[THREAD]

Deep Dive on Lucid Diagnostics $PAVM

- Product Offering

- $EXAS for esophageal cancer?

- Market Sizing

- Go-to-Market Strategy

- Massive Return Potential (>10x)

Future $PAVM threads on other segments and risk.

Have a starter position.

Please DYODD.

Let& #39;s dig in.

Deep Dive on Lucid Diagnostics $PAVM

- Product Offering

- $EXAS for esophageal cancer?

- Market Sizing

- Go-to-Market Strategy

- Massive Return Potential (>10x)

Future $PAVM threads on other segments and risk.

Have a starter position.

Please DYODD.

Let& #39;s dig in.

1/ GI Health segment operates under Lucid Diagnostics, 74% owned by $PAVM per Needham Conf. (81.9% per 10K).

Founded & #39;18.

$PAVM financed $17.5mm.

Patent licensed from Case Western (CWRU) for EsoCheck & EsoGuard.

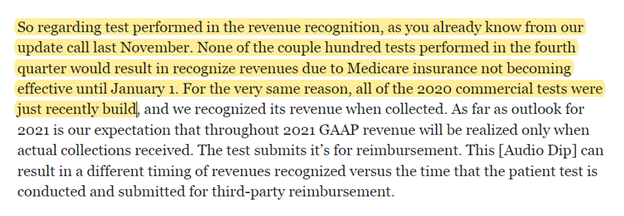

Per 10K, CWRU holds 8.4%. 3 physician inventors each w/ 2.9%.

Founded & #39;18.

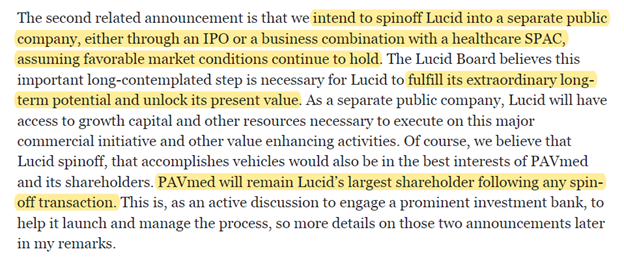

$PAVM financed $17.5mm.

Patent licensed from Case Western (CWRU) for EsoCheck & EsoGuard.

Per 10K, CWRU holds 8.4%. 3 physician inventors each w/ 2.9%.

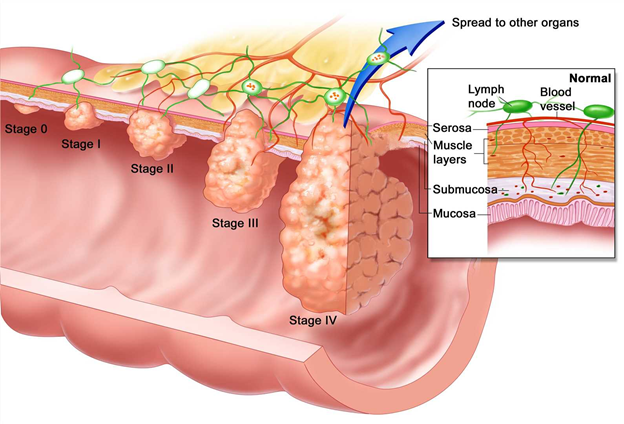

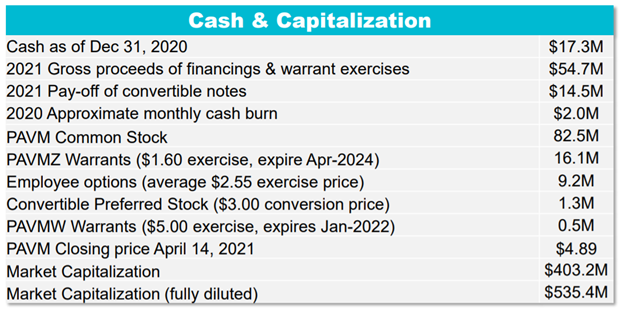

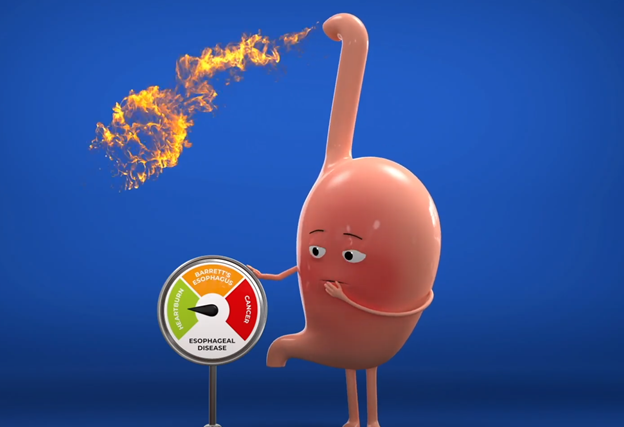

2/ What does Lucid Diagnostics address?

Early detection in:

- Adenocarcinoma of the esophagus ("EAC") i.e., esophagus cancer

- Barrett& #39;s Esophagus ("BE")

EAC primarily caused by chronic heartburn / acid reflux, or GERD.

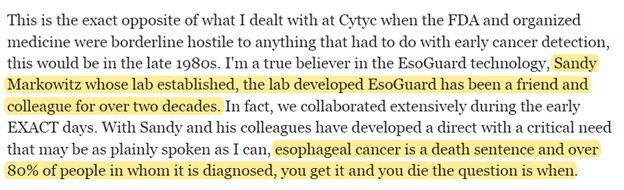

Stomach acid damages cells in esophagus.

Early detection in:

- Adenocarcinoma of the esophagus ("EAC") i.e., esophagus cancer

- Barrett& #39;s Esophagus ("BE")

EAC primarily caused by chronic heartburn / acid reflux, or GERD.

Stomach acid damages cells in esophagus.

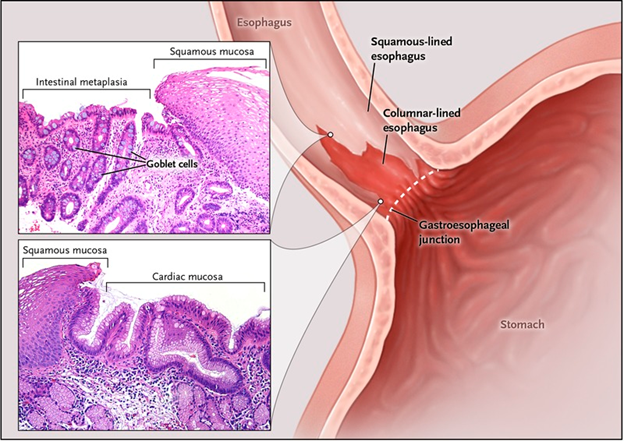

3/ Squamous cells at nexus of stomach is replaced by columnar epithelium.

