Long-term thoughts about the #crypto market

Get ready to get into a VERY long thread, full of charts.

Popcorns ready? Let& #39;s start!

1/n

Get ready to get into a VERY long thread, full of charts.

Popcorns ready? Let& #39;s start!

1/n

In this thread I will try to put together most of the reasons that make me think that we are not yet close to a top in the market, but rather that there is still the best part...

2/n

2/n

First of all, let& #39;s talk about #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">. Bitcoin is still the king, although it is losing dominance lately due to the altseason.

https://abs.twimg.com/hashflags... draggable="false" alt="">. Bitcoin is still the king, although it is losing dominance lately due to the altseason.

In my opinion, it still has a lot of room to rise in terms of price (not so much in terms of time)

3/n

In my opinion, it still has a lot of room to rise in terms of price (not so much in terms of time)

3/n

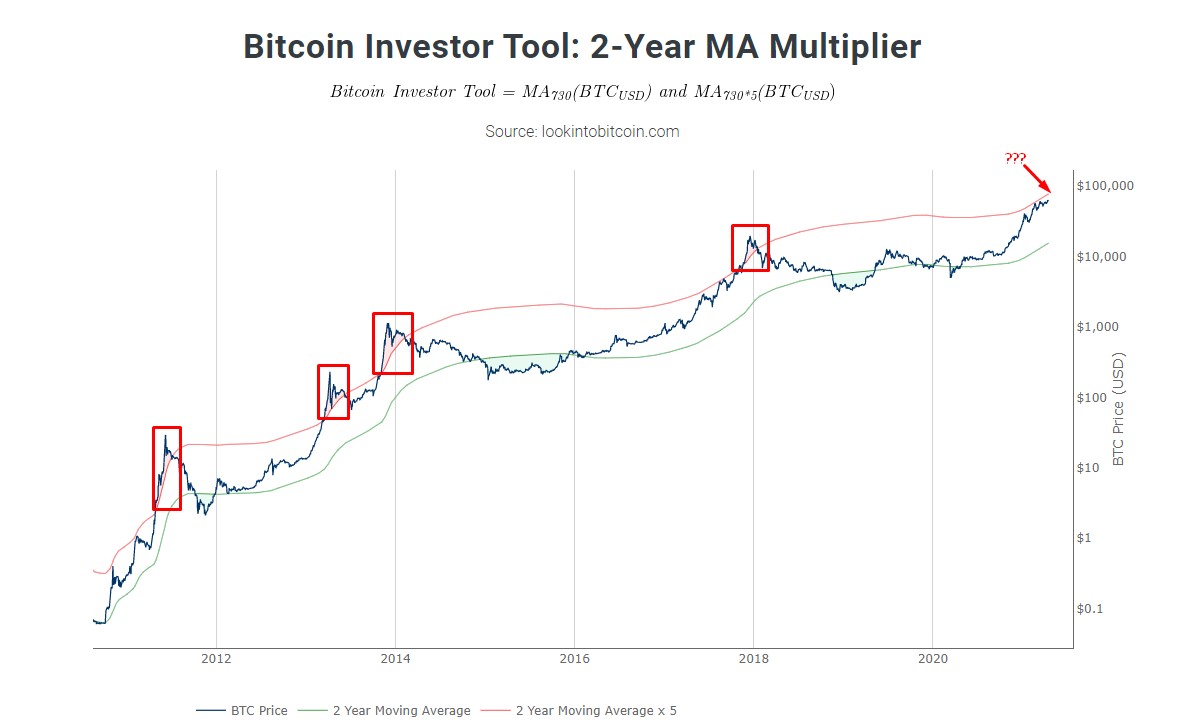

1) Bitcoin Investor Tool

As you can see, this indicator marks the cycle tops very well. However, these do not happen when it crosses the red average, but after a parabolic movement above it. At the moment it is not even above this MA.

4/n

As you can see, this indicator marks the cycle tops very well. However, these do not happen when it crosses the red average, but after a parabolic movement above it. At the moment it is not even above this MA.

