3 level of capital efficiency to the decentralized exchange, powered by KP3R technology.

With $SUSHI V3, users can simply turn on automation, having their funds swapped to the highest APY pairs on the sushi bar by Keep3r network Keepers...

With $SUSHI V3, users can simply turn on automation, having their funds swapped to the highest APY pairs on the sushi bar by Keep3r network Keepers...

Furthermore, their yields and rewards can be automatically compounded, increasing APY exponentially for all farms across the board.

Believe it or not, MIRIN was actually added to the SushiSwap GitHub just three days ago https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> https://github.com/sushiswap/mirin ">https://github.com/sushiswap...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> https://github.com/sushiswap/mirin ">https://github.com/sushiswap...

Believe it or not, MIRIN was actually added to the SushiSwap GitHub just three days ago

Another integration with SushiSwap, however is even more interesting...

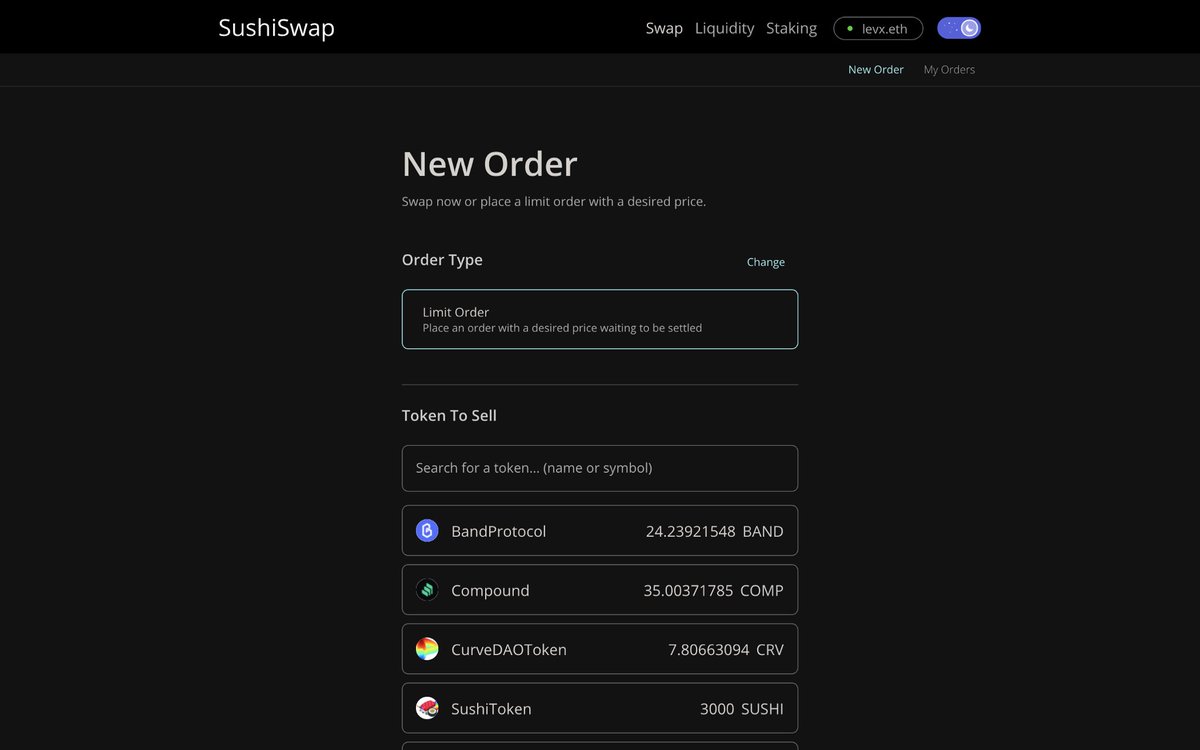

Did you know $SUSHI will soon offer limit orders on trades using Keep3r network? The ETA for this is Mid-April...

You can view the *unaudited* beta at https://lite.sushi.com"> https://lite.sushi.com

Did you know $SUSHI will soon offer limit orders on trades using Keep3r network? The ETA for this is Mid-April...

You can view the *unaudited* beta at https://lite.sushi.com"> https://lite.sushi.com

@AndreCronjeTech has additionally hinted at something big many times, but it got little attention from most...

Deriswap, mentioned in the $YFI & $SUSHI merger, is a protocol that combines... https://andrecronje.medium.com/deriswap-capital-efficient-swaps-futures-options-and-loans-ea424b24a41c">https://andrecronje.medium.com/deriswap-...

Deriswap, mentioned in the $YFI & $SUSHI merger, is a protocol that combines... https://andrecronje.medium.com/deriswap-capital-efficient-swaps-futures-options-and-loans-ea424b24a41c">https://andrecronje.medium.com/deriswap-...