Over time, can turn from precancerous into cancerous.

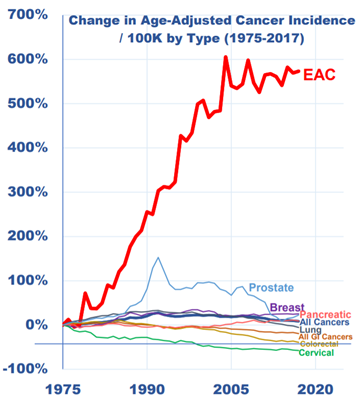

EAC x4 in past 30+ years.

30mm diagnosed GERD patients >50 y.o.

13mm high-risk population w/ other risk factors.

Today, only 10% undergo screening.

Over time, can turn from precancerous into cancerous.

EAC x4 in past 30+ years.

30mm diagnosed GERD patients >50 y.o.

13mm high-risk population w/ other risk factors.

Today, only 10% undergo screening.

4/ Other forms of cancer have declined, but EAC has risen due to lack of pre-screening tools.

Today, gold standard is upper endoscopy / EGD, which requires:

- Sedation

- Fasting

- Taking off from work

- Biopsies

Increasing screening from 10% to 25% can save thousands of lives.

Today, gold standard is upper endoscopy / EGD, which requires:

- Sedation

- Fasting

- Taking off from work

- Biopsies

Increasing screening from 10% to 25% can save thousands of lives.

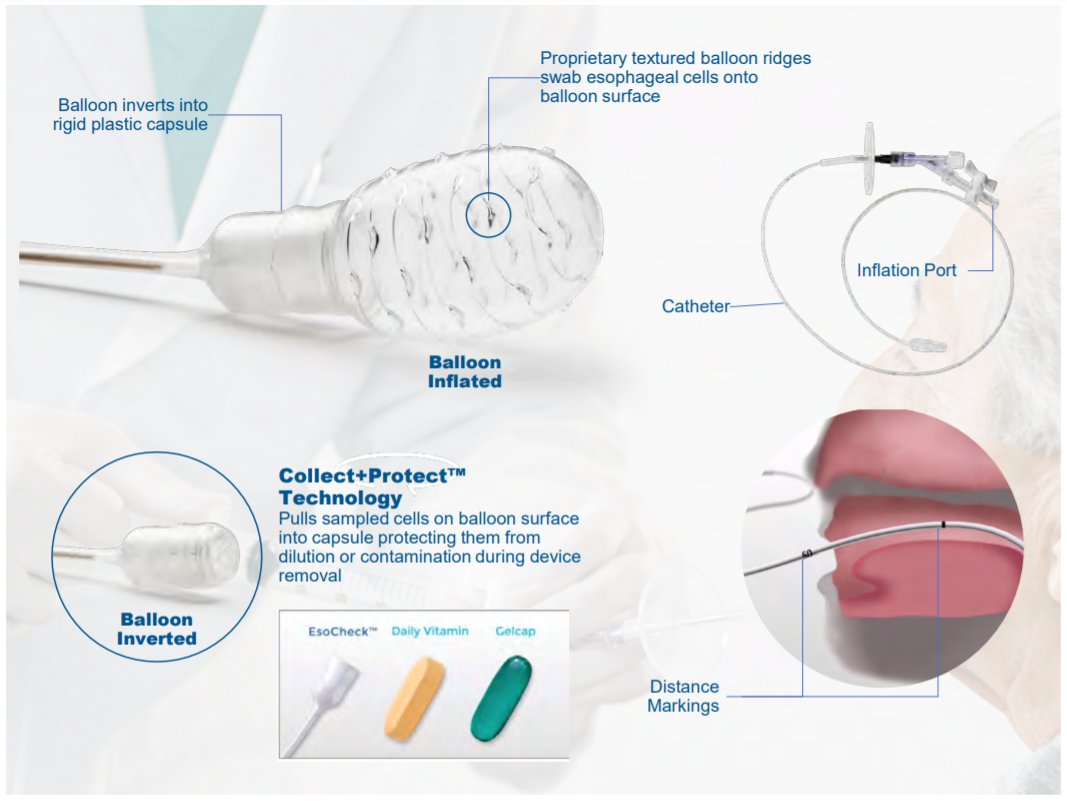

5/ Enter $PAVM.

EsoCheck is an esophageal cell collection device.

- Pill-sized bubble - "collect+protect" tech

- Office-based / <5 min

- FDA clearance on 6/21/19 (adults >22 y.o.)

- Patents end & #39;34

- Manufacturing contract w/ Coastline Int& #39;l

https://www.youtube.com/watch?v=iiv0Gws4sdA">https://www.youtube.com/watch...

EsoCheck is an esophageal cell collection device.

- Pill-sized bubble - "collect+protect" tech

- Office-based / <5 min

- FDA clearance on 6/21/19 (adults >22 y.o.)

- Patents end & #39;34

- Manufacturing contract w/ Coastline Int& #39;l

https://www.youtube.com/watch?v=iiv0Gws4sdA">https://www.youtube.com/watch...

