$CRV x $SNX cross asset multichain liquidity

Thread on how they solve Impermanent Loss for LPs while also enabling decentralized cross-chain swaps for traders

AMM innovation is heating up & they are competing directly with Bancor & Thorchain for volume on the major pairs

Thread on how they solve Impermanent Loss for LPs while also enabling decentralized cross-chain swaps for traders

AMM innovation is heating up & they are competing directly with Bancor & Thorchain for volume on the major pairs

Primer - The idea to use synths to power cross pool swaps originated late last year as a white swan event https://twitter.com/pythianism/status/1289228340721672196">https://twitter.com/pythianis...

Part 1 - Solving Impermanent Loss by offering single asset exposure to LPs

LPs who desire 100% price exposure to their chosen asset are able to provide liquidity to the sBTC or sETH pools on Curve

Their funds float between all assets in the pool based on what trades are made

LPs who desire 100% price exposure to their chosen asset are able to provide liquidity to the sBTC or sETH pools on Curve

Their funds float between all assets in the pool based on what trades are made

LPs are essential taking on the risk of both Curve& #39;s smart contracts & Synthetix& #39;s over-collateralization

in exchange for trading fees of the pool & $CRV rewards

Advantage over Bancor is that deposits do not need to be locked for 100 days to get full protection

in exchange for trading fees of the pool & $CRV rewards

Advantage over Bancor is that deposits do not need to be locked for 100 days to get full protection

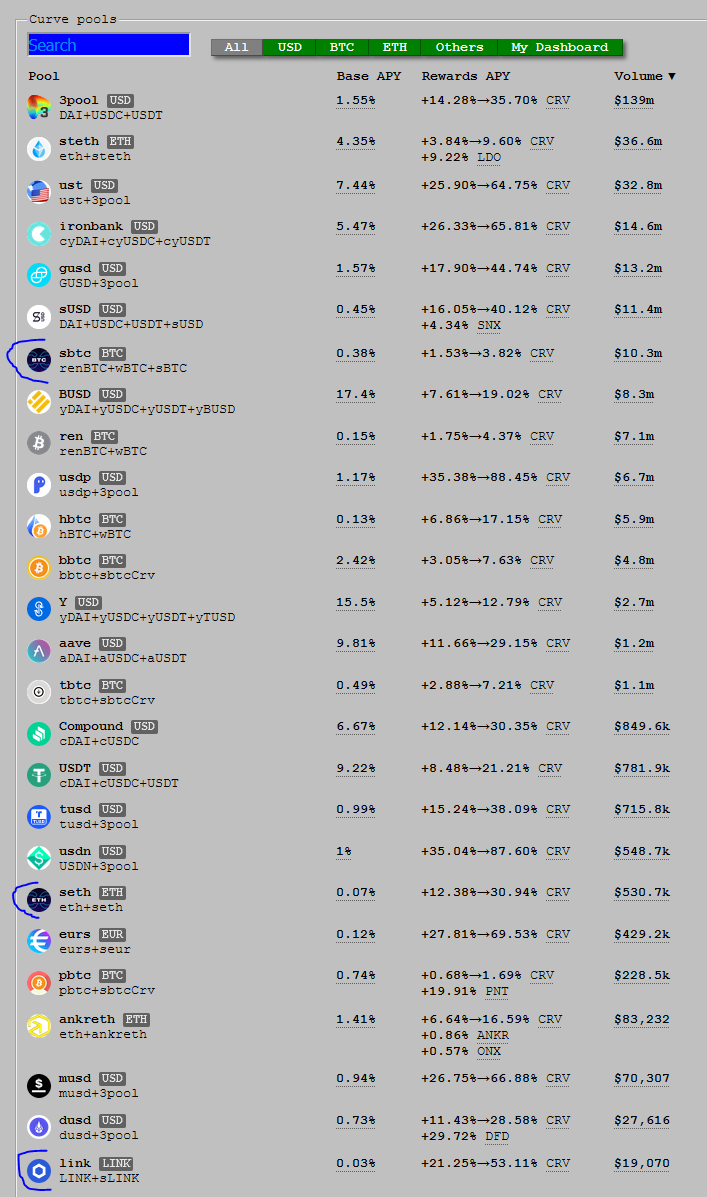

The newest addition to Curve& #39;s Synthetix powered pools has been $LINK

LPs have been able to provide LINKies & receive between 21.25% - 53.11% APY

Expecting pools for the other major blue chips to pop up soon

Imagine the new demand for $CRV to boost https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌊" title="Wasserwelle" aria-label="Emoji: Wasserwelle"> https://twitter.com/DeFiGod1/status/1368047540818546689?s=20">https://twitter.com/DeFiGod1/...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌊" title="Wasserwelle" aria-label="Emoji: Wasserwelle"> https://twitter.com/DeFiGod1/status/1368047540818546689?s=20">https://twitter.com/DeFiGod1/...

