Do u have kids? Do u have a pension fund at work? Have u filled in your beneficiary form? Do u know what happens if u don’t nominate a beneficiary on your risk inside a fund? If u said no to any of these, u might want to read this - happens all to often!

1) Complete your beneficiary form! Now! If u have an unapproved death benefit - and no one is nominated as a beneficiary, it pays out to your estate! To get an Executor appointed in SA, takes a very long time. Trust me, I know! Your money will be stuck! Don’t let it happen!

Even worse, if you have an unapproved benefit and your ex spouse is noted on the last completed Beneficiary Form, guess who the risk provider pays? Yes, u right your ex spouse! No questions asked! Go and update it!

2) A beneficiary form also helps the Board of Trustees under Section 37C of the Pension Funds Act to allocate money to beneficiaries that need it when u die! Education remains the most important item for consideration!

3) don’t leave everything to your spouse! If you have children, allocate to them separately! Each one! On their own! Separately! So that when they turn 18 - they have a nest egg and spouse didn’t spend it all! Plenty horror stories out there! This goes to both the men and woman!

4) put a Will in place! It’s easy! @terencetobin can help u! Or u can get one at your bank! No excuse! Don’t let your estate be devolved through Intestate Succession - it’s a ball ache! If u think the Master of the court is slow, try these guys out! Money in a black hole!

If u want more info on how Intestate succession works, here is Government’s website https://www.gov.za/faq/justice-and-crime-prevention/intestate-succesion#">https://www.gov.za/faq/justi... good luck

A Will helps the Trustees to allocate within Section 37C of the Pension Funds Act - especially since they then know how monies would be distributed to the beneficiaries and can adjust if necessary! Another reason to do your Will! Now!

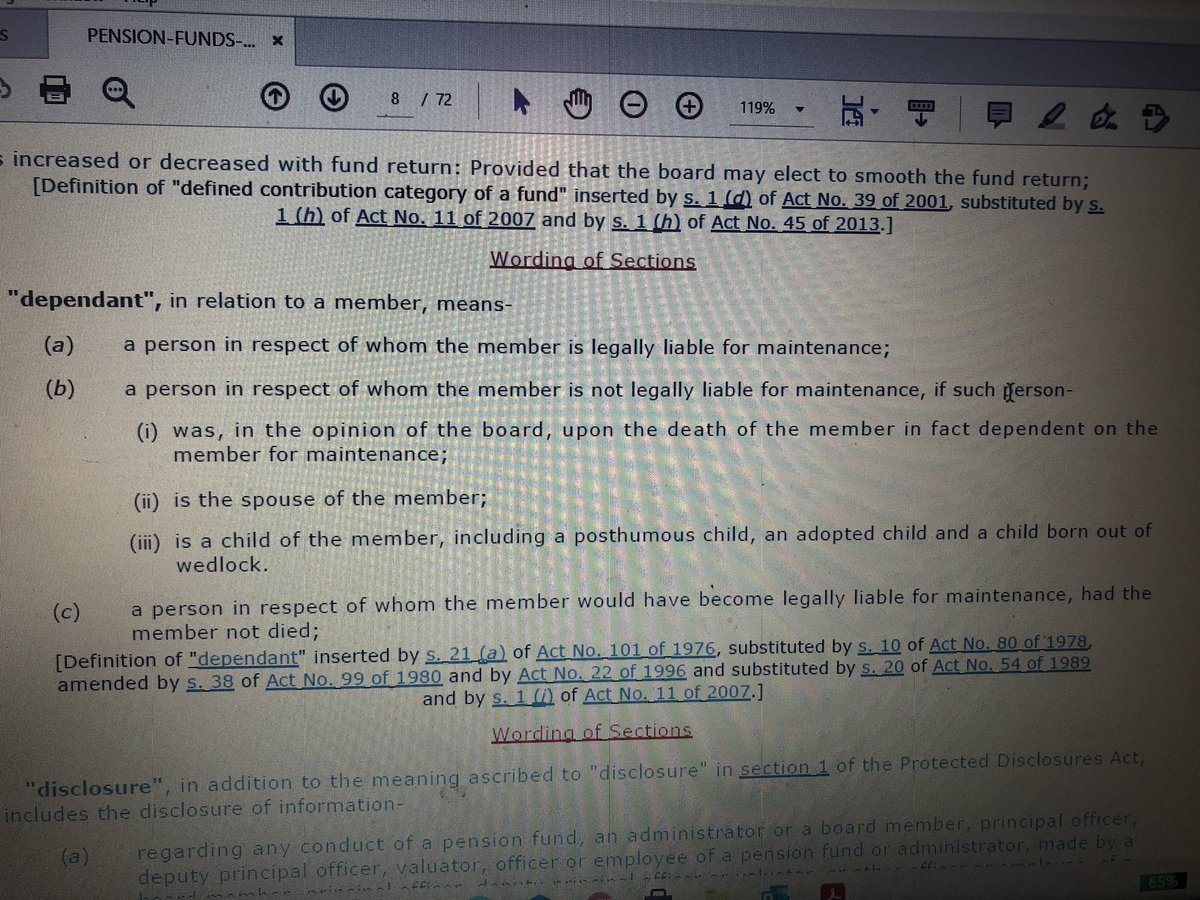

5) mistress or mister? These are the first people that knock at the Fund’s door when a person passed away! So, let me break it down, this is what a dependent is defined as according to the Pension Funds Act - not the only consideration! Other Acts apply!

So, if you are paying someone R1000 per month to assist with groceries, rent, paying for schooling etc, that person becomes financially dependent on u, and when u die, they would need to be considered! Be careful of this people! Rather write down all dependents! Why?

Are u crazy is what u asking me - no! The problem here is that by delaying the process with investigations, your family, kids, spouse etc, don’t have any disposable monies. Even worse if they were the breadwinner! Don’t delay the process!

Don’t let people who need the money suffer, cause not all beneficiaries were disclosed! Make it easy for the Fund to help the people who really need the money to carry on with school, to live under a roof! U get the point, don’t let them down!

So to conclude:

1) Complete your Beneficiary form now - some can be done electronically!

2) Don’t leave everything to your spouse! Leave to your kids separately!

3) Put your Will in place - it helps!

4) Dependents (factual and legal) to be noted! Time becomes critical!

1) Complete your Beneficiary form now - some can be done electronically!

2) Don’t leave everything to your spouse! Leave to your kids separately!

3) Put your Will in place - it helps!

4) Dependents (factual and legal) to be noted! Time becomes critical!

If u want to know more on how Trustees consider distributing a benefit - here is Section 37C of the Act! Minors trump adults! Spouse trumps everyone else! If u are no longer here, and your kid turns 18, they are entitled to the money u left them! They are now viewed as majors!

Hope this helps!

Some light reading if u are interested in recent findings around Section 37C - here is the link - https://www.ebnet.co.za/single-post/distribution-of-approved-death-benefits-and-guidance-from-a-recent-high-court-judgement">https://www.ebnet.co.za/single-po...

Read on Twitter

Read on Twitter