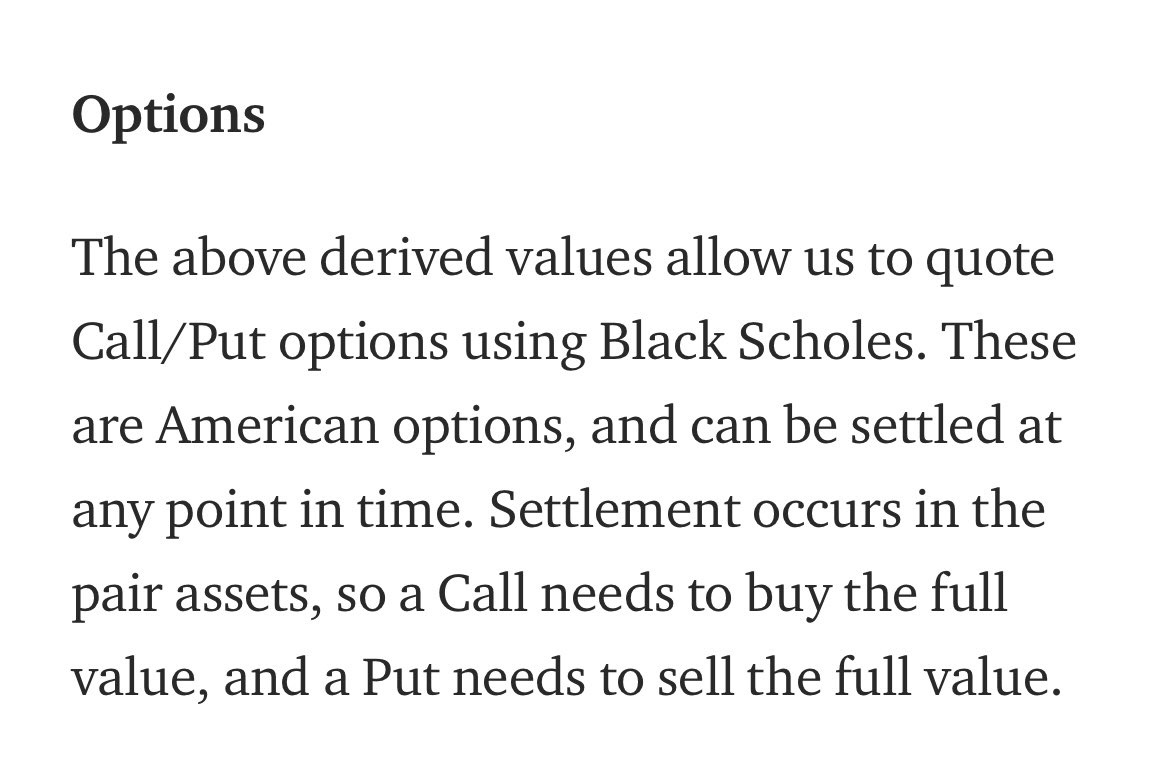

“Swaps, Options, and Loans into a capital efficient single contract, allowing interaction between the two assets that make up the pair”

Essentially it is a platform that combines all of the segmented liquidity spread across DeFi, in an aim to solve the capital efficiency problem

Essentially it is a platform that combines all of the segmented liquidity spread across DeFi, in an aim to solve the capital efficiency problem

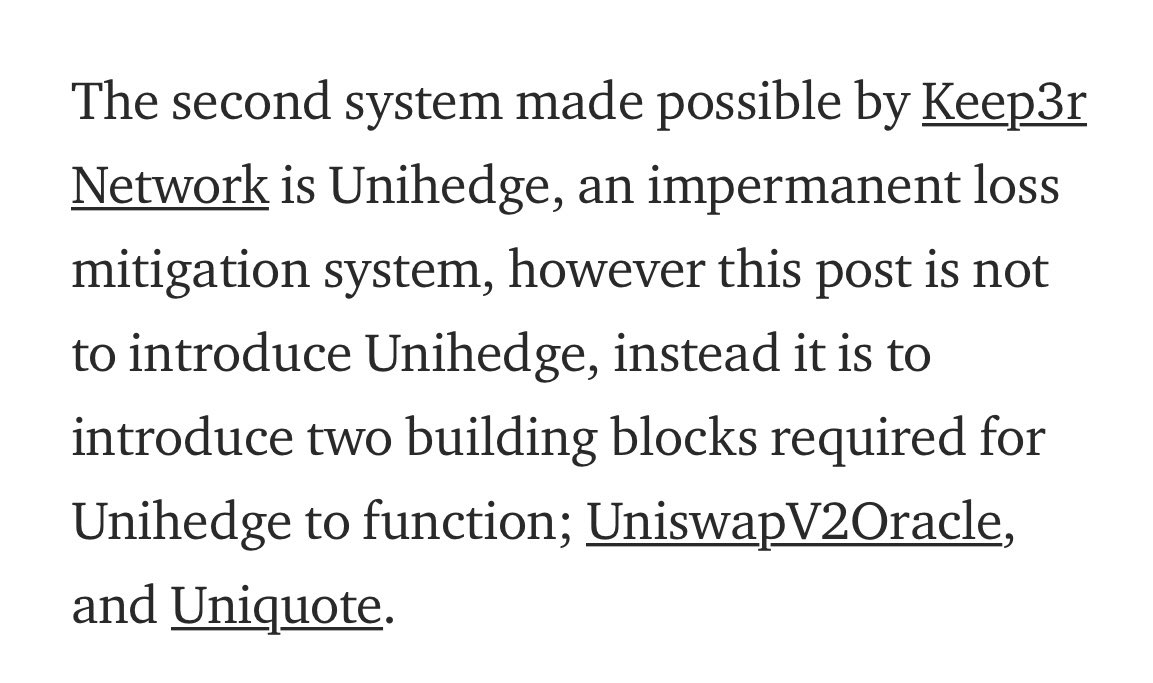

But, where does Keep3r network tie into all of this? The answer to that question will be obvious taking a look at the various hints left by Andre Cronje...

