1/ Coinbase& #39;s IPO is a big moment for Bitcoin.

Last week Coinbase rocked the mainstream financial world when they published their higher than expected Q1 2021 financials. The biggest shock was the $1.8B in revenue, which makes the $100B valuation quite sensible.

Last week Coinbase rocked the mainstream financial world when they published their higher than expected Q1 2021 financials. The biggest shock was the $1.8B in revenue, which makes the $100B valuation quite sensible.

2/ Other metrics included:

- $1.1B Adj. EBITDA

- $730-800M Net income

- $223B Assets on Platform

- 56M Verified users (VU) & 6.1M Monthly transacting users (MTU)

- $1.1B Adj. EBITDA

- $730-800M Net income

- $223B Assets on Platform

- 56M Verified users (VU) & 6.1M Monthly transacting users (MTU)

3/ With 56M users, that makes Coinbase larger than Robinhood, CashApp, and Venmo!

4/ If you want an analysis of Coinbase’s financials, I recommend reading @BlockBytch_& #39;s recent article which does a great job of going in depth on different calculations

After Coinbase goes public, the question will be “Who’s next?” Let& #39;s dive in! https://frostbyte.substack.com/p/coinbase-earnings-some-less-obvious">https://frostbyte.substack.com/p/coinbas...

After Coinbase goes public, the question will be “Who’s next?” Let& #39;s dive in! https://frostbyte.substack.com/p/coinbase-earnings-some-less-obvious">https://frostbyte.substack.com/p/coinbas...

5/ Crypto company valuations: Exchanges

These are the big moneymakers in crypto.

If Coinbase is worth $100B, what are all of the exchanges alone in aggregate worth?

These are the big moneymakers in crypto.

If Coinbase is worth $100B, what are all of the exchanges alone in aggregate worth?

6/ While many non-US exchanges are notorious for manipulating volume metrics in order to attract traders, we can certainly come up with a ballpark figure of what they might be work.

7/ @binance: They have an exchange token called BNB which is a quasi-equity. Current value of that is $86B, but this is likely discounted given the nature of the instrument (tokens are new) and the more “wild west” nature of the exchange and it’s relationship with regulators.

8/ Kraken: It was recently reported that Kraken is seeking a $20B valuation in new fundraising talks. (Disclosure: I work at Kraken. I am only sharing publicly available information contained in the news report). https://decrypt.co/60326/kraken-seeks-20-billion-valuation-in-new-funding-round">https://decrypt.co/60326/kra...