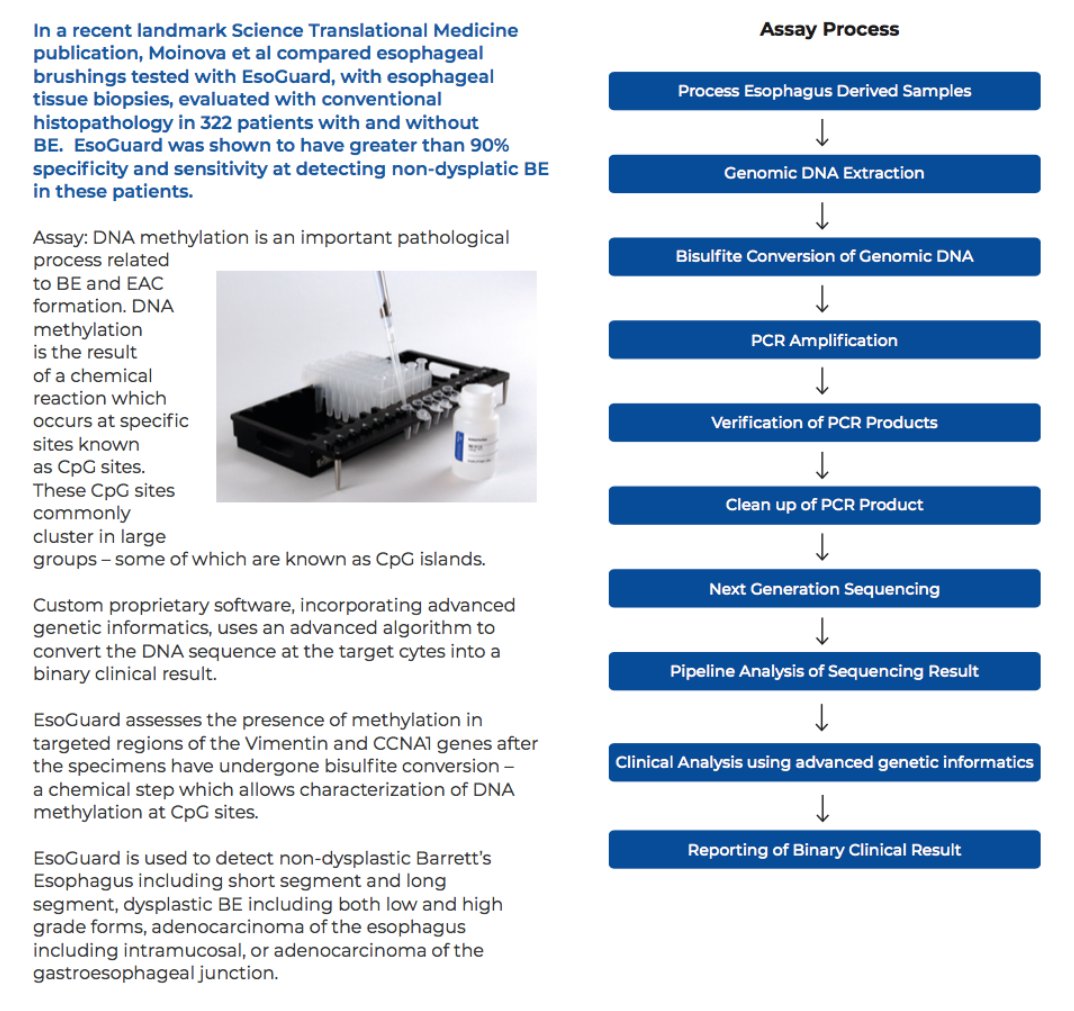

6/ EsoGuard is a Laboratory Developed Test ("LDT").

- Received FDA clearance in Dec & #39;19

- Patent ends Aug & #39;24 but if extension of clinical utility approved, expect extension to late & #39;30s

- Accurate in detecting EAC and BE

- 408-patient study; 90% sensitivity / specificity

- Received FDA clearance in Dec & #39;19

- Patent ends Aug & #39;24 but if extension of clinical utility approved, expect extension to late & #39;30s

- Accurate in detecting EAC and BE

- 408-patient study; 90% sensitivity / specificity

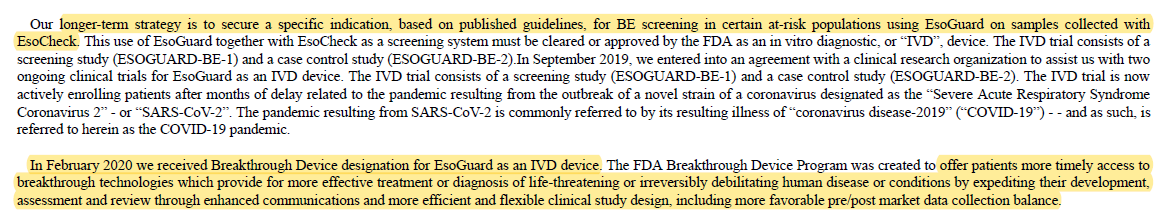

7/ We believe $PAVM will move needle by engaging in pivotal trials to COMBINE the usage of EsoCheck + EsoGuard (as In Vitro Device "IVD") to expand screening.

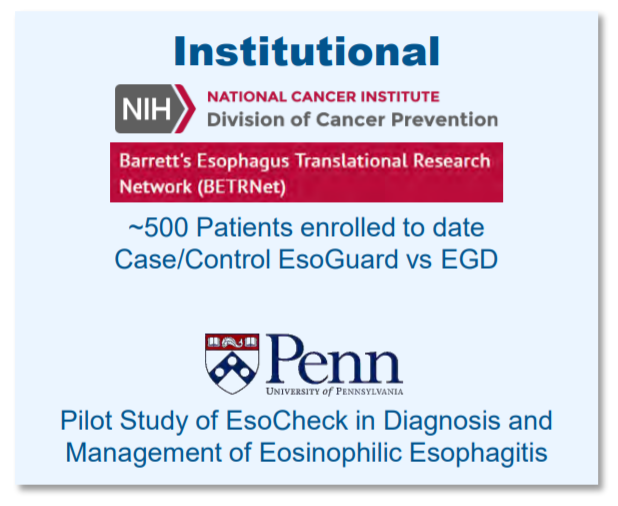

EsoGuard-BE-1: screening study; focus high-risk GERD

EsoGuard-BE-2: case control study of patients w/ known disease

EsoGuard-BE-1: screening study; focus high-risk GERD

EsoGuard-BE-2: case control study of patients w/ known disease

8/ Expect to finish enrolling by end & #39;21 w/ registration in & #39;22.

Robust literature will increase usage/confidence.

Breakthrough Device designation in Feb & #39;20 means:

- Priority FDA review

- Bipartisan bill seeks for Medicare to cover for 3 yrs while determine permanent coverage

Robust literature will increase usage/confidence.

Breakthrough Device designation in Feb & #39;20 means:

- Priority FDA review

- Bipartisan bill seeks for Medicare to cover for 3 yrs while determine permanent coverage

9/ Submitted dossier in May & #39;20 to MolDx, molecular diagnostic group of Palmetto, Medicare Administrative Contractor ("MAC").

MolDx coordinates coverage for molecular tests and expect coverage determination by late fall.

No private payers yet but engaged 2 consulting firms.

MolDx coordinates coverage for molecular tests and expect coverage determination by late fall.

No private payers yet but engaged 2 consulting firms.

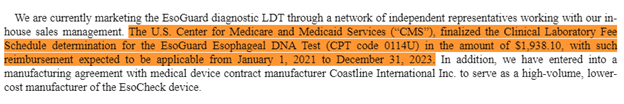

10/ CMS has already given final reimbursement of $1,938.10 for EsoGuard under CPT Code 0114U.