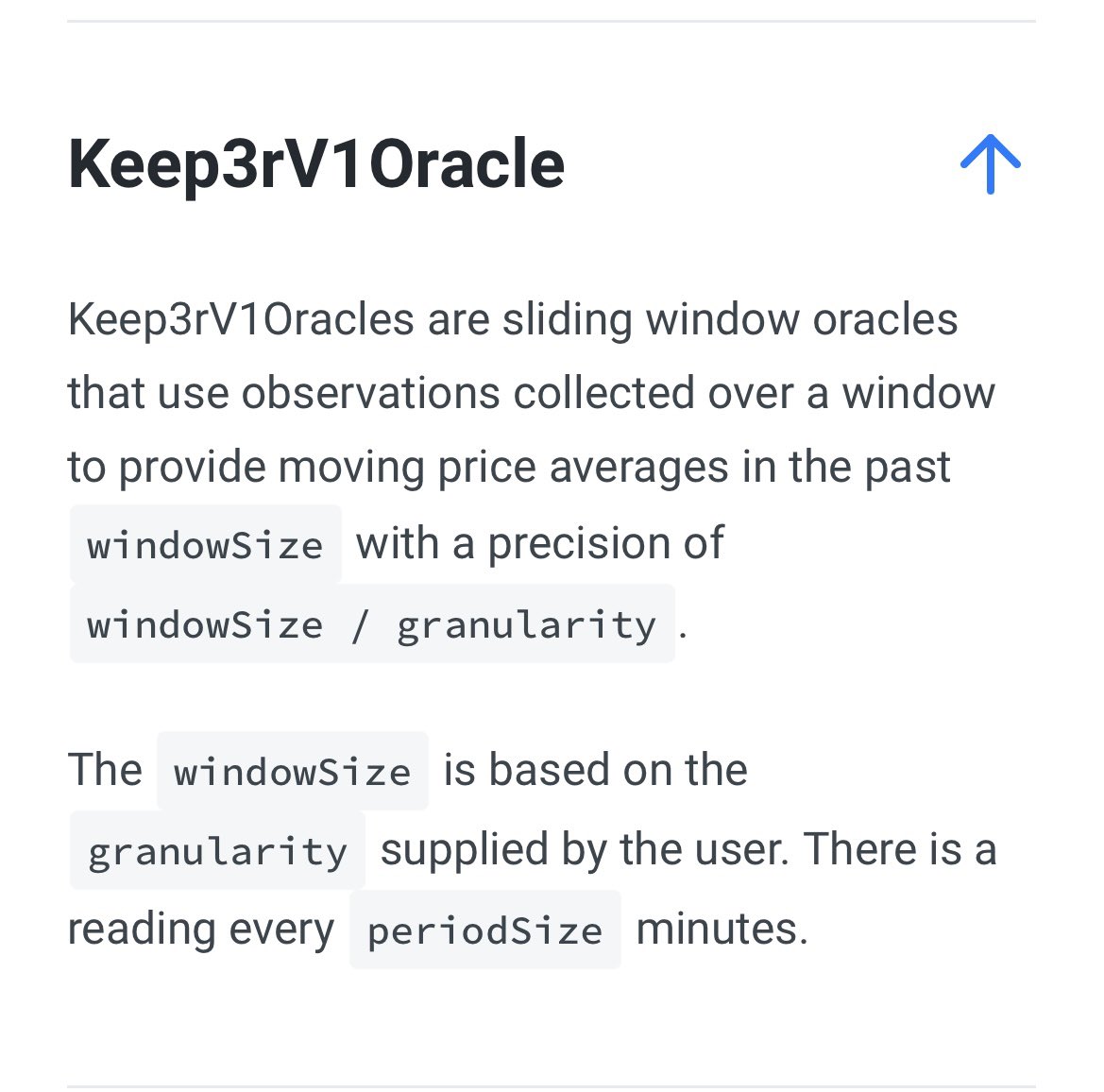

You’ll notice the explanation of Keep3r oracles to be awfully similar to that of the features offered by Deriswap

You’ll notice the explanation of Keep3r oracles to be awfully similar to that of the features offered by Deriswap

“Uniquote, is a simple liquidity provider (LP) pricing system, it denominates your liquidity into one of the two pairs. So you can quote ETH-WBTC LP tokens as ETH denominated or WBTC denominated.”