4/n

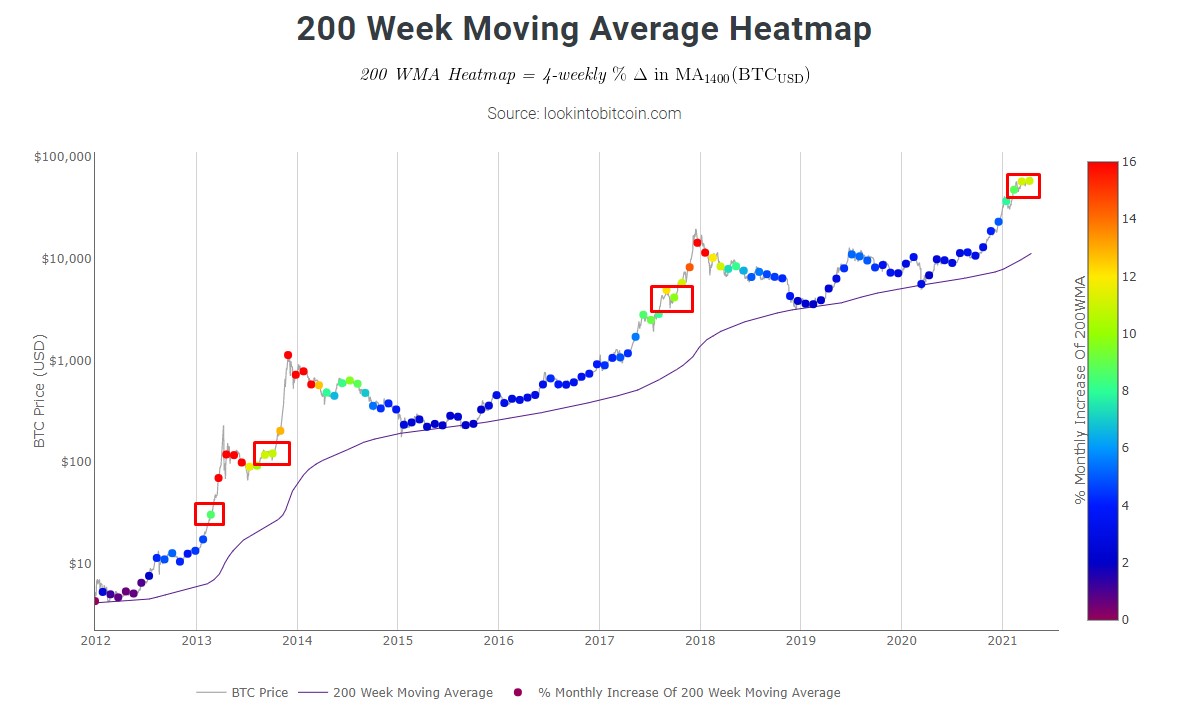

2) 200W MA Heatmap

No red dots yet visible. I& #39;d say we& #39;re halfway. An analysis cannot be based on a single indicator, but it all adds up.

5/n

No red dots yet visible. I& #39;d say we& #39;re halfway. An analysis cannot be based on a single indicator, but it all adds up.

5/n

3) Puell Multiple

Another very good indicator to know where we are in the cycle. All cycle tops have occurred in the red zone, but as with the first indicator, they happen rather when it leaves the red zone.

6/n

Another very good indicator to know where we are in the cycle. All cycle tops have occurred in the red zone, but as with the first indicator, they happen rather when it leaves the red zone.

6/n

4) Stock-to-Flow Model

Many of you will know this model, and it is really good. Assuming a constant or increasing demand in the long term, and an increasingly reduced supply, the price tends to rise.

7/n

Many of you will know this model, and it is really good. Assuming a constant or increasing demand in the long term, and an increasingly reduced supply, the price tends to rise.

7/n

By fractals, there is still the most parabolic part of the move, which could reach up to $900k-$1M in a few months.

Sounds good, right?

8/n

Sounds good, right?

8/n

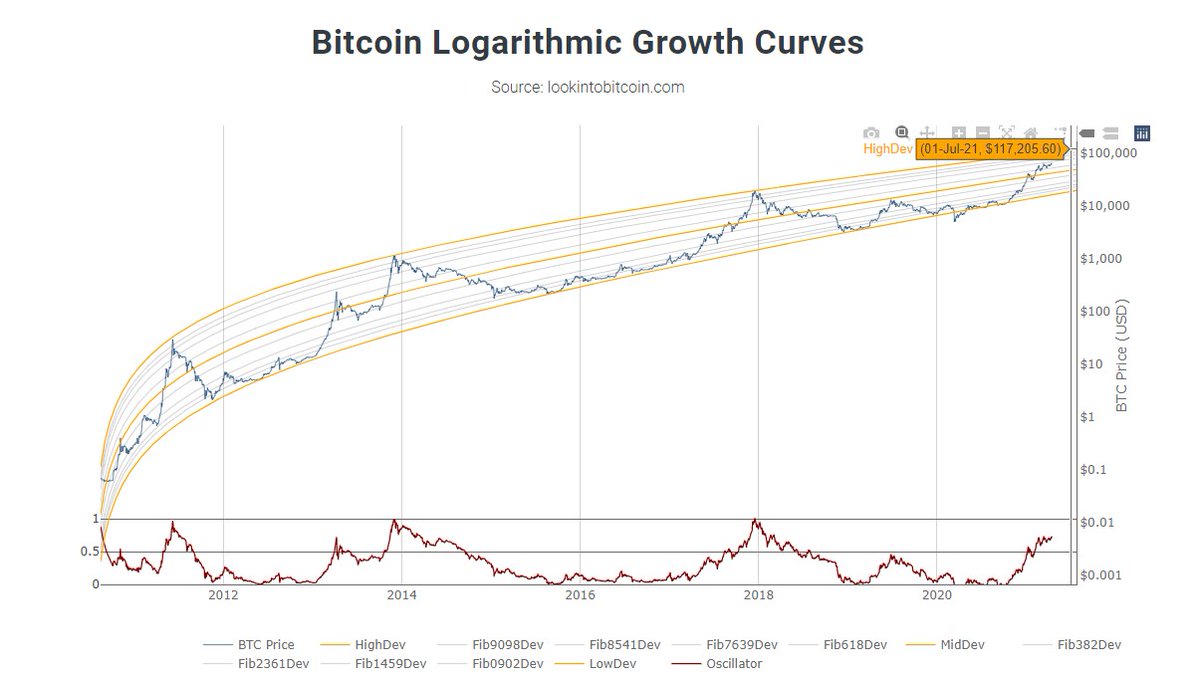

5) Bitcoin Logarithmic Growth Curves

Another indicator that has a margin of going up, like the previous ones. Currently the top of the logarithmic curve is above 100k, so nothing indicates that the top will be now.

9/n

Another indicator that has a margin of going up, like the previous ones. Currently the top of the logarithmic curve is above 100k, so nothing indicates that the top will be now.

