We& #39;ve got a new proposed #SEC #token #safeharbor that would let issuers offer tokens in the US. It& #39;s big. But, what& #39;s new? How is it different from the prior proposal? What& #39;s new? You guessed it. It& #39;s unavoidable, It& #39;s inevitable. It& #39;s a #THREAD. Let& #39;s dive in/1

Right off the top, we have the elimination of the "good faith" provision that was previously implied upon the issuers in a(1) & of a(4) which required the issuer to act in good faith to "create liquidity for users." /2

New section a(5) includes reference to the new "Exit report" which is a new requirment defined and explained further down but tldr; its a report issued by the issuer& #39;s counsel that asserts whether the tokens will be a security or not after the 3 year period. Good inclusion /3

section b(v) is interesting; it contemplates that tokens may have been sold prior to the notice of reliance on the safe harbor having been issued by the issuer; this previews a BIG change further down- this rule can be relied upon by issuers whose tokens are already out there /4

by way of private placement (i.e. exemption) or in an offering that violated rule 5 (i.e. was improperly unregistered). this is a path to fixing prior defective issuances. We& #39;ll talk about this later... /5

section b(iii)(E) also requires a new disclosure- the tokens need to have a block explorer. This makes sense & is good- its more disclosure. /6

section b(vi)(C) includes a disclosure of Related Persons (defined later) who recieved tokens "in a manner that is distinct from how any third party could obtain Tokens." Disclosing Insider transactions = good. /7

More disclosure of related party transactions in b(1)(ix)- including description of the nature of the transaction, the Related Person, the basis on which the person is a Related Person, and the approximate value of the amount involved in the transaction. /8

new: section b(1)(x) includes a mandatory "Warning to Token Purchasers." A statement that the purchase of Tokens involves a high degree of risk and the potential loss of money. /9

section b(2) would require a semi-annual update (i.e. every 6 months) to the mandatory disclosures. This replaces the prior requirement of updates when there are material changes to report. This is probably better. /10

(c) requires the notice of reliance to be filed before the first Token is sold; this is a change from prior draft which allowed the notice to be sold 15 days after the first sale, ala Form D. The notice is streamlined but not materially changed. /11

(f) introduces the #exitreport, which is to be prepared by counsel for the issuer, making a determination whether the network has reached maturity or not after 3 years. We now distinguish between maturity for networks focused on #Decentralization & #functionality /12

for #decentralization focused networks, counsel will evaluate: the extent to which decentralization has been reached across a number of dimensions, including voting power, development efforts, and network participation. If applicable, the description should include: /13

Examples of material engagement on network development & governance matters other unaffiliated parties, Explanations of quantitative measurements of decentralization, explanation of how the (issuer& #39;s) pre-Network Maturity activities are distinguishable from their ongoing /14

involvement with the network, including the extent to which the (issuer& #39;s) continuing activities are more limited in nature & cannot reasonably be expected uniquely to drive an increase in the value of the filing of the Tokens;

confirm that the (issuer) /15

confirm that the (issuer) /15

has no material information about the network that is not publicly available; and describe the steps taken to communicate to the network the nature and scope of the (issuer& #39;s) continuing activities. /16

for a #functional network, different factors: analysis should describe the holders’ use of Tokens for the transmission & storage of value on the network, participation in an application running on the network, or ...in a manner consistent with the utility of the network & /17

Detail how the Initial Development Team’s (i.e. issuer& #39;s) marketing efforts have been, and will be, focused on the Token’s consumptive use, and not on speculative activity. /18

Hot Take analysis: these are good rules but these are likely the beginning, not the end of the analysis that counsel will undertake. /19

Of course, not every token will make it; if the (issuer) determines that Network Maturity has not been reached, the following information must be provided: the status of the project and the next steps the Initial Development Team intends to take, /20

Contact information for Token holders to communicate with the Initial Development Team and a statement acknowledging that the (issuer) will file a Form 10 to register under Section 12(g) of the Securities Exchange Act of 1934 the Tokens as a class of securities within 120 days/21

BIG NEW INCLUSION: section (g) would appear to give exchanges that facilitate trading in these tokens 6 months to sunset them after a determination that the network did not mature. HUGE clarity for trading. US cryptocurrency platforms rejoice.