(Applicable 1/1/21-12/31/23)

This reimbursement can be used as guidepost for private plans.

(Applicable 1/1/21-12/31/23)

This reimbursement can be used as guidepost for private plans.

11/ Filed EU& #39;s CE Mark for EsoCheck in Nov & #39;20.

EsoGuard falls under self-declaration category, should be active by mid & #39;21.

Also in separate clinical trial with Penn to evaluate $PAVM vs. endoscopic biopsy in assessment of another condition, Eosinophilic Esophagitis ("EoE").

EsoGuard falls under self-declaration category, should be active by mid & #39;21.

Also in separate clinical trial with Penn to evaluate $PAVM vs. endoscopic biopsy in assessment of another condition, Eosinophilic Esophagitis ("EoE").

12/ Why is the above all so attractive?

Pre-screening is best method to prevent cancer.

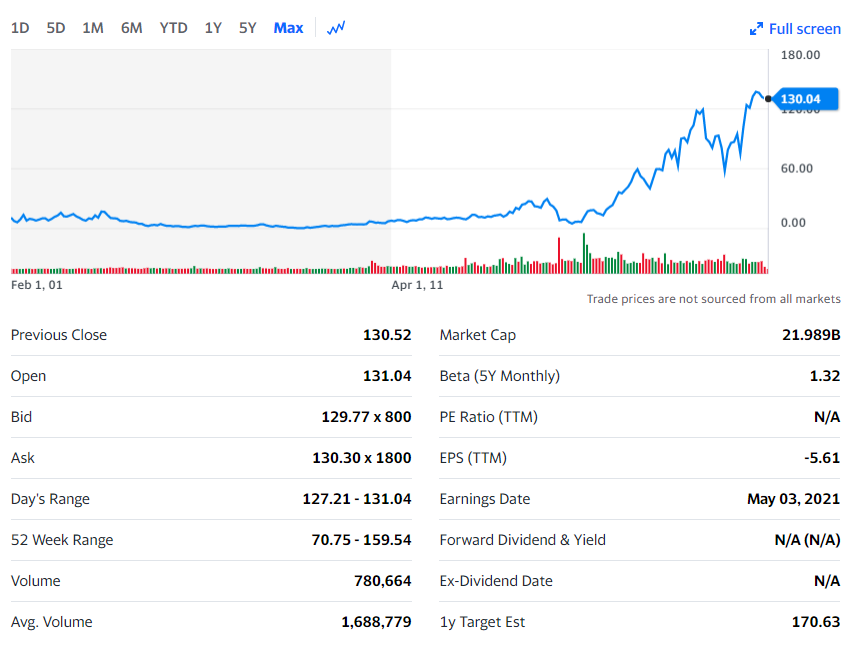

We& #39;ve seen this movie in the past with ColoGuard by $EXAS.

Since its pivotal trial... market cap rose from $600mm to $22Bn today.

Pre-screening is best method to prevent cancer.

We& #39;ve seen this movie in the past with ColoGuard by $EXAS.

Since its pivotal trial... market cap rose from $600mm to $22Bn today.

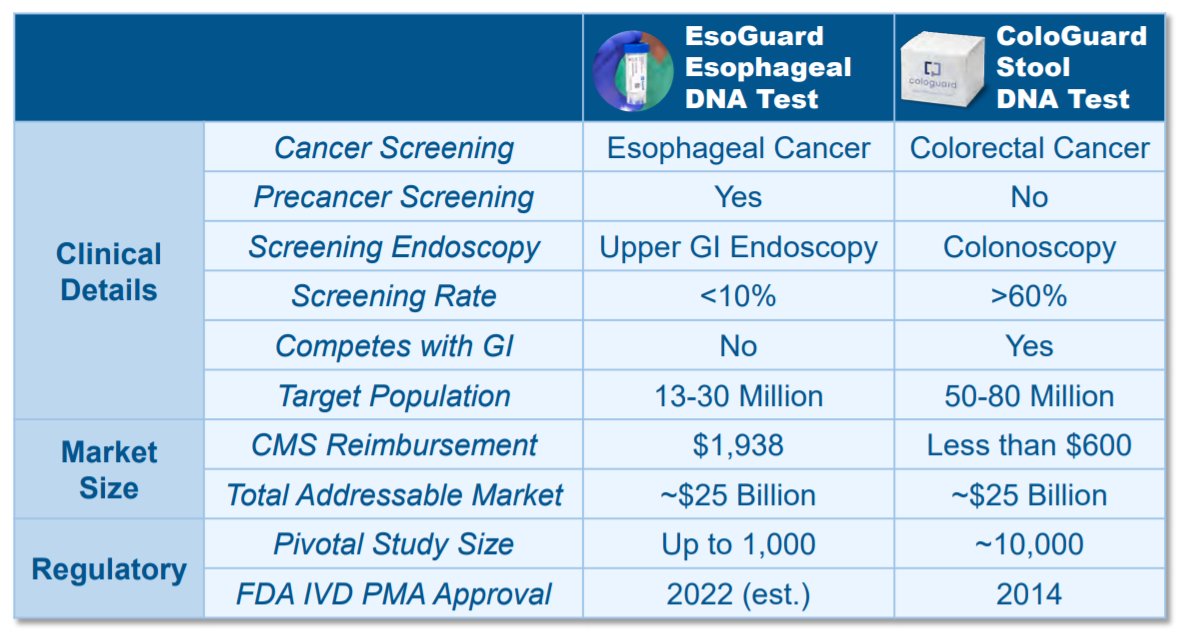

13/ Importantly, in-depth look at dynamics actually favor $PAVM over $EXAS.

- $EXAS was in landscape w/ existing screening, whereas upper EGD screening is <10%

- $EXAS competed w/ GI, whereas $PAVM will lead to confirmatory biopsy even w/ positive result.

$PAVM expands funnel.

- $EXAS was in landscape w/ existing screening, whereas upper EGD screening is <10%

- $EXAS competed w/ GI, whereas $PAVM will lead to confirmatory biopsy even w/ positive result.

$PAVM expands funnel.

14/ $PAVM goal is not to replace EGD but to enlarge top of funnel in screening.

If positive -> Confirmatory diagnostic procedure or therapeutic ablation w/ GI

If negative -> Follow-up sessions w/ GI

As a result, healthcare systems can allocate resources better.