LPs have been able to provide LINKies & receive between 21.25% - 53.11% APY

Expecting pools for the other major blue chips to pop up soon

Imagine the new demand for $CRV to boost

Due to fee reclamation on synths, cross pool trades previously had to be split into 2 transactions

This meant @1inchNetwork was unable to tap into this liquidity

SIP120 changes this by allowing cross asset trades to take place in a single transaction https://twitter.com/kaiynne/status/1379558437332209672?s=20">https://twitter.com/kaiynne/s...

This meant @1inchNetwork was unable to tap into this liquidity

SIP120 changes this by allowing cross asset trades to take place in a single transaction https://twitter.com/kaiynne/status/1379558437332209672?s=20">https://twitter.com/kaiynne/s...

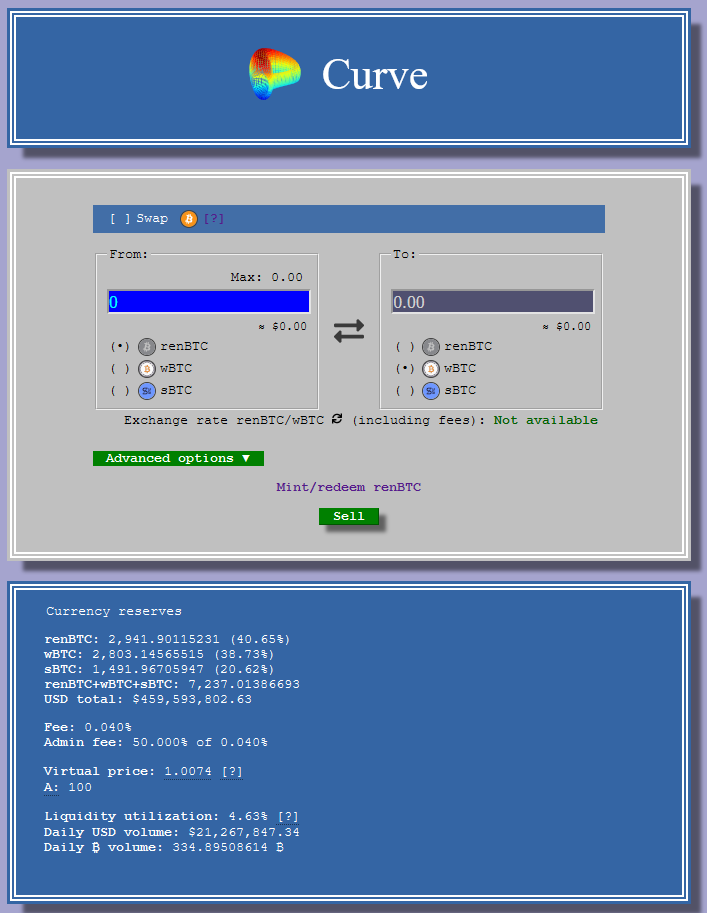

Part 2 - Enabling cross-chain swaps by partnering with @renprotocol

You can currently swap native BTC with sBTC / wBTC on Curve

As synth pools continue to grow, you will be able to trade from any liquid synth pool into mainnet BTC & vise versa https://resources.curve.fi/guides/swap-bitcoin-for-wbtc-or-sbtc">https://resources.curve.fi/guides/sw...

You can currently swap native BTC with sBTC / wBTC on Curve

As synth pools continue to grow, you will be able to trade from any liquid synth pool into mainnet BTC & vise versa https://resources.curve.fi/guides/swap-bitcoin-for-wbtc-or-sbtc">https://resources.curve.fi/guides/sw...

