Cap rates are a common metric used in real estate valuations to gauge the relationship of net operating income (“NOI” – a proxy for cash flow) to property asset value.

A cap rate represents the rate of return an investor would receive on “all cash” purchase, i.e., 100% equity with no leverage (debt) used to acquire the property

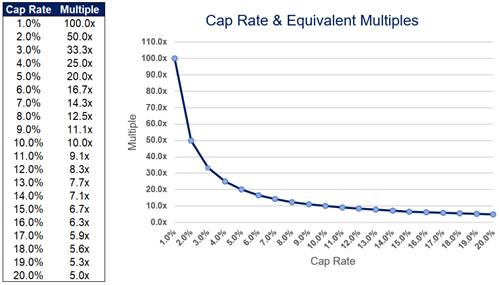

The cap rate has an inverse relationship to value.

Assuming NOI is constant, if a cap rates increase (decrease), property values will decrease (increase)

Assuming NOI is constant, if a cap rates increase (decrease), property values will decrease (increase)

Cap rates are an inverse earnings multiple; a 4.0% cap rate is the same as a 25.0x earnings (NOI X 25.0)

For example, if the property generates $1,000,000 in NOI and a 4.0% cap rate is used, the property would be valued at $25,000,000

For example, if the property generates $1,000,000 in NOI and a 4.0% cap rate is used, the property would be valued at $25,000,000

The same can be said by taking the inverse of the cap rate (1/4.0% = 25.0x) and applying that multiple to NOI

$1,000,000 in NOI multiplied by 25.0x will produce a $25,000,000 valuation.

$1,000,000 in NOI multiplied by 25.0x will produce a $25,000,000 valuation.

I wanted to write a short thread on cap rates and how to view them as multiples.

Hope this helps!

REM

Hope this helps!

REM

Read on Twitter

Read on Twitter