https://feeds.sushiquote.finance"> https://feeds.sushiquote.finance

https://feeds.sushiquote.finance"> https://feeds.sushiquote.finance

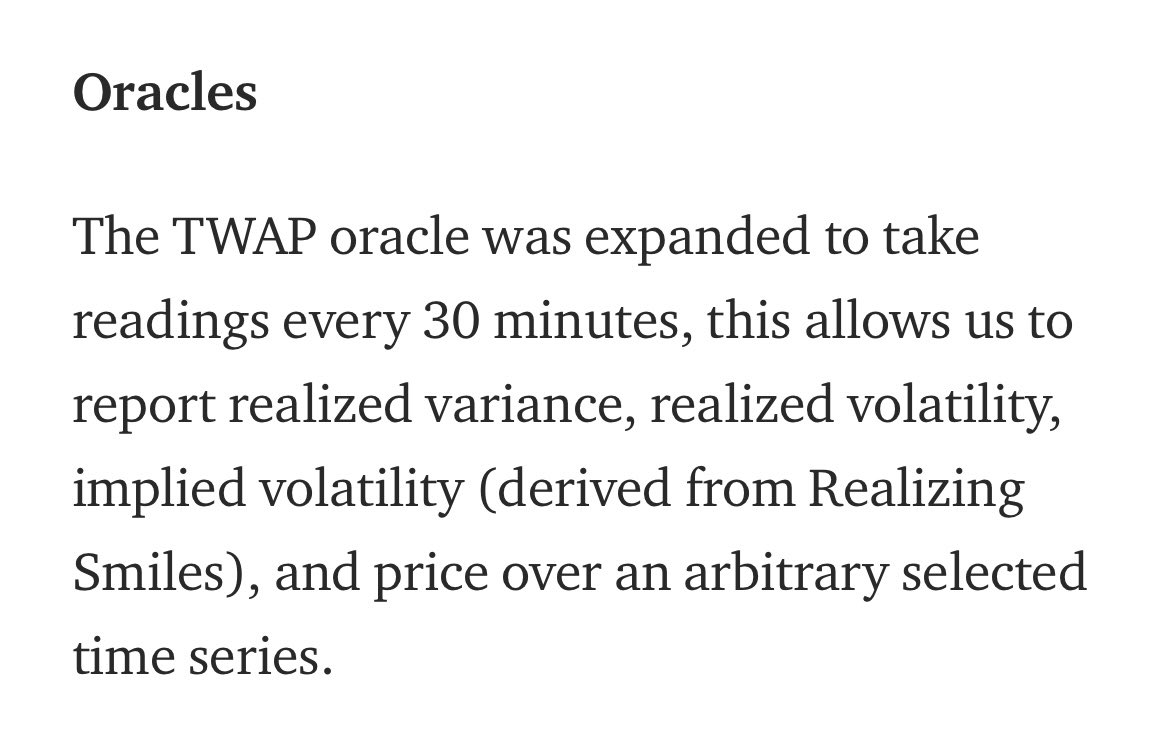

Deriswap oracles “take readings every 30 minutes, this allows us to report realized variance, realized volatility, implied volatility (derived from Realizing Smiles), and price over an arbitrary selected time series.”

Does this imply that Deriswap will utilize Keep3r oracles?

Does this imply that Deriswap will utilize Keep3r oracles?

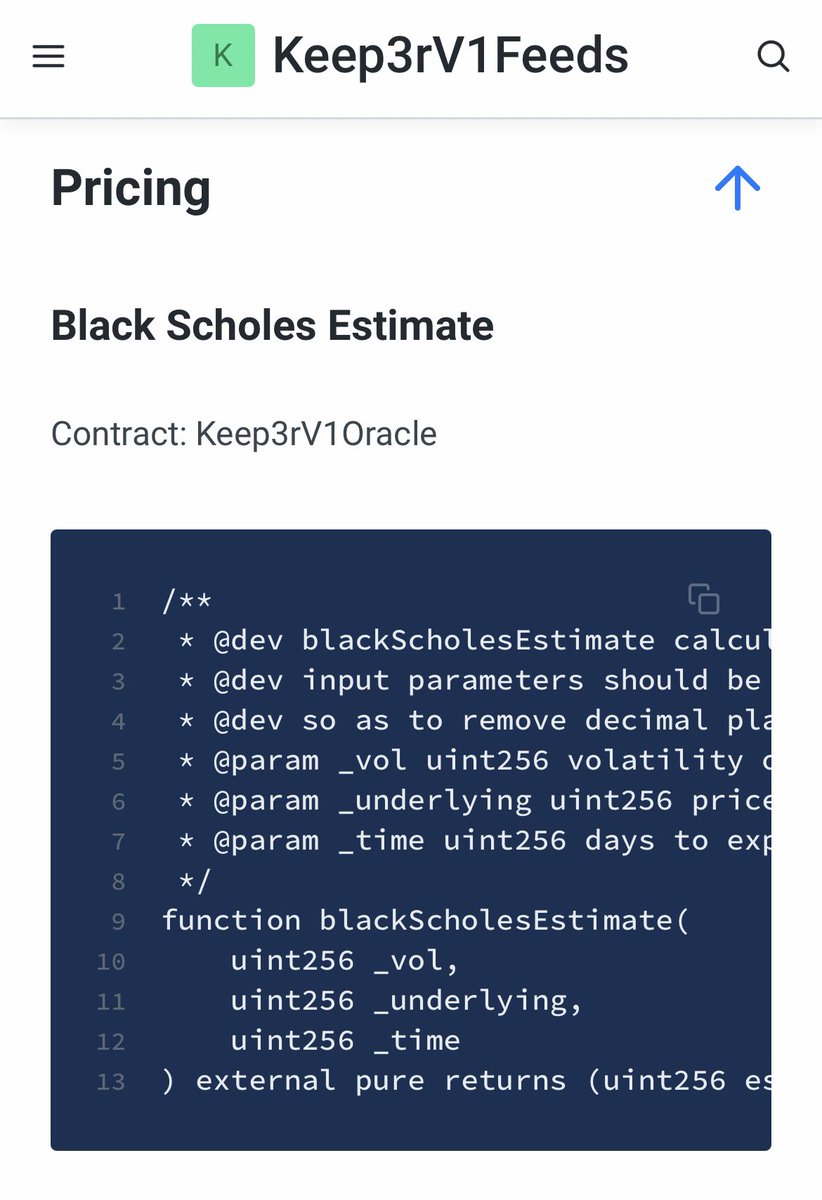

Keep3r network coincidentally utilizes sliding window oracles, and black scholes to price options...

Furthermore, a user can select which “arbitrary” selected time series this wish... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

Furthermore, a user can select which “arbitrary” selected time series this wish...

For even further reference:

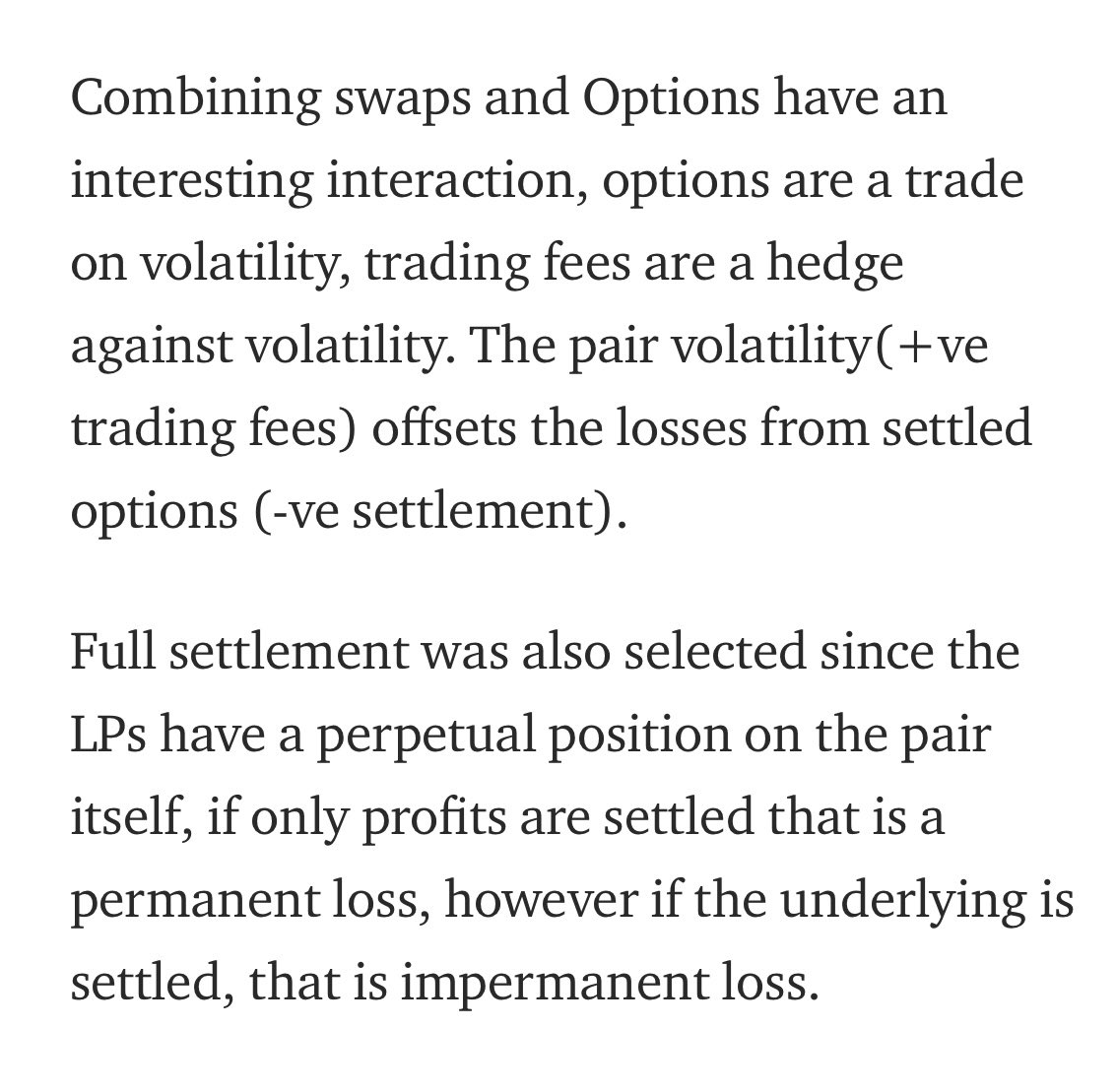

One section of the Deriswap article details an impermanent loss mitigation system, which you guessed it, is very similar in function to UniHedge offered by Keep3r network.

One section of the Deriswap article details an impermanent loss mitigation system, which you guessed it, is very similar in function to UniHedge offered by Keep3r network.

With this info I’m sure you’re all well aware of the synergy between both Keep3r network, Deriswap, and SushiSwap...

Deriswap is even one of the first things mentioned on the GitHub of $SUSHI

But it gets even better...

https://github.com/sushiswap/mirin ">https://github.com/sushiswap...

Deriswap is even one of the first things mentioned on the GitHub of $SUSHI

But it gets even better...

https://github.com/sushiswap/mirin ">https://github.com/sushiswap...