If positive -> Confirmatory diagnostic procedure or therapeutic ablation w/ GI

If negative -> Follow-up sessions w/ GI

As a result, healthcare systems can allocate resources better.

15/ Assume:

- 13mm U.S. male GERD patients w/ RF

- 10% already screened

- 11.7mm target screening pool

- $1,938 / test

- $22.7Bn TAM (Co provided $25Bn, w/o 10% haircut)

Above excludes 18mm female GERD patients & 30mm silent GERD patients.

Big opp as GERD PPI sales >$13Bn/yr

- 13mm U.S. male GERD patients w/ RF

- 10% already screened

- 11.7mm target screening pool

- $1,938 / test

- $22.7Bn TAM (Co provided $25Bn, w/o 10% haircut)

Above excludes 18mm female GERD patients & 30mm silent GERD patients.

Big opp as GERD PPI sales >$13Bn/yr

16/ If achieve:

1% -> $227mm

5% -> $1.13Bn

We believe $PAVM is a superior product vs. competition.

Other endoscopy requires effort, capital equipment or time.

Med device giant $MDT rolled out Cytosponge.

Though slow to gain traction, product also usable in any office.

1% -> $227mm

5% -> $1.13Bn

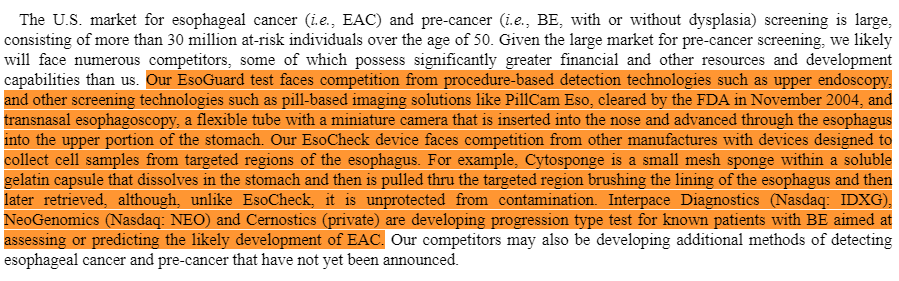

We believe $PAVM is a superior product vs. competition.

Other endoscopy requires effort, capital equipment or time.

Med device giant $MDT rolled out Cytosponge.

Though slow to gain traction, product also usable in any office.

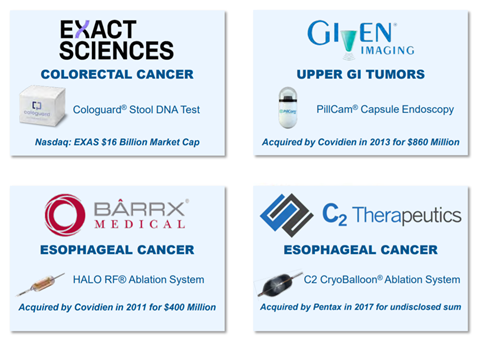

17/ List of other competition include:

- PillCam Eso (cleared by FDA in & #39;04)

- Interspace Diagnostics (IDXG)

- NeoGenomics (NEO)

- Cernostics (private)

Large market so expect competition but $PAVM is very well positioned.

Others in pic below. A lot acquired by larger players.

- PillCam Eso (cleared by FDA in & #39;04)

- Interspace Diagnostics (IDXG)

- NeoGenomics (NEO)

- Cernostics (private)

Large market so expect competition but $PAVM is very well positioned.

Others in pic below. A lot acquired by larger players.

18/ Another product in $PAVM& #39;s GI Health segment (not FDA approved yet) is EsoCure.

- Ablation technology to treat dysplasia

- Built on $PAVM technology (IP called Caldus)... not licensed from CWRU

- $PAVM will have arrangement w/ Lucid re: selling / marketing

- Ablation technology to treat dysplasia

- Built on $PAVM technology (IP called Caldus)... not licensed from CWRU

- $PAVM will have arrangement w/ Lucid re: selling / marketing

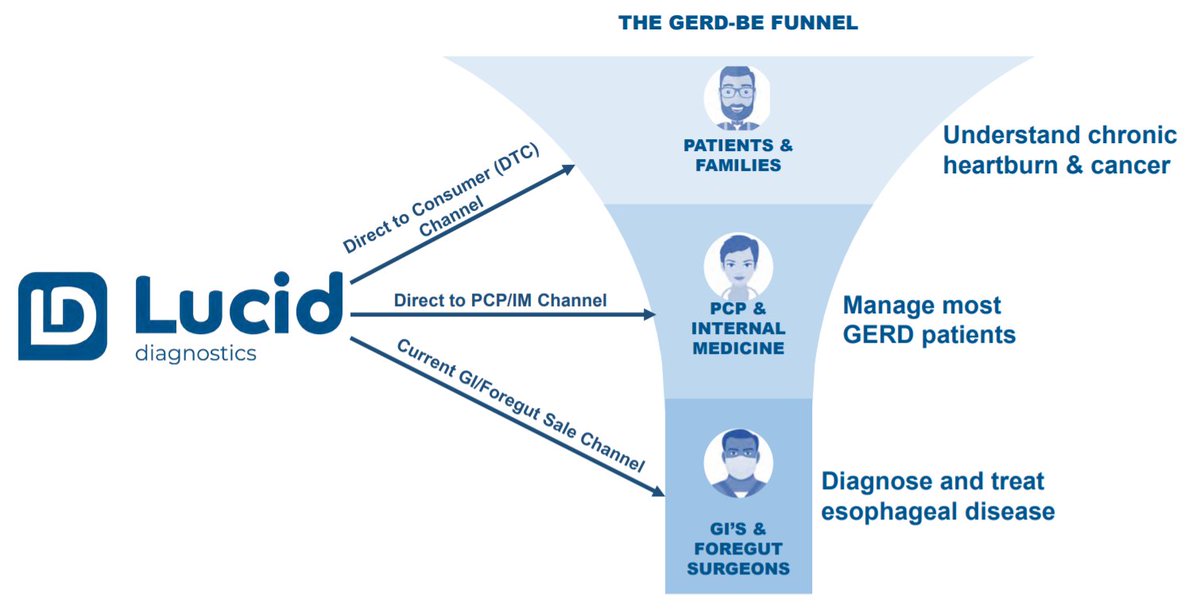

19/ What is $PAVM& #39;s go-to-market plan for Lucid?

Omnichannel approach:

1) GI/Forgut Sales Channel

2) PCP / Internal Medicine

3) Direct-to-Consumer

Believe all 3 work in unison to drive awareness / educate public that chronic heartburn can lead to cancer.