9/n

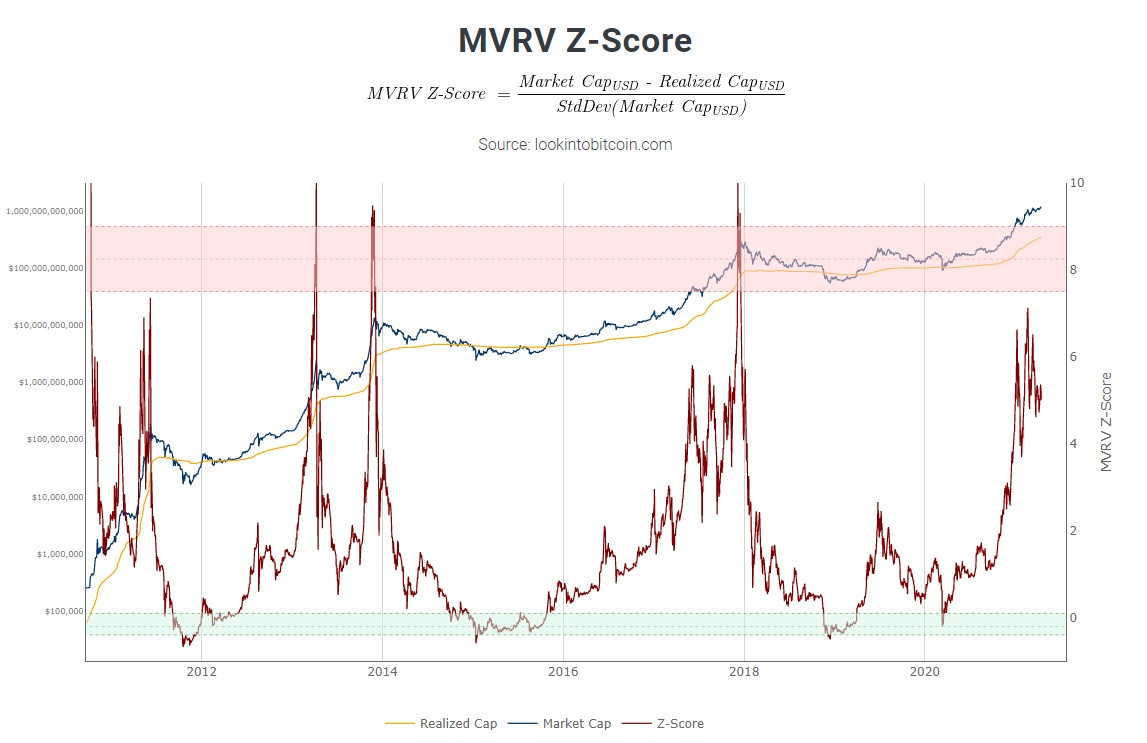

6) MVRV Z-Score

I really like this one. Similar to the Puell Multiple, cycle tops usually happens when it crosses the red zone. Not there yet!

10/n

I really like this one. Similar to the Puell Multiple, cycle tops usually happens when it crosses the red zone. Not there yet!

10/n

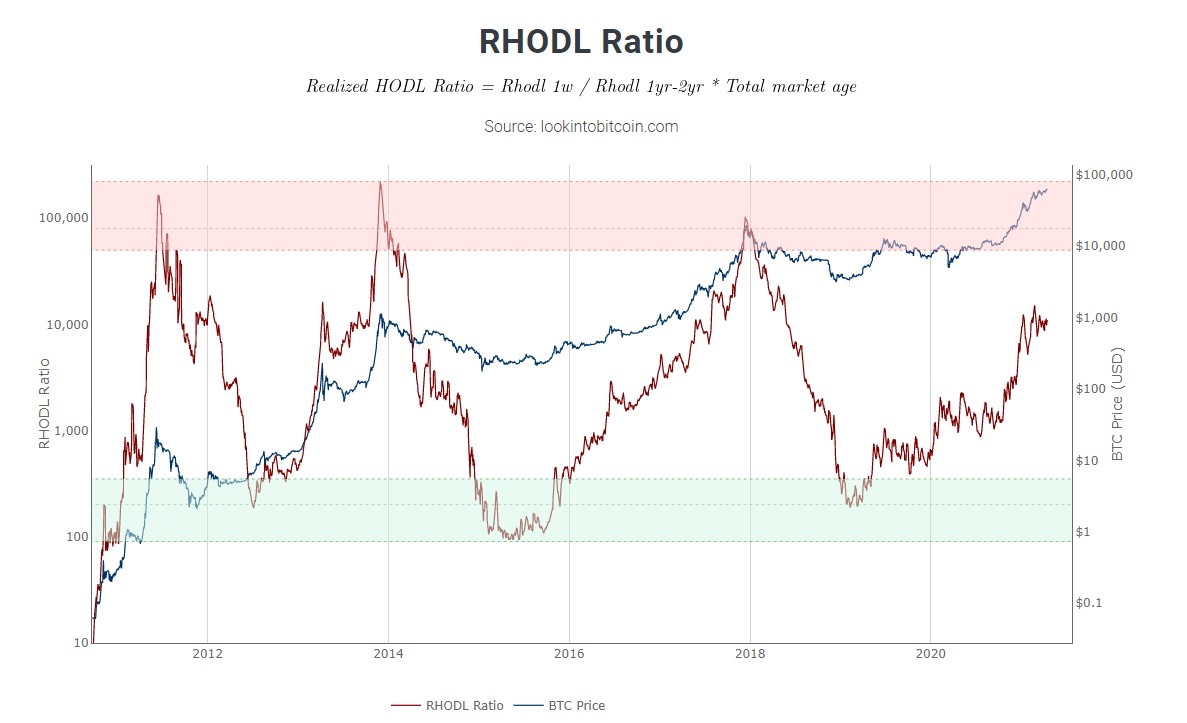

7) RHODL Ratio

This is an awesome indicator. It marks both bottoms and tops perfectly. As you can see, it can also go higher.