Now lets extend this further

This system works for any asset that is supported by both Synthetix & Ren

Prime candidates in my eyes are

sZEC / renZEC

sXMR / renXMR

sBNB / renBNB

sBCH / renBCH

sDOGE / renDOGE

Hope to see this vision turn into reality over the next few months

This system works for any asset that is supported by both Synthetix & Ren

Prime candidates in my eyes are

sZEC / renZEC

sXMR / renXMR

sBNB / renBNB

sBCH / renBCH

sDOGE / renDOGE

Hope to see this vision turn into reality over the next few months

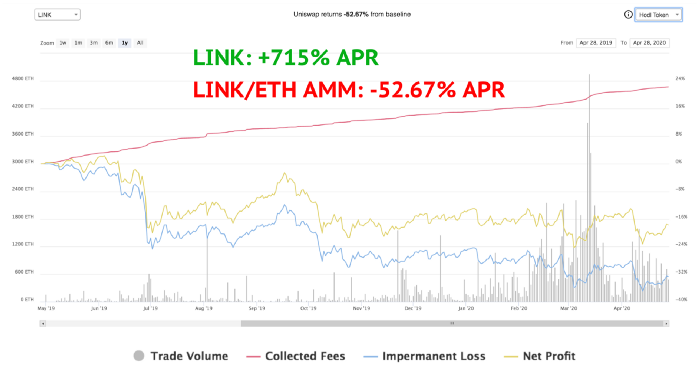

The big advantage I see over Thorchain is that LPs are able to provide liquidity while retaining 100% exposure to the asset of their choice

I have never been a fan of 50/50 LP myself

If you are bullish on a coin - you do not want to constantly sell as price rises

Here& #39;s why https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

I have never been a fan of 50/50 LP myself

If you are bullish on a coin - you do not want to constantly sell as price rises

Here& #39;s why

Impact for $SNX

Stakers receive fees on all trades that route between Curve pools using synths

I expect an exponential growth in revenue as liquidity grows and aggregators start routing trades through these new pools

Stakers receive fees on all trades that route between Curve pools using synths

I expect an exponential growth in revenue as liquidity grows and aggregators start routing trades through these new pools

Impact for $CRV

veCRV holders receive fees on all trades within or between their pools

$CRV demand will also increase as more non-stablecoin LPs deposit & start locking coins to boost their rewards

veCRV holders receive fees on all trades within or between their pools

$CRV demand will also increase as more non-stablecoin LPs deposit & start locking coins to boost their rewards

Impact for $REN

renVM charges a fee on all cross-chain withdraws & stands to benefit as more people use Curve instead of CEXs for their cross-chain transfers

renVM charges a fee on all cross-chain withdraws & stands to benefit as more people use Curve instead of CEXs for their cross-chain transfers

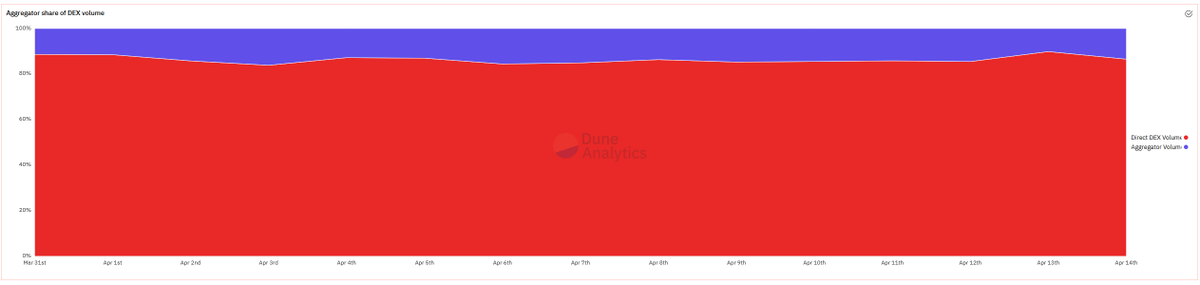

Impact for #1inch

Ultimately liquidity will remain fragmented between protocols in the near future as AMMs compete to see which design works best

1inch can continue to gain a larger share of DeFi volume by tapping into all liquidity available to provide the best rate to traders

Ultimately liquidity will remain fragmented between protocols in the near future as AMMs compete to see which design works best

1inch can continue to gain a larger share of DeFi volume by tapping into all liquidity available to provide the best rate to traders

Vance with an extra reason on why the $SNX x $CRV x $REN model may be superior to what others are implementing https://twitter.com/pythianism/status/1384912684882272257">https://twitter.com/pythianis...

Read on Twitter

Read on Twitter

" title="The big advantage I see over Thorchain is that LPs are able to provide liquidity while retaining 100% exposure to the asset of their choiceI have never been a fan of 50/50 LP myselfIf you are bullish on a coin - you do not want to constantly sell as price risesHere& #39;s why https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="The big advantage I see over Thorchain is that LPs are able to provide liquidity while retaining 100% exposure to the asset of their choiceI have never been a fan of 50/50 LP myselfIf you are bullish on a coin - you do not want to constantly sell as price risesHere& #39;s why https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>