Omnichannel approach:

1) GI/Forgut Sales Channel

2) PCP / Internal Medicine

3) Direct-to-Consumer

Believe all 3 work in unison to drive awareness / educate public that chronic heartburn can lead to cancer.

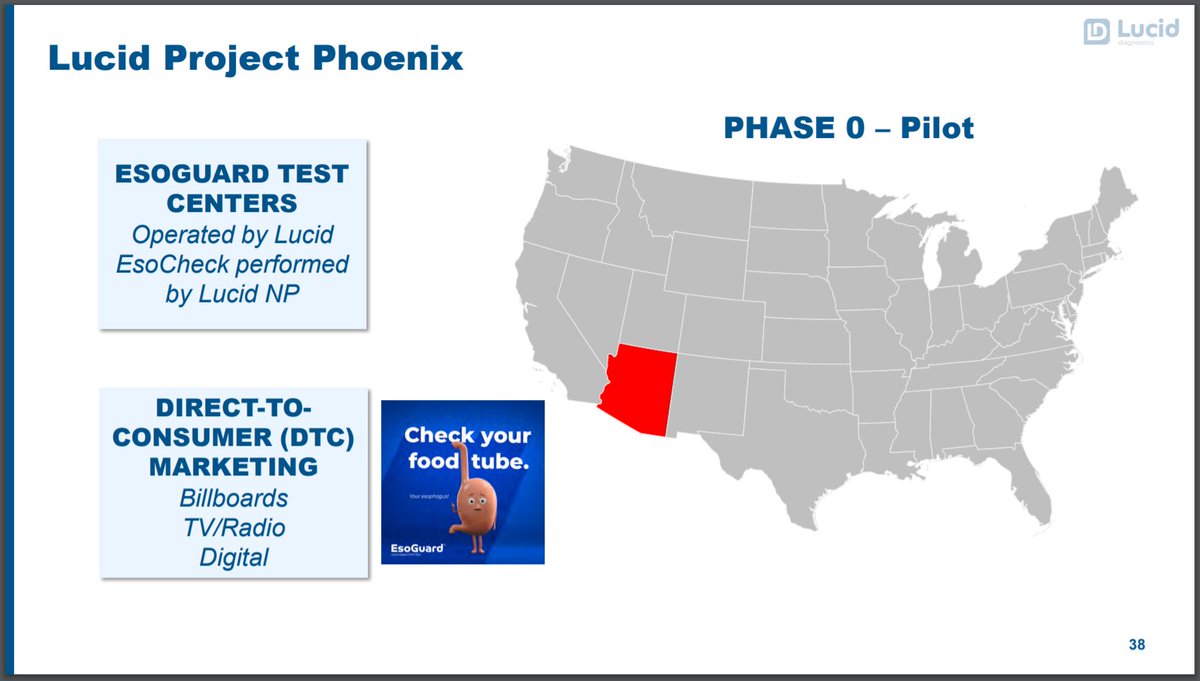

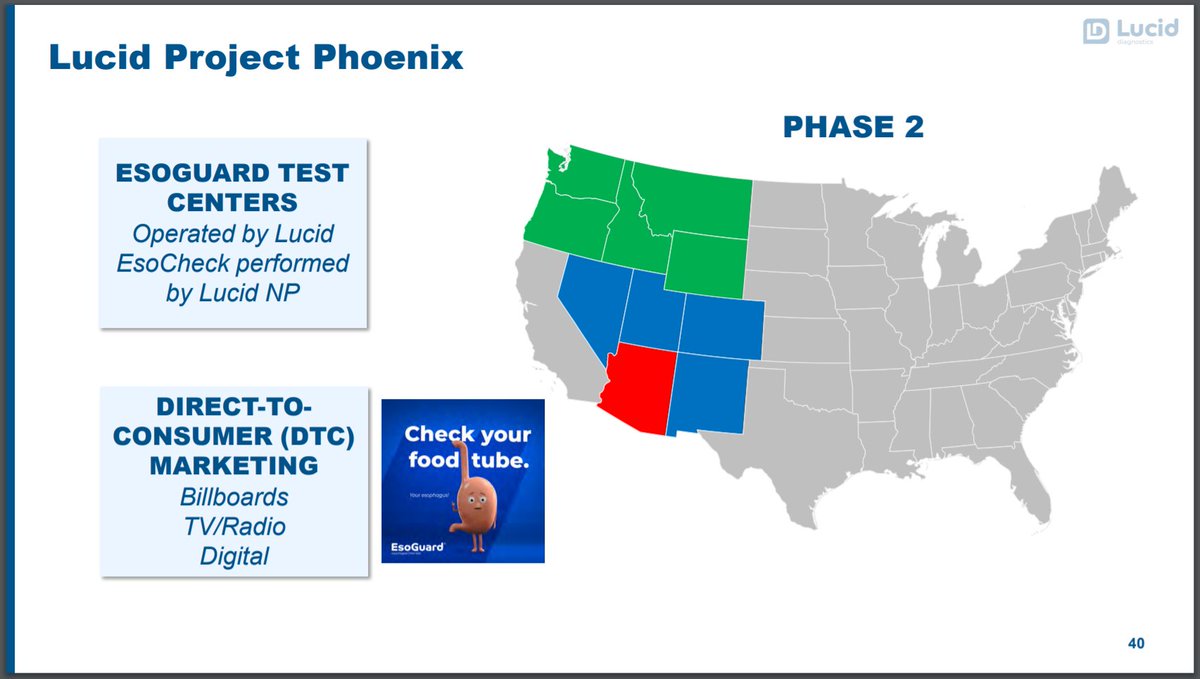

20/ Idea is to build EsoCheck& #39;s own network of operators (has some parallel to $TMDX& #39;s efforts in OCS National Program).

$PAVM initiative called Phoenix Program.

Commercialization process is important. It& #39;s not just about the product but how to sell it and speed up adoption.

$PAVM initiative called Phoenix Program.

Commercialization process is important. It& #39;s not just about the product but how to sell it and speed up adoption.

21/ 7 regional sales manager (8-10 goal), covering 50 independent sales reps (100-150 goal).

1 clinical specialist (7 goal); train clinicians / support accounts.

Lucid will train a network of FT nurses, sent to:

- Partner physician

- Own testing center

- JV w/ lab testing co

1 clinical specialist (7 goal); train clinicians / support accounts.