11/n

This is an awesome indicator. It marks both bottoms and tops perfectly. As you can see, it can also go higher.

11/n

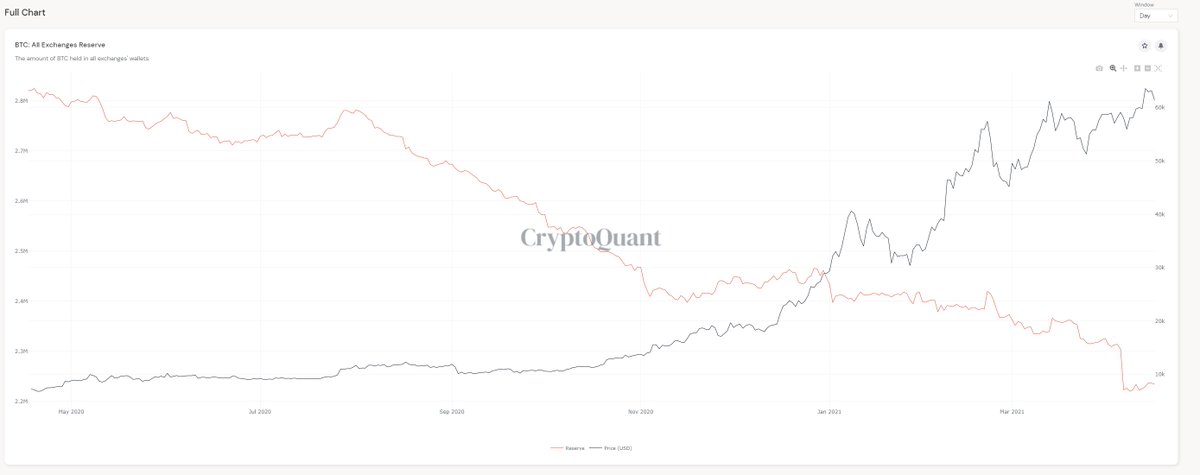

8) All Exchanges Reserve (Bitcoin)

When Bitcoin reserves in exchanges wallets drop, the price tends to increase. This can mean that strong hands are accumulating, which is confirmed in the following tweet (outflows)

12/n

When Bitcoin reserves in exchanges wallets drop, the price tends to increase. This can mean that strong hands are accumulating, which is confirmed in the following tweet (outflows)

12/n

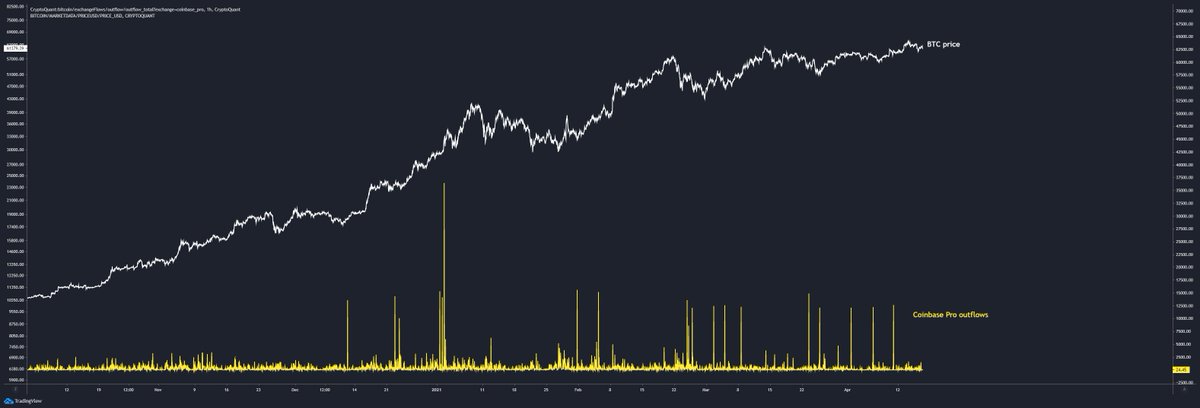

9) Coinbase Pro Outflows

Whenever there have been big outflows on this exchange, the price has had big pumps in the following days.

These outflows are usually followed by news such as MicroStrategy, Grayscale or Tesla buying $BTC (OTC deals) The amounts match.

13/n

Whenever there have been big outflows on this exchange, the price has had big pumps in the following days.

These outflows are usually followed by news such as MicroStrategy, Grayscale or Tesla buying $BTC (OTC deals) The amounts match.

13/n

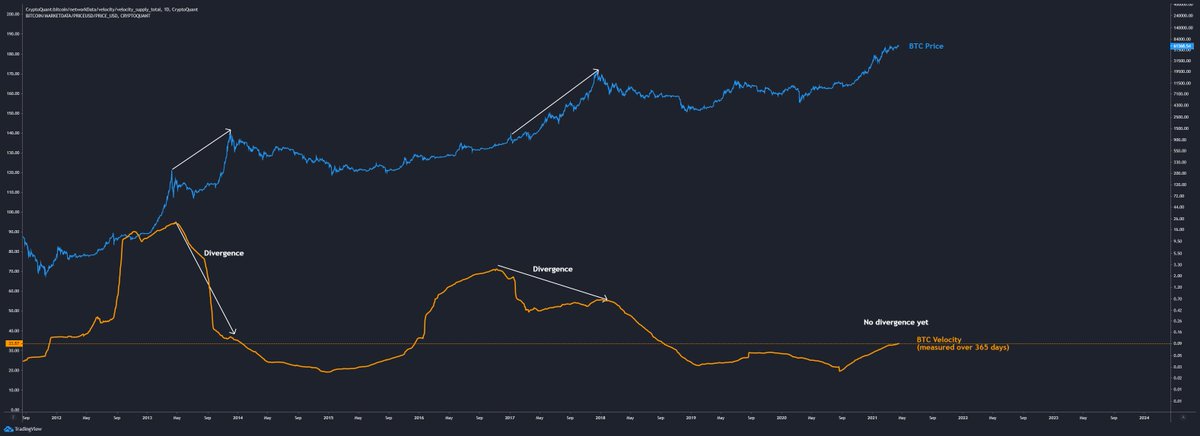

10) Bitcoin Velocity

Each top is usually marked by a divergence of this indicator with the price. There is no divergence yet.