Section (h) would allow Tokens sold via private placement or in violation of Rule 5 (i.e. unregistered security!!!) to qualify for the safe harbor. This is a huge change & creates a path for various tokens of unclear legal status to use the rule. but... details matter /24

this would allow unregistered offerings to use the safe harbor if they didn& #39;t comply with section 5 of the 33 Act as determined in a Commission order pursuant to Section 8A of the 1933 Act & as long as they do not identify any other violations of the federal securities laws /25

so, maybe we& #39;ll see a massive wave of Section 8A settlements/consents to "clean up" unregistered offerings using this proposed rule. /26

we& #39;ve got a new definition of "network maturity" in section k(2) which excludes any network where the (issuer) owns +20% of the tokens or +20% consensus mechanism control. Interesting line to draw. /27

section k(3) offers a new definition of Related Person and includes the initial development team, directors, advisors and relatives of those persons. /28

bad language on section k(4); the definition of "token" includes "a transaction history" that "cannot be modified." Every transaction on any blockchain including on #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> "can" be modified. It& #39;s just highly unlikely. /29

https://abs.twimg.com/hashflags... draggable="false" alt=""> "can" be modified. It& #39;s just highly unlikely. /29

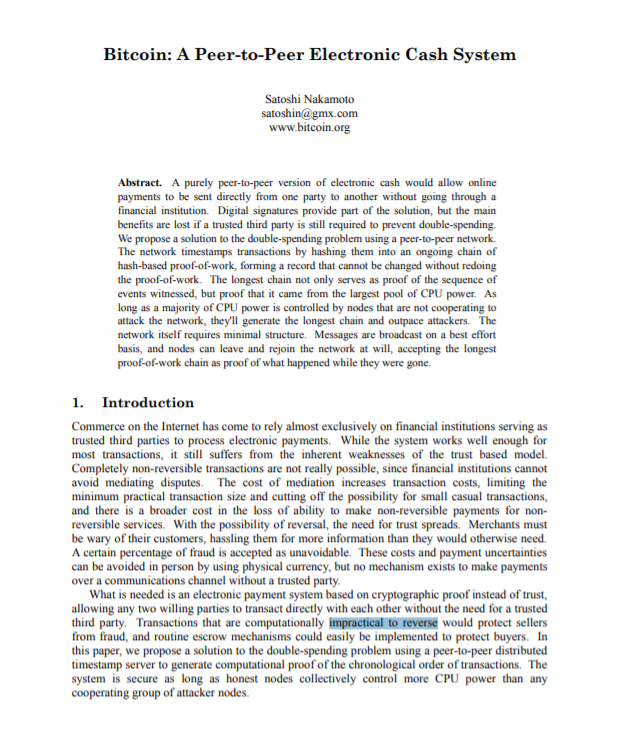

Satoshi talked about "computationally impractical to reverse" in the #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> whitepaper; the marketing spinmasters gave us "immutable," which stinks. I hate it when it shows up in statutes and in rules, even in a more benign form. /30

https://abs.twimg.com/hashflags... draggable="false" alt=""> whitepaper; the marketing spinmasters gave us "immutable," which stinks. I hate it when it shows up in statutes and in rules, even in a more benign form. /30

Summary: The new version of the rule adds the Exit Report requirement, clarifies the role of counsel, the potential use of the rule to fix existing defective issuances, gives exchanges clarity, & calls for more frequent reporting. It& #39;s a solid upgrade. More analysis to come! /end

Read on Twitter

Read on Twitter whitepaper; the marketing spinmasters gave us "immutable," which stinks. I hate it when it shows up in statutes and in rules, even in a more benign form. /30" title="Satoshi talked about "computationally impractical to reverse" in the #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> whitepaper; the marketing spinmasters gave us "immutable," which stinks. I hate it when it shows up in statutes and in rules, even in a more benign form. /30" class="img-responsive" style="max-width:100%;"/>

whitepaper; the marketing spinmasters gave us "immutable," which stinks. I hate it when it shows up in statutes and in rules, even in a more benign form. /30" title="Satoshi talked about "computationally impractical to reverse" in the #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> whitepaper; the marketing spinmasters gave us "immutable," which stinks. I hate it when it shows up in statutes and in rules, even in a more benign form. /30" class="img-responsive" style="max-width:100%;"/>