Lucid will train a network of FT nurses, sent to:

- Partner physician

- Own testing center

- JV w/ lab testing co

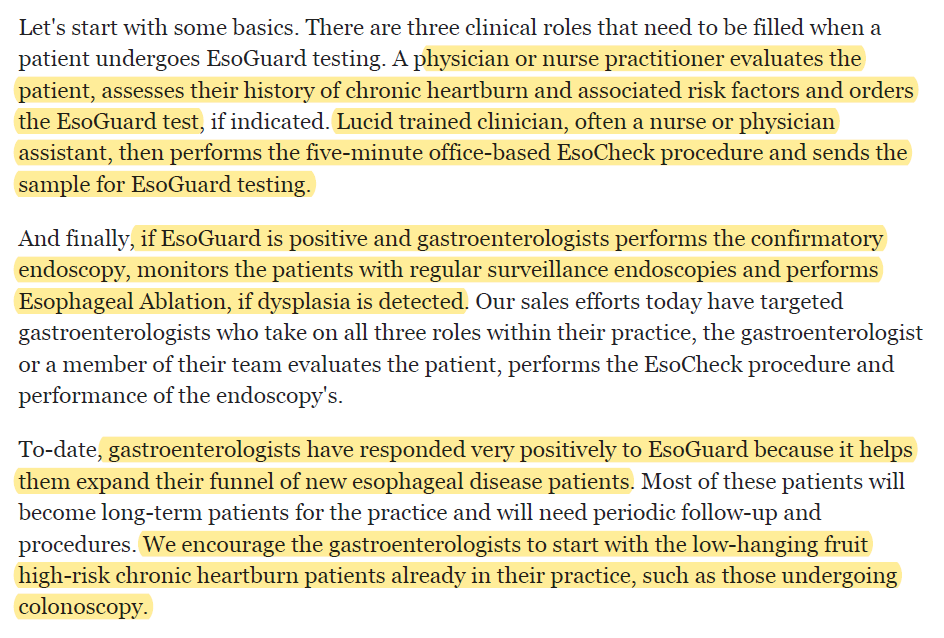

22/ EsoGuard testing process...

1) Physician/NP evaluates patient & assesses heartburn + RF

2) Lucid-trained Physician/NP performs procedure

3) If positive, treatment via endoscopy + ablation on dysplasia

Current sales effort on gastroenterologist who does all 3 steps.

1) Physician/NP evaluates patient & assesses heartburn + RF

2) Lucid-trained Physician/NP performs procedure

3) If positive, treatment via endoscopy + ablation on dysplasia

Current sales effort on gastroenterologist who does all 3 steps.

23/ Once broad GI adoption, can drive w/ PCP & DTC efforts.

Mascot: Freddy the Food Tube

- Social media engagement

- Drive self-referrals

- Patient inquiries

https://www.youtube.com/watch?v=PswcQ4jyq7g

Step">https://www.youtube.com/watch... on gas pedal once geographic coverage of testing locations ready and everyone has access.

Mascot: Freddy the Food Tube

- Social media engagement

- Drive self-referrals

- Patient inquiries

https://www.youtube.com/watch?v=PswcQ4jyq7g

Step">https://www.youtube.com/watch... on gas pedal once geographic coverage of testing locations ready and everyone has access.

24/ Keep in mind Covid-19 was negative impact.

"Testing volume grew steadily during the fall until the winter Covid surge filled hospitals and the testing pace slowed once again" Dr. Aklog, CEO

- Pace remained negative in January

- Rebound post-vaccination of healthcare workers

"Testing volume grew steadily during the fall until the winter Covid surge filled hospitals and the testing pace slowed once again" Dr. Aklog, CEO

- Pace remained negative in January

- Rebound post-vaccination of healthcare workers

25/ Despite performing few tests, no revenue recognition yet.

Per CEO, must be recognized upon receipt of cash. $PAVM didn& #39;t submit claims yet - keep in mind CMS payment became effective in 1/1/21.

Past claims submitted as of Q1& #39;21.

Revenue coverage metrics coming Q1& #39;21.

Per CEO, must be recognized upon receipt of cash. $PAVM didn& #39;t submit claims yet - keep in mind CMS payment became effective in 1/1/21.

Past claims submitted as of Q1& #39;21.

Revenue coverage metrics coming Q1& #39;21.

26/ At steady-state for EsoGuard...

- GM of 90%

- Variable sales rep cost of 20-25%

- Contribution Margin of 65-70%... or $735-790mm @ 5% sales penetration off sales opp above.

Note: $PAVM pays royalty fee to CWRU for licensing IP for EsoCheck / EsoGuard.

- GM of 90%

- Variable sales rep cost of 20-25%

- Contribution Margin of 65-70%... or $735-790mm @ 5% sales penetration off sales opp above.

Note: $PAVM pays royalty fee to CWRU for licensing IP for EsoCheck / EsoGuard.

27/ Important point to note - $PAVM is looking to spin-off Lucid into separate co. Announced intention as of 2/22/21.

Already hired bankers. Unsure if going traditional route or SPAC merger route.

Mgmt believes Lucid can better capitalize on potential if trade separately.

Already hired bankers. Unsure if going traditional route or SPAC merger route.

Mgmt believes Lucid can better capitalize on potential if trade separately.

28/ $PAVM confirmed they are not selling shares / exiting by any means.

Management still TBD for NewCo.

By going this route, Lucid gets more funding but $PAVM shareholders will get diluted.

If SPAC, will get SPAC Cash-in-Trust and PIPE $ but give up PF % ownership.

Management still TBD for NewCo.

By going this route, Lucid gets more funding but $PAVM shareholders will get diluted.

If SPAC, will get SPAC Cash-in-Trust and PIPE $ but give up PF % ownership.

29/ Lots of detail not yet disclosed / hammered out, but...

If we go by EsoCheck + EsoGuard (even excluding $PAVM& #39;s EsoCure)...

We believe Lucid can reach approx. $1Bn in sales assuming 5% market share.

Applying a very conservative 5x sales multiple gives $5Bn in EV.

If we go by EsoCheck + EsoGuard (even excluding $PAVM& #39;s EsoCure)...

We believe Lucid can reach approx. $1Bn in sales assuming 5% market share.

Applying a very conservative 5x sales multiple gives $5Bn in EV.