14/n

Each top is usually marked by a divergence of this indicator with the price. There is no divergence yet.

14/n

11) Bitcoin Open Interest

It shows that we are in a very strong trend. Open interest going up and price going up, and during the shakeouts OI goes down. This is a very healthy trend, and I don& #39;t see any signs of weakness yet.

15/n

It shows that we are in a very strong trend. Open interest going up and price going up, and during the shakeouts OI goes down. This is a very healthy trend, and I don& #39;t see any signs of weakness yet.

15/n

12) Funding + Premium

I read many people saying that funding is high, not only in Bitcoin, but also in altcoins. This is relative.

16/n

I read many people saying that funding is high, not only in Bitcoin, but also in altcoins. This is relative.

16/n

If we compare the current funding levels with those of the top of 2017, we see that they are low levels, taking into account that the price is three times higher. Also, the current trend is led by spot trading, and not by derivatives.

17/n

17/n

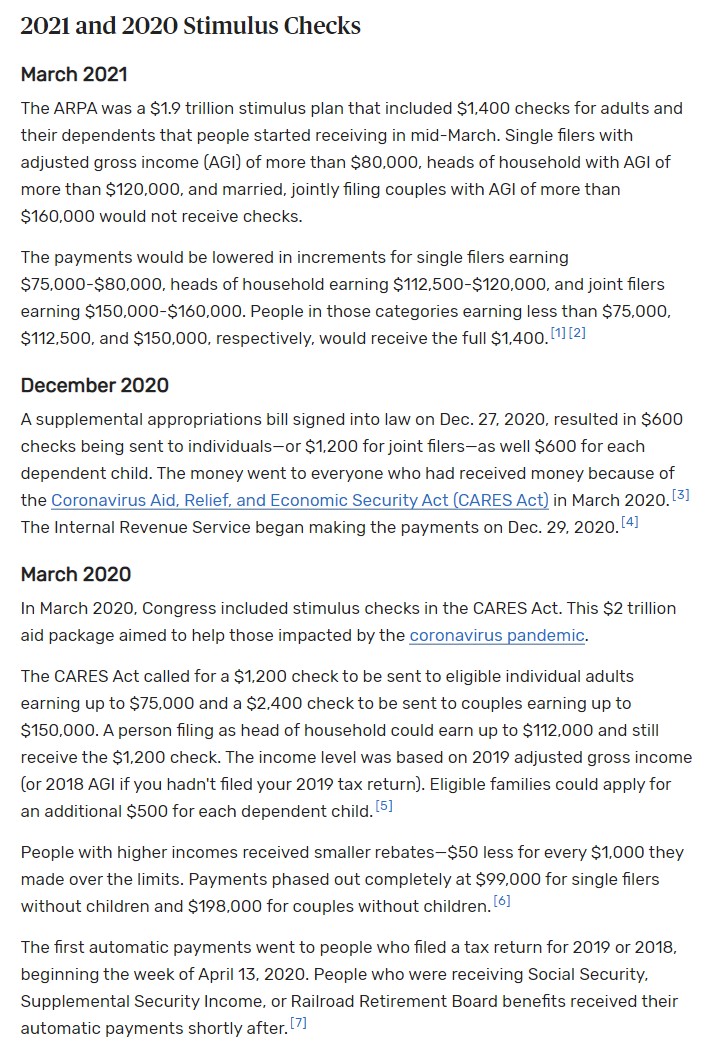

13) Printers going brrrrrrrrr

First Covid Stimulus had a big impact on the market. In fact, it marked the beginning of this bull cycle. After that, two new Stimulus have taken place.

18/n

First Covid Stimulus had a big impact on the market. In fact, it marked the beginning of this bull cycle. After that, two new Stimulus have taken place.

18/n

We are also seeing a big increase in the supply of Tether (and other stablecoins), which is a clear bullish sign (more demand)

19/n

19/n

Now some $BTC technical analysis.

Bitcoin has broken out of an accumulation range of over 1000 days. This usually results in long extensions.

Currently, the increase over the previous ATH is only 200%.

20/n

Bitcoin has broken out of an accumulation range of over 1000 days. This usually results in long extensions.

Currently, the increase over the previous ATH is only 200%.

20/n

$BTC Monthly RSI

https://twitter.com/CryptoCapo_/status/1343865707147259904?s=20

21/n">https://twitter.com/CryptoCap...

https://twitter.com/CryptoCapo_/status/1343865707147259904?s=20

21/n">https://twitter.com/CryptoCap...

Ok, Bitcoin looks pretty bullish but... what about #altcoins? Here comes the interesting thing.

Let& #39;s summarize why I think many altcoins will continue to outperform BTC.

22/n

Let& #39;s summarize why I think many altcoins will continue to outperform BTC.