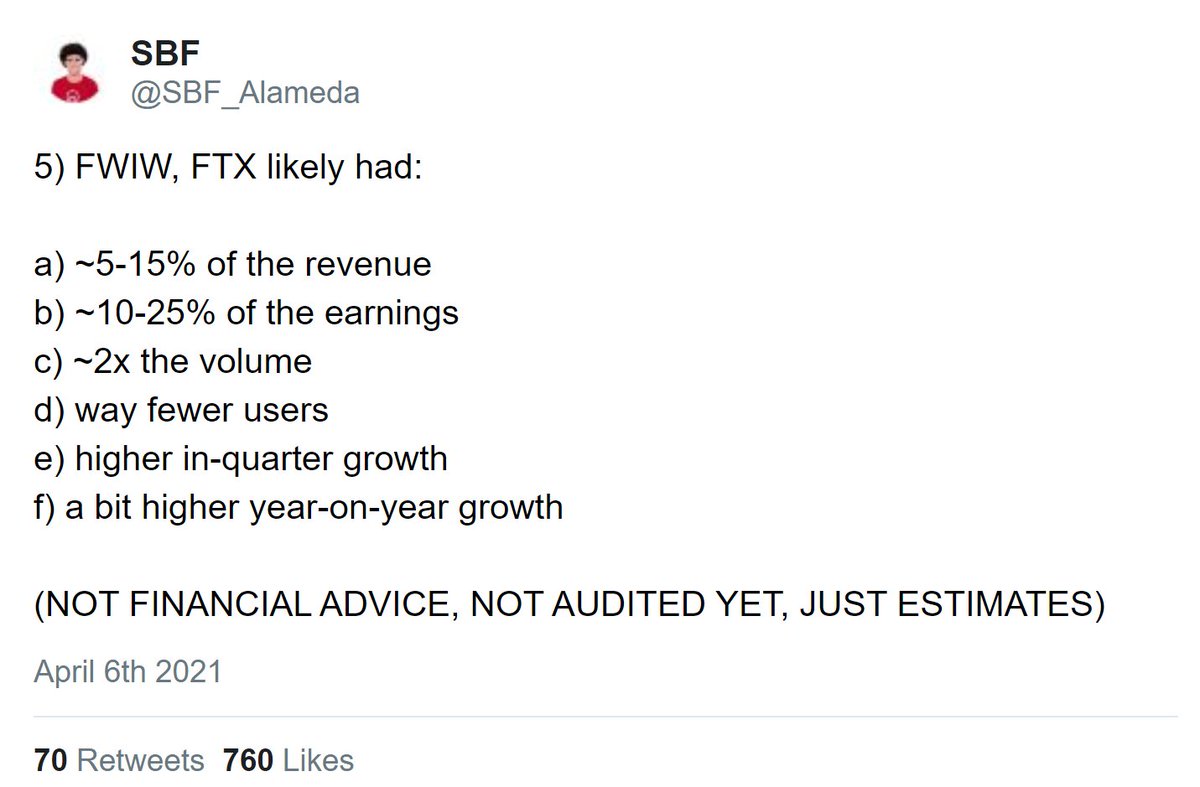

9/ FTX: @SBF_Alameda tweeted out a sneak peak of their financials, which would place them at $720M annualized revenue, and given the rev multiplier we get to a valuation of $10B. They also have a quasi-equity token “FTX Token” which is worth $4.5B.

10/ There are many other exchanges I didn’t mention.

Non-US exchanges are notorious for manipulating their volume metrics in order to attract traders, so it’s hard to estimate the value of Huobi, OKC, etc.

Non-US exchanges are notorious for manipulating their volume metrics in order to attract traders, so it’s hard to estimate the value of Huobi, OKC, etc.

11/ Additional, other exchanges like Bitstamp have been acquired so there are no fundraising rounds to calibrate with. We could probably guess that these other exchanges are worth at least $100B in aggregate.

That puts the value of all Crypto exchanges at ~$300B+.

That puts the value of all Crypto exchanges at ~$300B+.

12/ Spillover effect into other Crypto sectors

Exchange valuations will likely be surging post Coinbase IPO. That + general organic upswell of users, could cause a spillover into other types of Crypto companies like wallets, custodians, etc.

Exchange valuations will likely be surging post Coinbase IPO. That + general organic upswell of users, could cause a spillover into other types of Crypto companies like wallets, custodians, etc.

13/ Blockchain(.)com: Just raised $300M at a $5.2B valuation

Fireblocks: Just raised $133M

PayPal: Curv was acquired by PayPal for a rumored $500M. The were evidently looking at acquiring BitGo for $750M

BitPanda: Just raised at a $1.2B valuation

Anchorage: Just raised $80M

Fireblocks: Just raised $133M

PayPal: Curv was acquired by PayPal for a rumored $500M. The were evidently looking at acquiring BitGo for $750M

BitPanda: Just raised at a $1.2B valuation

Anchorage: Just raised $80M

14/ This is just a sneak peak of the money flowing into the space. There are hundreds of companies that I didn’t have time to list out.

If we include exchanges + all of the other crypto companies, I think a reasonable total Crypto company market cap could be $500B.

If we include exchanges + all of the other crypto companies, I think a reasonable total Crypto company market cap could be $500B.

15/ The total market cap of all crypto is ~$2T, so that puts the ratio of aggregate company valuations to aggregate crypto valuations at around 25%.

16/ Is this good for Bitcoin?

Some are concerned that Coinbase going public will soak up demand that would have otherwise been spent on Bitcoin. I think this is overly pessimistic.

Some are concerned that Coinbase going public will soak up demand that would have otherwise been spent on Bitcoin. I think this is overly pessimistic.

17/ Sure, some might use Coinbase as a substitute for direct exposure of Bitcoin, but they are completely separate types of investments.

18/ What will newly flush private shareholders (investors/employees) do with all that cash? There’s a possibility they could sell shares for Bitcoin. However, as @real_vijay noted, many exchange employees may not be interested in increasing their exposure to Bitcoin.

19/ Alternatively, these newly flush shareholders could spin up new funds that will increase visibility of Bitcoin and reinvest those proceeds into Bitcoin companies.

20/ These companies going public will further reinforce that Bitcoin is here to stay, is legitimate, and is trusted by institutions. This legitimization accelerates Bitcoin’s adoption as it will unlock more demand from retail and institutions.

21/ Like this tweet storm?

Get my thoughts on Bitcoin first on Thursdays by subscribing to my paid newsletter via the link below https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://danheld.substack.com/ ">https://danheld.substack.com/">...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://danheld.substack.com/ ">https://danheld.substack.com/">...

Get my thoughts on Bitcoin first on Thursdays by subscribing to my paid newsletter via the link below

Read on Twitter

Read on Twitter