30/ Per $PAVM& #39;s Needham Conf. using $4.89 stock price (4/14/21)

Basic Shares: 82.5mm

Adj. for:

PAVMZ Warrants ($1.60 strike)

Options ($2.55 strike)

Convert Pref Stock ($3.00 conv)

PAVMW Warrants ($5.00 strike)

FDSO: 109.6mm

FD Market Cap of consolidated $PAVM is $535.4mm

Basic Shares: 82.5mm

Adj. for:

PAVMZ Warrants ($1.60 strike)

Options ($2.55 strike)

Convert Pref Stock ($3.00 conv)

PAVMW Warrants ($5.00 strike)

FDSO: 109.6mm

FD Market Cap of consolidated $PAVM is $535.4mm

31/ Scrubbing subsequent events...

FY& #39;20 Cash: $17.3mm

New Cash: $54.7mm raised in & #39;21 (financing/warrants)

Debt: $14.5mm convert debt paid off in & #39;21

Cash burn: $2mm/mo (i.e., $7mm so far in Q)

Net cash: approx. $50.5mm

EV: $484.9mm

Feel free to let me know if diff numbers.

FY& #39;20 Cash: $17.3mm

New Cash: $54.7mm raised in & #39;21 (financing/warrants)

Debt: $14.5mm convert debt paid off in & #39;21

Cash burn: $2mm/mo (i.e., $7mm so far in Q)

Net cash: approx. $50.5mm

EV: $484.9mm

Feel free to let me know if diff numbers.

32/ Was unclear whether options/warrants on conference slide was PF& #39;ed for all recent exercises already.

Either way, this is directionally correct.

Believe investment can 10x.

If multiple was aggressive @ 10x sales, can 20x investment.

This is on Lucid segment alone.

Either way, this is directionally correct.

Believe investment can 10x.

If multiple was aggressive @ 10x sales, can 20x investment.

This is on Lucid segment alone.

33/ $PAVM is backed by a very capable team of seasoned executives & strategic advisors.

- Chairman/CEO: Lishan Aklog

- Strategic Advisor: Stan Lapidus

- Regulatory Advisor: Alberto Gutierrez

- Medical Advisory Board Chair / Principal Investigator in Pivotal Study: Nick Shaheen

- Chairman/CEO: Lishan Aklog

- Strategic Advisor: Stan Lapidus

- Regulatory Advisor: Alberto Gutierrez

- Medical Advisory Board Chair / Principal Investigator in Pivotal Study: Nick Shaheen

34/ CEO Aklog and his related party Pavilion Holdings Group ("PHG") hold a large stake in $PAVM.

Michael Glennon, his Co-Founder in PHG is still vice-chairman.

PHG was founded as a medical device incubator. Guys at $PAVM have the mindset of savvy capital allocators.

Michael Glennon, his Co-Founder in PHG is still vice-chairman.

PHG was founded as a medical device incubator. Guys at $PAVM have the mindset of savvy capital allocators.

35/ Partner w/ academic medical centers to drive product from concept to commercialization w/ low-risk on the company.

Lapidus is brought in as strategic advisor and joins public Biz Update calls w/ $PAVM.

Founder/CEO of:

- $EXAS (ColoGuard)

- Cytyc (acquired by Hologic $6.2Bn)

Lapidus is brought in as strategic advisor and joins public Biz Update calls w/ $PAVM.

Founder/CEO of:

- $EXAS (ColoGuard)

- Cytyc (acquired by Hologic $6.2Bn)

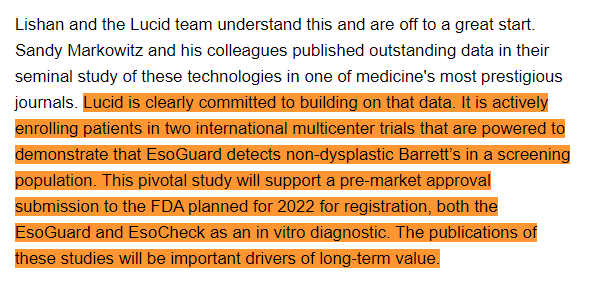

36/ Lapidus is tight w/ Sandy Markowitz whose lab established EsoGuard from CWRU (worked together since $EXAS days for >2 decades).

Lapidus& #39; expected involvement in spun-off entity also not disclosed. Nobody better than Lapidus for guiding Lucid.

Lapidus& #39; expected involvement in spun-off entity also not disclosed. Nobody better than Lapidus for guiding Lucid.

37/ Alberto Gutierrez $PAVM& #39;s other advisor - former Director, FDA Office of IVD (Perfect bullseye for IVD trials)

Nick Shaheen - Lead figure in Esophageal disease space and Lead author of American College of Gastroenterology Guidelines

Expert for all important aspects of biz.

Nick Shaheen - Lead figure in Esophageal disease space and Lead author of American College of Gastroenterology Guidelines

Expert for all important aspects of biz.

38/ It is clear that Dr. Aklog designs unique growth plans for each product in $PAVM pipeline.

$PAVM sources top-notch assets from academic medical centers, locks in valuable partnerships and adds value for all products.

When asked about other products, Dr. Aklog said...

$PAVM sources top-notch assets from academic medical centers, locks in valuable partnerships and adds value for all products.

When asked about other products, Dr. Aklog said...

39/ "B/c we are working in multiple clinical conditions, we have a targeted and tailored solution for each.

One of the things moving forward that will change is that as $PAVM has grown and we& #39;ve built this infrastructure...

We are looking to do the next Lucids. Lucid 2/3/4"

One of the things moving forward that will change is that as $PAVM has grown and we& #39;ve built this infrastructure...

We are looking to do the next Lucids. Lucid 2/3/4"

40/ Just on the Lucid segment alone and applying conservative multiples, we believe $PAVM can potentially >10x.

Feel free to provide any industry insights.

Always appreciate constructive comments.

Thank you - would appreciate RT of thread so can get more perspectives on Lucid.

Feel free to provide any industry insights.

Always appreciate constructive comments.

Thank you - would appreciate RT of thread so can get more perspectives on Lucid.

Read on Twitter

Read on Twitter![[THREAD] Deep Dive on Lucid Diagnostics $PAVM - Product Offering- $EXAS for esophageal cancer?- Market Sizing- Go-to-Market Strategy- Massive Return Potential (>10x)Future $PAVM threads on other segments and risk.Have a starter position. Please DYODD.Let& #39;s dig in. [THREAD] Deep Dive on Lucid Diagnostics $PAVM - Product Offering- $EXAS for esophageal cancer?- Market Sizing- Go-to-Market Strategy- Massive Return Potential (>10x)Future $PAVM threads on other segments and risk.Have a starter position. Please DYODD.Let& #39;s dig in.](https://pbs.twimg.com/media/EzLizhEVIAI07aH.jpg)