22/n

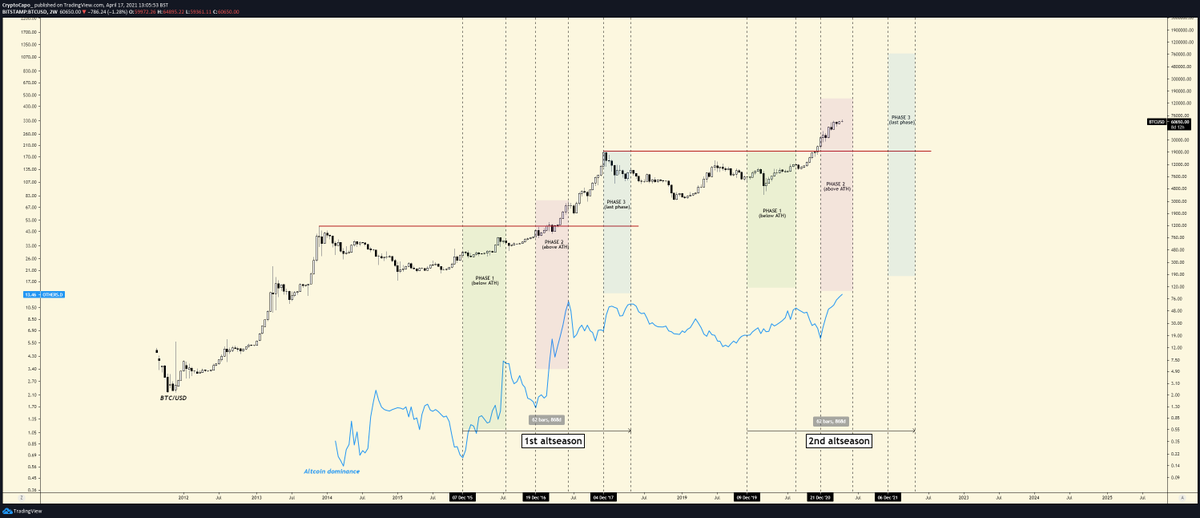

Altseason Schematic

A few months ago I made this schematic, which shows very well how an altseason is developed. This is dynamic and it may not quite fit reality, but it gives us a clear vision.

We are currently in phase 2 of the second altseason.

23/n

A few months ago I made this schematic, which shows very well how an altseason is developed. This is dynamic and it may not quite fit reality, but it gives us a clear vision.

We are currently in phase 2 of the second altseason.

23/n

How long will this second phase last? If we analyze the dominance of Bitcoin, we can see that the key level is 48-50%

At this level the second phase could end, and there would be a bounce of the dominance. Consolidation below = third phase

24/n

At this level the second phase could end, and there would be a bounce of the dominance. Consolidation below = third phase

24/n

In my opinion there will be a third phase, or at least a longer second phase. Why?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

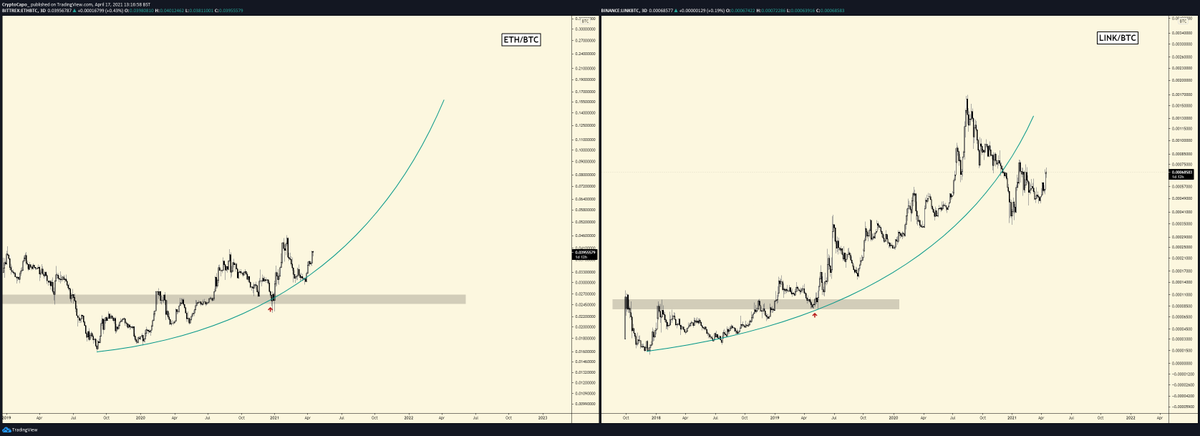

$ETH / $BTC looks VERY good. Every time I see this chart I get goosebumps.

0.10 is inevitable, and a new ATH is very likely. With a new ATH, we could see ETH above BTC in the ranking for a few days.

26/n

0.10 is inevitable, and a new ATH is very likely. With a new ATH, we could see ETH above BTC in the ranking for a few days.