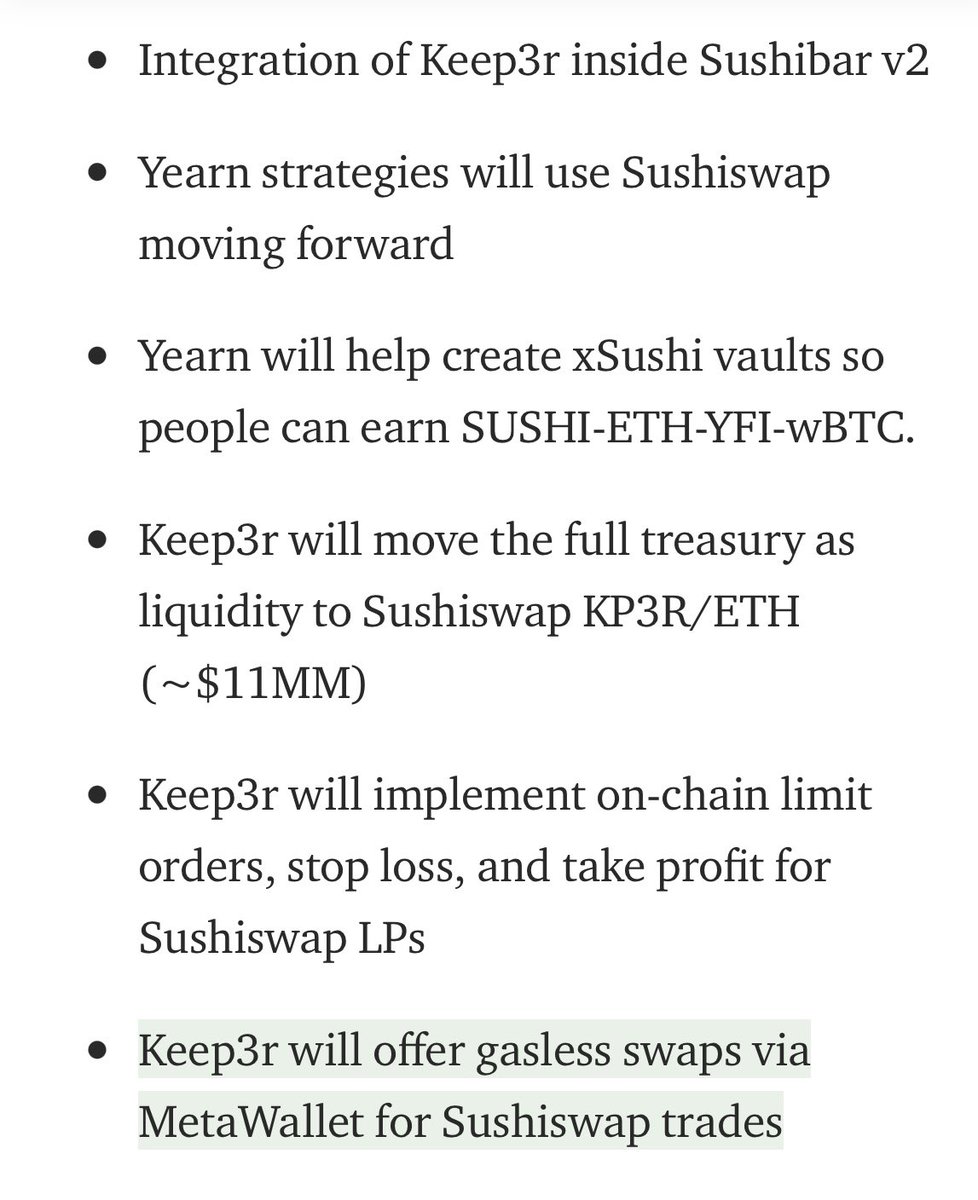

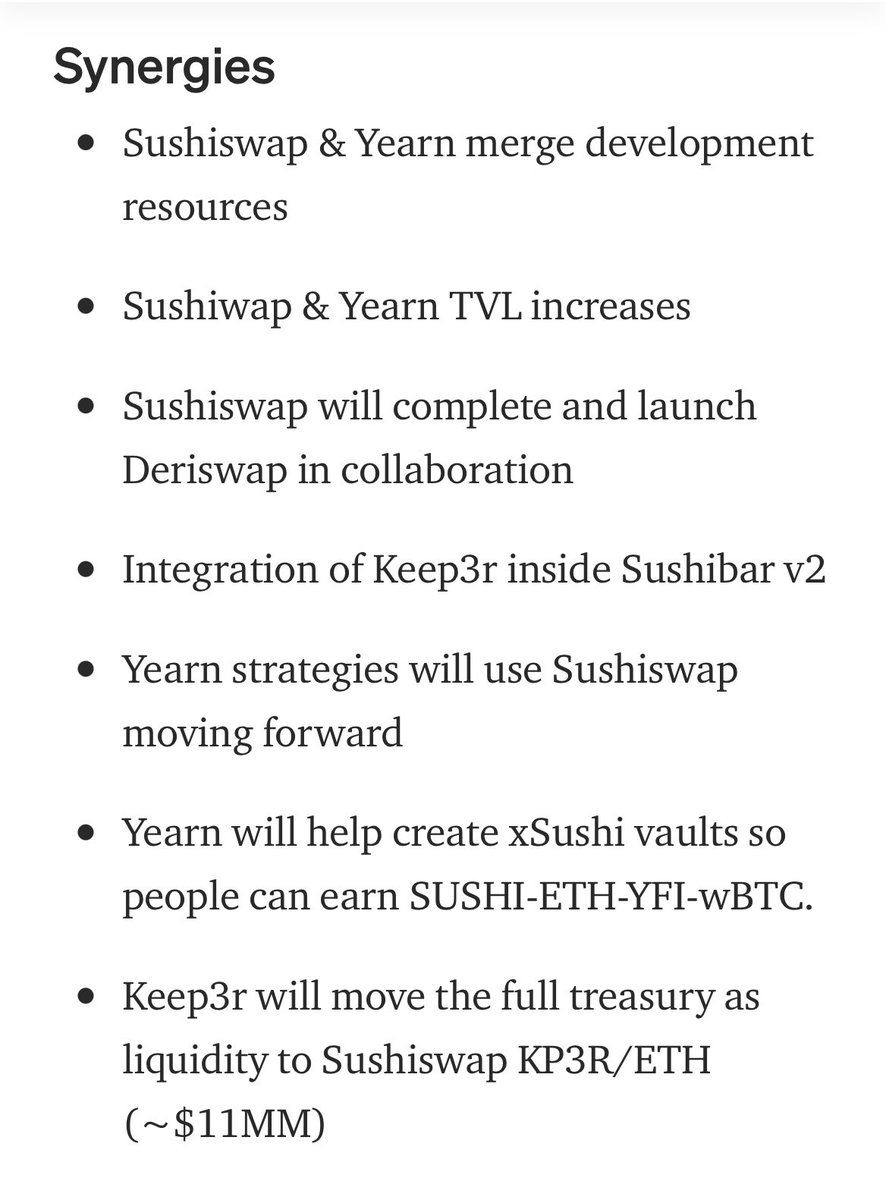

In the $SUSHI x $YFI merger, a collaborative “stealth project” made by the two was mentioned, which they say will follow the release of Deriswap.

Very interesting, don’t you think? It is also worthy to note just how often Keep3r is mentioned in this section... https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">

Very interesting, don’t you think? It is also worthy to note just how often Keep3r is mentioned in this section...

So, what exactly may this project be?