26/n

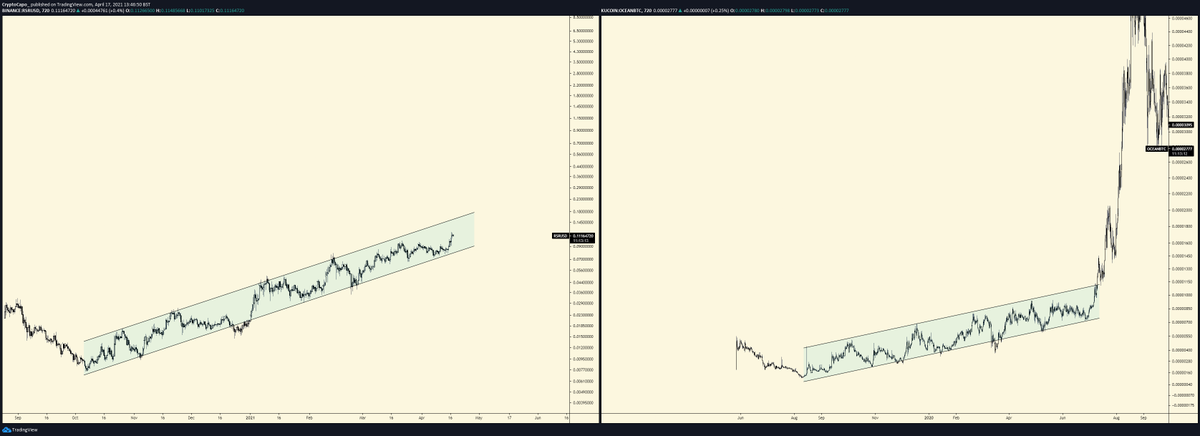

$ETH/BTC vs. $LINK/BTC

These two trends are very similar and I would not be surprised if Ethereum repeats the cycle of LINK against Bitcoin.

27/n

These two trends are very similar and I would not be surprised if Ethereum repeats the cycle of LINK against Bitcoin.

27/n

Altcoins Market Cap

The most bullish chart you& #39;ll probably see these days.

After that accumulation range, extension could be huge.

28/n

The most bullish chart you& #39;ll probably see these days.

After that accumulation range, extension could be huge.

28/n

Altcoins dominance (OTHERS.D)

It& #39;s confirming the break of the range high, which is very good for altcoins.

https://twitter.com/CryptoCapo_/status/1343662204197998595?s=20

29/n">https://twitter.com/CryptoCap...

It& #39;s confirming the break of the range high, which is very good for altcoins.

https://twitter.com/CryptoCapo_/status/1343662204197998595?s=20

29/n">https://twitter.com/CryptoCap...

DEFI PERP (DeFi Index)

This chart keeps looking very bullish to me.

https://twitter.com/CryptoCapo_/status/1343662222208364544?s=20

30/n">https://twitter.com/CryptoCap...

This chart keeps looking very bullish to me.

https://twitter.com/CryptoCapo_/status/1343662222208364544?s=20

30/n">https://twitter.com/CryptoCap...

Many individual charts look awesome against USD and also against BTC. I will post examples of coins that I& #39;m currently holding, explaining why do they look bullish (only TA)

31/n

31/n

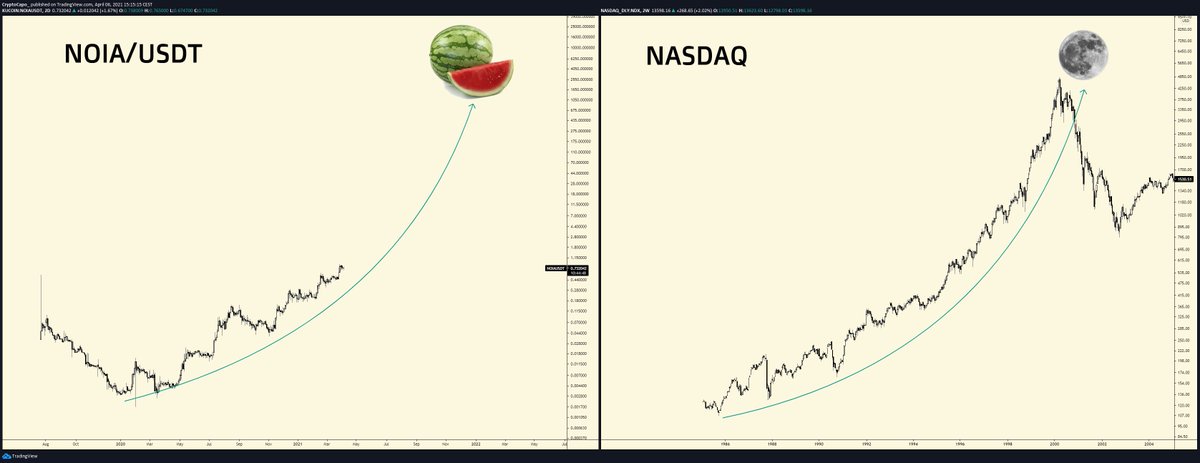

$NOIA / USD

As some of you know, this is one of my favourite projects.

Chart against USD is a perfect bullish trend. Not even a single sign of weakness. How long can this trend last? Only time will tell, but it will probably be epic.

$10-20 by EOY wouldn& #39;t be crazy

32/n

As some of you know, this is one of my favourite projects.

Chart against USD is a perfect bullish trend. Not even a single sign of weakness. How long can this trend last? Only time will tell, but it will probably be epic.

$10-20 by EOY wouldn& #39;t be crazy

32/n

$RSR / USD

Another very bullish altcoin. Solid trend as the previous one, with strong fundamentals.

Targeting $1+ this year

34/n

Another very bullish altcoin. Solid trend as the previous one, with strong fundamentals.