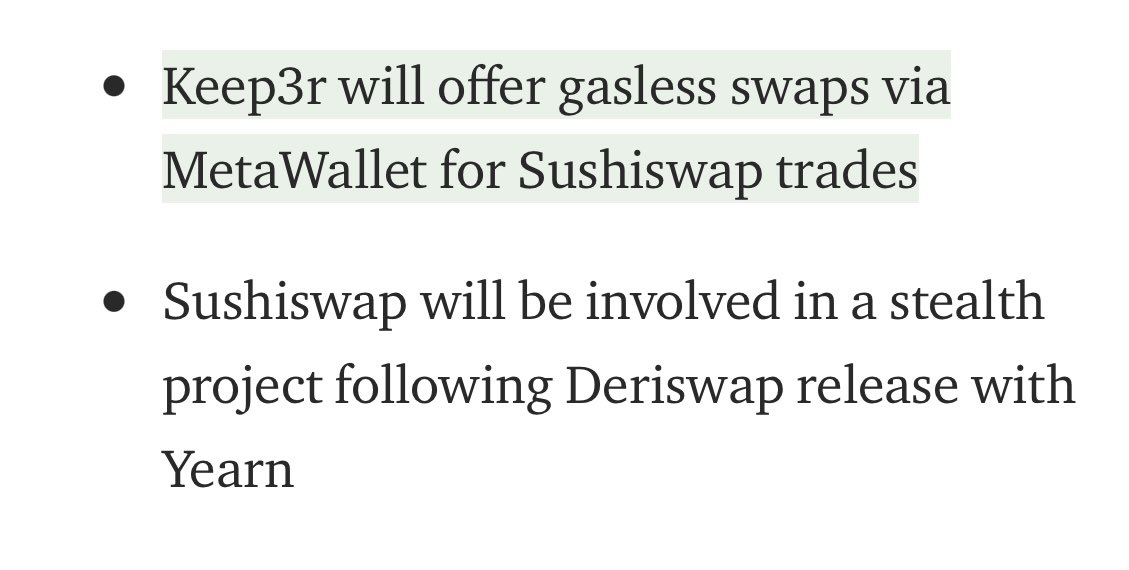

Is it possible that $SUSHI may soon be releasing a new project with $YFI, featuring a gasless DeFi wallet for trades?

This appears to be what is happening in the near future, considering the info I am about to reveal below:

Remember this?

Is it possible that $SUSHI may soon be releasing a new project with $YFI, featuring a gasless DeFi wallet for trades?

This appears to be what is happening in the near future, considering the info I am about to reveal below:

Remember this?

What is MetaWallet?

“MetaWallet is a smart contract that functions as a normal smart wallet...

You can transfer ETH, send tokens, approve contracts, or execute arbitrary contract call data to other contracts.

“MetaWallet is a smart contract that functions as a normal smart wallet...

You can transfer ETH, send tokens, approve contracts, or execute arbitrary contract call data to other contracts.

The core exception here, you can do all the above without ever needing to submit a transaction or spend gas yourself. You simply sign the send, transfer, approve, or execute and this is queued in the Keep3r Network.” https://andrecronje.medium.com/metawallet-a-gasless-wallet-58bf2ab88931">https://andrecronje.medium.com/metawalle...

The best piece of information pointing at this being the “stealth project” between $SUSHI & $YFI outside of what has already been mentioned is revealed in a tweet from Future Fund, a DeFi investment firm (very close to $SUSHI)

Take a look: (notice how the wallet name is blank?) https://twitter.com/FUTURE_FUND_/status/1347857108407091202">https://twitter.com/FUTURE_FU...

Take a look: (notice how the wallet name is blank?) https://twitter.com/FUTURE_FUND_/status/1347857108407091202">https://twitter.com/FUTURE_FU...

I’ll wrap this up in the next few tweets as best as possible, but it’s a lot of info to compile in one

What MIRIN & $SUSHI propose is a new level of capital efficiency for the dex, all powered by Keep3r network

Every protocol (& the jobs) will need to market buy KP3R for credit

What MIRIN & $SUSHI propose is a new level of capital efficiency for the dex, all powered by Keep3r network

Every protocol (& the jobs) will need to market buy KP3R for credit

We have very good reason to believe Keep3r network will launch MetaWallet and integrate it with $SUSHI soon

This will be a game changing wallet for gas-less transactions, and quicker trades.

& KP3R is only sitting at 50m mcap https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍞" title="Brot" aria-label="Emoji: Brot">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍞" title="Brot" aria-label="Emoji: Brot"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> https://www.coingecko.com/en/coins/keep3rv1">https://www.coingecko.com/en/coins/...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> https://www.coingecko.com/en/coins/keep3rv1">https://www.coingecko.com/en/coins/...

This will be a game changing wallet for gas-less transactions, and quicker trades.