Targeting $1+ this year

34/n

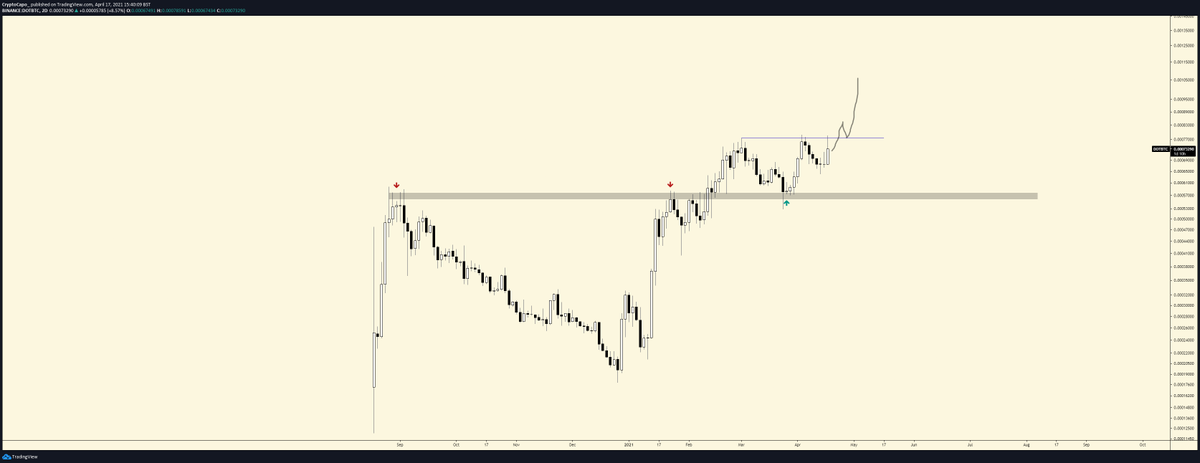

$DOT / BTC

A S/R flip for the books. #Polkadot will keep performing very good imo, and it will be one of the majors with better perfomance in the coming months.

36/n

A S/R flip for the books. #Polkadot will keep performing very good imo, and it will be one of the majors with better perfomance in the coming months.

36/n

$XOR / ETH

This one will caught many people by surprise. Bullish on the entire #Sora Ecosystem ( $PSWAP, $VAL)

37/n

This one will caught many people by surprise. Bullish on the entire #Sora Ecosystem ( $PSWAP, $VAL)

37/n

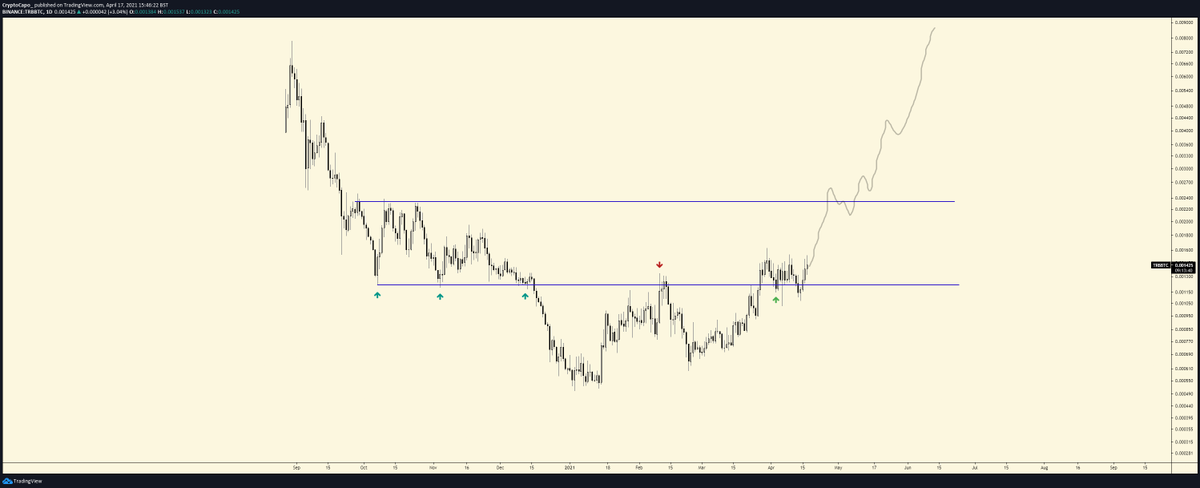

$TRB / BTC

Bearish trend broken, re-entering the value zone with strength. A new uptrend is forming.

39/n

Bearish trend broken, re-entering the value zone with strength. A new uptrend is forming.

39/n

$SAND / BTC

Hidden bullsih divergence formed on higher timeframes. One of my favourite NFT projects.

41/n

Hidden bullsih divergence formed on higher timeframes. One of my favourite NFT projects.

41/n

These have been only some examples of good looking charts. There are a lot. Majors also look good against Bitcoin.

Bitcoin bullish and alts/btc bullish = altseason

Right?

44/n

Bitcoin bullish and alts/btc bullish = altseason

Right?

44/n

Sources:

- @tradingview

- @cryptoquant_com

https://www.lookintobitcoin.com/charts/

Disclaimer:">https://www.lookintobitcoin.com/charts/&q... nothing posted here is a financial advice. Always do your own research before investing.

45/n

- @tradingview

- @cryptoquant_com

https://www.lookintobitcoin.com/charts/

Disclaimer:">https://www.lookintobitcoin.com/charts/&q... nothing posted here is a financial advice. Always do your own research before investing.

45/n

Final conclusions:

With all this, and some things that although I want to explain, they cannot be explained because they are intrinsic in the mind of an analyst, I can say that the best is yet to come.

46/n

With all this, and some things that although I want to explain, they cannot be explained because they are intrinsic in the mind of an analyst, I can say that the best is yet to come.

46/n

My strategy will continue similar to that of recent months: HODL and DCA in strong projects

When there are REAL bearish signs, I will start DCAing out.

47/n

When there are REAL bearish signs, I will start DCAing out.

47/n

We are in the best place at the right time. What cryptocurrency defends goes beyond wanting a better financial situation. Holding cryptocurrencies is a first step to defend what is ours, to defend our rights and freedoms, which are under attack nowadays.

48/n

48/n

Read on Twitter

Read on Twitter