& KP3R is only sitting at 50m mcap

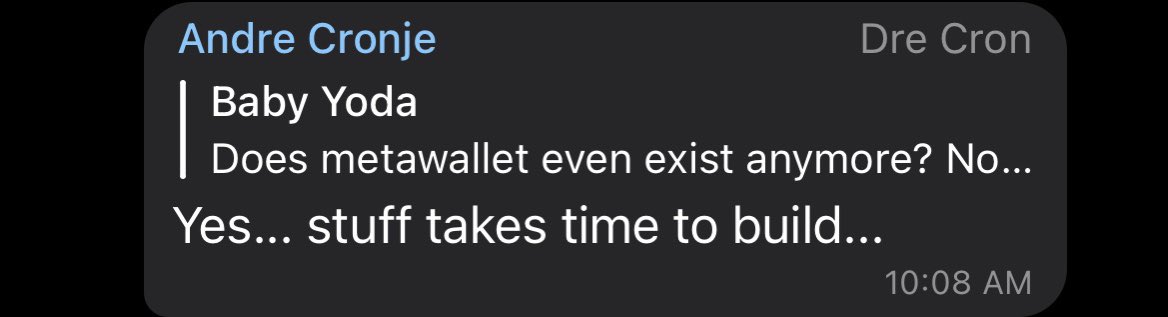

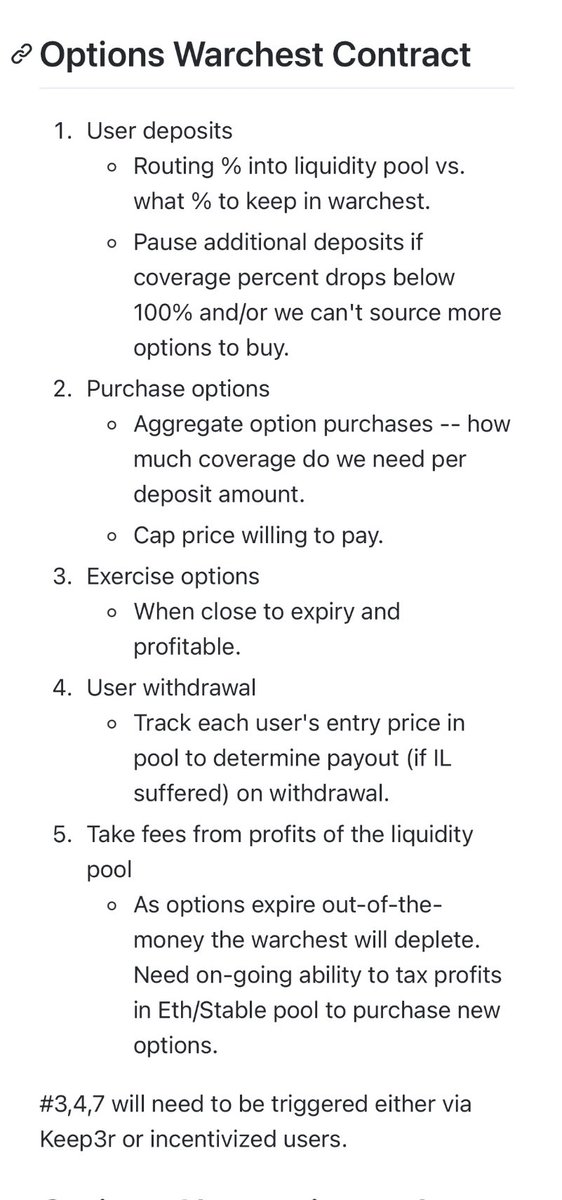

Keep3r involvement with $SUSHI war chest & Deriswap?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht">

https://hackmd.io/j70mou-pQ_KZ8lcDPrb1qA

https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu...

https://hackmd.io/j70mou-pQ_KZ8lcDPrb1qA

Read on Twitter

Read on Twitter

" title="In just a few months, the protocol has become a core tool in both the $YFI & $SUSHI ecosystem, being put to use every day.Some even more recent news has given us reason to believe further integration is underway... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" class="img-responsive" style="max-width:100%;"/>

" title="In just a few months, the protocol has become a core tool in both the $YFI & $SUSHI ecosystem, being put to use every day.Some even more recent news has given us reason to believe further integration is underway... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">" class="img-responsive" style="max-width:100%;"/>

" title="Keep3r network coincidentally utilizes sliding window oracles, and black scholes to price options...Furthermore, a user can select which “arbitrary” selected time series this wish... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">">

" title="Keep3r network coincidentally utilizes sliding window oracles, and black scholes to price options...Furthermore, a user can select which “arbitrary” selected time series this wish... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">">

" title="Keep3r network coincidentally utilizes sliding window oracles, and black scholes to price options...Furthermore, a user can select which “arbitrary” selected time series this wish... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">">

" title="Keep3r network coincidentally utilizes sliding window oracles, and black scholes to price options...Furthermore, a user can select which “arbitrary” selected time series this wish... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">">

" title="In the $SUSHI x $YFI merger, a collaborative “stealth project” made by the two was mentioned, which they say will follow the release of Deriswap.Very interesting, don’t you think? It is also worthy to note just how often Keep3r is mentioned in this section... https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">">

" title="In the $SUSHI x $YFI merger, a collaborative “stealth project” made by the two was mentioned, which they say will follow the release of Deriswap.Very interesting, don’t you think? It is also worthy to note just how often Keep3r is mentioned in this section... https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">">

" title="In the $SUSHI x $YFI merger, a collaborative “stealth project” made by the two was mentioned, which they say will follow the release of Deriswap.Very interesting, don’t you think? It is also worthy to note just how often Keep3r is mentioned in this section... https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">">

" title="In the $SUSHI x $YFI merger, a collaborative “stealth project” made by the two was mentioned, which they say will follow the release of Deriswap.Very interesting, don’t you think? It is also worthy to note just how often Keep3r is mentioned in this section... https://abs.twimg.com/emoji/v2/... draggable="false" alt="😉" title="Zwinkerndes Gesicht" aria-label="Emoji: Zwinkerndes Gesicht">">

https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu..." title="Keep3r involvement with $SUSHI war chest & Deriswap? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu...">

https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu..." title="Keep3r involvement with $SUSHI war chest & Deriswap? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu...">

https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu..." title="Keep3r involvement with $SUSHI war chest & Deriswap? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu...">

https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu..." title="Keep3r involvement with $SUSHI war chest & Deriswap? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu...">

https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu..." title="Keep3r involvement with $SUSHI war chest & Deriswap? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu...">

https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu..." title="Keep3r involvement with $SUSHI war chest & Deriswap? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu...">

https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu..." title="Keep3r involvement with $SUSHI war chest & Deriswap? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu...">

https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu..." title="Keep3r involvement with $SUSHI war chest & Deriswap? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Denkendes Gesicht" aria-label="Emoji: Denkendes Gesicht"> https://hackmd.io/j70mou-pQ... href=" https://github.com/kamiebisu/gusoku">https://github.com/kamiebisu...">